Keep up with the food delivery market in every market with Measurable AI’s transactional e-receipts data panel. This week we did an overview of the food delivery market in Europe throughout the past few years.

First stop, España.

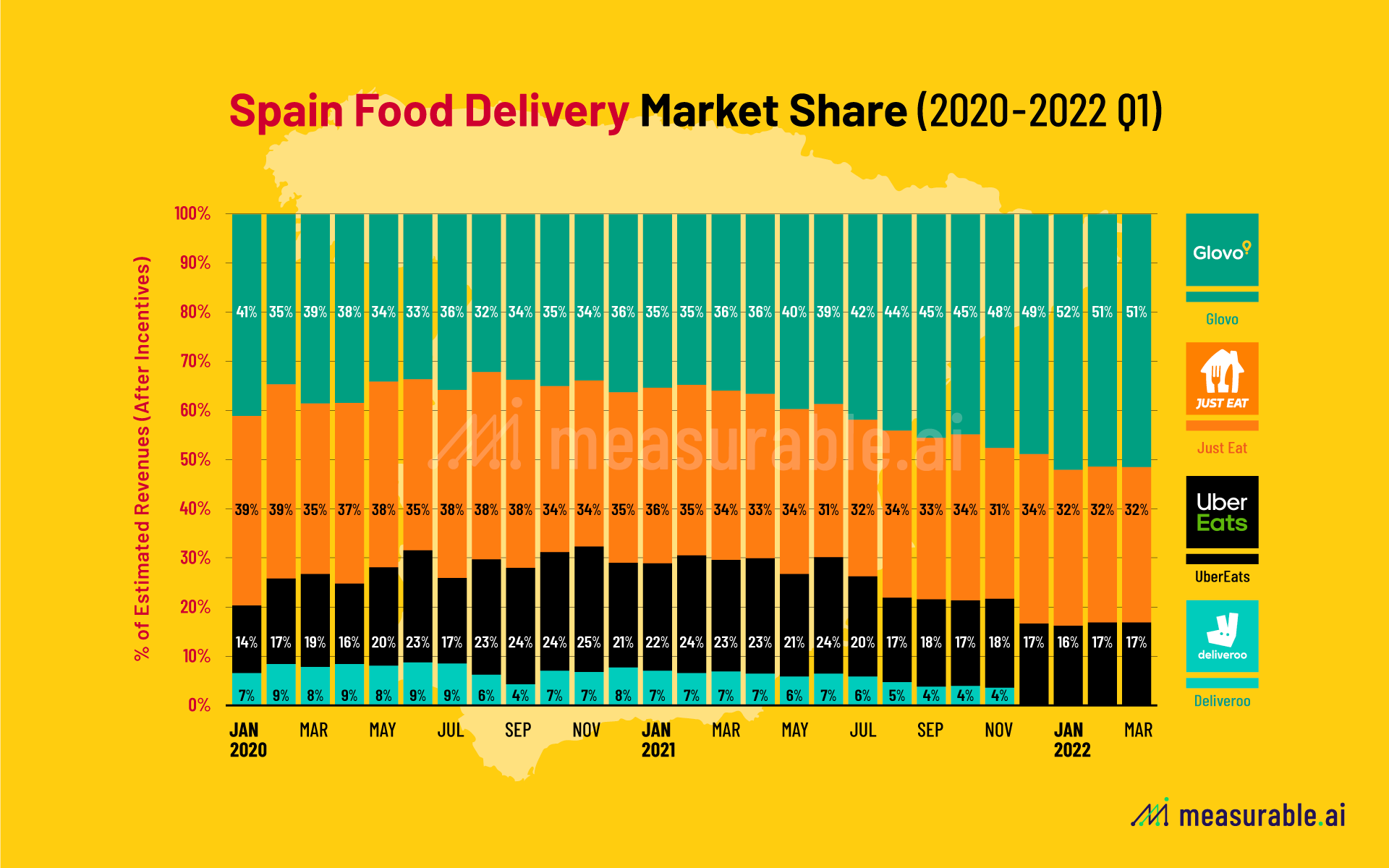

Looking back, the Spain food delivery market has been quite competitive with over four players in the game: Glovo, JustEat, UberEats and Deliveroo. In 2020, Glovo was on a par with JustEat at around 35% of the market share by revenues.

Glovo started to lead the Spain food delivery market since Q2, 2021 and continued the momentum into 2022. Entering 2022, Glovo takes over around 50% of the market share by revenues as of Q1, followed by JustEat (at around 32%). Deliveroo quit the Spain market end of 2021 with 5% of the marketshare, making Glovo’s advantage more significant in this year. The only non-European player UberEats has remained 3rd place in Spain with around 20% of the market share by revenues.

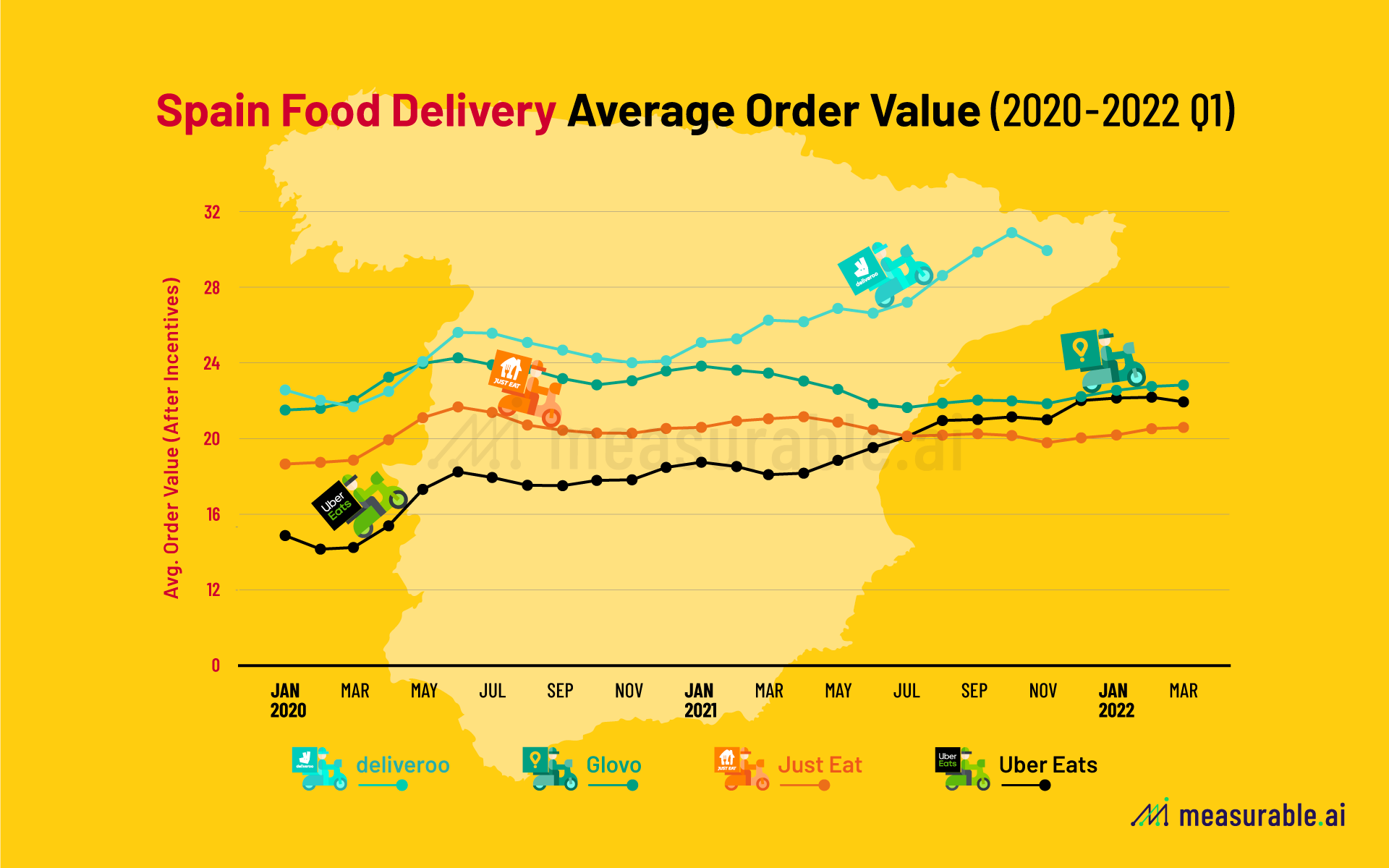

The food delivery market, over the pandemic, has experienced a good amount of growth, as well as consolidations with multiple mergers and acquisitions. In Spain, Glovo is now owned by Delivery Hero as a majority holder. According to Measurable AI’s granular transactional data, apart from Deliveroo (whose AOV is much higher than its rivals), Glovo consumers tend to spend the most on food delivery per order in Spain. UberEats’s AOV kept growing over the years and now is only slightly under Glovo’s. JustEat’s AOV level remains stable and hovers around 20 Euro.

For geographic coverage, each company has its own focusing regions. Glovo’s top 3 cities of food delivery volume are: Madrid, Barcelona, Zaragoza; JustEat: Madrid, Sevilla, Barcelona; UberEtas: Madrid, Barcelona, and Valencia.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.