Talabat Winning Market Share and Loyalty by a Mile

When it comes to the food delivery aggregators in the Middle East, ever wonder who is catering to the Emiratis’ hankerings in the United Arab Emirates? Or curious to find out how much does the average UAE consumer spend on each of the major food delivery services? What about the frequency in which they are ordering food delivery services across or from each of the food delivery apps and which dishes are the most popular for the Middle Eastern palate?

Intrigued? Read on to find out more.

The Food Delivery Landscape in the Middle East

According to Statista, revenue in the UAE online food delivery segment is projected to reach US$2.18bn in 2022 with an expected annual growth rate of 6.33% (CAGR 2022-2026), resulting in a projected market volume of US$2.79bn by 2026. The number of online food delivery users is expected to amount to 5.5m by 2026 with a user penetration rate of around 44.5% in 2022.

Now, let’s dive deeper into Measurable AI’s granular e-receipt consumer panel in the Middle East to see what insights we can unearth when it comes to online food delivery in the UAE.

First, as a broad overview, the main food delivery players in the UAE are Talabat, Careem Now, Zomato (owned by Delivery Hero and operated by its subsidiary Talabat Middle East) and Deliveroo. Can you guess which player is the most loved amongst the Emiratis?

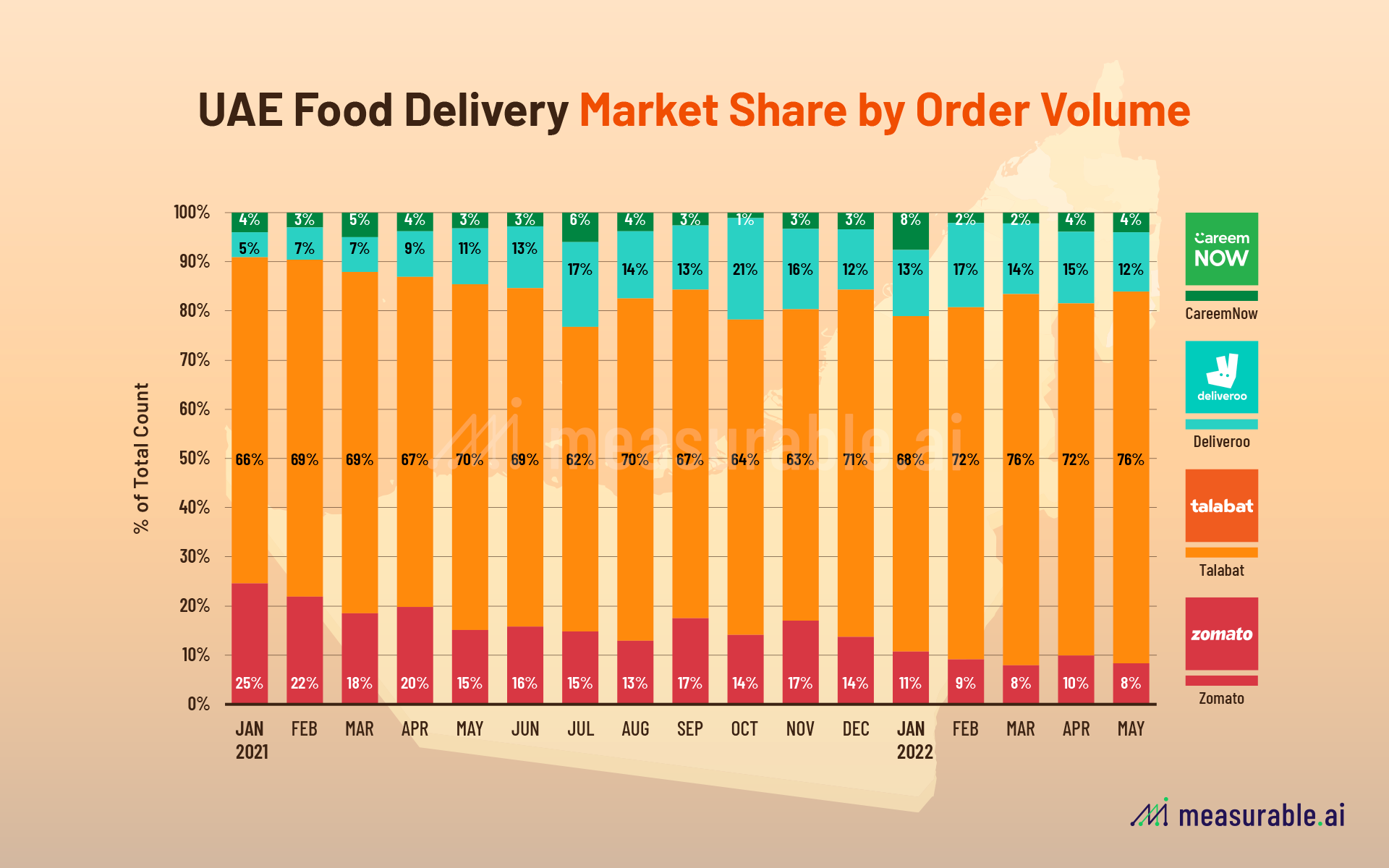

When it comes to market share (calculated based on order volume), our panel reveals that Talabat is leading by a clear mile with Deliveroo coming in as the runners up, followed closely by India’s Zomato (which was acquired by Delivery Hero in 2019).

Which Food Delivery App Attracts the Bigger Spenders?

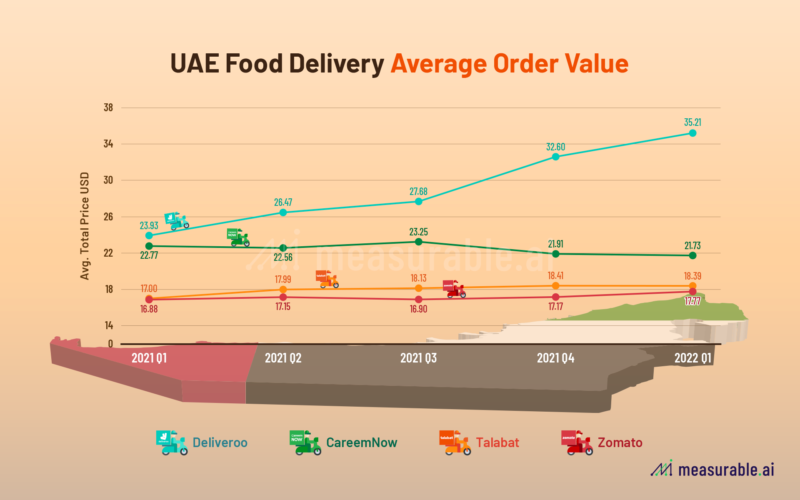

While Talabat dominates in terms of market share (by order volume), Deliveroo seems to attract the bigger spenders when we look at the average order value per receipt.

Diving into our granular dataset of Deliveroo deeper, it looks like the merchants that account for the biggest order amounts (i.e. more than 100USD in total) per Deliveroo’s receipts this year to date are Le Pain Quotidien (‘LPQ’), Tashas To Go and Projeto Acai.

What are they most likely to order from LPQ? Seems like a lot of Emiratis’ love the vegan chickpea omelet (46 AED / 12.5 USD).

What about Talabat? What are the Emirati’s ordering from the most popular food delivery app in the UAE?

While Deliveroo seems to cater for the higher end type of restaurants, the most popular restaurants which deliver on Talabat seem to be the popular fast food chains KFC, and McDonalds, followed by Pizza Hut and Burger King. Our dataset also revealed popular usage of Talabat Mart, Talabat’s own grocery delivery service.

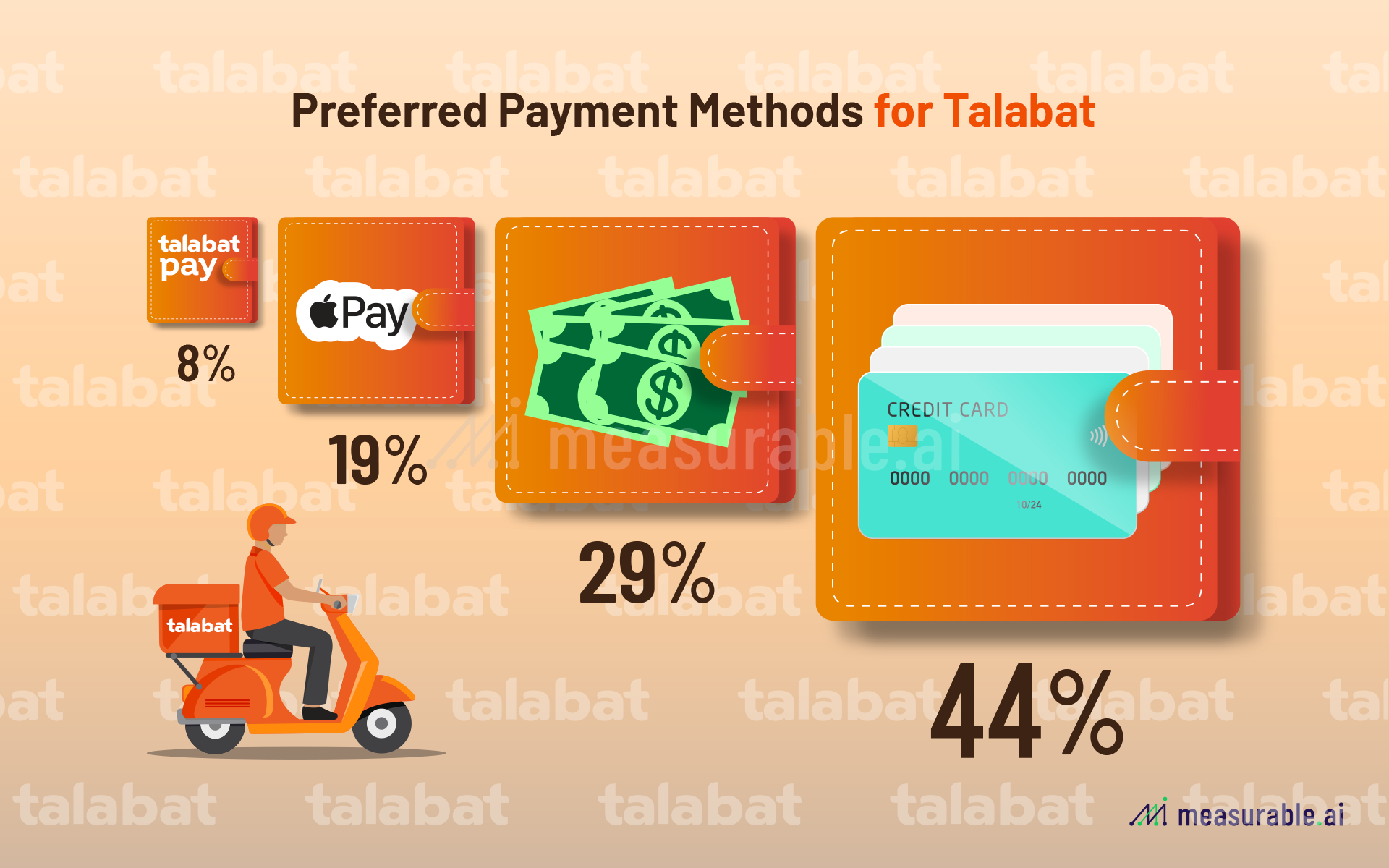

Preferred Payments Methods for Talabat in the UAE

When it comes to payment methods, zooming in on Talabat alone (given its popularity), our data reveals credit card still remains the preferred payment method YTD (i.e. 44% of Talabat users from our panel choose credit card), followed by cash (29%).

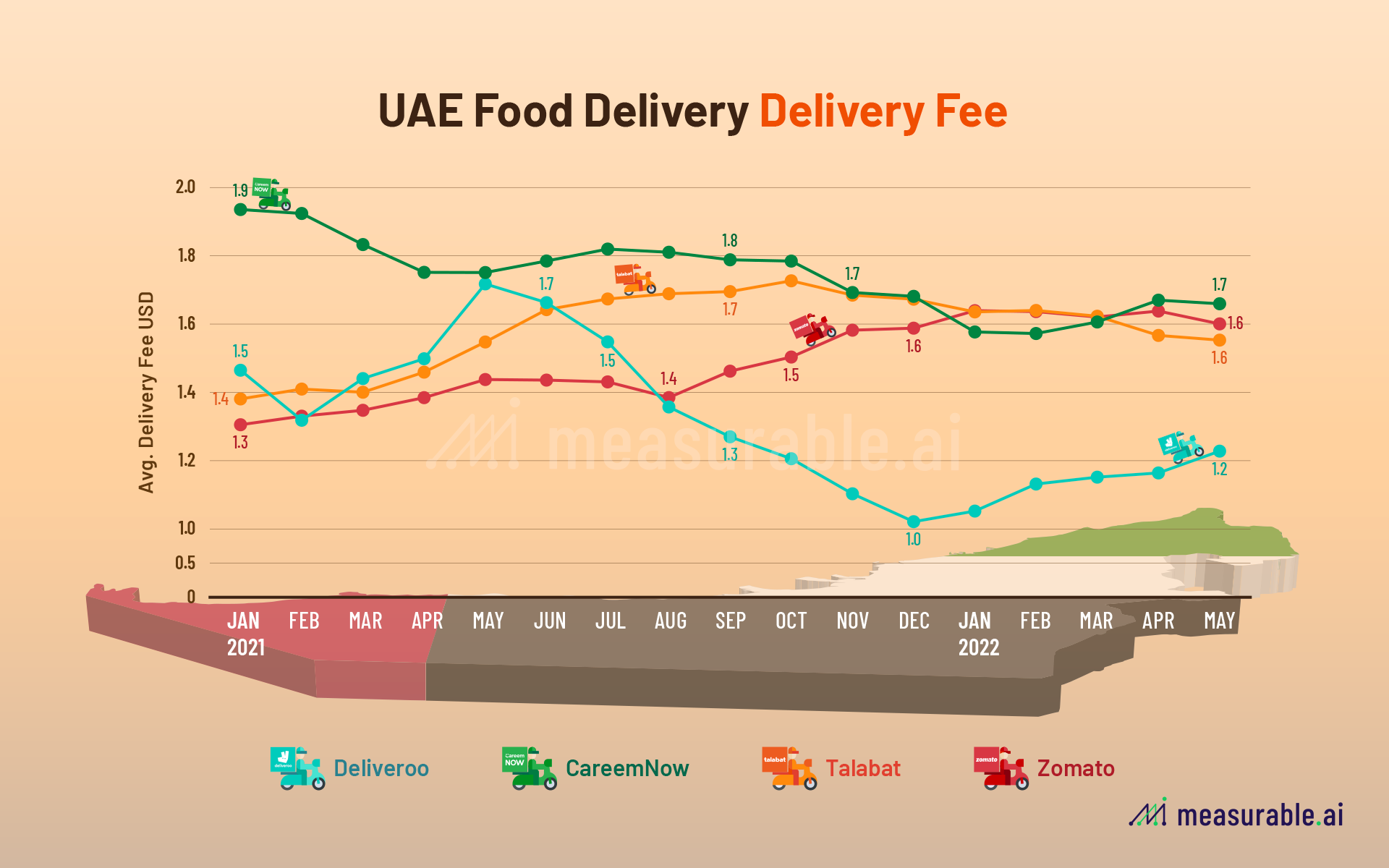

Delivery Fee Comparison Amongst the Four Food Delivery Players in the UAE

Now, let’s take a look at delivery fees across the four players. From our panel, the delivery fee amongst the four players have been hovering within the range of 3.67-6.98 AED (1-1.9 USD) mark on average for each order. Deliveroo seems to be the only player that has lowered its delivery fees since the 2H21 to remain competitive.

Note that this data only captures those paying a delivery fee for each order (so excludes instances where delivery fee is waived).

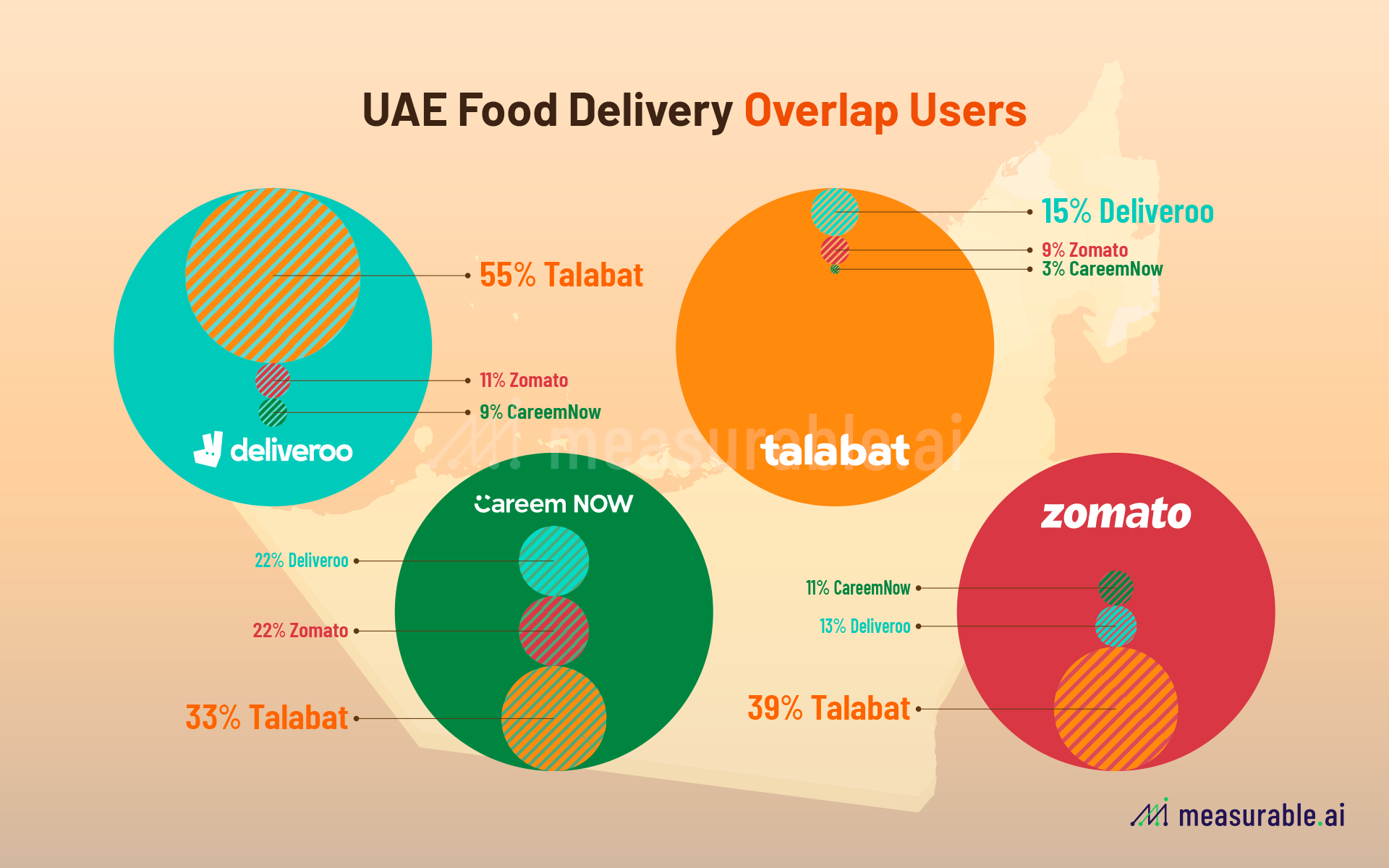

Talabat Wins in Terms of User Loyalty

Last but not least, user overlap. Measurable AI’s granular dataset also enables us to see how much each food platform’s customers also utilize the services of its competitors. From our UAE panel, we can infer that Deliveroo’s users are a big fan of Talabat, with 55% of Deliveroo users also ordering from Talabat.

The reverse case does not necessarily apply however. Flipping the coin, our data reveals that only 15% of Talabat users also order on Deliveroo (do they not like to order the LPQ vegan chickpea omelet? :p ).

Amongst the four players, we can deduce that Talabat’s customers are the most loyal to the delivery apps services.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.