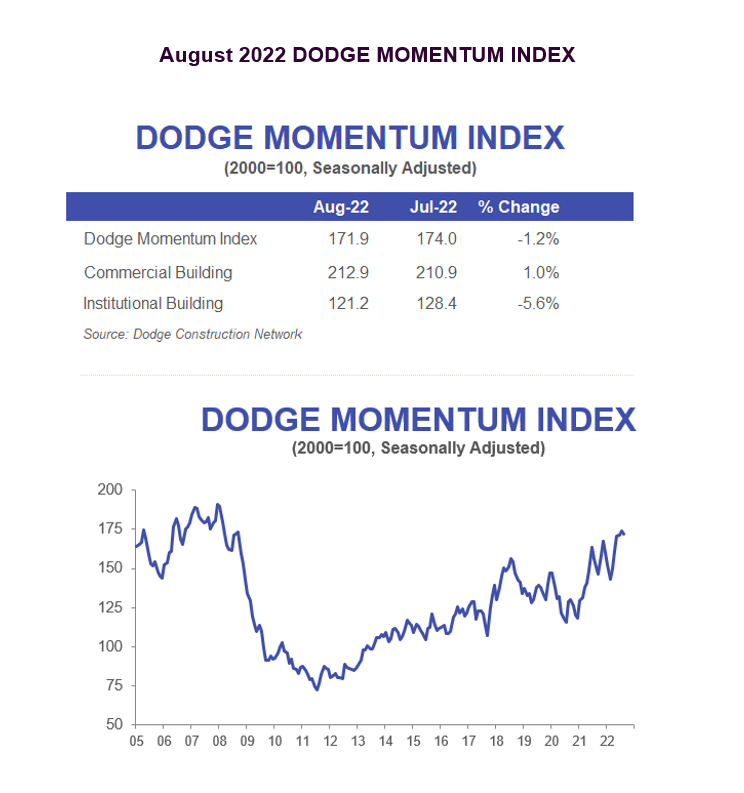

The Dodge Momentum Index (DMI) ticked down by 1.2% in August to 171.9 from the revised July figure of 174.0.

The Momentum Index, issued by Dodge Construction Network, is a monthly measure of the initial report for nonresidential building projects in planning, shown to lead construction spending for nonresidential buildings by a full year. In August, the commercial component of the Momentum Index rose 1%, while the institutional component fell 5.6%.

Commercial planning in August was led by an increase in hotel projects, while fewer healthcare projects drove the institutional component lower. Compared to August 2021, the Momentum Index was up 14%. The commercial component was 16% higher, and the institutional component was 10% higher than a year ago.

A total of 26 projects with a value of $100 million or more entered planning in August. The leading commercial projects were the $400 million Two Tower office building in Chicago, IL, the $300 million phase 2 of the Sungate Logistics Park in Daytona Beach, FL, and the $275 million Aligned Data Center in Sterling, VA. The leading institutional projects were the $360 million Scripps Mercy Hospital expansion and the $275 million Triton Center redevelopment, both located in San Deigo, CA. Additionally, $275 million in improvements for Okemos Public Schools in Meridian Charter Township, MI, went into planning since a bond measure for this project will appear on the local ballot in November.

“In spite of weak institutional planning activity, the Momentum Index remained elevated in August, just a notch below July’s 14-year high. This indicates continued confidence from owners and developers that nonresidential building projects will be realized in the coming year,” said Sarah Martin, senior economist for Dodge Construction Network. “Weaker economic conditions and rising interest rates, however, may grind down overall consumer and business confidence as we move into 2023 — translating into fewer nonresidential building projects breaking ground.”

To learn more about the data behind this article and what Dodge Analytics has to offer, visit https://www.construction.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.