The return of seasonal offerings like the pumpkin spice latte (or “PSL”)—which launched at Starbucks (NASDAQ: SBUX) this year on August 30—coincided with a noticeable uptick in weekly U.S. sales for the coffee chain. Looking at Starbucks’ sales volume during fall menu launches over the past four years, U.S. weekly sales were also highest during the launch in 2022.

Starbucks (NASDAQ: SBUX) U.S. sales perked up when PSLs returned to the menu

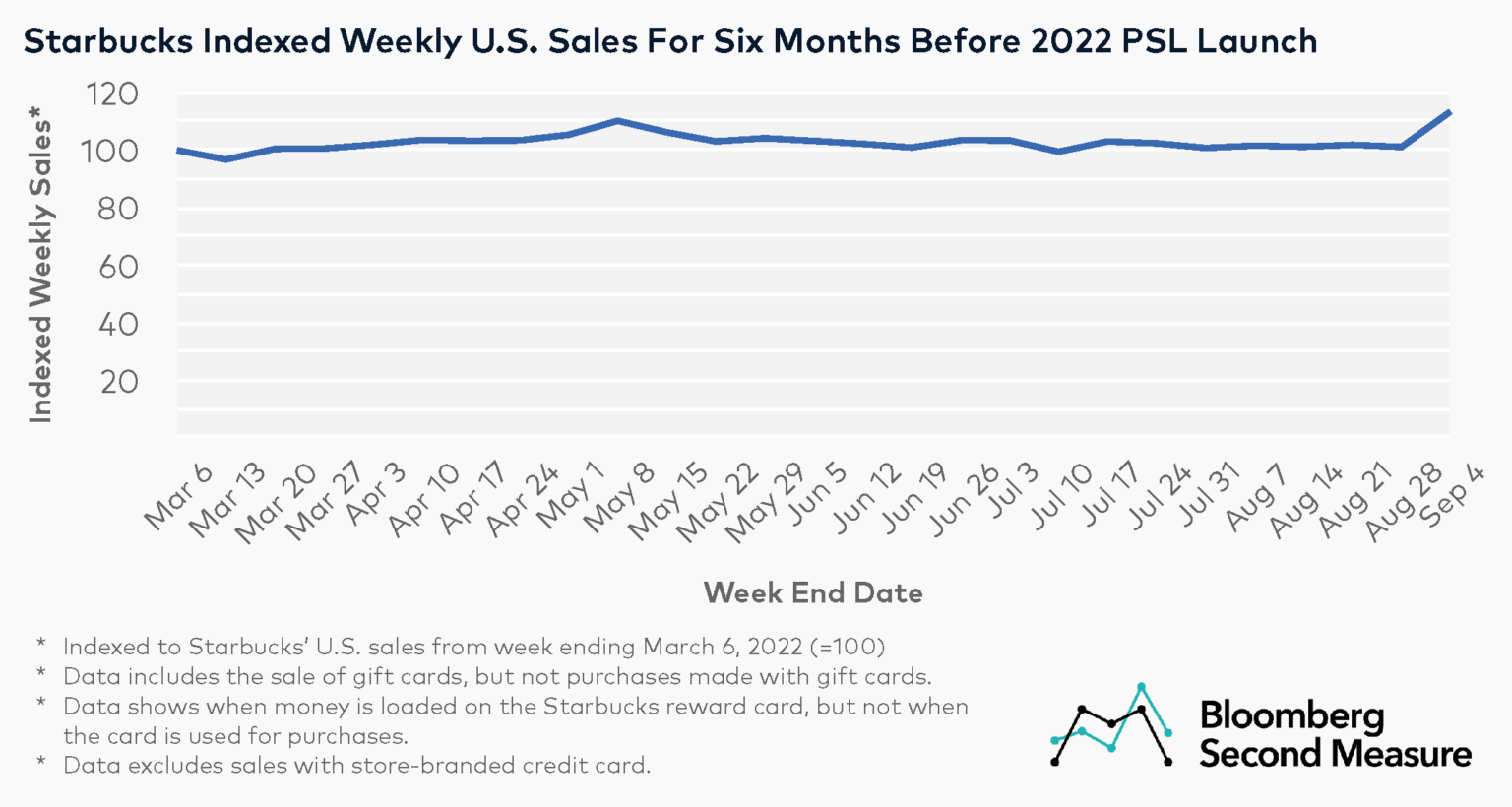

Consumer transaction data shows that Starbucks’ weekly U.S. sales over the past six months have remained relatively steady. Most week-over-week changes during this period fell within 3 percent (with the exception of a 5 percent increase in week-over-week sales during the week leading up to Mother’s Day). However, the week that Starbucks’ pumpkin-flavored beverages and treats were re-introduced, sales increased 12 percent compared to the previous week.

Bloomberg Second Measure data includes the sale of gift cards, but not purchases made with gift cards. For the Starbucks Rewards card and app, our data tracks when money is pre-loaded but not when the funds are used for purchases. Our data also excludes sales through the store-branded credit card, as well as international sales and sales of Starbucks products through third parties.

How did Starbucks sales during the PSL 2022 launch compare to previous years?

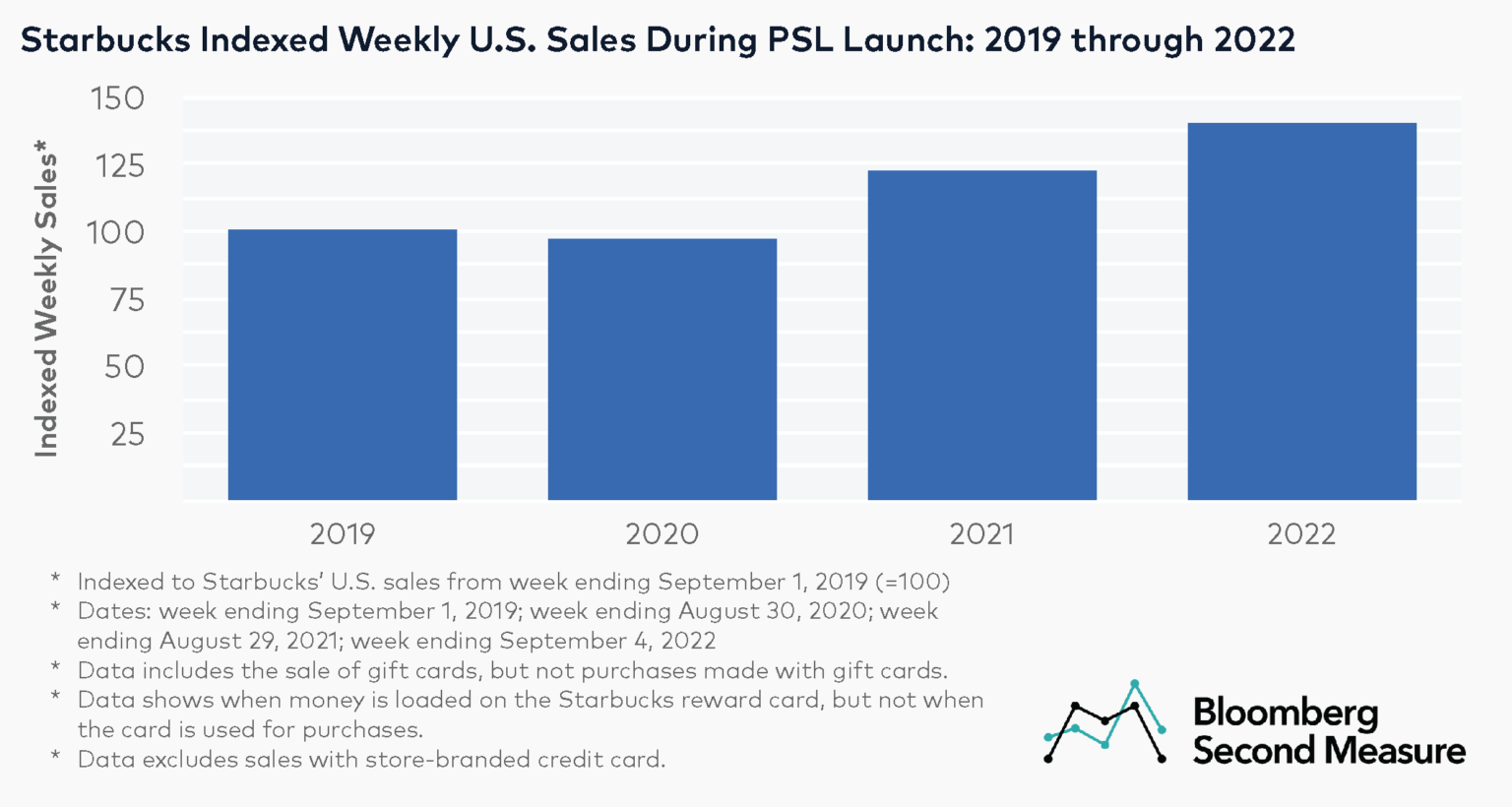

Starbucks U.S. sales during the fall menu launch week in 2022 were 14 percent higher than sales during the fall menu launch week in 2021, 44 percent higher than in 2020, and 40 percent higher than in 2019.

Sales during PSL launch week have generally increased over the past four years, with the exception of 2020, the first year of the COVID-19 pandemic. Starbucks sales were 2 percent lower during PSL launch week in 2020 compared to launch week in 2019. The biggest year-over-year increase over the past four years was between fall menu launch in 2020 and 2021, with sales growing 26 percent. Starting in 2019, Starbucks also added its pumpkin cream cold brew to the fall menu, and then added hot and iced apple crisp beverages in fall of 2021. Interestingly, iced drinks now reportedly comprise about 70 percent of Starbucks sales.

Grande plans for the future

The same week as the 2022 fall menu launch, Starbucks announced a new CEO who will succeed Howard Schultz next April. The coffee chain reportedly also intends to revamp its stores and equipment to improve efficiency, especially as consumer tastes are evolving toward cold drinks, food orders, and customized beverages. Furthermore, Starbucks plans to expand to 45,000 stores globally, with much of that growth coming from domestic openings as well as new stores in China.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.