Before the impending IPO of GoTo Group, it’s about time to update the latest market share of Southeast Asia’s biggest super apps: Gojek and Grab. At Measurable AI, we build and own a unique consumer panel and are the largest transactional email receipt data provider for the emerging markets, delivering both aggregated and raw data. In our previous article, we reviewed the market share of Gojek and Grab’s ride-hailing business across the year of 2021. Our results indicate a close score between the two rivals, with Grab leading by a slight advantage in total revenues in Indonesia last year.

What do you think of when you hear the word “Alternative Data”? A neat definition would be non-traditional data sources that can provide indications as to a firm’s future performance other than conventional sources such as corporate filings and analyst predictions. Or to borrow from the Alternative Management Association (AIMA, 2020), “alternative data comes from unconventional information, mostly in an unstructured form, is not broadly distributed within the industry and is being used to deliver both investment alpha and operational alpha”.

Digital payments in India are growing at a scorching pace. According to the Economist Intelligence Unit, when it comes to digital payments, India has outpaced the rest of the world, registering the highest number of real-time payment transactions. CLSA Research forecasts the digital payment market in India to grow three-fold to touch US$1 trillion by financial year 2026 compared to $300 billion in 2021. India’s large number of real-time transactions can largely be explained by the prevalence of low-value payments in the Indian economy. Similar trends can be witnessed in developing countries.

In South East Asia, Gojek and Grab remain to be the two biggest ride-hailing mobility players, just like Uber and Lyft in the US. A lot has happened to both companies in Southeast Asia in the past year: Gojek announced its merger with Tokopedia and became GoTo Group; Grab app just finished its bell-ringing ceremony at Nasdaq with the biggest SPAC deal (NASDAQ: GRAB).

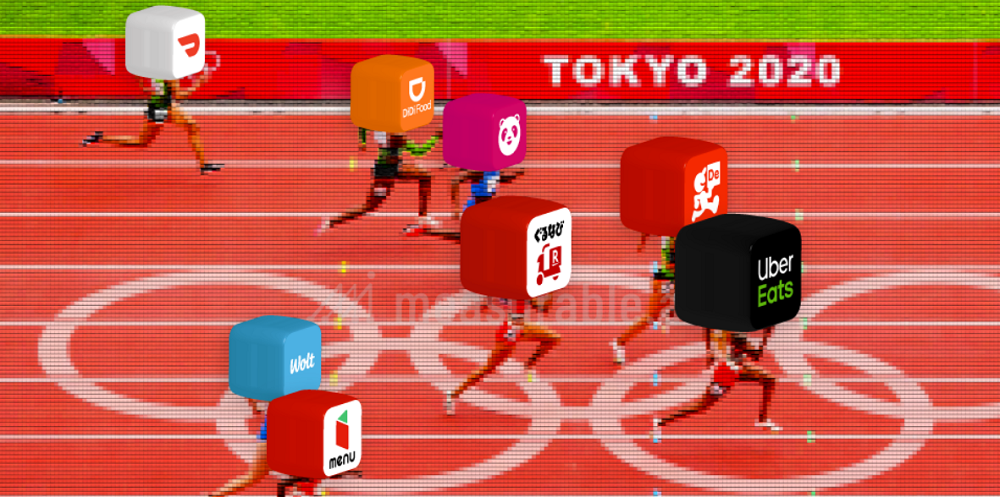

As the food delivery industry continues to grow with record high order volumes in different markets every day, it’s like a roller coaster that only goes up. On this roller coaster, the ultimate goal for all the food delivery companies right now is to compete for market share. Asia has grown to be a major battlefield for the biggest food tech companies in the world. As 2021 draws to an end, Measurable AI presents the third part of this food delivery industry research in Asia, covering specifically market share and average order value.

The latest trend in the fashion industry is the rise of a handful of fast fashion brands targeted at Gen Z. Amongst these fast fashion companies, the one that has catapulted to cult status among young women across the globe is the Chinese retailer Shein, with a valuation of over $15 billion. Shein is one of the fastest – and most secretive – growing e-commerce companies in the world. Raking in close to $10 billion in 2020 (CB Insights), Shein has reportedly enjoyed eight consecutive years of over 100% revenue growth.

Taiwan, the birthplace of bubble milk tea, is one of the fastest growing food delivery markets in Asia. In Taiwan, people created cute nicknames for UberEats and Foodpanda (吳伯毅 and 傅胖達), which sounds just like two guys’ names in Chinese. After Deliveroo quit the market in 2020, the “two guys” remain the biggest players in Taiwan and continue to own almost half of the market share respectively. Recognizing the huge potential in the Taiwan food delivery market, recently though E-commerce giants Shopee from Singapore and Coupang from Korea have decided to enter the game too.

The rapid development of the on-demand food delivery industry has transformed dining all over the world. Even cultures where dining at home is more the norm, they have succumbed to the convenience of ordering online from food delivery apps now. This can be seen even in countries like Japan, which remains one of the largest food delivery markets in the world but yet it still remains grossly underpenetrated relative to the size of the population and the size of the economy.

Ola, let’s talk about the food delivery market in Brazil. With Brazil covering almost half of the Latin America food delivery market, it is definitely the most important battlefield for on-demand food delivery companies. According to Measurable AI’s e-receipts data panel in Brazil: iFood, Rappi and UberEats are currently the three major players in the Brazil food delivery market. As of Q2 2021, iFood leads the market with over 80% market share, and UberEats comes next with around 10%. UberEats had a higher market share from March to July in 2020 at over 25%, but the momentum stopped soon after.

With Swiggy’s recent $1.25 billion dollar raise from SoftBank, Zomato’s acquisition of Ubereats last March for $206 million, Amazon’s forage into the food delivery sector, plus the recent IPO of Zomato, India’s online food delivery market is surely heating up and garnering a lot of worldwide attention and heavy investments. At Measurable AI, we analyse millions of email transactions to produce actionable consumer insights for corporations and financial institutions who wish to stay ahead of their peers in today’s competitive market.

Founded in 2012, Southeast Aasia’s super app Grab is seeking an IPO through SPAC merger, which reportedly might become the biggest-ever U.S. equity offering by a South-East Asian company. Grab provides essential services including rideshare, food delivery, hotel booking, on-demand delivery, and payment services with its namesake mobile application. It now serves 670 million people across Singapore, Indonesia, Malaysia, Thailand, Philippines, Vietnam, Cambodia and Myanmar.

The competitive landscape of the food delivery market in Asia has changed a lot in 2021. Previously our reports showed how major food delivery companies in Asia were performing during covid (Read The Roller Coaster Goes On: Food-Delivery Companies in Asia). After a year of pandemic, the battle goes on, and is heating up in one of the most densely populated markets – Hong Kong.

When it comes to consumer behavior under the pandemic, nothing has been too different all around the world now. The war among food delivery companies that we have seen in many regions is also happening in the Arab world. According to Measurable AI’s transactional e-receipts data, the overall food delivery market in the Middle East has doubled its revenue size in 2020.

“Whales” are usually referred to as a small group of people who contribute a large percentage of revenues in successful games. These users’ purchasing behavior can be very different from regular users. Previous studies showed that 1% of the users are responsible for over 59% of the revenues on iPhone’s marketplace in the US.