Bed Bath & Beyond has survived the test of time as one of the last remaining big box brick-and-mortar category killers. But recent performance has lagged, and reports of debt restructuring call into question how much longer the business model can survive. In today’s Insight Flash, we review the Bed Bath basics to showcase how equity investors might have been able to get ahead of the company’s large drops in share price, and how potential bondholders can better understand the risk profile compared to others in the space, by banner, and by channel.

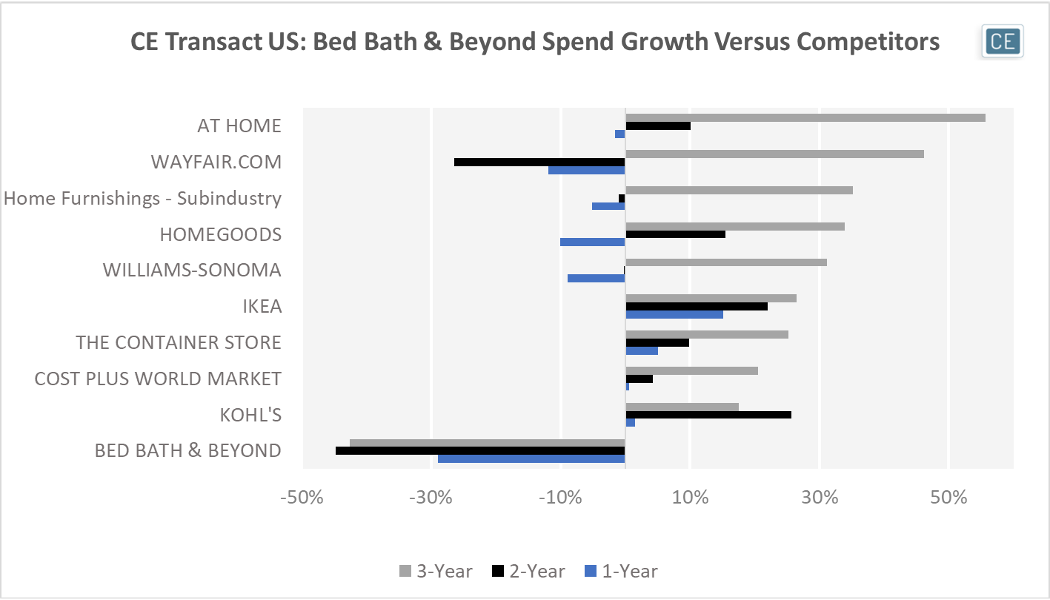

Over the last 91 days, the decline in spend for BBBY’s flagship Bed Bath & Beyond brand have been the most negative among top competitors as well as the subindustry as a whole on a one-year, two-year, and three-year basis. On a three-year basis compared to pre-COVID spend levels, Bed Bath & Beyond brand spend on credit and debit cards is down -43%, while every major competitor is showing positive spend growth and spend for the subindustry as a whole is up 35% versus three years ago.

Spend Growth

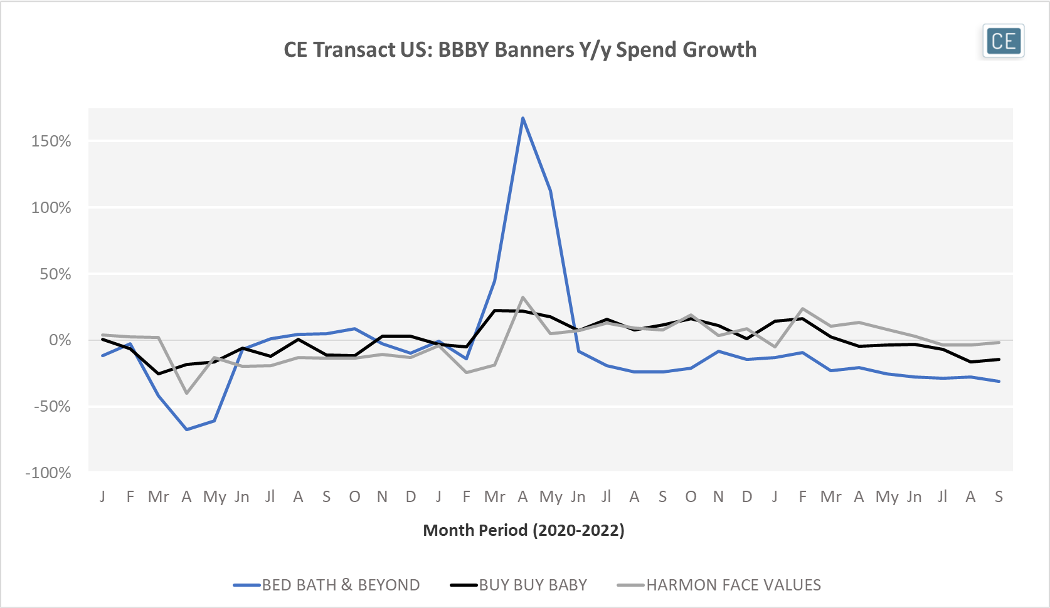

Although restructuring Bed Bath and Beyond’s debt could help the company, understanding the value of its underlying assets is an important input. Consumer Edge data breaks out how the individual banners are performing, isolating options for a spinoff or rebanner. In the case of Bed Bath and Beyond, all three of its top banners have experienced negative y/y spend growth over the last three months. Throughout 2022, all three brands have been experiencing a significant deceleration in spend growth, resulting in a negative trajectory heading into the holiday season.

Brand Performance

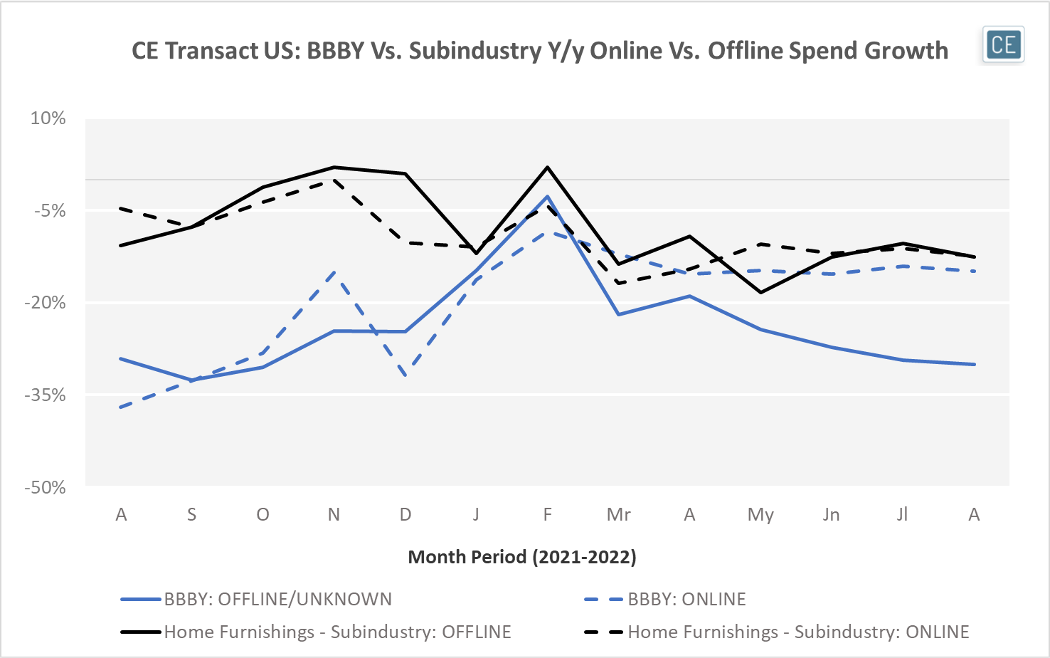

Looking at channel trends might also be important in a BBBY restructuring, as those trends shed light on the relative importance of the company’s real estate agreements. For the BBBY portfolio of brands as a whole, online growth hasn’t decelerated as quickly as offline growth. While y/y change in offline spend has been decelerating over the last few months to -30% in August 2022, online spend declines have been holding mostly steady and at -15% in August were only half the level of offline declines. For the subindustry overall, online and offline trends have moved more closely together. And although the subindustry still saw y/y spend drop -12% both offline and online in August, it still appears that Bed Bath & Beyond is underperforming its broader competitive set across channels.

Channel Trends

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.