Following Party City Holdco Inc’s (NYSE: PRTY) FY22 Q2 earnings beat, the company announced its hiring of 20,000 additional workers, anticipating a busy Halloween in 2022. Bloomberg Second Measure’s consumer transaction data shows that Party City Holdco Inc.’s U.S. sales increased year-over-year in October 2021, but are yet to reach pre-pandemic levels. Additionally, we found that the average October sales per customer at Party City Holdco Inc increased during the pandemic.

Party City’s (NYSE: PRTY) October sales increased in 2021, but were still slightly below their pre-pandemic levels

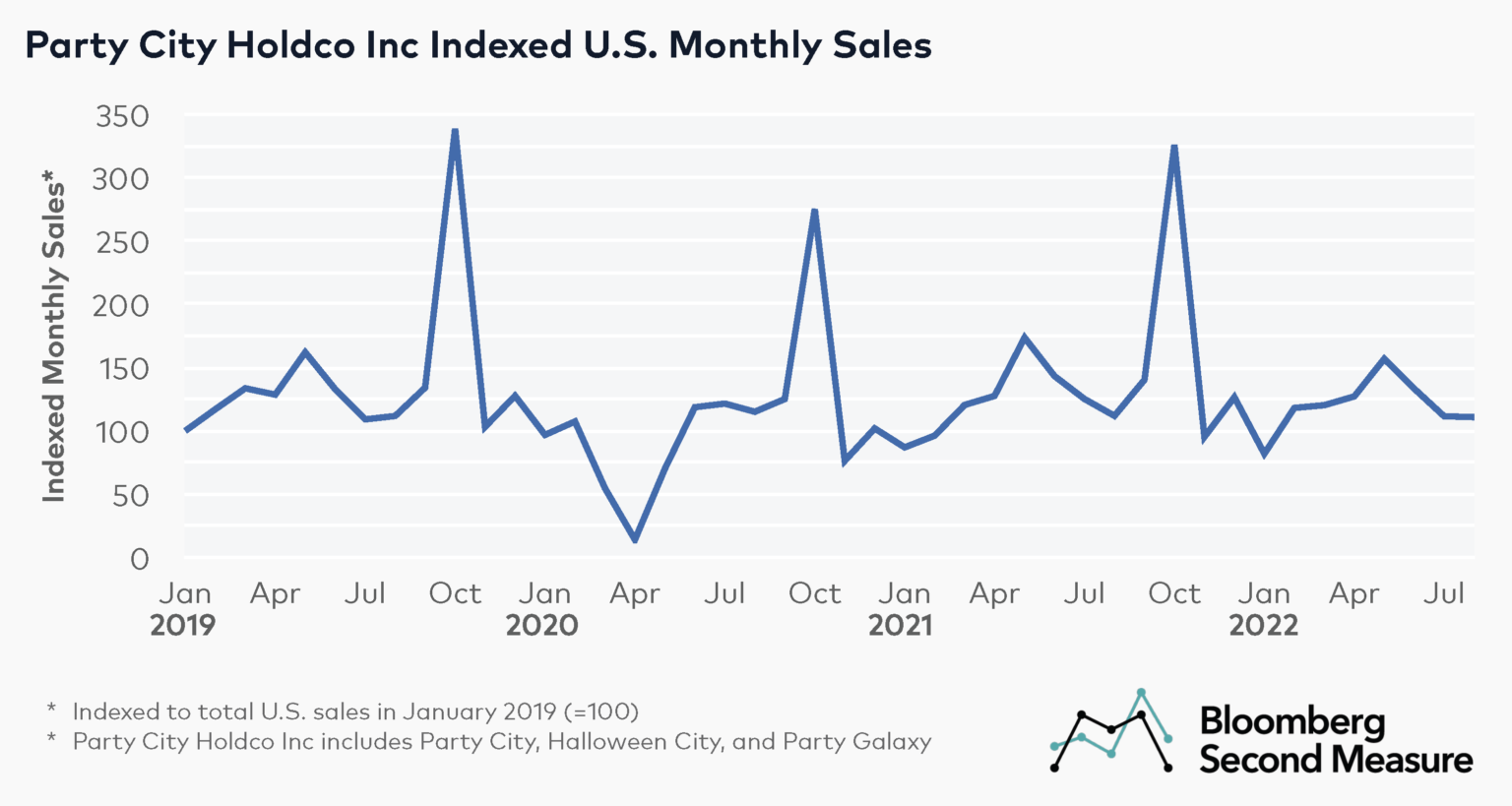

Our analysis of U.S. sales at Party City Holdco Inc, a national costume and party goods chain that, apart from its namesake brand, owns Halloween City, a pop-up store chain, and Party Galaxy, a local party goods chain acquired in 2017, shows that they follow a seasonal pattern and reach their peak in October, around Halloween.

U.S. sales in October 2021 accounted for 19 percent of Party City Holdco Inc’s total U.S. sales in 2021. This is a continuation of the trend recorded in previous years, with October 2020 sales accounting for 22 percent of the company’s annual U.S. sales and October 2019 sales accounting for 20 percent of Party City Holdco Inc’s annual U.S. sales.

On a year-over-year basis, Party City Holdco Inc’s U.S. October sales decreased by 19 percent in the first year of the pandemic, as COVID-19-related concerns might have kept some trick or treaters home, and Halloween festivities in many cities across the U.S. were canceled. U.S. sales rebounded in October 2021 and were up 18 percent year-over-year. Notably, ahead of Halloween in 2021, the Delta variant of COVID-19 passed its peak, and both CDC and Dr. Anthony Fauci gave a go-ahead to trick-or-treating.

However, Party City Holdco Inc’s U.S. sales in October 2021, despite trending upward year-over-year, did not reach pre-pandemic levels. The company’s U.S. sales in October 2021 were down 4 percent, compared to the same month in 2019.

Aside from sales spikes each October, Party City Holdco Inc records an uptick in sales each May. This pattern could be observed before the pandemic, as well as in May of 2020, 2021 and 2022. One potential factor contributing to this trend might be an increase in sales of party decorations during the graduation season.

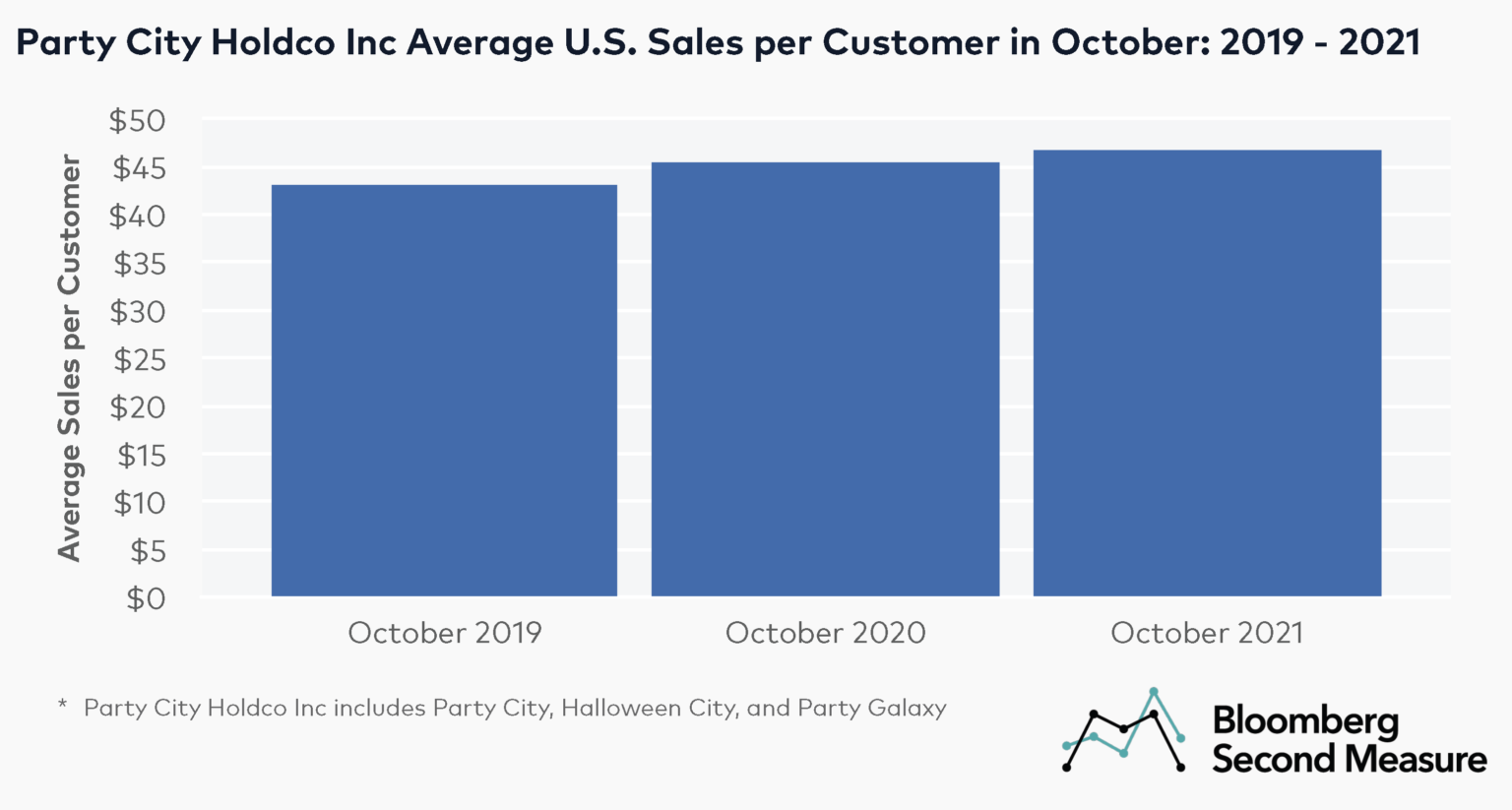

Party City’s average sales per customer in October of 2020 and 2021 were higher than in October 2019

Our analysis of consumer transaction data shows that Party City Holdco Inc recorded higher average U.S. sales per customer in October 2020 and 2021, compared to October 2019.

In October 2021, Party City Holdco Inc’s U.S. customers spent, on average, $47, up 3 percent compared to October 2020. Compared to October 2019, Party City Holdco’s U.S. customers spent, on average, 5 percent more in October 2020 and 8 percent more in October 2021.

Party City gets creative to keep consumer demand up

Countering the potentially negative effects of the pandemic on demand for party wares, and to revive interest in its offerings, Party City Holdco Inc introduced a number of initiatives—including the launch of the “2020 Forget You” New Year’s Merchandise line, and, ahead of Halloween in 2021, an immersive “Boo-Loon” pop-up installation in New York City.

What does Party City have in store for Halloween in 2022?

For Halloween in 2022, apart from increasing its seasonal workforce, Party City announced that it will celebrate a 50-day countdown to the Halloween night by hiding 100 life-skeletons across a number of the U.S. cities, as a part of its “Yorrik Scavenger Hunt Sweepstakes.”

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.