Millennials have made up the largest share of home purchase mortgage applications for the last six years. According to the CoreLogic Loan Application Database, Millennial homebuyer share rose to its highest level in 2022, comprising about 54% of overall home-purchase applications (Figure 1). The Millennial home purchase share has steadily increased since 2015, rising about two to three percentage points per year. At the same time, Gen Z — the generation succeeding Millennials whose members were born after 1997 — is entering the housing market. This year, the cohort comprised about 4% of overall home-purchase applications.

The CoreLogic Loan Performance Insights report features an interactive view of our mortgage performance analysis through October 2022. Measuring early-stage delinquency rates is important for analyzing the health of the mortgage market. To more comprehensively monitor mortgage performance, CoreLogic examines all stages of delinquency as well as transition rates that indicate the percent of mortgages moving from one stage of delinquency to the next. The report is published monthly with coverage at the national, state and Core Based Statistical Area (CBSA)/Metro level and includes transition rates between states of delinquency and separate breakouts for 120+ day delinquency.

Housing is expensive, and this year, homeowners saw housing affordability decline as their monthly mortgage payments jumped to the highest levels in 15 years. With inflation simultaneously pushing the cost of goods up everywhere, current economic conditions are exerting pressure on current and future homeowners leaving many wondering if they can afford a mortgage. Over the last year, home prices increased by double digits, with CoreLogic’s most recent Home Price Insights report showing a 10.1% year-over-year increase in October 2022. And this rise in prices is independent of interest rates which spiked to over 7% in mid-

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released its latest Single-Family Rent Index (SFRI), which analyzes single-family rent price changes nationally and across major metropolitan areas. U.S. rental price growth slowed for the sixth straight month on an annual basis in October to 8.8%, the lowest rate of appreciation in more than a year but still three times higher than the pre-pandemic level. Despite the continued cooling, a shortage of available properties is keeping costs elevated, a trend that is partially fueling year-over-year gains in the lower-priced tier.

The CoreLogic Homeowner Equity Insights report, is published quarterly with coverage at the national, state and Core Based Statistical Area (CBSA)/Metro level and includes negative equity share and average equity gains. The report features an interactive view of the data using digital maps to examine CoreLogic homeowner equity analysis through the third quarter of 2022. Negative equity, often referred to as being “underwater” or “upside down,” applies to borrowers who owe more on their mortgages than their homes are worth. Negative equity can occur because of a decline in home value, an increase in mortgage debt or both.

The CoreLogic Home Price Insights report features an interactive view of our Home Price Index product with analysis through October 2022 with forecasts through October 2023. CoreLogic HPI™ is designed to provide an early indication of home price trends. The indexes are fully revised with each release and employ techniques to signal turning points sooner. CoreLogic HPI Forecasts™ (with a 30-year forecast horizon), project CoreLogic HPI levels for two tiers—Single-Family Combined (both Attached and Detached) and Single-Family Combined excluding distressed sales.

As it has turned out, July was an inflection point for multifamily rent growth nationally. Apartment demand, exceedingly tepid all year, had its highest monthly total in January. Despite this, and thanks in no small part to remaining excess occupancy built up during 2021, rent growth momentum above the typical level continued into the summer. Monthly average effective rent growth for new leases peaked in June with a 1.3% gain. The rate of growth then declined in each subsequent month before finally entering negative territory in November to the tune of a 0.3% decline.

Welcome to the December 2022 Apartment List National Rent Report. Our national index fell by 1 percent over the course of November, marking the third straight month-over-month decline, and the largest single month dip in the history of our index, going back to 2017. The timing of the recent cooldown in the rental market is consistent with the typical seasonal trend, but its magnitude has been notably sharper than what we’ve seen in the past, suggesting that the recent swing to falling rents is reflective of a broader shift in market conditions beyond seasonality alone.

ATTOM, a leading curator of real estate data nationwide for land and property data, today released its third-quarter 2022 U.S. Residential Property Mortgage Origination Report, which shows that 1.97 million mortgages secured by residential property (1 to 4 units) were originated in the third quarter of 2022 in the United States. That figure was down 19 percent from the second quarter of 2022 – the sixth quarterly decrease in a row – and down 47 percent from the third quarter of 2021 – the biggest annual drop in 21 years.

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released its latest Single-Family Rent Index (SFRI), which analyzes single-family rent price changes nationally and across major metropolitan areas. Consistent evidence of a single-family rental market cooldown follows nearly two years of above-trend rental price hikes. Year-over-year single-family rent growth slowed for the fifth consecutive month in September 2022 to 10.2%, down from a high of 13.9% in April 2022.

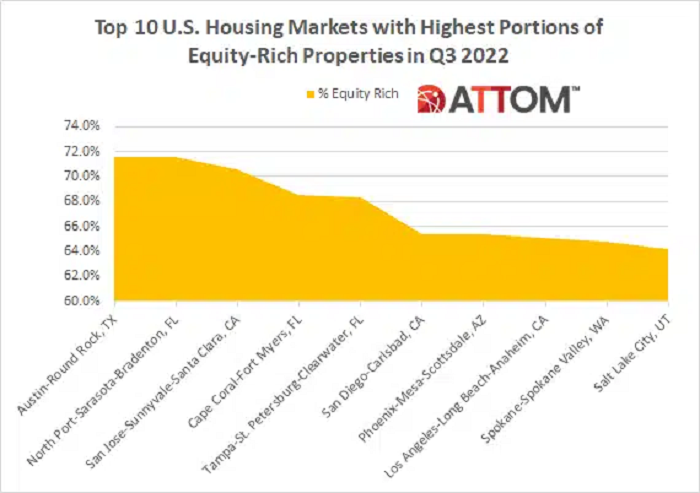

According to ATTOM’s Q3 2022 U.S. Home Equity & Underwater Report, 48.5 percent of mortgaged residential properties in the U.S. were considered equity-rich in the third quarter. The report noted that figure was up from 48.1 percent in Q2 2022 and 39.5 percent in Q3 2021. ATTOM’s latest home equity and underwater analysis also noted the latest increase fell below other gains in recent years, but still marked the 10th straight quarterly rise, and resulted in virtually half of all mortgage payers landing in equity-rich territory.

Home price appreciation dropped in July for the first time since December 2018, ending a 40-month streak of growth. But depending on the statistic referenced, this decline could be considered either an extreme or minor correction. One of the most widely-cited industry metrics for home price changes is the median sales price, which determines trends based on the midpoint of all houses sold in a given market. By contrast, repeat sales indexes, such as CoreLogic‘s Home Price Index (HPI) and the CoreLogic S&P Case-Shiller Index, measure appreciation based on the difference between the price of a home now versus its previous sale.

The CoreLogic Home Price Insights report features an interactive view of our Home Price Index product with analysis through September 2022 with forecasts through September 2023. CoreLogic HPI™ is designed to provide an early indication of home price trends. The indexes are fully revised with each release and employ techniques to signal turning points sooner. CoreLogic HPI Forecasts™ (with a 30-year forecast horizon), project CoreLogic HPI levels for two tiers—Single-Family Combined (both Attached and Detached) and Single-Family Combined excluding distressed sales.

Welcome to the November 2022 Apartment List National Rent Report. Our national index fell by 0.7 percent over the course of October, marking the second straight month-over-month decline, and the largest single month dip in the history of our index, going back to 2017. These past two months have marked a rapid cooldown in the market, but the timing of that cooldown is consistent with a seasonal trend that was typical in pre-pandemic years. Going forward it is likely that rents will continue falling in the coming months as we enter the winter slow season for the rental market.

With the 2022 midterm elections in less than two weeks, economic issues are taking center stage. Throughout this year, inflation has been running at its hottest pace in four decades, and there are growing fears that the Fed’s efforts to push back could induce a recession in the year ahead. Skyrocketing housing costs have been a key component of inflation, and one that could constitute a wedge issue between renters and homeowners. Most homeowners are locked into fixed monthly mortgage payments, and for those that already owned at the start of the pandemic, quickly rising home values have been primarily experienced as a boon to their net worths.

Record-high home prices and rising mortgage rates have shut out a number of potential buyers, and the reduced competition gives other shoppers more time to house hunt before making an offer. Figure 1 shows the median days on market before a listing enters pending status for the month of September of each year since 2000. As of September 2022, the median days on market before pending was 19 days, which is eight days more than the median time in September 2021. However, it’s still less than one-third of the 20-year[\[1\]](https://www.corelogic.com/intelligence/the-pace-of-home-sales-slows-as-mortgage-rates-pick-up/#ftn1) average of 35 days before the pandemic.

CoreLogic®, a leading global property information, analytics and data-enabled solutions provider, today released its latest Single-Family Rent Index (SFRI), which analyzes single-family rent price changes nationally and across major metropolitan areas. U.S. single-family home rental costs posted an 11.4% year-over-year increase in August, marking the fourth straight month of annual deceleration. Even so, rental costs remained elevated, with annual growth running at about five times the rate than in August 2020 in the midst of the COVID-19 pandemic.

With warnings that inflation could exceed 20% by the start of next year, plans to introduce a tighter rent cap for tenants in the social rented sector are being discussed, to try help insulate some of the most vulnerable from the current cost of living crisis. However, this rent cap could negatively impact housing associations and affect their ability to maintain and improve existing residents’ homes and deliver more new affordable housing.

The past two and half years have been the most tumultuous time for the rental market in recent memory. Much of that tumult can be traced back to the way that the pandemic has changed the ways that we live and work. In the earliest phases of the pandemic, many of the nation’s large cities saw sharp rent declines as a subset of renters with newly remote working arrangements moved away from expensive downtown areas that had temporarily lost their vibrancy, in search of more space in the surrounding suburbs. At the same time, widespread job losses also forced many workers to give up leases they could no longer afford.

The CoreLogic Home Price Insights report features an interactive view of our Home Price Index product with analysis through August 2022 with forecasts through August 2023. CoreLogic HPI™ is designed to provide an early indication of home price trends. The indexes are fully revised with each release and employ techniques to signal turning points sooner. CoreLogic HPI Forecasts™ (with a 30-year forecast horizon), project CoreLogic HPI levels for two tiers—Single-Family Combined (both Attached and Detached) and Single-Family Combined excluding distressed sales.