Darden Restaurants is one of the world’s largest restaurant groups. The company owns nearly 2,000 restaurants, from its higher-end concepts such as Eddie V’s and The Capital Grille to its more casual dining options, which include Olive Garden and LongHorn Steakhouse. With restaurants across the country continuing to feel the inflationary pressures, how is the brand faring? We take a closer look.

Outdoing the Competition

Darden has eight restaurant chains in its portfolio – Eddie V’s Prime Seafood, Olive Garden, LongHorn Steakhouse, Seasons 52, The Capital Grille, Bahama Breeze, Yard House, and Cheddar’s Scratch Kitchen. Each brand caters to a wide range of price points, with the average check per person in fiscal 2022 ranging from $16.50 at Cheddar’s Scratch Kitchen to $109.00 at Eddie V’s.

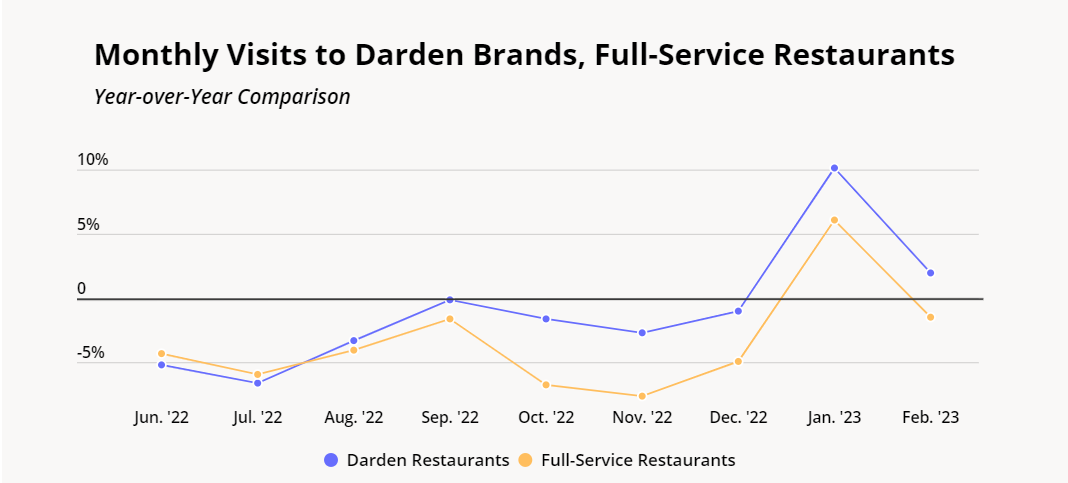

And the company’s reach is still growing, with Darden adding new locations of its current chains and hoping to welcome a new restaurant to its portfolio. Since August 2022, overall year-over-year (YoY) visits to the full portfolio of Darden restaurants trended above traffic overall restaurants in nearly all months examined, with January and February 2023 YoY visits up 10.1% and 2.0%, respectively. And although some of the strength in early 2023 is helped by a favorable comparison to an Omicron-plagued January 2022, the consistent outperformance of the wider full-service restaurant sector still highlights Darden’s ability to succeed in a difficult economic environment.

The company’s efforts to ease consumers’ inflation-induced budgetary burden may be playing a role in its success. Despite the rising operations costs in the restaurant space, many Darden concepts have doubled down on their value-proposition by maintaining price increases below the inflation rate to stay competitive in a highly challenging retail climate. This is likely helping to build customer loyalty as would-be diners feel confident they can get the best price for their meal at a Darden location. Still, the company is not immune to the overall slowdown in discretionary spending and difficult comparisons to a strong 2021, highlighted by the company’s slight YoY visit dips in the second half of 2022.

A Wide Buffet of Options

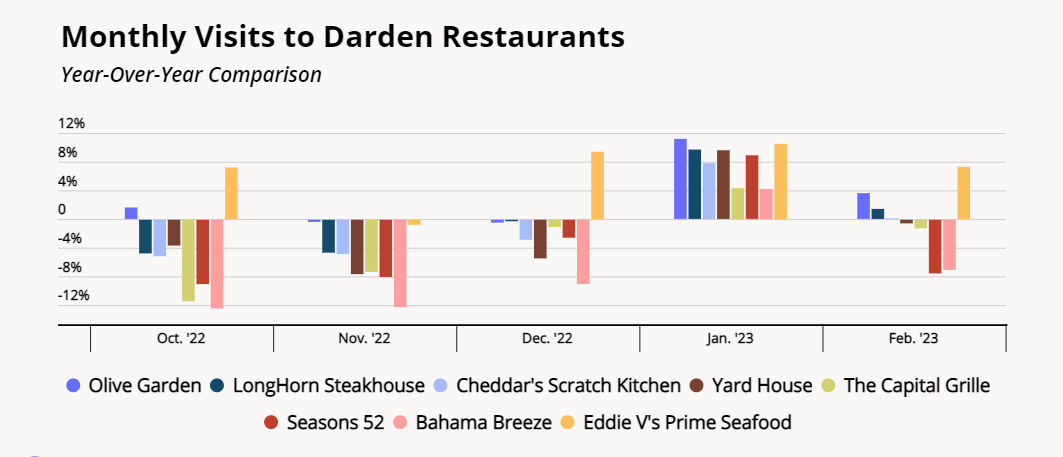

Darden’s overall portfolio is successfully performing even amid the current economic headwinds. And all concepts saw a significant YoY visit spike in January 2023, thanks to the Omicron-induced drop in visits in early 2022. But digging into the visit data for the individual brands provides some insights as to the current state of restaurant consumers.

Eddie V’s, Darden’s fine dining concept with the highest average check per person in fiscal 2022, has been particularly successful, with February 2023 visits up 7.3% relative to February 2022. This strength seems consistent with the more muted impact inflation has had on higher-income households.

On the lower end of Darden’s pricing spectrum, Olive Garden, the Darden brand with the most locations, saw positive YoY monthly visit trends for three out of the past five months, with February foot traffic up 3.6% compared to February 2021. LongHorn Steakhouse, the company’s second-largest concept, also performed well, with February traffic up 1.4% despite the 1.5% YoY dip in nationwide full-service restaurant visits. The rise in food-at-home costs has outpaced the increase in restaurant menu prices, so some budget-conscious consumers are likely still dining out on occasion – albeit less than in 2021. And many of these diners may be trading down from higher-priced restaurants and opting for more affordable brands such as Olive Garden and LongHorn that feel festive without breaking the bank.

Meanwhile, Darden’s mid-range concepts – Yard House, Seasons 52, and Bahama Breeze – have mostly underperformed the overall Darden YoY visit average, which could be another reflection of consumers’ current trading-down behavior.

Final Bites

Darden’s careful pricing strategy should continue to pay off into 2023 as more and more restaurants consider how to manage the rapidly rising cost of goods and labor. With more and more consumers looking to save on dining costs, the company should be well-positioned to weather any economic storm.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.