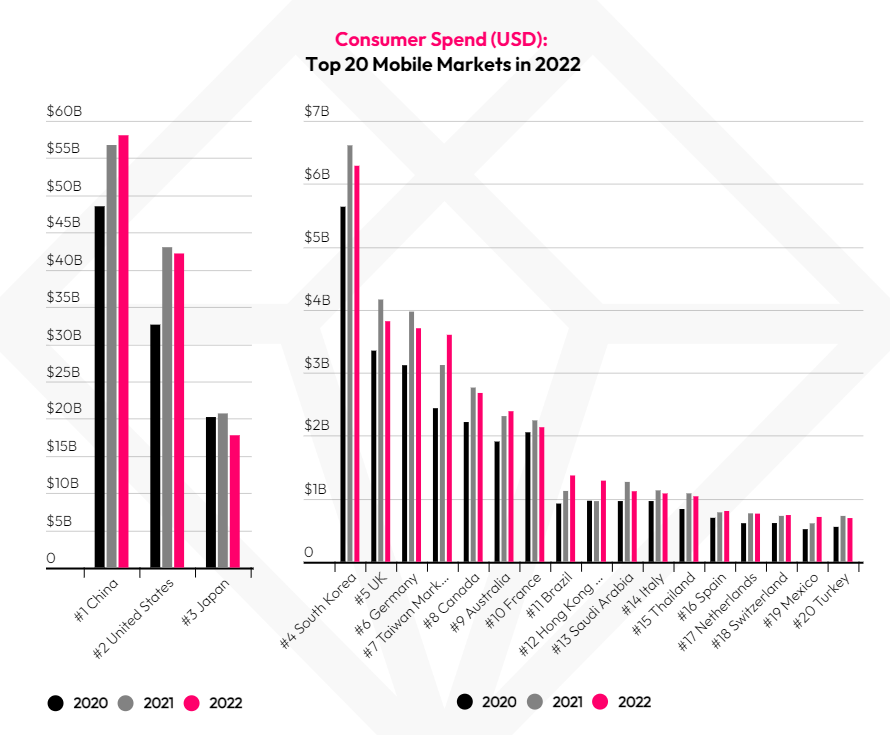

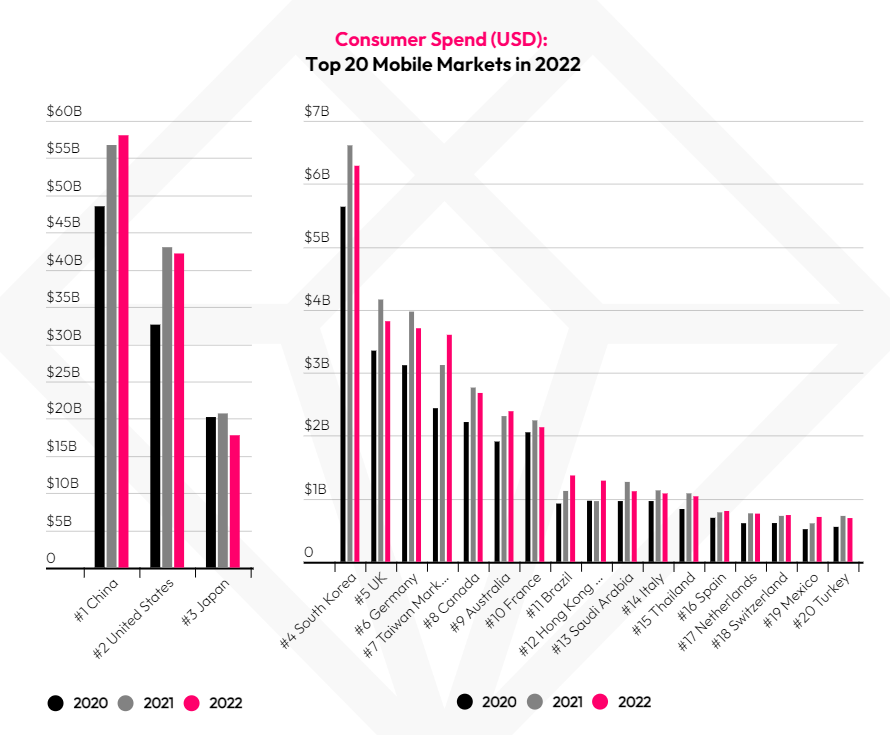

It was one of the headline takeaways from data.ai’s State of Mobile 2023 report that there was a slight decline in direct consumer spending in mobile apps last year. The $167 billion total was 2% down from 2021. Inflation and other economic headwinds seemed to be the key factors here.

Across North Asia, there was a mixed picture. China remained the world’s most valuable market in terms of consumer spend (although its lead is far smaller than its lead in downloads). Chinese app users actually increased their spending from $56.7 billion to $58.1 billion in 2022 (ahead of the second-place United States which dropped from $43 billion to $42.19 billion).

Japan came in third – although its collective spending slipped from $20.7 billion to $17.8 billion in 2022. Despite the decline, the total is impressive – more than 4x the totals for the United Kingdom and Germany. The most likely explanation is Japan’s passion – and its willingness to spend money on – mobile games and digital manga.

South Korea is a similar market in this respect. This might explain why it is the world’s fourth-largest region in terms of consumer spending. Like Japan, its total fell year-over-year (from $6.6 billion to $6.3 billion), but it remained nearly double the size of the world’s #5 market (the U.K. at $3.8 billion).

China, Japan and South Korea: App Downloads

If 2022 was a year in which macroeconomic factors squeezed spending in apps, there’s plenty of evidence that consumer interest in the medium is still on the rise. Time spent data is one indication (see below). So are download estimates.

Global downloads grew an impressive 11% YoY in 2022. And the overwhelmingly dominant force in this area was China. Last year, Chinese consumers downloaded a remarkable 111.1 billion apps across iOS and Third-Party Android stores, up from 98.3 billion in 2021. It’s a vast number – more than 4x the total of the world’s second most active market, India, at 28.9 billion.

Japan’s download total went in the other direction. Its total slipped from 2.6 billion in 2020 to 2.56 billion in 2021 to 2.4 billion last year. A similar pattern can be observed in other ‘mature’ mobile markets such as France, Germany, the UK and the US. However, it is important to note that there is still a strong appetite for new mobile services — shown in the high levels of annual downloads, despite maturity in the market.

Indeed, all the significant download growth comes from developing economies (Indonesia, Pakistan, etc). It’s noticeable that South Korea does not appear in the top 20 markets by this measure.

China, Japan and South Korea: Time Spent in Apps

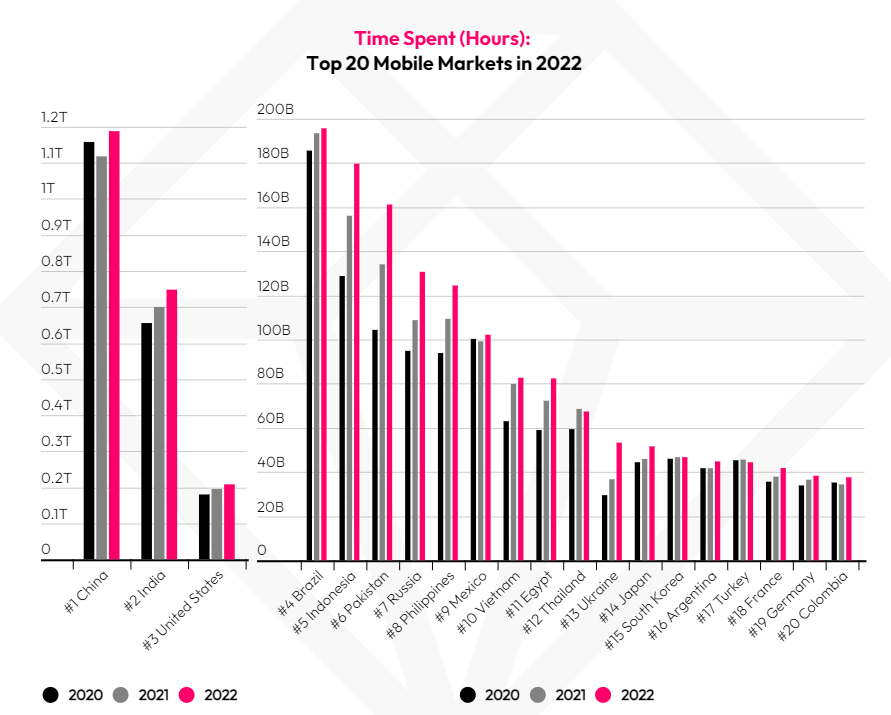

Despite the slight contraction in direct consumer app spending across 2022, the amount of time consumers spent in apps globally continued to rise. Last year, the average daily time spent in apps per user across the top 10 markets analyzed reached 5 hours and 2 minutes on Android phones.

The North Asia regions indeed followed this time spent pattern. In fact, they were among its most impressive performers.

Japan was one of the few areas to show a marked boost. The average time spent in apps hit 4.8 hours a day. This was up over 2021, and it represents a rise of more than 60 minutes over the pre-lockdown figure of 3.7 hours for 2019.

Meanwhile, South Korea stabilized at 5 hours (it is one of just five countries to have passed this milestone), while China increased its time spent from 3.2 hours to 3.6 hours year-over-year. This represents a modest gain, but China remains – curiously – the lowest of all mobile-first markets by this measure. This may be due, at least in part, to mounting restrictions placed on mobile gamers under the age of 18, who are now limited to just three hours of play time per week (known as the “3-hour rule”). It is also important to note that this is based on Android phones operating off Third Party Android Stores in China, whereas usage data for other markets is based on apps available on the Google Play store, which could partially contribute to differences in consumer usage patterns.

A Region That Remains Resolute Against Headwinds

The three regions of North Asia wield considerable influence on the global app space. China is its biggest market by value, while Japan and South Korea have historically shaped many of its key trends – notably in gaming and digital manga. So it’s worth noting how these countries fared in a year that saw the first global fall in spending while still maintaining growth in downloads and time spent.

China actually improved its performance across all three measures – an indication that its app market still has plenty of scope for growth.

By contrast, the numbers for Japan and South Korea generally showed very slight falls (although Japan improved its time spent). These are two of the most mature app economies. In a year of difficult economic conditions, they held up well.

To learn more about the data behind this article and what AppAnnie has to offer, visit www.appannie.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.