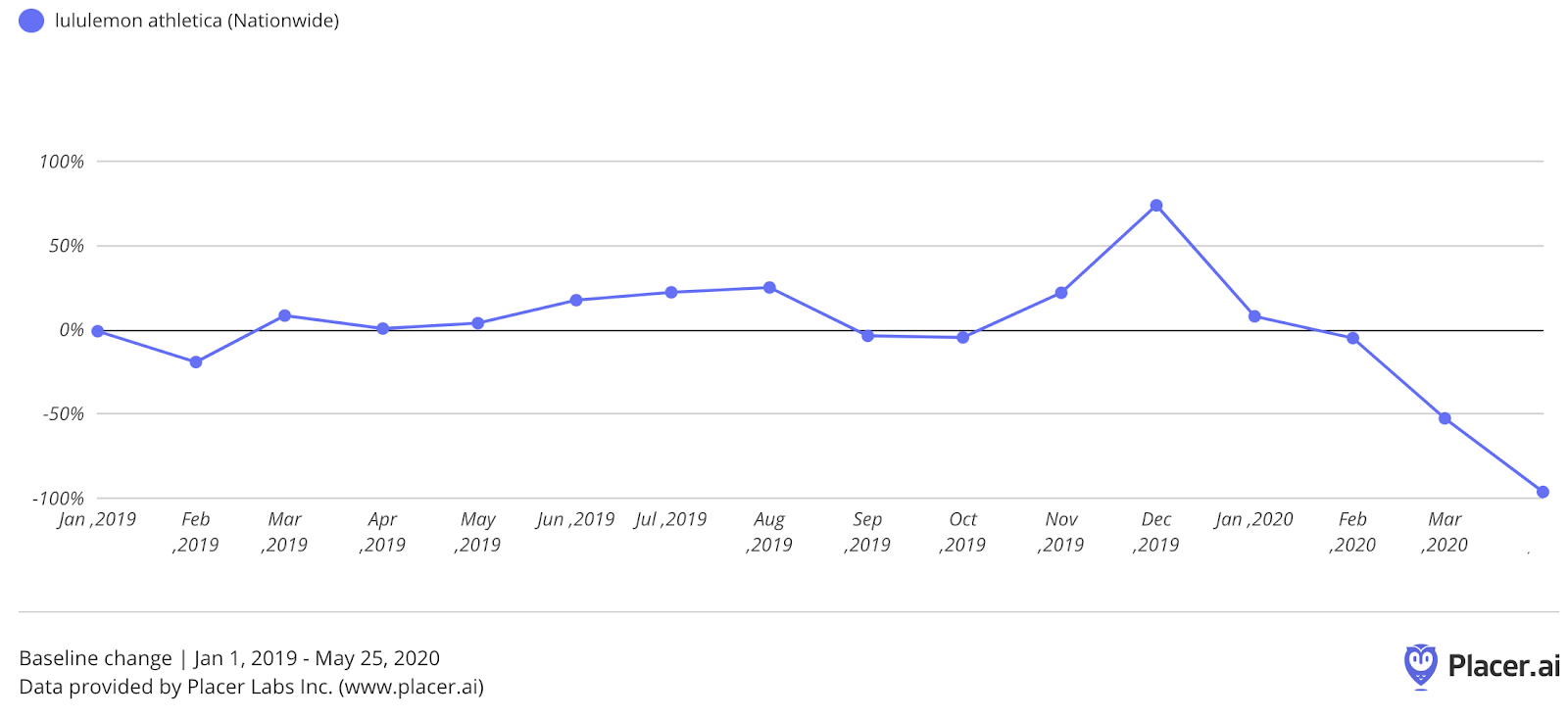

Pre-COVID, Lululemon was one of the most exciting brands in the apparel sector, with 2020 kicking off in incredibly strong fashion. January and February saw year-over-year visits grow 8.8% and 15.3% respectively, before March’s 61.0% decline and visits completely disappearing in April.

But, while the decline can be forgiven considering the circumstances, the pace of the bounce-back could prove incredibly important to the brand’s ambitious plans. With Lululemon beginning to reopen in mid-May, the brand saw a significant jump in traffic the week of May 18th. And while visits were still down 77.5% compared to the equivalent week in 2019, they were up nearly 100% week over week. So, while there is a long way to go, it does not appear that demand has significantly declined. Considering the strong geographic predisposition towards major cities and the coasts, – some of the hardest-hit – Lululemon could be in for even greater jumps as more of these areas open up.

And all this before considering the ever-increasing pull of wearing more comfortable clothes as we work from home.

Home Depot Rises

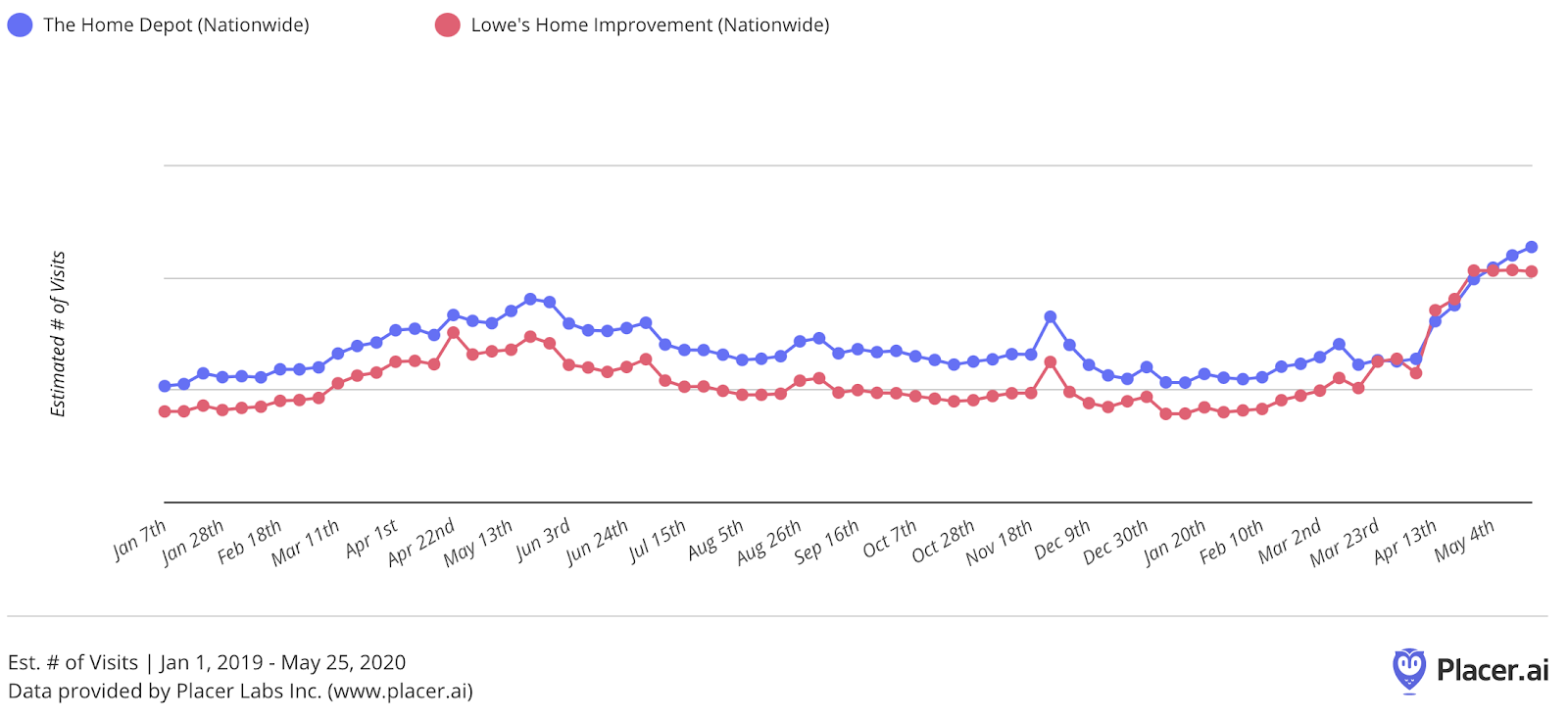

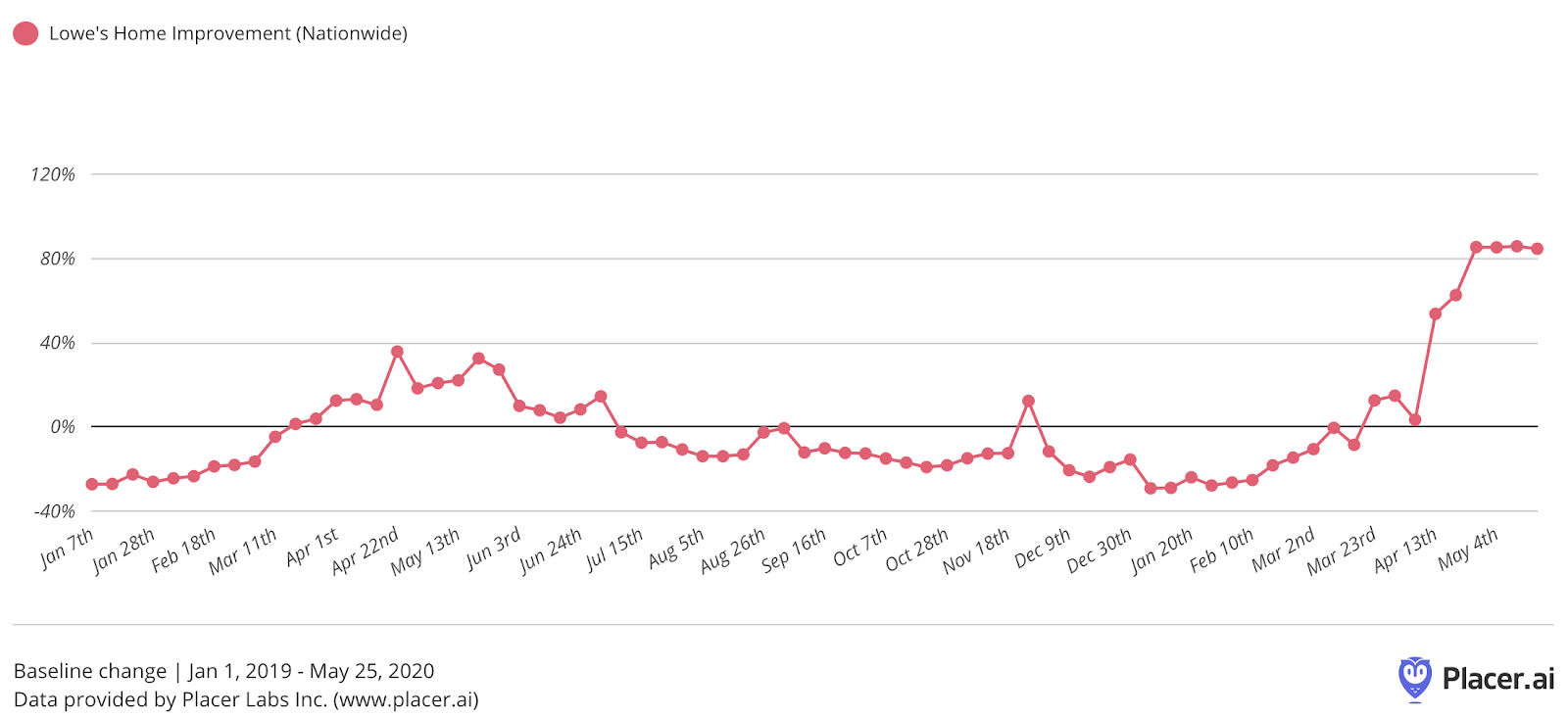

In what is turning out to be an epic battle between the long time leader, Home Depot, and rising challenger, Lowe’s, the former looks to have gained the upper hand once again. Following a massive Q1 highlighted by 9.1% year-over-year growth in visitors, Lowe’s has fallen back behind Home Depot.

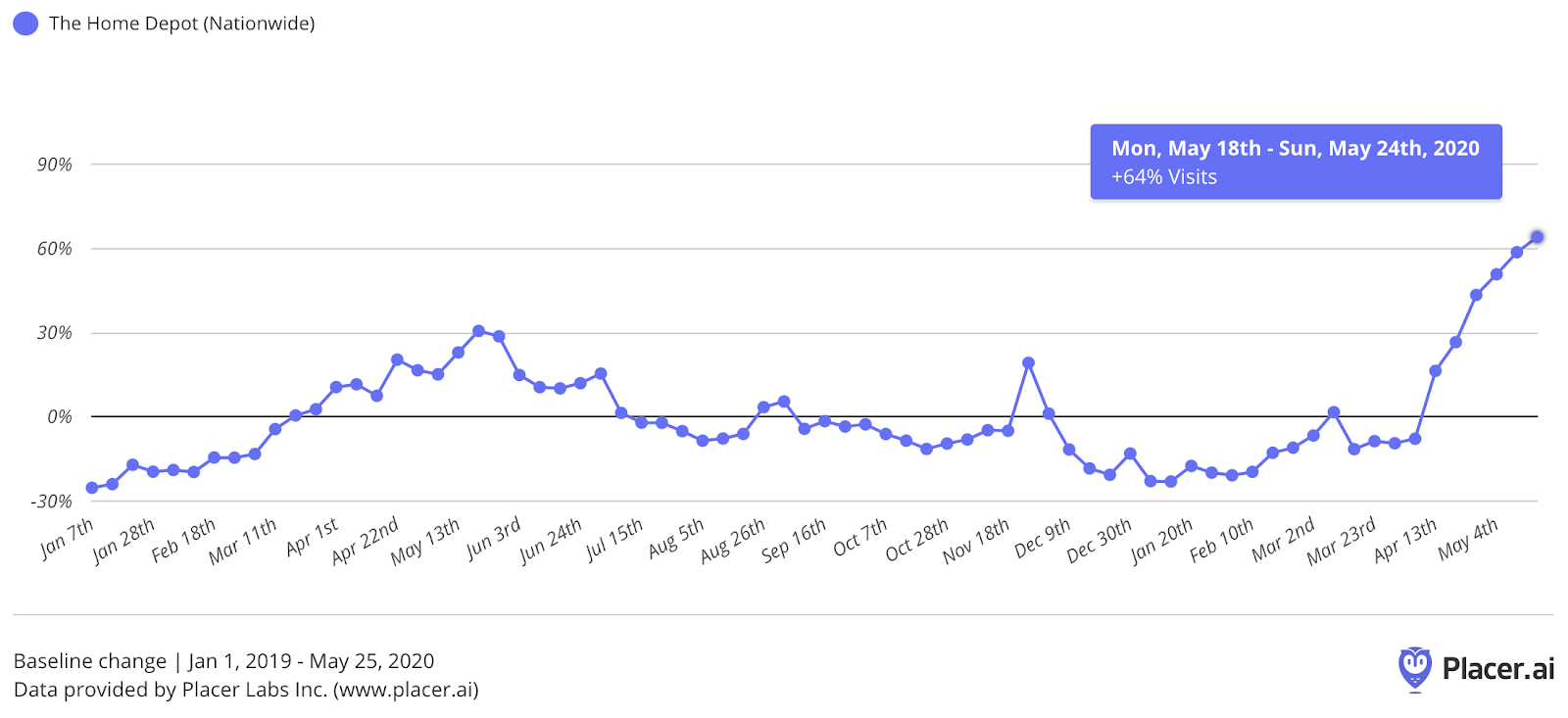

Home Depot, which noted their returning strength early in Q2 has shown a surge in visits to offline locations. The four weeks from April 27th through May 24th all surpassed the highest visit numbers of any week since the start of 2019. This surge peaked the week of May 18th, with visits rising 64.0% above the baseline for the period, a 33.4% increase year over year on the equivalent week in 2019. This is a dramatic surge indicating a strong closing to the end of the DIY period that generally lasts until late May. Should the rise continue past that point, the impact could be enormous for Home Depot. Considering they fought their normal seasonality so well in Q4 of 2019, there is reason for optimism on this front.

And while Lowe’s did fall back from its lead over Home Depot, visits have remained at extremely high levels. Visits the week of May 18th were 84.6% above the baseline, signifying a massive year-over-year increase of 52.1%. So Home Depot’s resurgence has likely not been coming at Lowe’s expense.

Will Lululemon return to its pre-pandemic dominance? What new changes does the battle between Home Depot and Lowe’s hold in store? Visit Placer.ai to find out.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.