With high gas prices continuing to impact consumer spend, delivery startups gaining market share, and, well, the fact that it’s the eleventh of July, it’s only appropriate to take a deep dive into the world’s largest convenience chain 7-Eleven. In today’s Insight Flash, we take advantage of our ability to separate the company’s fuel versus ex-fuel sales to assess performance versus the overall Convenience subindustry, examine how often its customers cross-shop competitors, and look at how demographics differ between the two sides of the business.

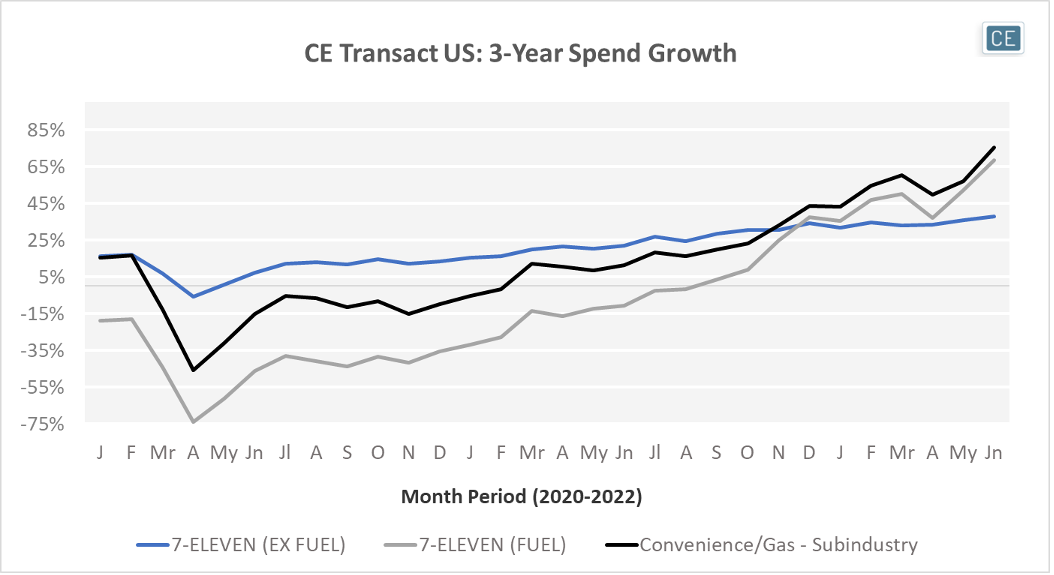

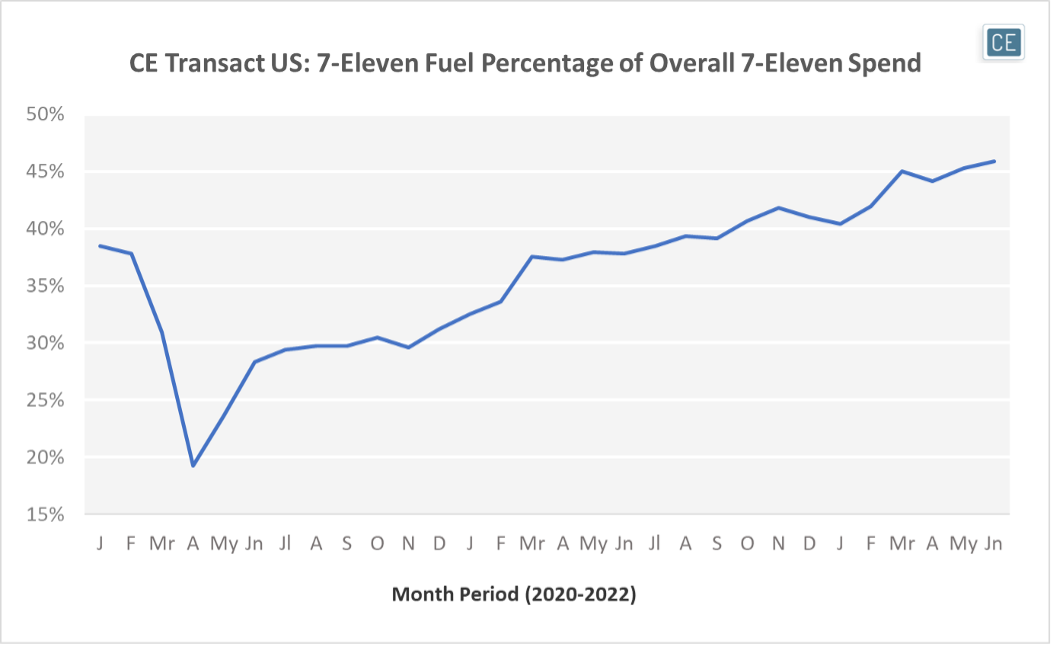

Unsurprisingly given how important oil prices are to fuel spend, 7-Eleven’s Fuel business spend growth has tracked the growth of the overall Convenience/Gas subindustry very closely. With gas prices skyrocketing, fuel purchases at the pump have climbed to 46% of total spend at 7-Eleven in June. Although this matches pre-pandemic levels, with many commuters still engaging in Hybrid work the high share is more likely due to higher prices per gallon than gallons of gas purchased. As 7-Eleven has expanded into urban areas, Ex-Fuel spend growth has also been strong, up 37.7% in June versus three years ago.

Subindustry Spend

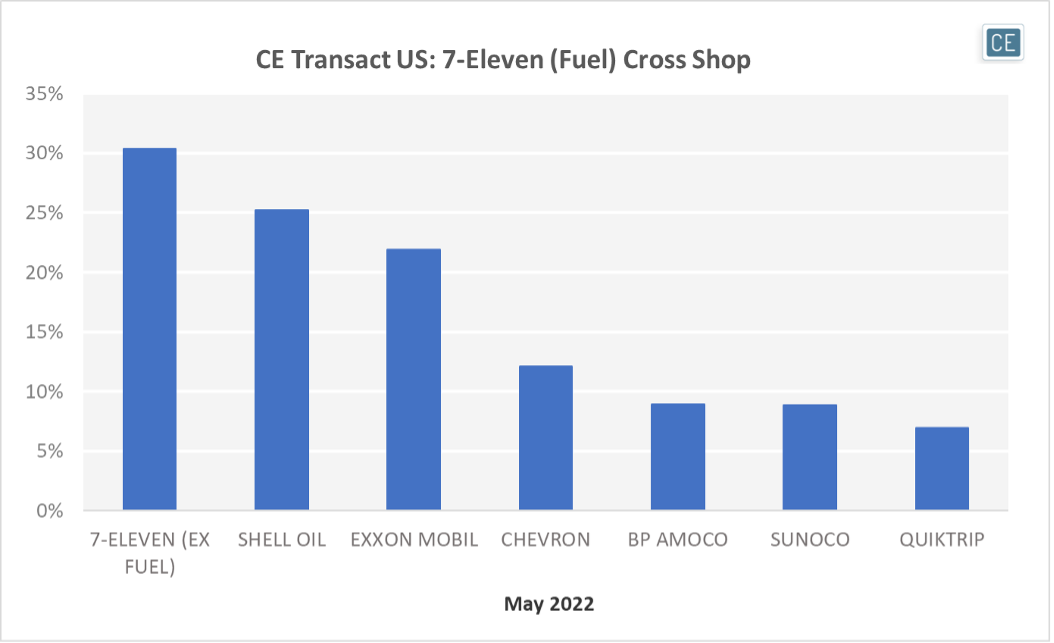

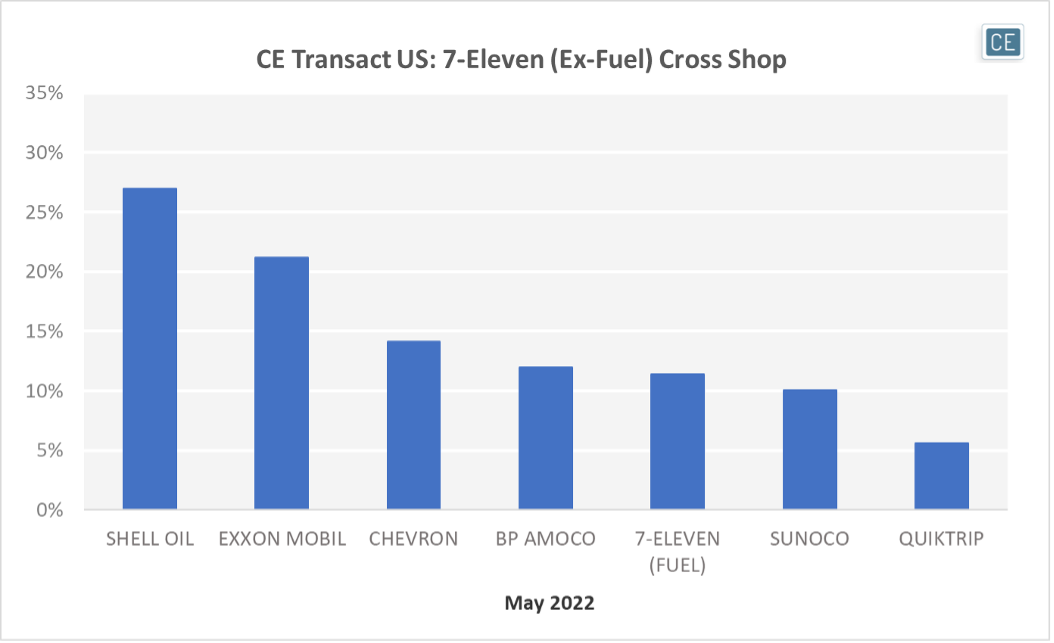

7-Eleven’s gas customers who pay at the pump do also go inside the store for snacks and other items – 30% of fuel shoppers in May also cross-shopped inside the store. Beyond that, however, they are not particularly loyal. In May, 25% of 7-Eleven fuel customers also made a purchase at Shell Oil, and 22% also purchased at Exxon Mobil. For those buying convenience items, only 11% also bought gas from 7-Eleven. While some stores are in urban areas without fuel pumps, this wouldn’t explain why 27% of ex-fuel customers also made a purchase at Shell Oil and 21% also shopped Exxon Mobil. Instead, it could be inferred that the food and beverage sold at the convenience store itself are more of a standalone draw than commoditized fuel.

Cross-Shop

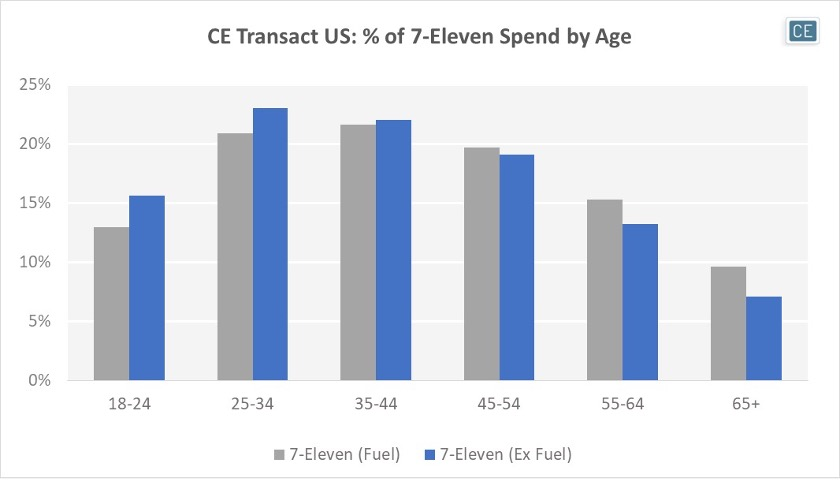

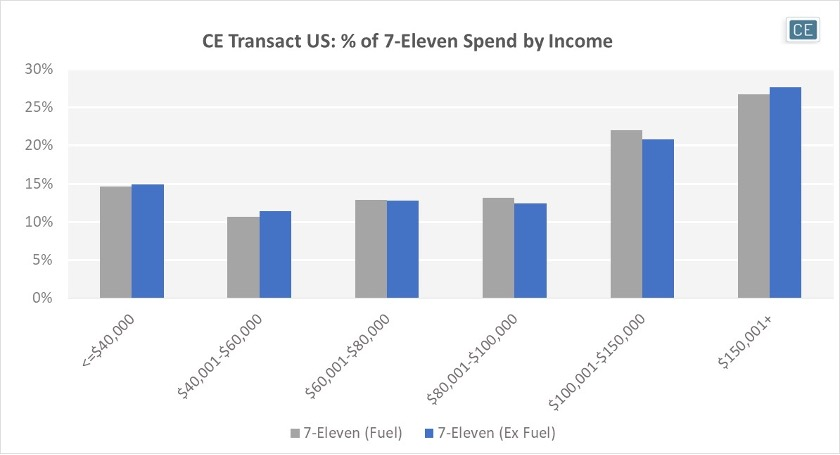

There are demographic differences between 7-Eleven Fuel and Ex Fuel shoppers as well. Those spending money in the convenience store tend to be younger, with those aged 18-34 accounting for 39% of spend versus 34% for fuel purchases. Interestingly, 7-Eleven Fuel and Ex Fuel spend show the same distribution across income groups, with higher income shoppers unsurprisingly able to spend more.

Demographics

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.