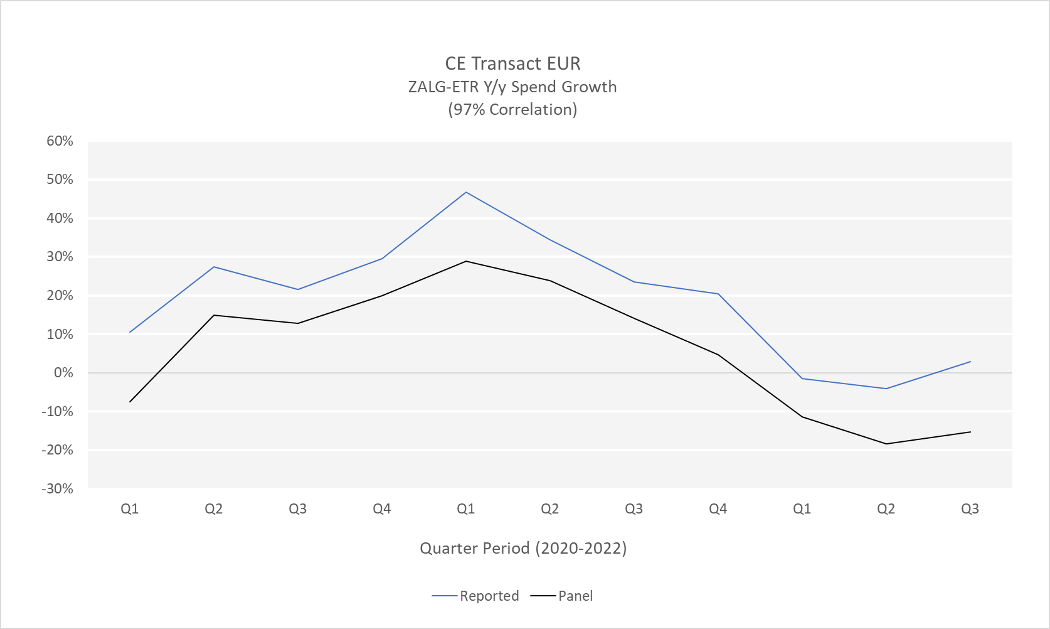

Zalando, much like Consumer Edge, has rapidly expanded its presence across European markets with on-trend products that meet customer needs. This makes the company a fitting topic for our first pan-European Insight Flash using our newly launched CE Transact EUR dataset to examine how Zalando’s performance has trended across the six countries covered. CE Transact EUR has been highly predictive of Zalando’s reported sales growth over the past three years with a 97% correlation. In today’s Insight Flash, we peel back the onion on those topline numbers to see how the company’s home market of Germany has changed in importance recently, how spend growth has trended across Europe, and how important the in-progress holiday season is to Zalando’s overall health.

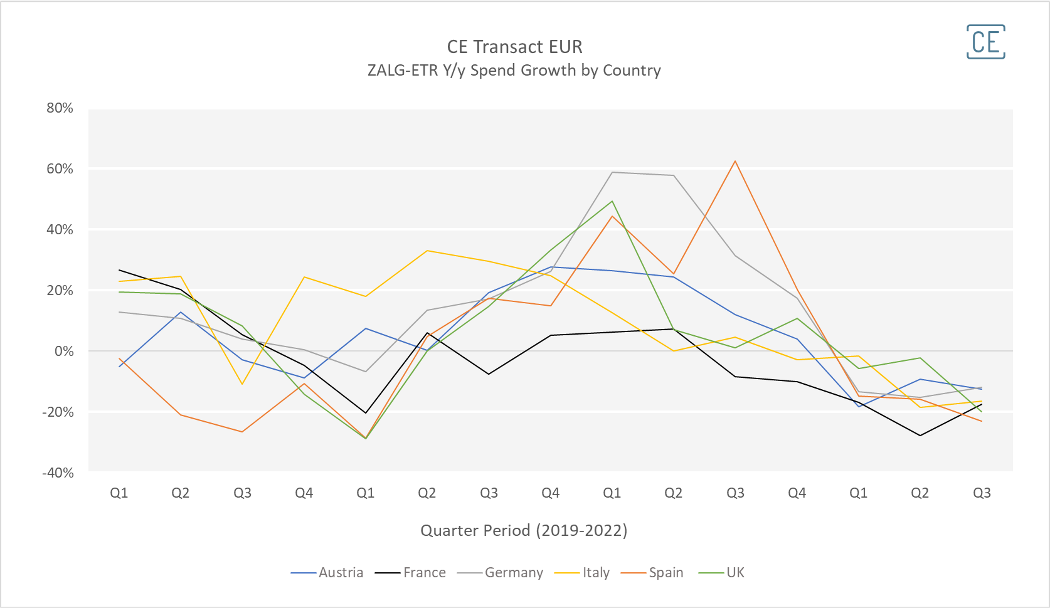

Among the six countries covered by CE Transact EUR, which country has been driving Zalando’s overall spend growth has differed over the past four years. Zalando spend growth was strongest in Italy at the end of 2019 and beginning of 2020. The first half of 2021, however, saw the strongest growth for Zalando in its home market of Germany, while growth in the second half of that year was strongest in Spain. The first three quarters of 2022, however, have seen declining y/y spend in all six tracked countries as Europe struggles with inflation and consumers look for more affordable clothing or cut back on discretionary purchases entirely.

Spend Growth by Country

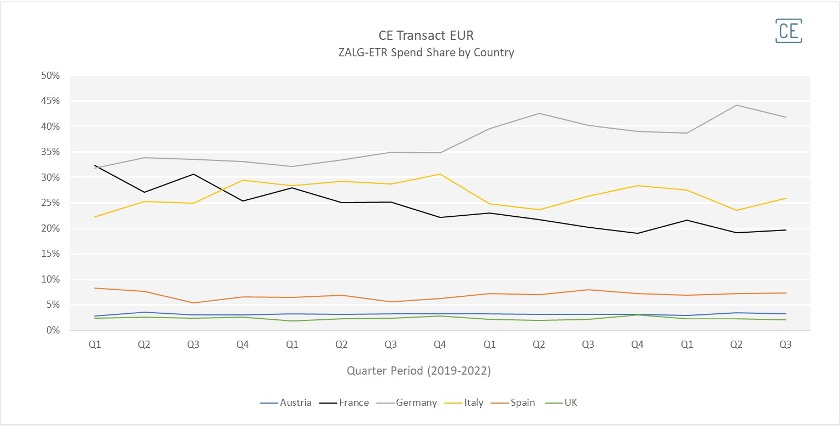

These differences in spend growth have coincided with changes in spend share. Zalando’s home market of Germany has not only comprised the highest share of spend among our six tracked countries since the beginning of 2019, but it has actually been gaining share over the past two years. Throughout 2021 and 2022, Germany’s share of spend has been about 40% among tracked countries, with the last two quarters showing y/y share increasing further. In the same time period, both Italy and France have been comprising a smaller percentage of spend. Italy dropped from 29% of total spend in Q3 of last year to only 26% this year, while France dropped from just over 25% of total spend to just under 20%.

Spend Share by Country

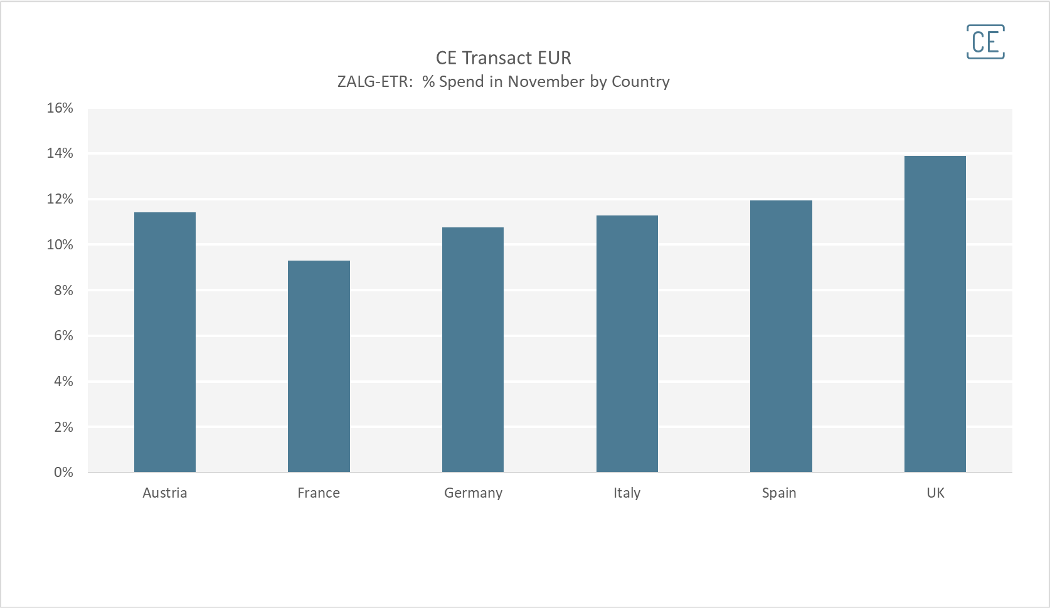

Using CE data to understand whether consumers are buying more from Zalando will become even more important during the holiday season. In 2021, Zalando spend in November made up 9%-14% of the company’s total for the year. The holidays are most important in the UK, where 14% of Zalando spend was concentrated in November, two-thirds more than for an average month.

Holiday Importance

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.