Consumer Spending Trends to Watch This Holiday Season

Retailers are understandably nervous about the upcoming holiday shopping season. It’s a season that has traditionally accounted for up to 40% of annual sales. Given the economic turmoil of recent years, it’s no wonder merchants and service providers are anxious about whether they can expect the fourth quarter to resemble those of Christmases past, rather than the disruption they’ve endured since the onset of COVID.

Fortunately, Envestnet® | Yodlee®’s wealth of consumer spending and transaction data may offer some insights. Tracking recent spending history in several industries that are key holiday-season players, Envestnet’s research team has noted several trends that are likely to characterize holiday spending in 2022. Among them:

Envestnet® | Yodlee®’s study of changes in consumer spending and transaction data over recent holiday seasons and year-to-date offers a glimpse of how these trends may shake out in selected industries where consumer spending has been traditionally robust during the holidays.

Travel

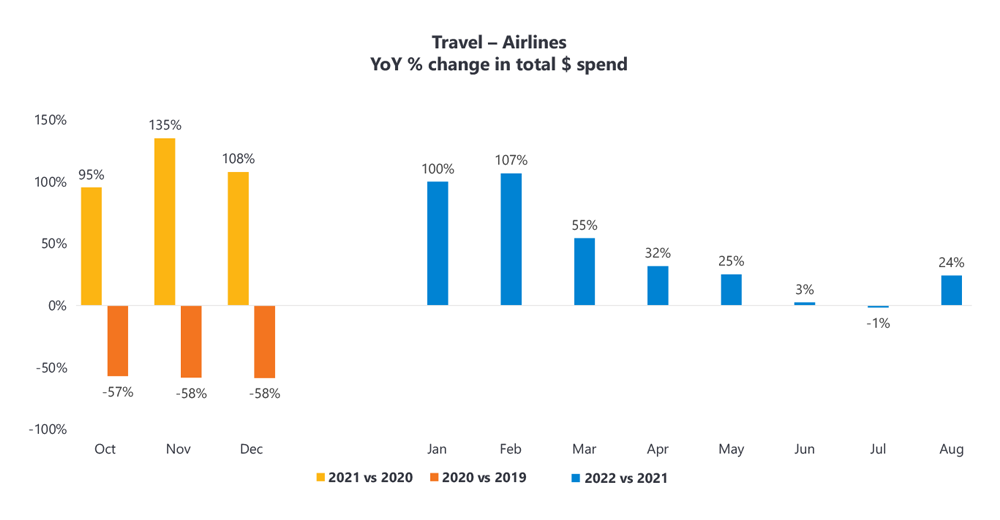

In 2020, COVID not only forced demand for air travel to near-zero, it also led to the current staffing shortages throughout the industry, as pilots opted for early retirement and TSA workers and baggage handlers sought higher-paying jobs elsewhere. That’s why in 2022, even as demand has rebounded, flights have been scarce and delays have been common. High demand, limited availability, and fuel prices have driven large increases in ticket prices.

This helps explain why spending on air travel, which bounced back big during the 2021 holiday season, declined over the course of 2022. Nonetheless, spending did start to rise again at the end of the summer. That increase, along with the example set last winter and a likely jump in fuel prices due to recently announced OPEC production cuts, bodes well for airline revenues this holiday season.

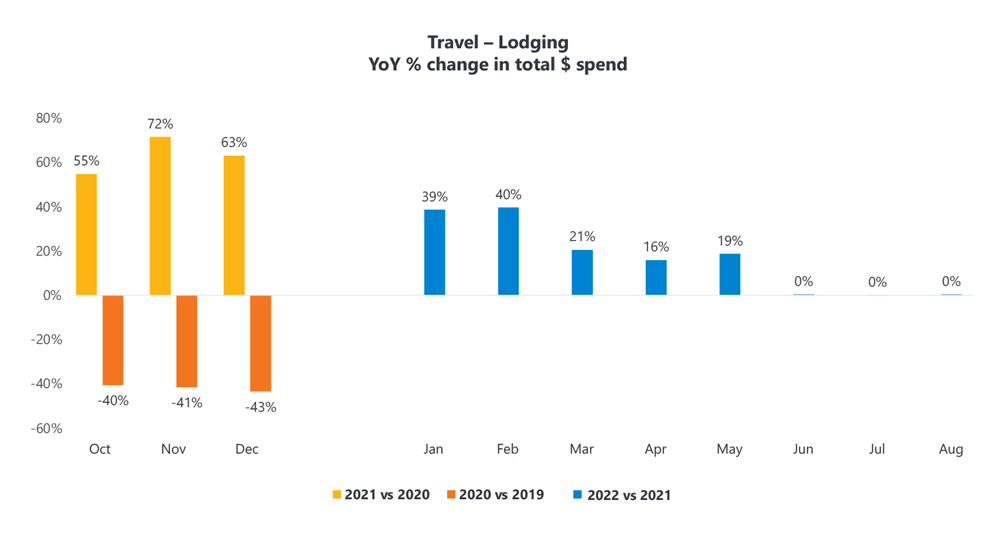

Like the airlines, hotels also saw demand plummet and staffing levels shrink during the pandemic. Similarly, demand bounced back during the 2021 holidays. 2022 saw post-holiday demand slip as travel costs rose, but it appeared to stabilize over the summer, with demand equaling that of last year. If that trend persists, hotels should be filling up this winter like they did a year ago.

Food

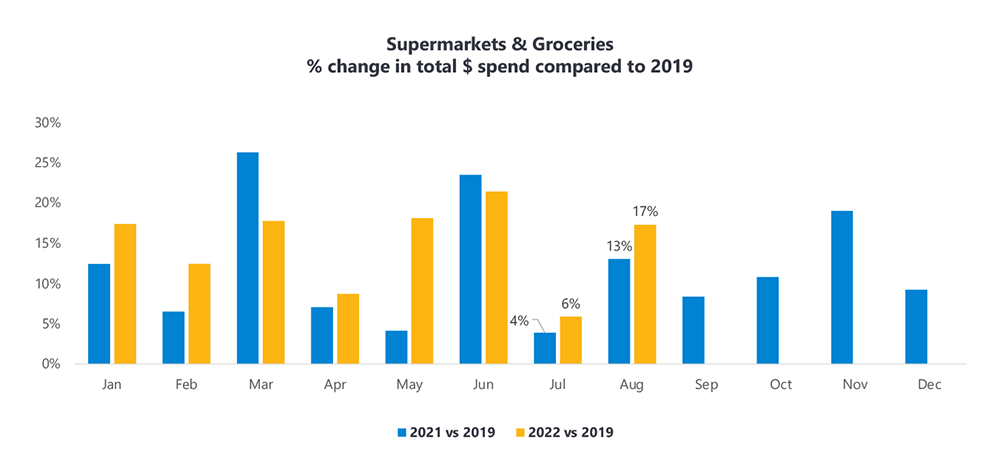

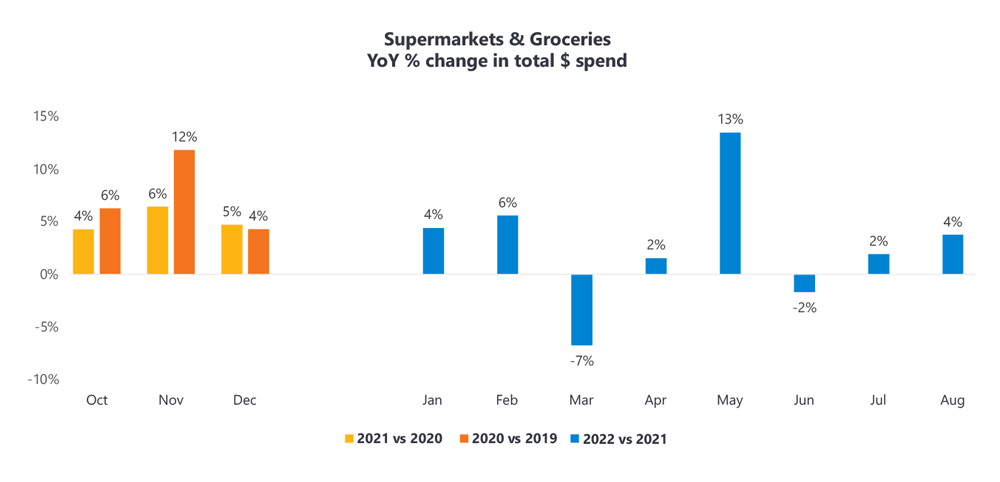

How lavish will holiday feasts be this year? Inflation hit supermarket shoppers hard in 2022. They did spend more than they did in 2019.

But sticker shock meant that 2022 grocery spending still fluctuated as consumers tried to distinguish necessities from delicacies.

Supermarket spending started to rise again in late summer. That trend, along with the increase signaled by last winter’s spending, suggests that this holiday’s turkeys will be served with all the trimmings.

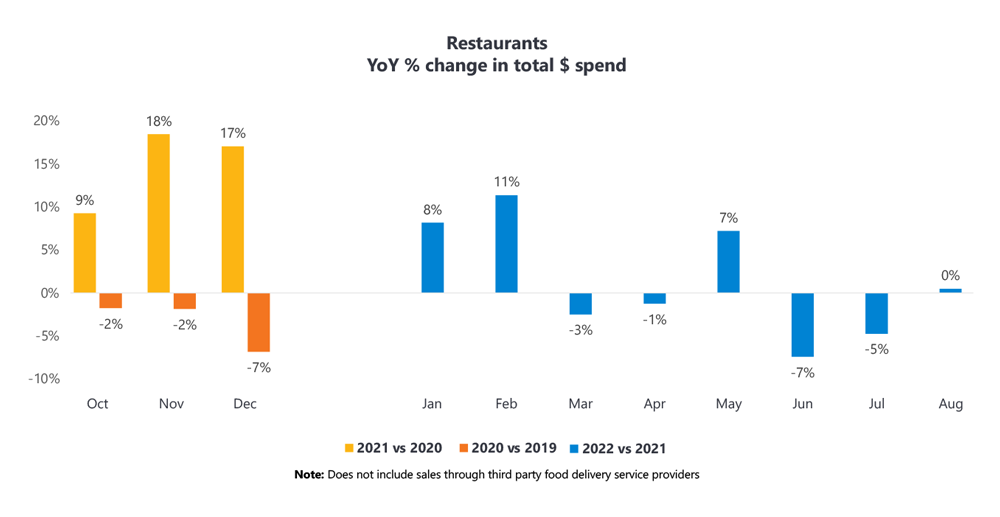

Restaurant spending has followed a similar pattern in 2022. Demand is back, but inflation and labor shortages have caused spending to fluctuate. Nonetheless, a late-summer boost and last winter’s huge year-over-year increase are signs of hope for eateries eager to book big family celebrations.

Apparel and Accessories

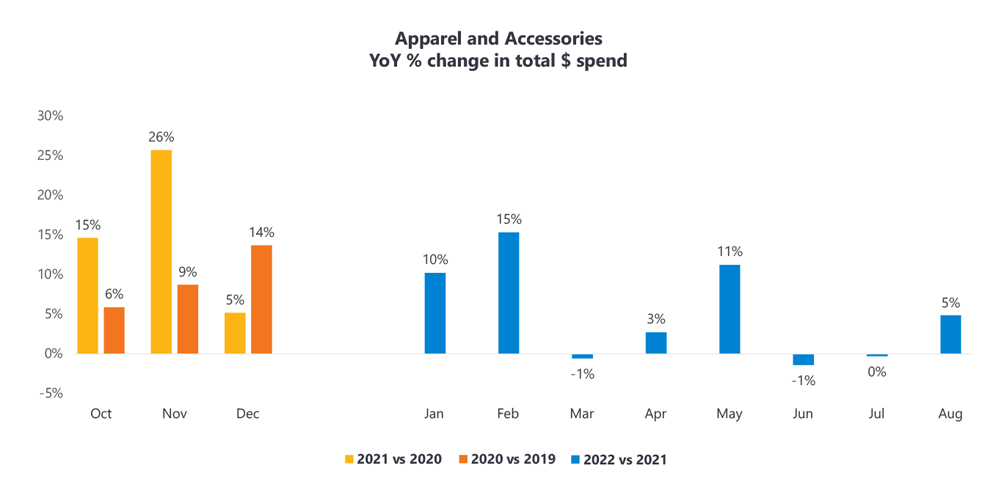

Traditionally, some 50 percent of holiday gifts are apparel and accessories. This year, the chart for consumer spending in this sector looks remarkably like those for supermarkets and restaurants, with similarly-timed fluctuation attributable to inflation.

Unlike restaurants, clothing spending has consistently risen during the holidays, even throughout the pandemic. And even if staffing shortages mean increases in both prices and the hassles of brick-and-mortar shopping, the pandemic has made most of us accustomed to online gift-buying. Get ready for the possibility of more socks and sweaters under the tree, especially from retailers with discounted merchandise and well-developed e-commerce channels.

Home Entertainment

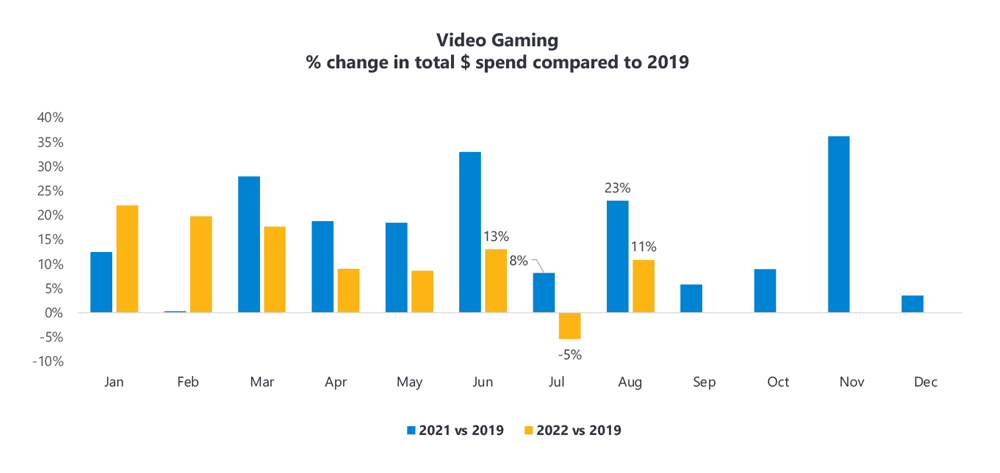

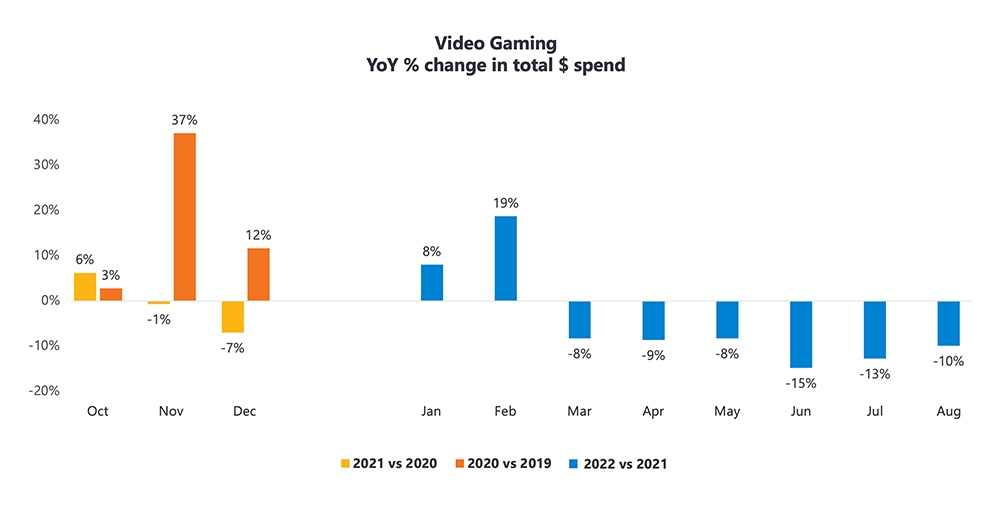

At holiday time during the pandemic, instead of huddling around the hearth, it’s likely your family huddled around the TV, playing video games and binge-watching streaming shows. Spending on gaming3 and streaming4 skyrocketed during COVID, but now that holiday revelers can venture out for entertainment again, the gaming industry is expecting spending to slide. As with groceries, inflation has still meant higher spending in 2022 than before the pandemic.

But year-over-year spending has been down nearly every month since November 2021.

For the streaming platforms, however, spending has been up steadily since 2019, even with industry leader Netflix alarming investors this year by reporting that subscriber growth is plateauing.

Streaming differs from gaming in that, even though demand is slowing, spending continues to grow. New services keep joining the subscription stack (Disney+ in 2019, HBO Max in 2020), and the prices of those subscriptions keeps rising, as the platforms offer either higher-priced ad-free service tiers or (as with Disney+, Hulu, and ESPN) bundles of multiple channels.

Wrapping It All Up

Despite the Fed raising interest rates several times this year, data shows consumer demand has not diminished, nor has the inflation resulting from still-high demand. Consumers may be spending more judiciously, but they’re still spending, and in many cases, spending more than they did before the pandemic. It may be harder to travel, to feast with an extended family, or to put gifts under the tree, but if last holiday season is any indication, consumers will still spend more in order to make this holiday as festive as those in years past.

To learn more about the data behind this article and what Yodlee has to offer, please reach out to Dylan Curtis at Dylan.Curtis@yodlee.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.