As the battle for consumer spending intensifies in the 2022 holiday season, Bloomberg Second Measure analyzed three major big-box retailers known for their Black Friday events—Walmart Inc (NYSE: WMT), Target Corporation (NYSE: TGT), and Best Buy Co, Inc (NYSE: BBY)—to see how they fared during Black Friday week. Using consumer transaction data, we found that Walmart outperformed its peers in terms of overall year-over-year sales growth in the U.S. Additionally, all three companies saw greater year-over-year growth in their online sales than their retail sales.

Black Friday week sales growth was a mixed bag in 2022

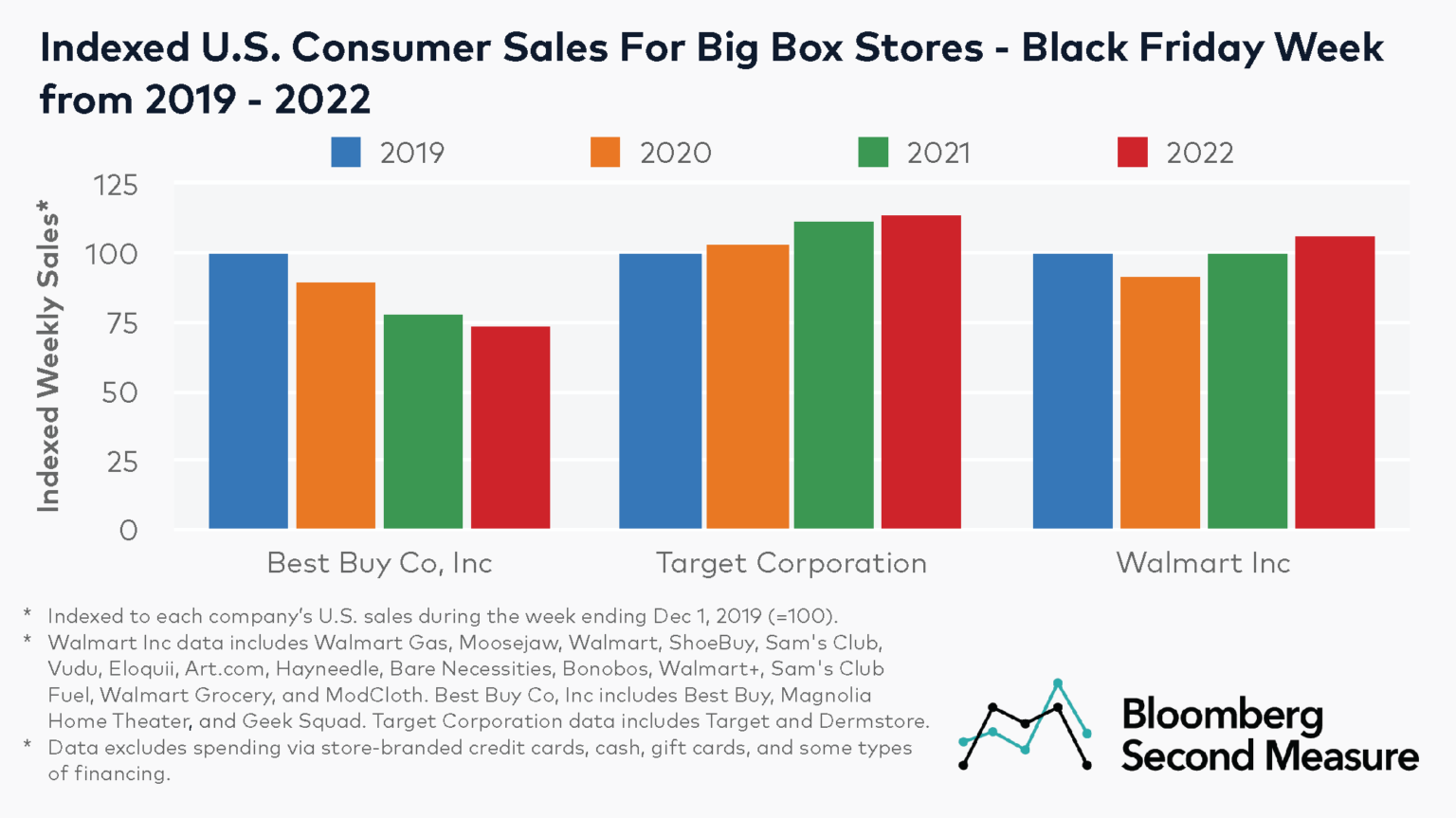

Looking at Black Friday 2022 results, U.S. consumer sales during that week grew 6 percent year-over-year at Walmart Inc and 2 percent year-over-year at Target Corporation. Compared to Black Friday week in 2019, consumer sales during Black Friday week in 2022 increased 13 percent at Target and 6 percent at Walmart Inc.

In contrast to the modest growth seen at Target Corporation and Walmart Inc during the 2022 Black Friday week, U.S. consumer sales at Best Buy Co, Inc—which primarily sells discretionary products like electronics—have decreased every Black Friday week since 2019. Consumer spending during the week of Black Friday 2022 was down 6 percent year-over-year and 27 percent lower than the comparable week in 2019. Demand for electronics has reportedly declined compared to earlier in the pandemic, likely influenced by factors such as economic uncertainty and the relative longevity of tech products.

When looking at each of these big-box retailers’ most recent earnings reports, results were similarly varied. In its most recent earnings report, Target missed expectations and cut its holiday quarter outlook, citing challenges like inventory management, high inflation, and decreased consumer spending in categories like home items and sporting goods. Unlike Target, Walmart’s third quarter earnings beat estimates, and the retailer recently raised its guidance. Walmart has also reportedly seen a boost in its grocery sales, but lower demand for higher-priced, discretionary items. Additionally, Best Buy’s most recent earnings report exceeded investors’ expectations, and the company has maintained its holiday quarter outlook.

Ecommerce sales growth exceeded retail sales growth at all three big-box retailers

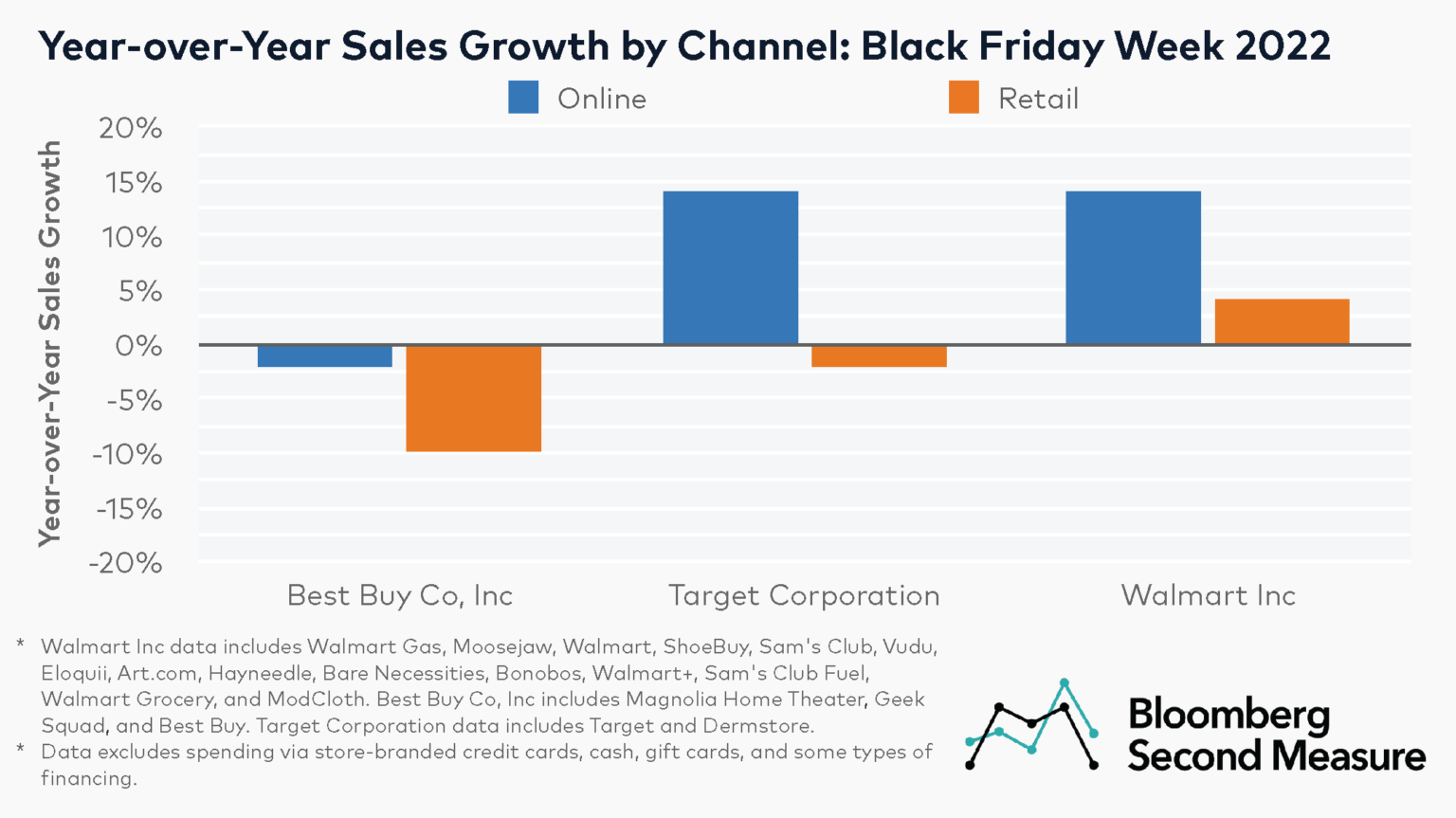

Over the past few years, many retailers have transitioned away from in-person doorbusters on Black Friday and toward online deals. The big-box retailers in our analysis have been closed on Thanksgiving Day since 2020, thus shortening the in-store sales period for the past three years. Our breakout of Black Friday week sales by channel shows that online sales at the three companies had a higher year-over-year growth rate than retail sales in 2022.

At both Walmart and Target, online sales during Black Friday week in 2022 increased 14 percent year-over-year. Retail sales also increased 4 percent at Walmart, but decreased 2 percent at Target. Online sales at Best Buy Co Inc decreased 2 percent year-over-year during the week of Black Friday 2022, compared to a 10 percent decline for retail sales.

An earlier start to holiday sales?

One of the major trends of the 2022 holiday shopping season has been the introduction of more sales events prior to Black Friday. In early October—around the same time as Amazon’s surprise second Prime Day—Walmart hosted its Rollbacks and More sale and Target launched its Deal Days.

At the beginning of November, Walmart also launched a holiday promotion for half-price Walmart+ membership. One of the touted benefits of the membership program was early access to online holiday sales, including Black Friday deals and the new Deals for Days sales events that took place online every Monday in November.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.