The Placer.ai Nationwide Office Building Index: The office building index analyzes foot traffic data from 800 office buildings across the country. It only includes commercial office buildings, and commercial office buildings on the first floor (like an office building that might include a national coffee chain on the ground floor). It does NOT include mixed-use buildings that are both residential and commercial.

With January coming to a close, we checked in with our Nationwide Office Index. Are workers being required to come into the office more than they did in 2022? And what do January office visit trends portend for the rest of the year?

2022 Hybrid Model Holding Strong

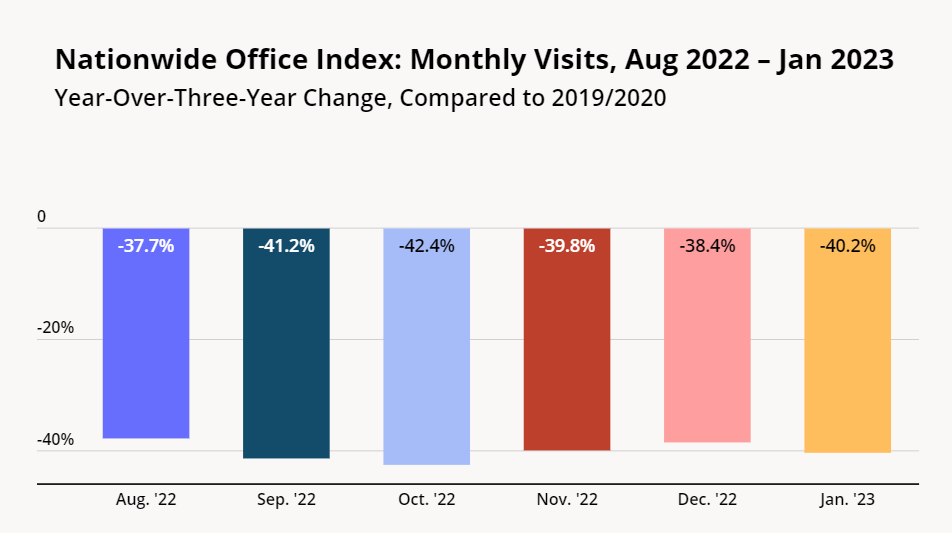

Despite a growing number of reports that many employers want workers to spend more time in the office, the data shows that at least for now, the office visit patterns that took hold in the second half of 2022 remain strong. In our last office recovery breakdown, we showed that in Q3 and Q4 2022, overall office visits remained about 60% of what they were pre-pandemic – and that trend has continued into January 2023. The year-over-three-year (Yo3Y) visit gap, which had narrowed somewhat in December 2022 to 38.3%, climbed back up to 40.2% last month.

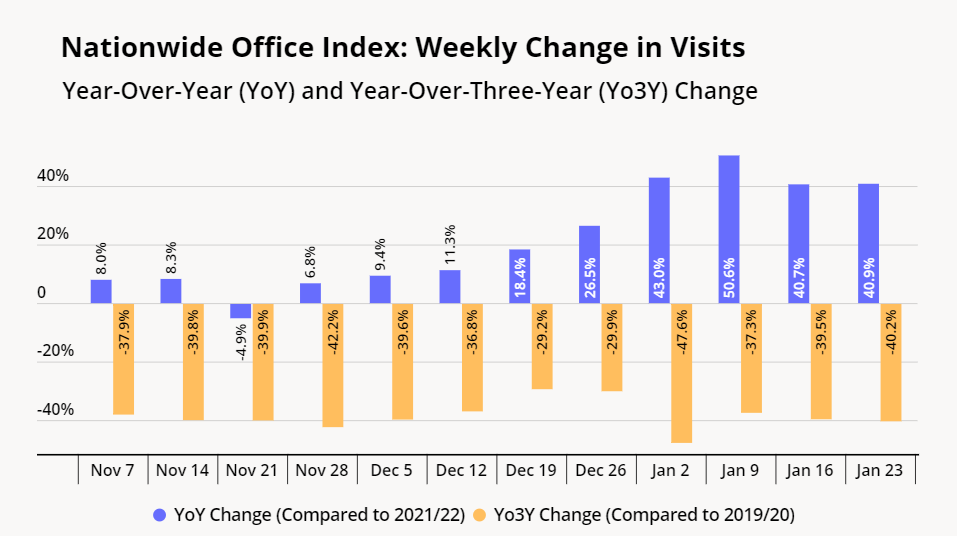

A dive into the weekly data also confirms that despite some fluctuations, particularly over the holiday season, office visits remain about 60% of what they were in 2019 and early 2020. Year-over-year (2023 compared to 2022) visits were up between 40.7% and 50.6% throughout January, but this is primarily due to the rise of the Omicron variant of early last year, which kept many people home in January 2022.

A Regional Breakdown

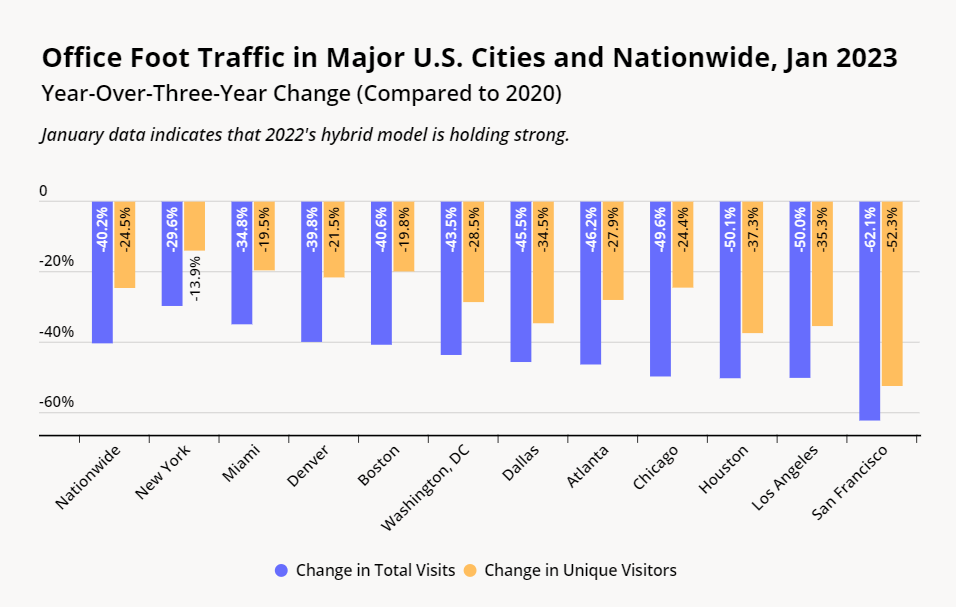

And with just a couple of exceptions, similar holding patterns were reflected in major cities nationwide. Of all the cities analyzed, only New York, Miami, and Los Angeles saw their overall visit gaps shrink significantly in January 2023 (i.e. more than 1%), as compared to Q4 2022. New York, in particular, continued the steady recovery it experienced throughout 2022 – with visits up last month to just over 70% of pre-pandemic levels. Miami, for its part, saw its overall Yo3Y visit gap shrink to 34.8% (down from 37.8% in Q4 2022) – perhaps reflecting a growing influx of workers to the Sunshine State. Boston also saw a slight decrease in its visit gap. But in Washington, D.C., Denver, Dallas, Atlanta, Chicago, Houston, and San Francisco, the Yo3Y visit gap was larger in January than in the fourth quarter of last year. Unsurprisingly, tech-heavy San Francisco remains at the bottom of the office recovery pack.

As always, overall visits only tell part of the story – and the data on unique visitors continues to indicate that in many cities, a large majority of workers have indeed returned to the office for at least part of the week (Unique visitors refers to the total number of people who visited an office building during a specified period of time, so one unique visitor can account for several visits). Here too, New York stands out as a major center for office recovery, with unique visitors reaching just over 86% of pre-pandemic levels in January 2023. Nationwide, however, the data does not yet indicate an increase in the overall number of workers coming into the office, when compared to Q2-Q4 2022.

Key Takeaways

While it may take time for shifts in employer expectations to be reflected in the data, January foot traffic data has yet to show a significant change in the hybrid work model that has taken root in regions across the country. Although many cities continue to see a large majority of workers coming into the office at least part of the week, most have not seen an increase in overall visits during January 2023 – and nationwide, office visits remain about 60% of pre-COVID levels. Looking ahead, it remains to be seen how employers and workers will continue to negotiate the “Great Mismatch” of 2023. But for now, at least, 2023 has not yet emerged as the year of return to the office – and rumors of the demise of remote work appear to be greatly exaggerated.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.