Part one of our annual two-part Back to School report. Stay tuned for part 2 in September.

Key takeaways:

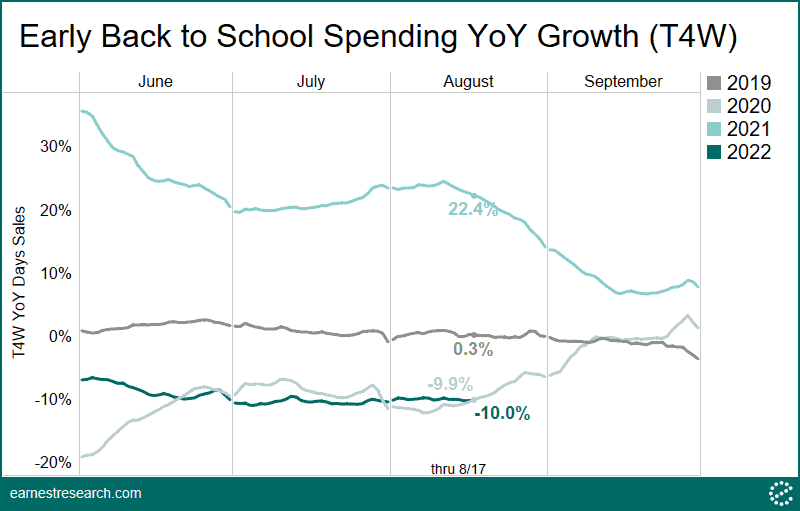

Back to school spending growth falls below 2019 levels

Back to school spending in states where class is back in session** fell 10% YoY at key retailers* for the 4 weeks ended August 17, 2022 as schools reopened in a challenging inflationary environment. The decline comes after the initial shock of pandemic-driven remote learning in 2020 drove a similar 10% YoY decline, while assistance in the form of child tax credit payments in 2021 pushed growth near 25% YoY. Growth during this key spending period in August 2022 is a full 30 points slower than in 2021. Pre-pandemic back to school spending was largely flat during the same period in 2019.

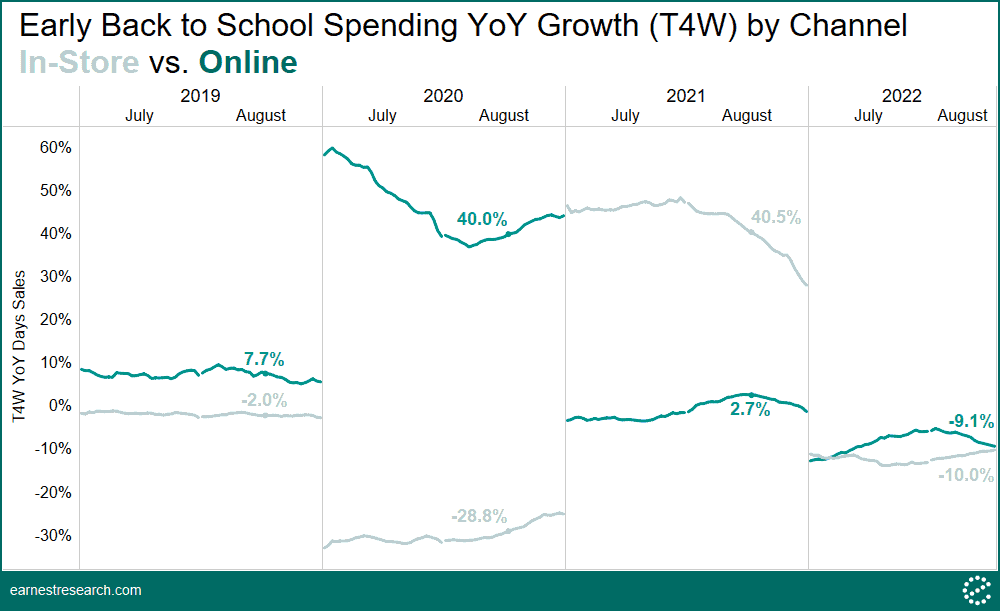

Online and in-store spending declining in equal parts

Prior to Covid, back to school sales were already moving online, growing in the high single digits during the 2019 season, while in-store sales declined slightly. Covid accelerated the shift to online sales in 2020 as consumers stayed home and quarantine orders halted in-store operations, boosting online growth over 40% YoY for states in which class is already back in session. Back to school sales reverted to brick and mortar in 2021, though online sales remained at or above 2020 levels, buoyed by child tax credits. The channel whipsaw seems to be over now–in the four weeks ended August 17th, 2022, online spending declined 9% YoY, while in-store declined 10% YoY. So far the current season appears to be more impacted by inflation and the possibility of a looming recession than by diverging channel trends.

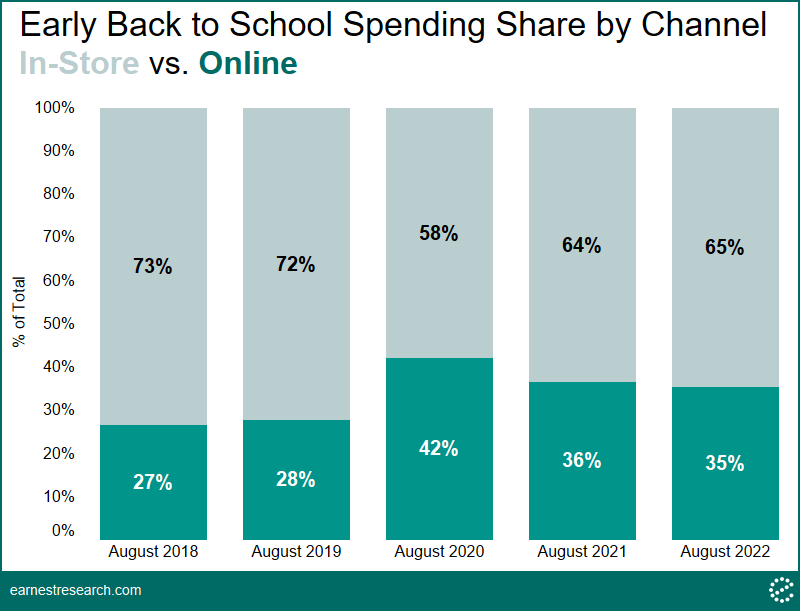

Online sales share significantly higher than pre-pandemic

The share of online back to school spending remains around a third of all back to school spending for the second year in a row for states in which class is already back in session, up from around a quarter before the pandemic. This suggests a new normal for channel penetration during the back to school season. The change also reflects the broader shift to online in the consumer economy during Covid. Online spending in August 2022 (ending the 17th) is 7 points higher than pre-COVID levels, but 7 points below 2020 levels.

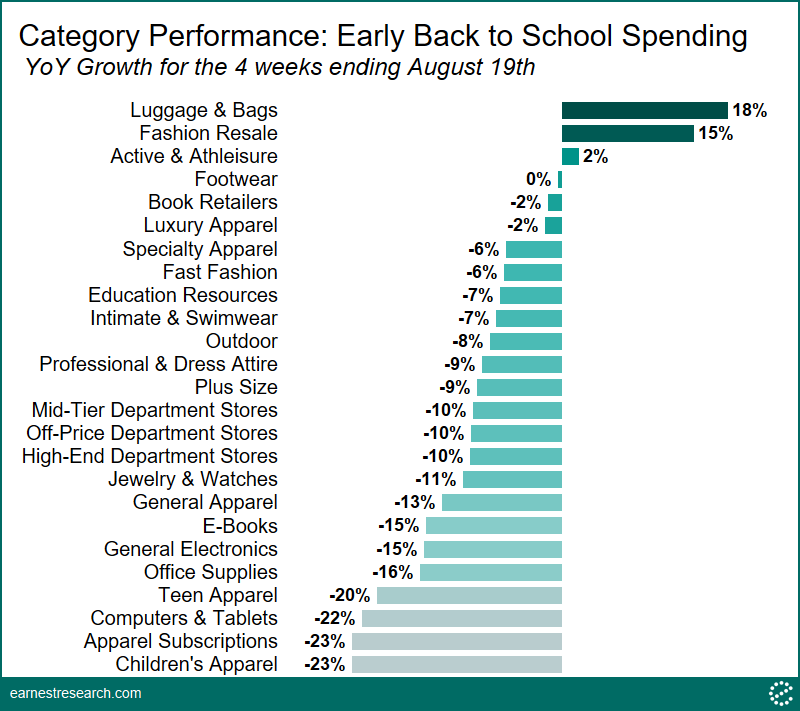

Bags, Fashion Resale, and Athleisure outperform in 2022

Back to school spending for states in which class is already back in session fell across most major categories in the four weeks ending August 19, 2022. Overall, apparel is the most challenged so far, with Children’s Apparel, Apparel Subscriptions, and Teen Apparel all posting 20% YoY declines or worse. Several categories that also outperformed during the pandemic as consumers built their home offices such as Computers & Tablets, Office Supplies, and General Electronics suffered significant declines as they lap difficult pandemic comps.

Luggage & Bags topped back to school spending for states in which class is already back in session, likely benefiting from increased overall travel spend this year to date. Fashion Resale is the fastest growing apparel category, continuing to grow in line with the broader trend of increasing interest in recycling and thrifting fashions. Active & Athleisure slightly grew YoY as consumers continued to flock to more comfortable and versatile clothes.

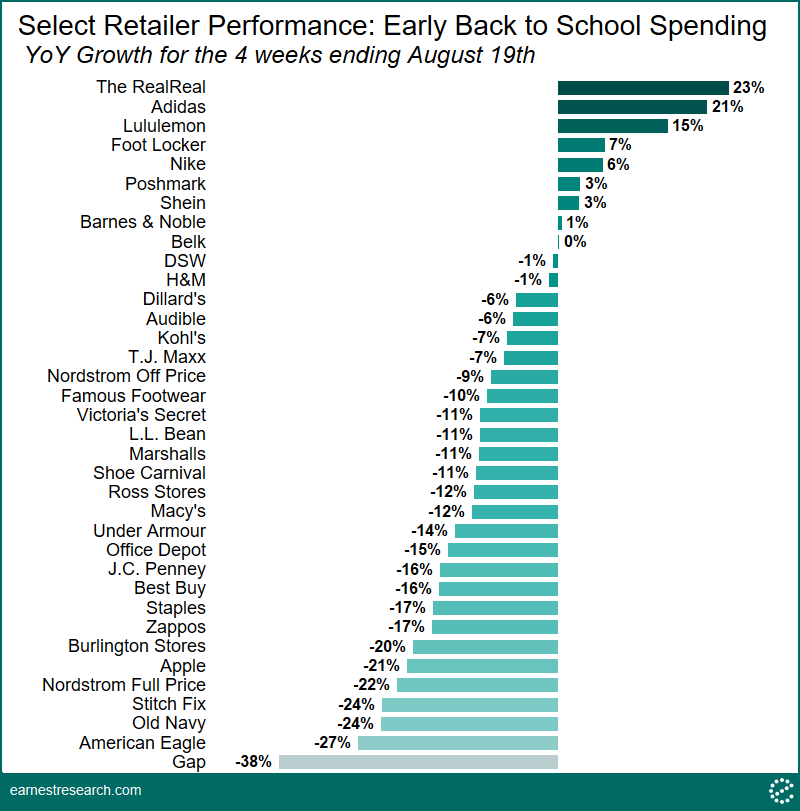

The RealReal, Adidas and Lululemon top Gap, American Eagle, and Old Navy

Fashion resellers are winning apparel sales in the 2022 back to school season in states in which class is already back in session. The RealReal topped all other apparel retailers notching 23% YoY growth, with Poshmark growing 3% YoY. Activewear and footwear brands rounded out the list of fastest growing retailers during the four weeks ended August 19th, 2022. Adidas, Lululemon, Foot Locker, and Nike all outperformed competitors reflecting continued strength in Active & Athleisure. Shein was the only Fast Fashion retailer with growing sales during the period, though growth decelerated significantly since earlier in the year when the retailer routinely grew double digits.

Back to school apparel stalwarts Gap, American Eagle, and Old Navy suffered some of the YoY largest declines of any apparel names during the same period, followed by the department store brands such as Nordstrom, Burlington, and J.C. Penney. In keeping with the broader move away from home office and electronics sales declines, Apple and Best Buy sales also declined significantly YoY during the early back to school season.

To learn more about the data behind this article and what Earnest Research has to offer, visit https://www.earnestresearch.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.