Source: https://secondmeasure.com/datapoints/amzn-holiday-sales-performance-2022-superstore-competitors/

At the end of November 2022, Amazon.com, Inc (NASDAQ: AMZN) announced that it saw record sales during the five-day shopping period between Thanksgiving and Cyber Monday. But how did the rest of the holiday season fare? Consumer transaction data shows that Amazon’s U.S. consumer sales during the 2022 holiday season exceeded its holiday sales during the previous three years. In addition, Amazon’s year-over-year holiday sales performance outpaced that of several major superstore companies, such as Target and Costco.

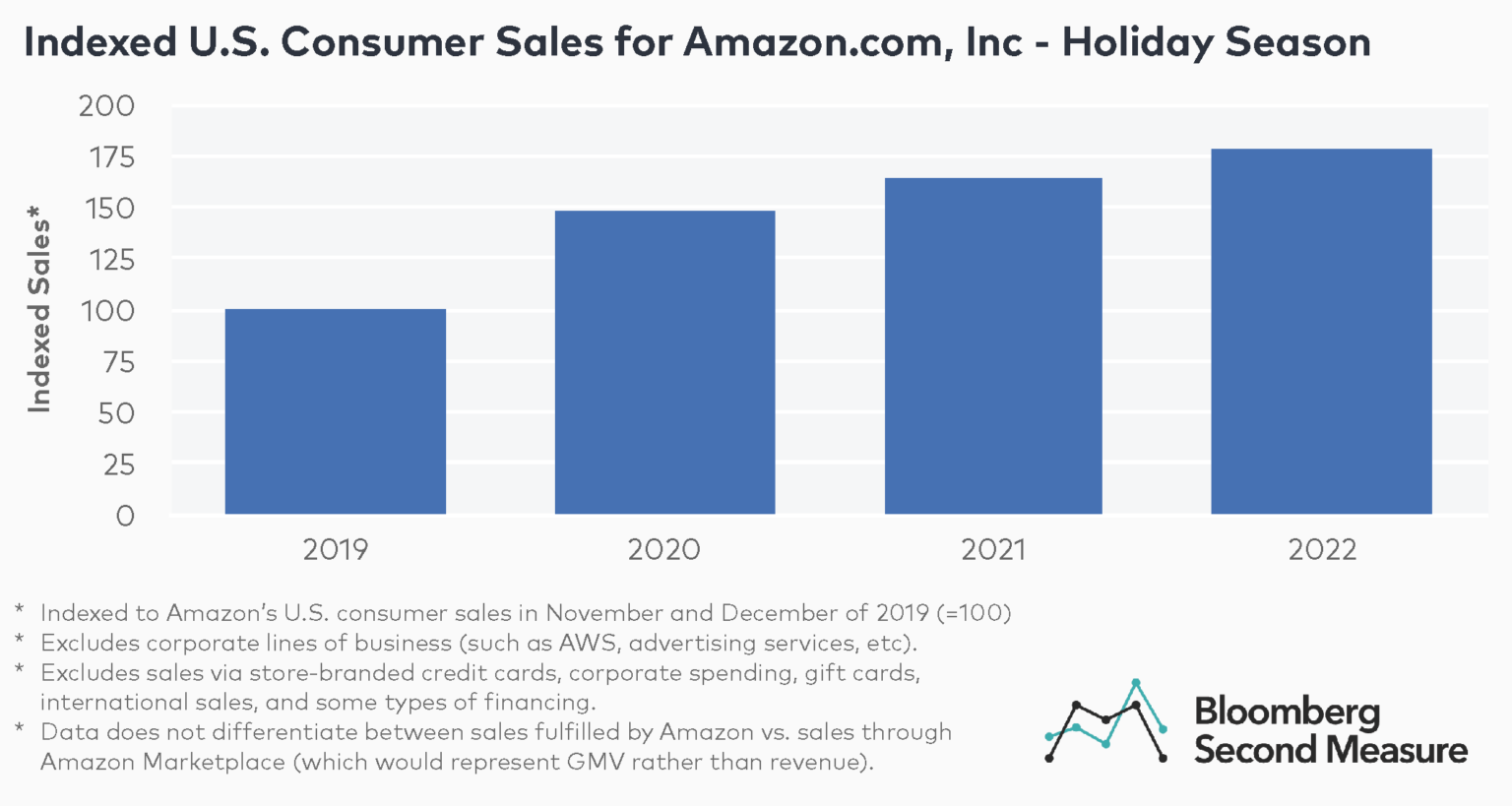

Amazon’s (NASDAQ: AMZN) U.S. consumer sales have grown each holiday season

Looking at Amazon holiday spending trends over the past four years, U.S. consumer spending at Amazon and its subsidiaries has increased every holiday season (defined for this analysis as combined sales in November and December) since 2019.

Amazon’s U.S. consumer sales during the holiday season in 2022 were up 9 percent year-over-year, as well as 20 percent higher than the same period in 2020 and 78 percent higher than the holiday season in 2019. During this time frame, Amazon saw its biggest year-over-year increase in U.S. consumers’ holiday sales between 2019 and 2020, with an increase of 49 percent.

It is worth noting that Bloomberg Second Measure data only includes U.S. consumer sales at Amazon and its subsidiaries. The data excludes purchases through B2B lines of business (such as AWS and advertising services), as well as purchases via store-branded credit cards, gift cards, international sales, and some types of financing. The data also does not differentiate between sales fulfilled by Amazon and sales through Amazon Marketplace, which may represent gross merchandise volume (GMV) rather than revenue.

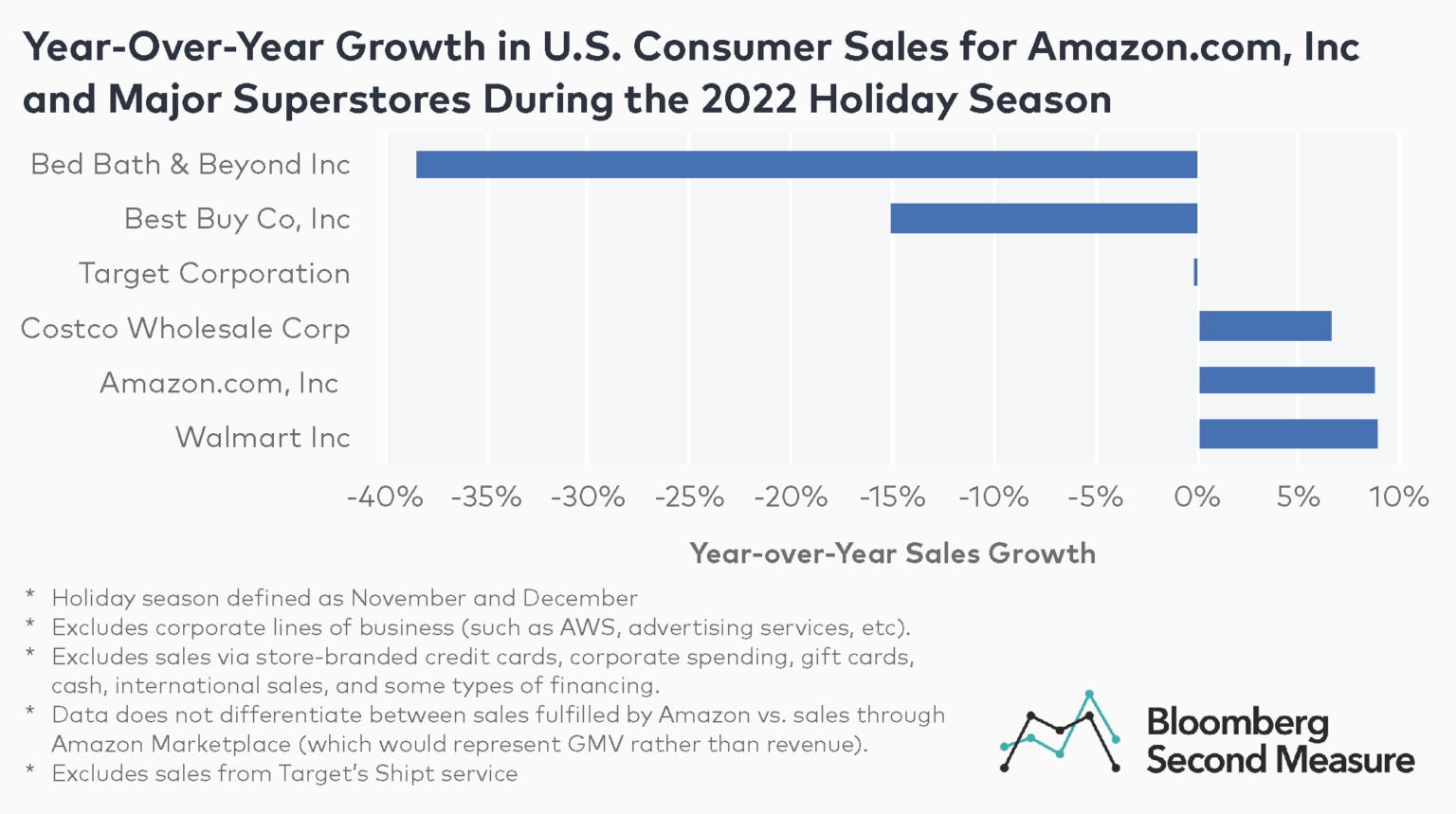

How did Amazon’s year-over-year growth in holiday spending stack up against major superstore competitors?

Comparing holiday sales performance at Amazon and major superstore companies, Amazon and Walmart Inc (NYSE: WMT) led the pack in terms of year-over-year growth. U.S. consumer sales at each of these companies grew 9 percent year-over-year during the 2022 holiday season. Both Amazon and Walmart, in addition to Target, kicked off the 2022 holiday shopping season early with sales events held at the beginning of October, including a second Amazon Prime Day (the first time Amazon has held two such events in one year).

U.S. consumer sales at Costco Wholesale Corp (NASDAQ: COST) grew 7 percent between the 2021 and 2022 holiday seasons. In recent months, Costco—which sells discounted goods in bulk—has reportedly seen rising demand from consumers hampered by inflation. Sales at Target Corporation (NYSE: TGT), which reportedly experienced challenges related to excess inventory and steep markdowns throughout 2022, remained relatively consistent year-over-year. Notably, this analysis excludes sales through Target’s Shipt service.

Two of the companies in our analysis—Best Buy Co, Inc (NYSE: BBY) and Bed Bath & Beyond Inc (NASDAQ: BBBY)—experienced a decrease in U.S. consumer sales year-over-year during the 2022 holiday season, with respective declines of 15 percent and 39 percent. Earlier this year, Best Buy cited high inflation and softening consumer demand for electronics as major challenges. Meanwhile, Bed Bath & Beyond Inc has been shuttering stores over the past year as a result of slowing demand. The company also recently disclosed that it defaulted on debt payments and has planned more store closures—including all Harmon brand locations—in 2023.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.