Silicon Valley Bank – 16th largest in the US – is the latest casualty of the Fed assault on inflation. It was regulated as a regional bank, and these are typically local, specialising in one sector (e.g. agriculture). SVB also specialised in one sector – tech – but it had a global reach. With assets of less than $250bn, they benefited from looser regulation and built a loan portfolio of start ups with limited assets, patchy cash flows, and no profits. Customers included Biotech, Fintech, Crypto and even California wineries.

By this time, you probably already know what day it is: Equal Pay Day. Don’t worry, this isn’t another rant on the pay gap, but rather an examination of a measure purported to address the problem, pay transparency laws. The hope is that through access to complete information on salary ranges, all employees and applicants will be better equipped to navigate salary negotiations with existing and potential employers. If men tend to negotiate salaries more aggressively, then explicit pay ranges remove some of the guesswork that has kept women from negotiating with the same confidence.

Through the first 26 days of the tax filing season, the average refund size is down 7% YoY to $2,377 in Earnest Analytics’ IRS Payments dashboard, in-line with reported figures**. The IRS began accepting and processing tax returns on January 23, 2023 and Americans have until April 18, 2023 to file. As the tax season kicked off, the IRS warned taxpayers should expect smaller refunds in 2023 relative to 2022 due tax law changes such as the elimination of the Advance Child Tax Credit and Recovery Rebate credit to claim pandemic stimulus payments.

Consumers with credit card debt outspent at non-discretionary retailers as much as, if not more than, discretionary retailers, which continued into the holiday season. Driving this increase could be depletion of stimulus check payments. Government assistance during the pandemic initially buoyed debt paydowns in 2020 and 2021, possibly depressing spending by former debt-holders. Now that most stimulus programs are over, consumers are again increasingly moving into debt.

High inflation and rate hikes were expected to hit the annual Black Friday sales, but early reports show mostly good news: online sales hit a record $9 billion, and Adobe Analytics figures show ebbing pandemic health concerns with shoppers returning to in-store purchases. But the improvement could be short-lived, reflecting relief at a lockdown-free holiday period and the lure of short-term promotions.

The Basic Materials Industry includes Chemicals, Metals, Mining, Forestry and Paper. Output prices for these sectors have been very volatile in the past 12 months, reflecting recent rapid structural changes in the global economy. Metals for steel and alloy production – Aluminium, Iron Ore, Lead, Zinc, Manganese, Molybdenum and Tellurium are mainly down. Rare earths used in mobile phones, EVs, batteries, catalytic convertors, and flat screens – such as Rhodium, Titanium, Lithium, Palladium, Neodynium – are higher, with Lithium up over 200% YoY. Mined fuels such as Coal are up nearly 150% over the past 12 months in response to the Ukraine war.

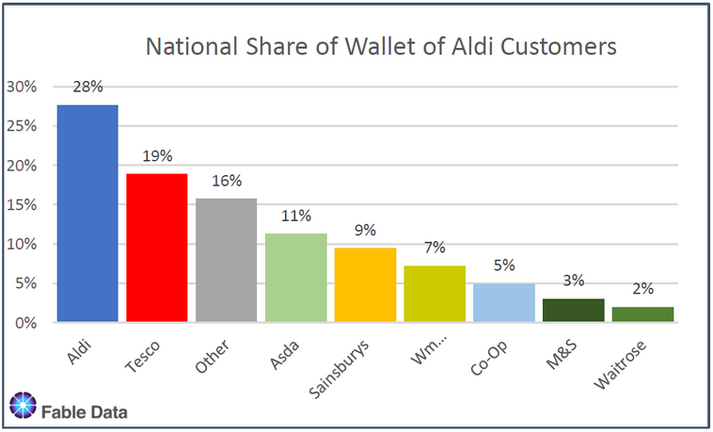

Earnest data exhibited supermarket spending growth of 5.3% YoY in July, boosted by 7.1% growth in average ticket, offset by a 1.7% decrease in the number of transactions. Ticket growth was yet another acceleration from the 6.2% YoY growth in June; similarly, the transaction decline was another slowdown from -0.9% in June. With price levels on the grocery shelf not seen since March 1979 (Food at Home prices increased 13.1% in July, up from 12.2% in June according to the latest BLS figures) forcing some to trade down into value-oriented items, shoppers may find a better deal by switching to more budget-friendly grocers

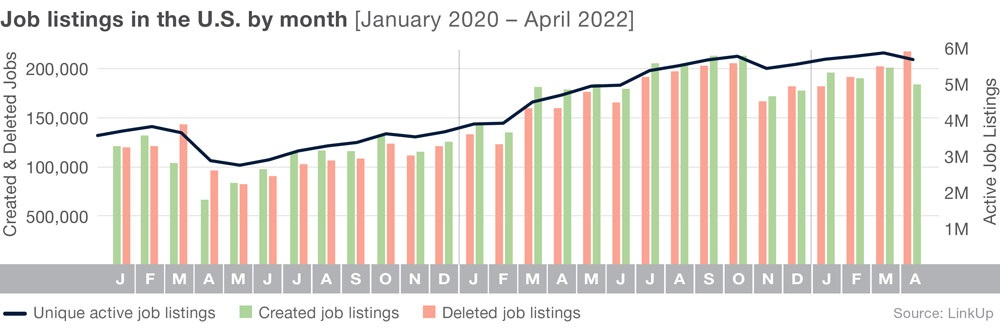

Inflation rate in the U.S. rose in August 2021 and continued its upward trajectory on the back of post-pandemic recovery spending, supply constraints and the war in Ukraine, impacting commodities’ supply. While there are multiple forecasts suggesting that the economy might tip into recession as the Federal Reserve takes steps to rein in inflation; the job market, has continued to show strong signs of recovery in 2022.\[1\]

As we stated in a blog post last June, and it’s even more the case today, at no time in the past 20 years has the intensity of the focus on the job market been stronger. While the economy has successfully recovered from the Covid cataclysm, our landscape has been permanently altered by the tectonic shifts that rocked the world and deep aftershocks continue to reverberate throughout every aspect of post-pandemic (maybe some day?!) life.

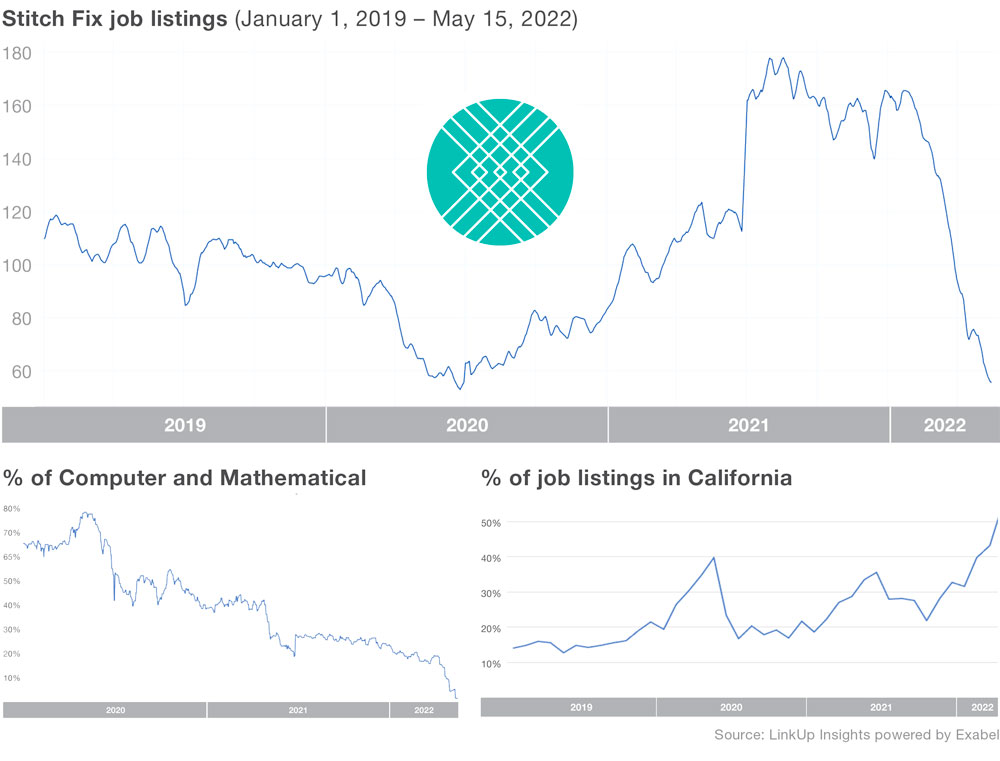

Over the past few months, a number of high-profile employers have announced hiring slowdowns or all-out hiring freezes. In this post, we will take a quick look at the recent job listings trends from some of the companies reporting earnings this week. First, let’s check in on the companies we have already seen announce hiring slowdowns or freezes. The blue line in each chart indicates when these slowdowns were first announced, worth noting that many of these announcements came after job listings had been slashed and the data we provide was predictive of such an announcement.

It’s been more than a decade since “Satoshi Nakamoto,” a suspected pseudonymous person or persons, introduced Bitcoin—and cryptocurrency—to the world. In that time, its value has skyrocketed from zero to $60k, turning thousands of ordinary people into millionaires, a lucky few into billionaires and a long list of others into oh-so-comfortable. In 2021, the cryptocurrency market was valued at more than $3t, which came at a time when many coins reached all-time highs and crypto started to gain widespread appeal, especially among corporations and governments.

With Johnson’s resignation and new leadership on the horizon, the overall state of the UK economy is becoming more important to monitor. In today’s Insight Flash, we review the tools available in CE Transact UK for understanding overall UK spend, for looking at spend by country, and to understand which industries are driving the total growth. UK consumer spend on debit and credit cards has been growing at about 10% above pre-pandemic levels (on a three-year basis) since calendar Q2 2021.

The current cost of living crisis has seen a significant shift in consumer spending patterns as household budgets have been increasingly squeezed. The Grocery sector traditionally acts as a reliable barometer for the wider economy, so it’s perhaps unsurprising that since April, there has been a noticeable shift in consumer spend towards Discounters - Aldi, Lidl and Iceland. This has occurred at the expense of the large Multiples, and Sainsbury’s, Waitrose and Morrisons are particularly feeling the pinch, as shown in the graph below.

If you've been paying attention to the news, we've been hearing a lot about inflation and recession. A quick look at some high level indicators help explain why: Dow Jones Industrial Index = -14% YTD NASDAQ = -27% YTD Bitcoin = -57% YTD U.S. Consumer Price Index = +3.4% YTD U.S. national gas price average = +34% YTD So as you can see, things are going pretty well -_- . These kind of market conditions tend to change the way people spend. We've already reported that consumers are flocking to grocery store apps to access digital coupons to save on their supermarket shopping.

Feelings of dread around the inflation rate, sunken stock prices, and recession fears still loom, of course. And hiring slowdowns are being experienced across industries, occupations, and business types. Created job listings at both public and private companies have been in sync since 2020, with sharp decreases seen in all markets lately, as hiring slows. At the industry level, companies with the largest drops in job listings in May include those in: Utilities (-8.8%); Information (-7.3%); and Transportation and Warehousing (-6.8%).

A recession is starting to look like a possibility. Household budgets are being squeezed by decades of rising inflation, housing costs are continually breaking records, and consumer confidence is plummeting. As a result, customers are less likely to spend money on non-essential things. The apparel industry bears the brunt of the impact. Consumers can easily trade down for less expensive items and stretch out the lifespan of their existing wardrobe. It’s easy to slash spending on apparel when times are tough.

On Friday Kendrick Lamar announced his first tour in 5 years and presale tickets could be purchased via Cash App. This was no surprise after our findings in the Brand Relative App Growth Index (BRAG Index) revealed partnerships was a popular mobile marketing strategy used by top apps over the last six months. The savviest of apps, like Cash App and Chick-fil-A, thought beyond brand marketing and used partnerships to drive installs by lining up value on the other side.

After the four previous months of slow, yet steady job listings growth, April jobs data shows employers are removing job postings and putting a pause on recruitment. With the uncertainty in the economy and increased interest rates businesses are being more conservative when hiring. Total active job listings in the U.S. were down by 3.1%, affecting nearly every occupation, industry, and state. Job listings with the highest rates of decline were concentrated in Healthcare, with listings down more than 5%.

[](https://blog.linkup.com/data-seekers/wp-content/uploads/sites/4/2022/05/LinkUpRecapMapApr2022.jpg)

As a market, Apptopia estimates the top six teen banking apps in the United States have seen downloads fall 26% year-over-year in the first quarter. Monthly active users have fallen alongside, but this is mostly due to the two largest players, Step and Greenlight, slowing growth while their competition has strengthened. Over the past five years or so, the explosion of financial tech (fintech) products and the importance consumers are placing on financial education have increased.

In order to deal with increased prices due to inflation, consumers have modified their spending habits, and are choosing lower-cost alternatives to help them stick to their budgets. Trends over the past 24-months seem to indicate that consumers are more likely to substitute products/services or procure them from less expensive sources than do away with them altogether. Shopping at retail liquor outlets instead of going out to restaurants seems to reflect this consumer switching behavior.