With the midterm elections fast approaching and the balance of power in Washington teetering on the edge, Democrats and Republicans are doing everything in their power to get in voters’ good graces.

One of the ways they’re doing that is by investing in ads.

We looked at our data through April of this year to understand how both parties are spending their ad dollars leading up to one of the most pivotal elections in the history of the United States.

Here’s what we found:

The PACs Agree…on Digital Ads

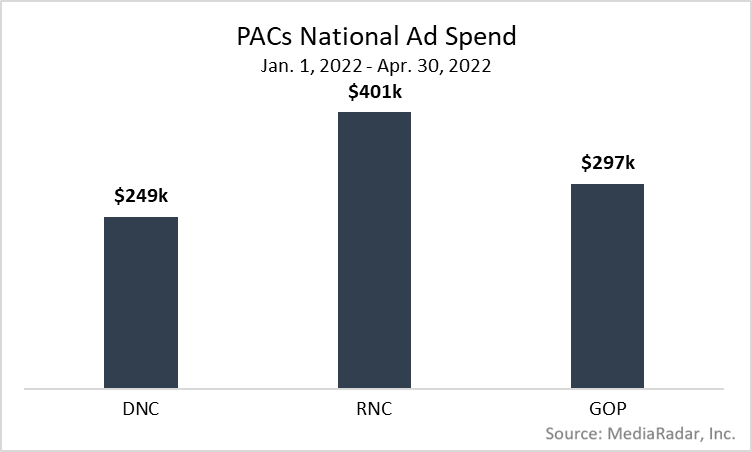

The Republican National Committee (GOP), Republican National Committee (RNC), Democratic National Committee (DNC), and National Democratic Redistricting Committee (NDRC) combined to spend nearly $950k on ads through April.

Nearly all of these dollars were for digital ads.

In fact, the DNC was the only PAC that ventured outside of digital ads, but even that only meant it spent 4% of its dollars on print ads; The Philadelphia Tribune was the sole beneficiary.

When looking at how these PACs spent on digital ads, their affinity for Facebook was clear, with the RNC and GOP investing 99% and 100% into Facebook, respectively.

For both PACs, the Facebook-or-nothing attitude is undoubtedly a reflection of the platform’s audience.

Not only does Facebook have nearly 3b monthly active users (MAUs), making it the most popular social network in the world, but it attracts users from every generation, giving advertisers the ability to reach all subsets of the voting population in one place.

This isn’t something other social networks can necessarily say. Instagram, for example, skews much younger, with about 70% of its users between the ages of 13 and 34.

In contrast, about 46% of Facebook’s users fall into this age bucket.

So, while the political parties disagree on a lot of things, it appears they agree that digital ads are the superior format to woo voters leading up to the midterm elections.

That said, while their tactics were nearly identical, there was a sizable difference in the amount spent.

Through April, the RNC outspent the DNC by more than $150k (the GOP spent an additional $297k).

From the outside, the increased spending from the Republican party likely results from what’s on the line during these elections.

With a handful of Republican victories having the potential to sway the balance of power in the nation’s capital, it appears that Republicans are relying on ads, to some degree, to attract these votes.

What’s Diversification?

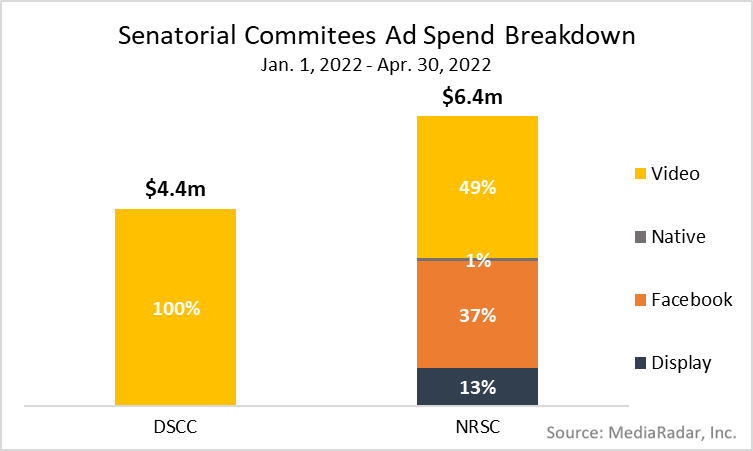

That’s what the National Democratic Senatorial Campaign Committee (DSCC) would probably say if you asked its advertising team how they’re diversifying their media mix in 2022.

Through April, the DSCC has spent all—yes,100%—of its $4.4mm on video ads.

Unsurprisingly, all of those dollars went to YouTube, with the expected channels getting the most attention, including National News (18%), Music (14%), and Society & Culture (14%).

With more than 2.2b MAUs, which is second only to Facebook, and some of the most proven ad capabilities out there—70% of people have bought a product after seeing it in a YouTube ad—can you blame them for going all-in?

Despite that, the National Republican Senatorial Committee (NRSC) did explore outside of YouTube’s hallowed walls.

Not only did the NRSC diversify its media mix, but it did so in a big way across video (49%), Facebook (37%), display (13%) and native (1%). Perhaps this was to complement their major spending on TV spots in battleground states ahead of midterm elections.

While the NRSC isn’t as awestruck by YouTube as its colleagues across the aisle, it did spend 24% of its digital ad dollars on YouTube across channels related to National News (11%), Society & Culture ( 8%), and Entertainment & Movies (5%).

Again, YouTube’s too powerful to ignore.

Why Do We Need Ads?

Everyone loves digital ads.

The DSCC hates diversification.

The Congressional Committees shun ads.

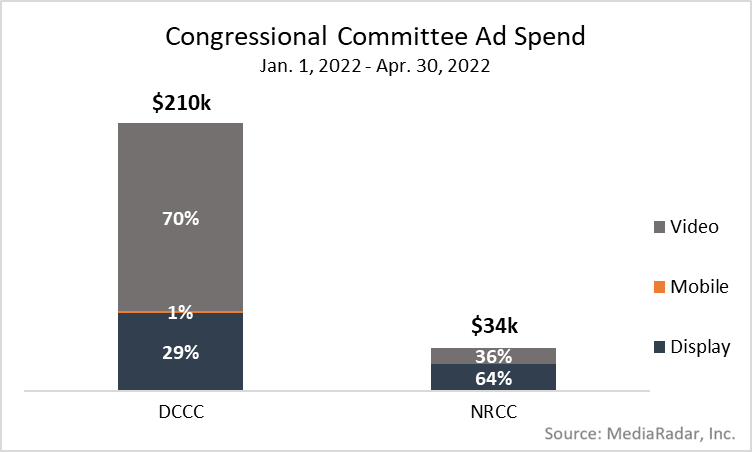

So far in 2022, the Democratic Congressional Campaign Committee (DCCC) and the National Republican Congressional Committee (NRCC) have combined to spend just $244k on ads.

If it wasn’t for the DCCC having some affinity for ads, spending would be significantly less.

To put the lack of spending into perspective, that $244k is more than $10mm less than the combined spending of the Senatorial Committees.

With the few dollars the DCCC did invest, it followed the tried-and-true strategy of going heavy into video, with 70% or $147k going to these formats.

Breaking news: the Republicans did the opposite.

The NRCC spent 64% of its dollars to display ads on sites like Investing.com (27%), Toronto Sun (9%), and National Review (8%), which combined to account for 44% of its total ad investment.

At first glance, the lack of spending may seem surprising given the digital world we live in and the rippling effect these elections will undoubtedly have.

But, when you consider who’s doing the spending—or lack thereof—it makes all the sense in the world.

There are no term limits in Congress, which mean the Congressional Committees aren’t dishing out all the stops to keep people on their side.

That said, a continued push for term limits could flip the script on their stingy ad spending.

If term limits do see the light of day, we’ll almost certainly see the NRCC and DRCC adopt ad strategies similar to those used elsewhere in Washington.

With A Lot at Stake, Will Ads Make a Difference?

There’s no getting around the fact that there’s a lot at stake with these midterm elections, which means the days, weeks and months leading up to them are key.

Will they bring good news or bad news for inflation and the economy?

What will the outlook for President Biden’s bid for reelection look like?

Will Republicans take Congress? Which side will control the Senate?

All of these questions—and more—will remain up in the air until the polls close.

What’s not in question, however, is the fact that ads have joined the campaign trail.

While they’re unlikely to make a sizeable difference given the low spend, ads will remain a mainstay in the strategies of both political parties for years to come as they fight for control of the country.

To learn more about the data behind this article and what MediaRadar has to offer, visit https://mediaradar.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.