As shoppers are gleefully returning to stores this holiday season, where is the biggest divergence between online and offline growth rates? In today’s Insight Flash, we examine these differences across top holiday industries and subindustries, as well as in the US vs. UK.

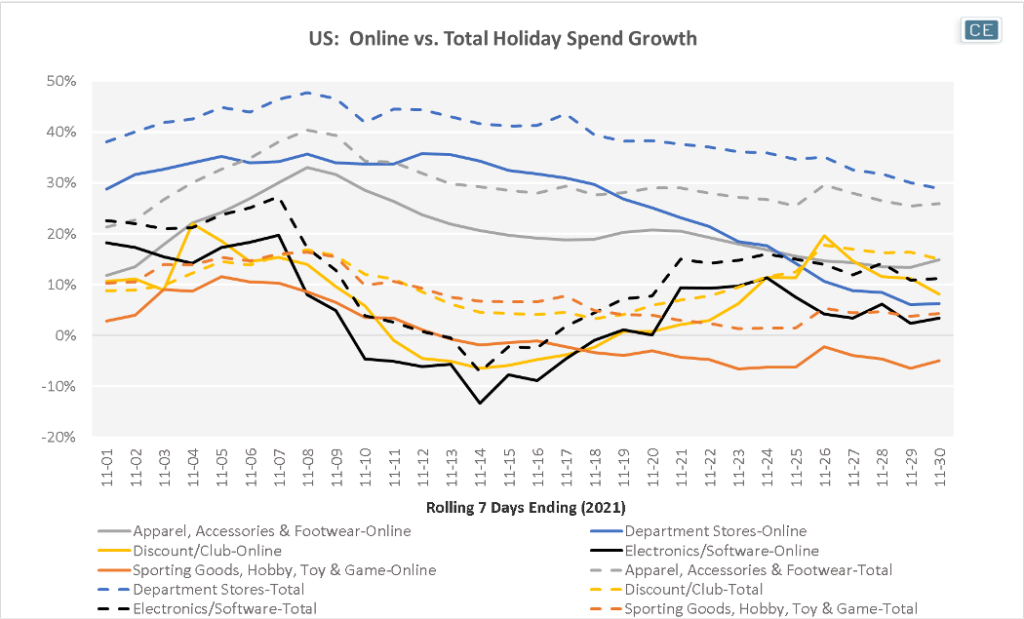

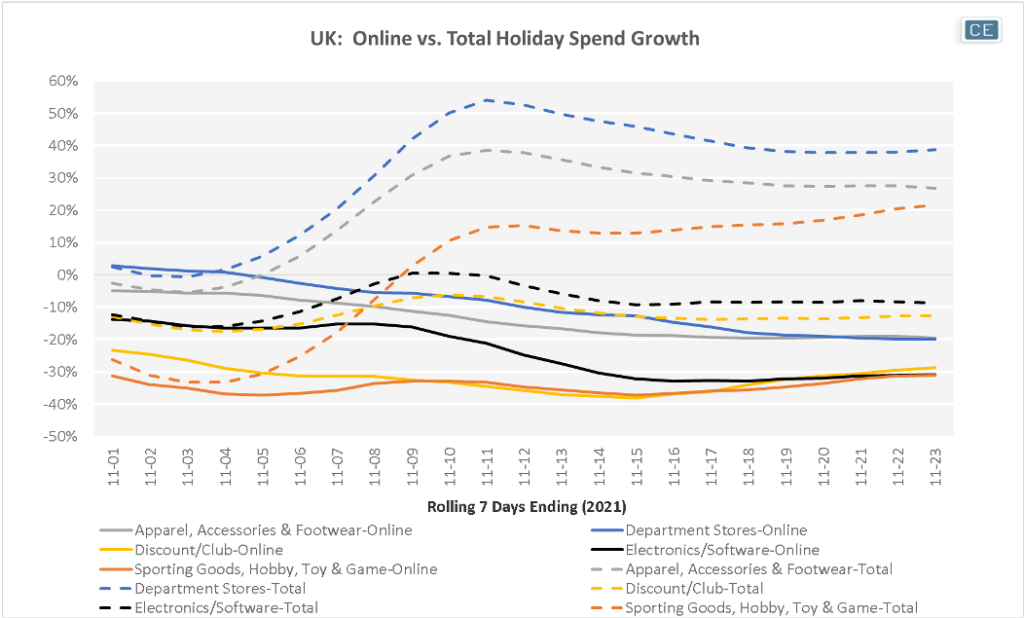

In both the US and the UK, total spend growth is outpacing online spend growth across the top holiday industries. In the US, one interesting trend has been in Department Stores, where online growth started strong at the beginning of November but has decelerated dramatically at the end of the month. Discount/Club online spend in the US has been very sensitive to promotional events, outpacing in-store spend both during “Early Access” Black Friday on November 3 and Black Friday itself. In the UK, where a second lockdown was implemented on November 5 last year, offline spend growth spiked on easier compares lapping that date. Department Stores and Apparel, Accessories, & Footwear have seen the highest online holiday growth so far.

Online vs. Total Spend Growth

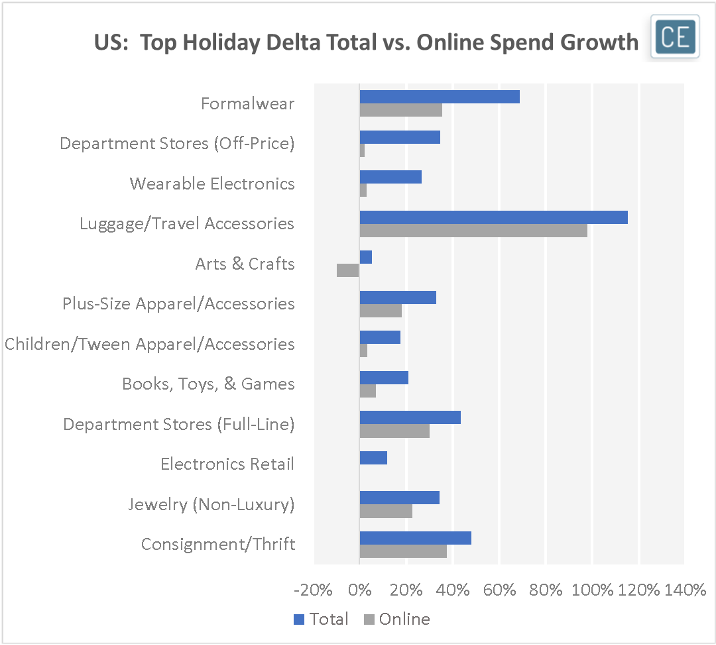

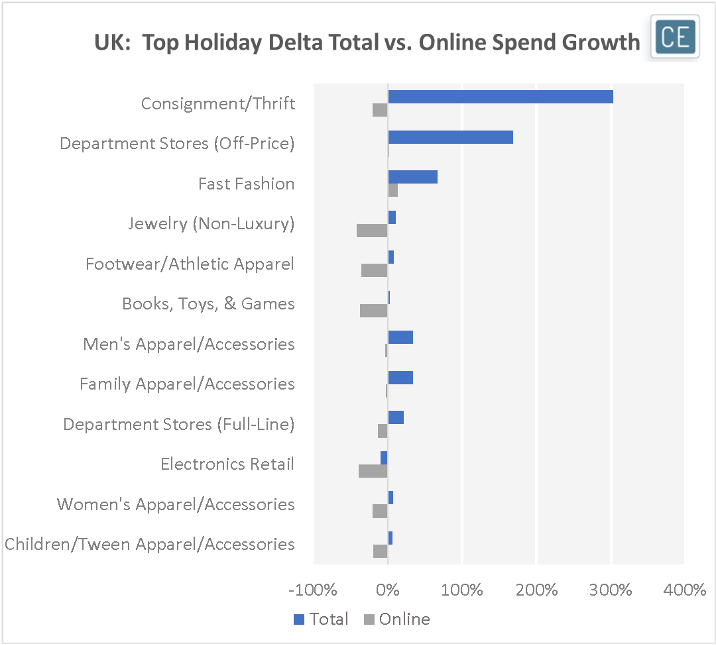

Digging into subindustries, the return of holiday parties in the US has seen Formalwear with the largest gap between total growth and online growth. It is followed by Off-Price Department Stores and Wearable Electronics. In the UK, lower-priced fashion saw the biggest drive in-store with the highest gap between total and online growth in Consignment/Thrift, Off-Price Department Stores, and Fast Fashion.

Subindustry Online vs. Total Holiday Growth

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.