As inflation and gas prices remain high, foot traffic to dollar, discount, and thrift stores is booming. We dove into visits to Dollar General, Family Dollar, Five Below, and Goodwill to find out more about these high-performing retailers.

Quick Recovery From March Downturn

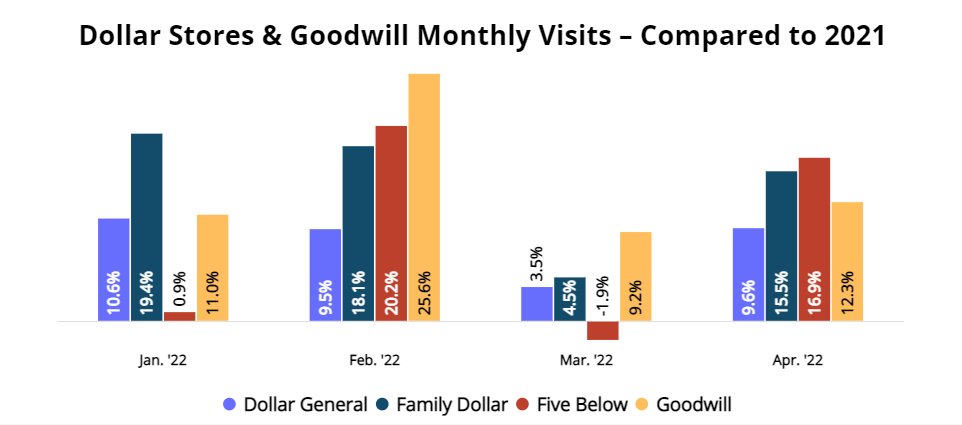

Inflation hasn’t spared dollar stores, with a recent analysis of various discount brands finding that prices at leading chains increased for several basic products. But since prices have also increased across retail categories throughout the western world, discount retailers are still remaining comparatively cheaper and giving value-driven customers a reason to visit their stores. So, although all the brands we analyzed did see a dip in year-over-year (YoY) visits in March, Dollar General, Family Dollar, Five Below and Goodwill all showed strong YoY growth in April, with monthly visits up by 9.6%, 15.5%, 16,9%, and 12.3%, respectively, relative to April 2021.

Comparing to Pre-Pandemic Foot Traffic

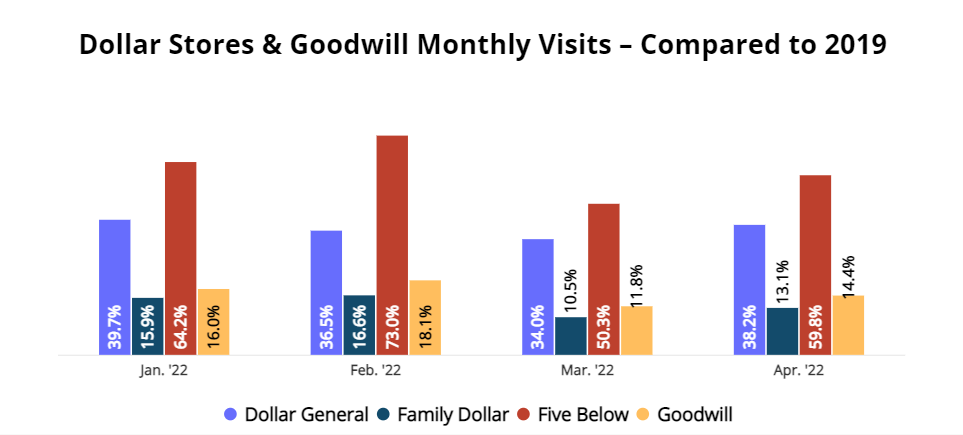

Comparing foot traffic to these four brands to pre-pandemic levels drives home their strength: each retailer has seen double-digits increases in monthly visits every month this year relative to 2019. Five Below and Dollar General led the pack thanks to significant recent expansions, but both retailers have also seen an increase in visits per venue, meaning their success is not just a product of their larger physical footprint. Likewise, Family Dollar (owned by Dollar Tree) has also opened 223 new stores since the end of fiscal 2019 for a total of 8016 stores by the end of fiscal 2021. But as this represents only an approximately 3% increase in store fleet, Family Dollar’s success is likely due to a genuine increase in consumer demand for value-priced goods.

Goodwill has also seen a significant increase in year-over-three-year (Yo3Y) visits, and its success may be particularly telling of the current consumer mood. Typical discount stores such as Dollar General and Five Below sell a wide variety of non-durable goods such as packaged foods and cleaning products, which require frequent re-purchasing. Because of their product assortment, dollar stores’ strong YoY visitation trends could be due to efforts to save money on regular household purchases until the current inflationary tide falls.

But Goodwill carries longer-lasting merchandise in categories such as apparel, kitchenware, and furniture, that may well remain in consumers’ homes for months or years. Some of Goodwill’s success may be due to the increased interest in sustainable consumption. But the fact that foot traffic growth to Goodwill is on par with foot traffic growth to dollar stores could also indicate that many consumers are willing to make more radical shifts in their shopping habits in an effort to reduce expenses.

Looking Ahead

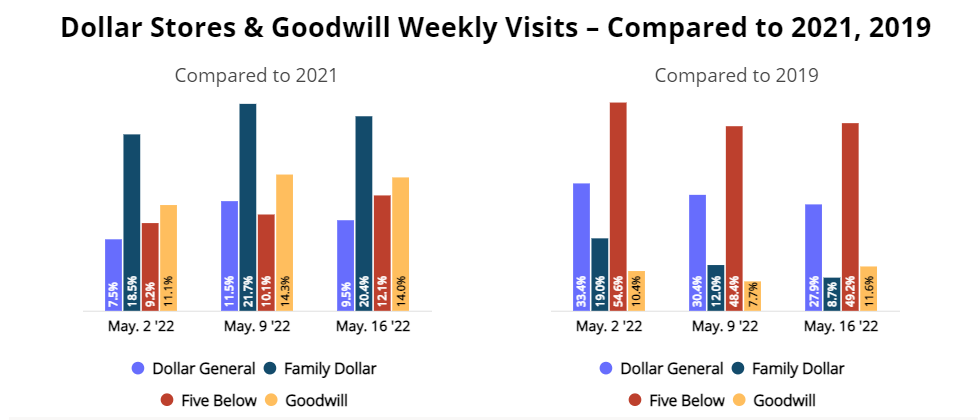

Looking at the most recent weekly data from May shows that dollar and discount store foot traffic is not slowing down. During the week of May 16th to 22nd – the last week for which data is available – foot traffic to Dollar General, Family Dollar, Five Below, and Goodwill was up 9.5%, 8.7%, 21.1%, and 14.0%, respectively, relative to the equivalent week 2021.

There is reason to believe that this category’s current strength is here to stay. If and when prices decrease again, shoppers who began shopping at dollar stores or at Goodwill due to the recent inflation may well choose to maintain their frugal habits. And, competition is already heating up for some legacy superstores. Given many of these companies’ ambitious expansion plans, the current economic climate could be cementing these brands’ status as newly minted retail giants.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.