2022 saw the coffee space impacted by high inflation and the curbing of discretionary spending. But amidst these setbacks, the leading coffee chains expanded their footprints, rolled out perennial favorites, and welcomed crowds of loyal visitors. In recent months, many consumers saw coffee as an affordable luxury and were once again enchanted by coffee’s seasonal charm.

With the lid on coffee space foot traffic for 2022, and the first sips of 2023 underway, we dove into the data for three leaders in the coffee category – Starbucks, Dunkin’, and Dutch Bros. Coffee – to take a closer look at how inflation, consumer loyalty, and promotions have impacted visits to the space.

Starbucks: ‘Tis the Season to Drink Coffee

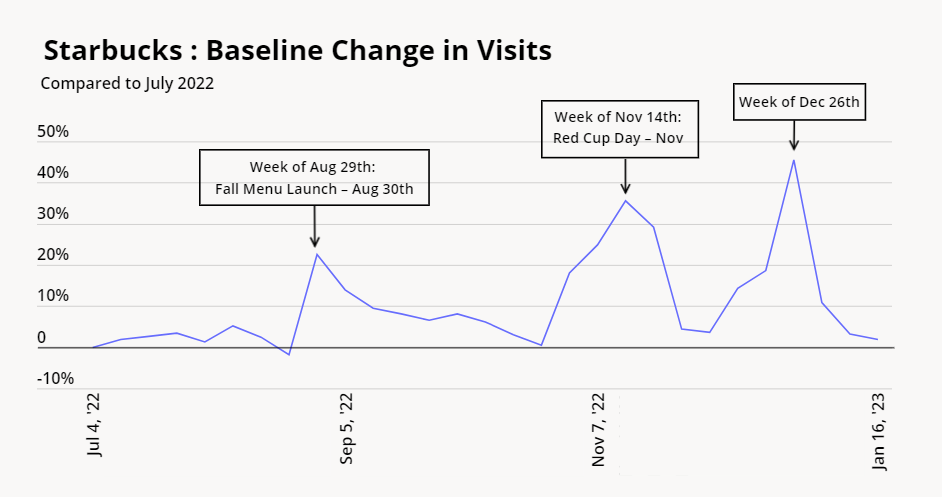

Starbucks has consistently demonstrated its capacity to command the promotional calendar and drive foot traffic around the holidays – and last year was no exception. In the second half of 2022, visits increased following seasonal menu launches and promotions. Coffee was an especially hot commodity in the days and weeks post-Christmas as many bargain-hunters were out hawking steep discounts.

In the second half of 2022, Starbucks saw its largest weekly visit growth over the weeks of August 29th (22.6%), November 14th (35.6%), and December 26th (45.6%) compared to a July 4th, 2022 visit baseline. These weeks coincided with the launch of Starbucks’ ever-popular Pumpkin Spice Latte, Red Cup Day, and the last week of the year when many consumers were on vacation and had time to shop or socialize over coffee. Evidently, the holiday season at Starbucks – even in times of economic headwinds and tighter consumer budgets – still drove visit peaks to the chain.

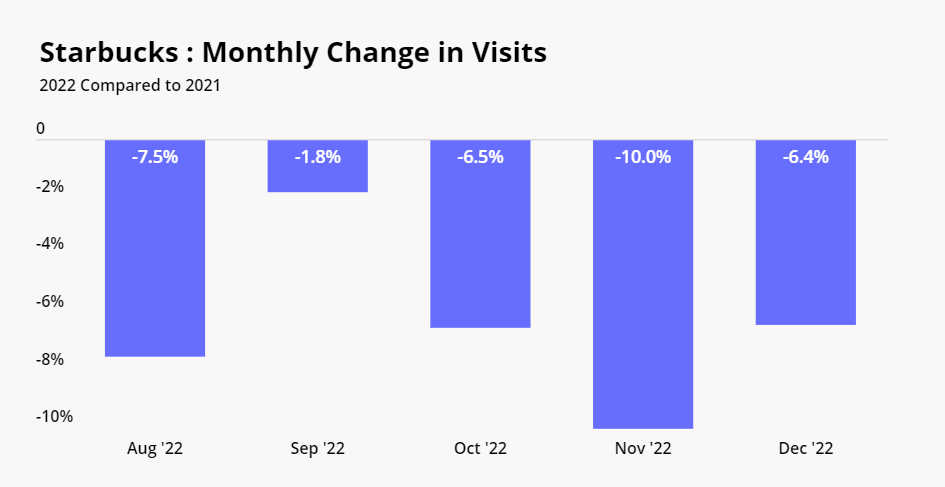

But adopting a wider lens indicates that, despite the bright spots, the coffee category as a whole was still plagued by rising inflation and a decline in consumer spending for much of 2022. Despite the success of the brand’s seasonal offerings, monthly Starbucks traffic stayed consistently below 2021 levels as consumers tightened their budgets in the face of the ongoing economic headwinds.

Dunkin’: In it for the Long Haul

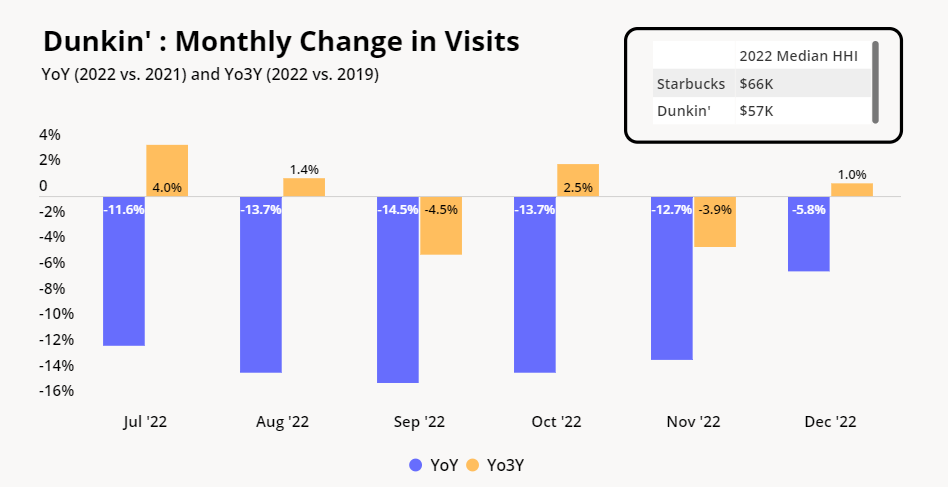

And compared to Starbucks, which attracts a relatively affluent clientele, Dunkin’ was particularly affected by spending cuts due to a significant portion of its audience being acutely impacted by inflation.

In 2022, Dunkin’s True Trade Area residents had a median HHI of $57K while residents of Starbucks’ True Trade Areas had a median HHI of $66K. This meant that Dunkin’ was especially susceptible to discretionary spending cuts by its potential visitors who were more likely to be feeling the pinch of inflation. This ultimately attributed to larger year-over-year (YoY) visit gaps for Dunkin’ for most of 2H 2022.

But despite a decline in YoY visits, Dunkin’ received a welcome foot traffic boost towards the end of the year. In December 2022, YoY visits were down just 5.8%, the best YoY comparison of 2H 2022. And for a majority of 2H 2022, Dunkin’s year-over-three-year (Yo3Y) visits were positive – an indication of the brand’s true strength relative to 2019 and a less inflation-dominated era.

Dutch Bros.: A Loyal Fraternity

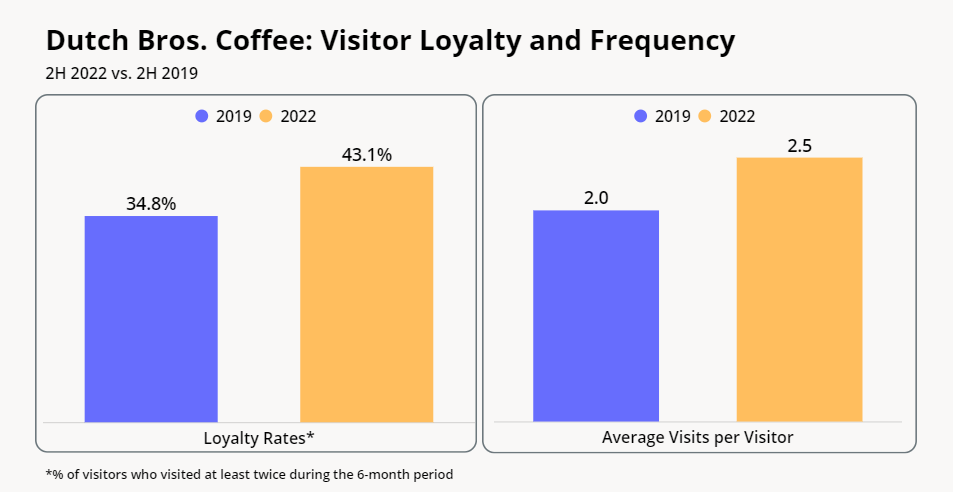

In tough times, it’s loyalty that brings brand and consumer together. While expansion undoubtedly played a role in driving heavy foot traffic to Dutch Bros. Coffee in 2022, behind the chain’s growth lies strong customer loyalty that justifies the opening of the many new locations. In 2022, more visitors to Dutch Bros. were repeat visitors than in 2019. And on average, Dutch Bros. visitors visited more frequently than they did three years ago.

In 2H 2022, 43% of Dutch Bros. visitors visited at least twice in the six-month period, up from 34.8% in 2019. The average visit frequency also jumped from 2.0 in 2H 2019 to 2.5 in 2H 2022. Strong customer loyalty is clearly a factor in Dutch Bros.’ aggressive expansion strategy and indicates that there is likely plenty of room for the brand to continue to grow.

Coffee Doesn’t Stunt Growth

Despite inflation continuing to wreak havoc on consumer spending, coffee category leaders saw a strong end to 2022. Successful holiday promotions, fleet expansion, and visitor loyalty all played a part in a robust finish to the end of the year. With bold brick-and-mortar strategies in the works, there is reason for optimism that coffee shop visitors will continue to fill their cups in 2023.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.