As we stated in a blog post last June, and it’s even more the case today, at no time in the past 20 years has the intensity of the focus on the job market been stronger. While the economy has successfully recovered from the Covid cataclysm, our landscape has been permanently altered by the tectonic shifts that rocked the world and deep aftershocks continue to reverberate throughout every aspect of post-pandemic (maybe some day?!) life.

It’s difficult to imagine a more chaotic, unprecedented set of circumstances that together could possibly lead to a higher degree of uncertainty about the future than what we’re confronting today. Through a lens pertaining solely to the economy, the world of work has been turned upside down, supply-chain shocks persist, the war in Europe continues to devastate, and inflation remains elevated (for now) while the Fed continues to douse the flames with rate hikes. And of course, the depressing backdrop behind all this is a nation headed toward civil war and a planet destined for incineration.

Happy summer everyone!

But returning back to employment, it is the job market that serves as our best hope for some type of guide-wire to guide us through this foggy, crevasse-strewn landscape of Everest-scale chaos. So as we attempt to summit above the clouds where we hope to obtain some clarity about the future, we’ll attempt to rope up and lay out a handful of ‘anchors’ along the way – things we believe to be true given our real-time and predictive job market data and our 20+ years in the human capital management industry. And at the risk of pummeling a dead analogy, we’ll start the ascent by revisiting and updating some of the baseline observations we’ve been making for the past year or so (a basecamp refresher, if you will), followed by what our data is indicating might be in store for July and August’s non-farm payroll reports.

• The Great Resignation/Reshuffle has shifted the labor/capital pendulum back toward employees

Last July, we observed that with 21 million Americans unemployed, underemployed, or not working but willing to do so, the economy was not at all confronted by a labor shortage but rather an enormous bid-ask spread between employees and employers that had frozen the labor market with debilitating illiquidity. As we wrote at the time and in subsequent posts throughout the remainder of the year, our view was that that bid-ask spread would only be bridged when employers started making significant concessions being demanded by workers who, unwilling to return to their old jobs to work for their old employers in their old workplaces for their old salary, had essentially gone on strike.

A year later, not only is it safe to say that employees won the war, but that the pendulum is now swinging back in the direction favoring employees. Don’t get me wrong – this will need to be a decades-long trend with massive upheaval in order to reach any semblance of balance between labor and capital, but things have shifted dramatically in the past year. With unprecedented speed and scale, companies have raised wages aggressively, added meaningful benefits, made workplaces more appealing, embraced remote and hybrid work, committed themsleves to treating employees with dignity and respect, improved corporate culture, provided greater opportunity for career development, and injected more humanity into the workplace. The concessions employers have made will largely (hopefully) be irreversible and the change in employer/employee balance will (hopefully) be long-lasting.

• Remote work fundamentally will transform the U.S.

Not only will all those concessions be permanent, but remote and hybrid work will be a permanent fixture in the economy and its full impact, still yet to be fully realized, will fundamentally transform countless aspects of how we work, where we work, where we live, how we manage work-life balance, what work we do, how we learn, and what careers look like. The impact will be profound in every region, every demographic, and every industry.

• Beveridge Curve

The Beveridge Curve essentially tracks the efficiency or liquidity of the job market and it is clear that over the past 20 years, the labor market has gotten increasingly inefficient and illiquid. Returning again to the post last June, we wrote:

Regarding the structural impediments to a perfect, high-functioning job market, it has always been the case that the job market is far from efficient. First and foremost, the job market, arguably the largest market in the world, centers around people, making it infinitely more complex than traditional markets of any kind, financial or otherwise.

But additionally, the job market is afflicted by a high degree of information asymmetry, nearly a complete lack of transparency, insanely complex, multi-variate motivations, an abundance of subjectivity and far too much bias, little to no standardization, massive decentralization, extraordinarily inadequate market-makers, wildly dynamic pricing, highly variable substitution effects, lagging technology, and above-average regulation. And until recently, jobs were largely location-specific, adding onerous illiquidity factors at a global, national, regional, and local level.

We can add to the list few additional contributing factors such as employer-provided healthcare, cultural, political and religious affiliation (The Big Sort), monopsony and business concentration, unaffordable and ineffective education, lack of affordable childcare, and challenging public transportation, to name just a few.

Despite the fact that job market liquidity has improved over the past year as employers acted quickly and aggressively to attract workers, the labor market nevertheless remains highly inefficient and is getting more so all the time. One of the countless lessons we hopefully learned from the pandemic is that the Beveridge Curve is insanely important to how our economy functions and illiquidity in the job market costs employees, employers, and the economy as a whole billions of dollars in lost wages, lost productivity, lost revenue, and increased costs.

• Phillips Curve

There have been rumblings on and off over the years that the relationship between employment and inflation had been broken, that the Phillips Curve had become obsolete for any number of reasons. While there has been and will always be excessive debate about the relationship between employment and inflation, The Phillips Curve is very much still a thing – low unemployment in a strong economy causes employers to raise wages, and those increased wages eventually lead to rising inflation.

The challenge in our current set of circumstances is that a pandemic, global supply shocks, a European war with serious implications for food and energy prices, and corporate greed are all also contributing to inflation, so it’s impossible to determine what portion of the present inflation spike should be attributed to wages. But rest assured that low unemployment will cause wages to rise which, in turn, causes inflation to rise.

Having said all of that, we have consistently been of the mind for the past year that the primary drivers of inflation for the past 12+ months have been largely related to Covid and the post-pandemic after-shocks and that seriously elevated inflation rates would be transitory. The Russian invasion of Ukraine earlier this year added additional inflationary pressure to the global economy not only in terms of magnitude but also duration, and that has to be appropriately factored into any fair debate around whether or not inflation in the economy today could be termed transitory. And even if one were to remove any leeway for the war in Europe, or perhaps we can call it a draw between the hikes to date and the war in Europe, we remain firmly in the transitory camp. Inflation is trending down and all signs point to it being back to tolerable levels in the near future.

• As wage inflation persists, automation will accelerate (everybody knows)

Everybody knows that technology dislocates workers and that when wages are rising, investment in technology to replace workers rises along with it. But it’s still worth noting the speed, depth, and breadth of the dislocation over the past few years. Mixing a global pandemic and an 18-month quarantine, a nation-wide employee walk-out (the Great Resignation), insatiable consumer demand, global supply-shocks, and accelerating developments in technology (computing power, robotics, AI, etc.) is clearly a lethal combination that massively accelerates the Schumpeter effect of technology on America’s workforce.

Startling enough is what we can see every day as automation and human-less work has popped up everywhere you look. But even more dramatic is what most people don’t see – the automation, robotics, and AI-powered technology that is displacing workers in every single industry across the entire economy. And as technology evolves, the displacement will continue moving up the from low-wage, low-skill work to increasingly more sophisticated labor. And just wait until driverless, electric vehicles become mainstream everywhere.

The interesting questions are not whether technology displaces workers (it does) or if the rate of disruption is increasing (it is), but the extent to which technology creates new jobs that didn’t previously exist, how efficiently we can transition workers to those new roles, and what we need to do to minimize or eliminate the negative aspects of technology vis-a-vis the workforce.

And as all this relates to wages, employment, and inflation, technology will continue to dislocate workers, exert downward pressure on wage inflation in some areas and raise it in others, and increase productivity in the aggregate across the economy.

• NAIRU

It is safe to say that we are in a world that no one on the planet has ever experienced before. There is nothing normal about any aspect of life these days, especially aspects related to the economy, consumers, business, inflation, employment, growth, and the markets (not to mention climate, politics, technology, pandemics, etc.). As a result, old models need to be significantly updated, abandoned altogether, or at the very least, temporarily shelved to see how things unfold amid the insane magnitude of change, chaos, and uncertainty. One perfect example is the non-accelerating inflation rate of unemployment (NAIRU).

NAIRU is largley an unknowable number even in a normal environment and in today’s world, the quantity, magnitude, velocity, and uncertainty surrounding the forces in play make understanding and attributing the causes, consequences, and correlations between those forces impossible to determine with a sufficient level of certainty. The debate, however – so long as participants appropriately check their ego, demonstrate some humility, and reduce their confidence – can still be interesting and potentially worthwhile to the extent that it generates improved thinking around these incredibly complex issues.

So in that vein, I’d propose the following:

• Unemployment, wage growth, and inflation should trend toward 4-5% over the medium to long term

With past and future rate hikes and an economy and a job market that are cooling off a bit from their torrid state, we expect that unemployment should rise slowly to somewhere between 4-5%. This increase will occur in fits and starts as the job market gyrates towards equilibrium, with continuing but slowing wage growth, continuing but gradual net increase in the number of people returning to the workforce until we reach ‘Full Employment’ that will have a lower participation rate and fewer people in the workforce (those two things are related but result from different drivers) than at any point in anyone’s lifetime, and job openings gradually trending down over time but the job market as a whole remaining strong.

Wage growth in the aggregate will settle into a range in the same 4-5% band as the present chaos slowly subsides and businesses, the economy, and the job market settle down. Certain regions and industries will see higher wage gains while other areas of the economy will see no gain and even declining wages, but net-net, wage growth will remain elevated above the 2.8% average we’ve seen over the past 20 years.

And finally, the temporary contributors to inflation (supply-chain shock, Russia/Ukraine, insatiable consumer demand, high savings, etc.) will subside and inflation will settle down into a long-term range between 4-5%, lower than the 40+ year highs we’ve experienced recently but still higher than what we’ve seen for decades pre-Covid due primarily to elevated wage inflation triggered by the Great Resignation/Reshuffle that is making up for 50 years of stagnant wages in the country. (In that assessment of elevated long-term inflation, I am netting out rising wage inflation from demographic trends (retiring baby-boomers) with falling wage inflation due to immigration and/or technology).

All of this will happen over an extended period of time (1-5 years?) with high volatility and broad but highly uneven and varied distriubution of impact across time periods, regions, demographics, and industries. This will make for a great deal of apparent noise and everyone will have ample opportunity to cherry-pick whatever data they want to strengthen their argument and/or confirm the accuracy of their forecast(s).

But over at least a 1-5 year horizon, we believe, first, that things will trend in the direction outlined above and that, second, the optimal state of the economy is such that a 4-5% range should be the target range for unemployment, wage growth, and inflation.

I have no view whatsoever on what the Fed will do as far as rate hikes go, but I believe strongly that patience is very much in order and that the Fed’s inflation target needs to be raised from 2% to 4% given the realities of what is happening in the economy and the job market, combined with recognizing the severe pain (a deep recession with high unemployment) that would likely result from jamming the breaks on the economy and smashing us all into the windshield by maintaining an arbitrary yet militant adherence to the anachronistic target of 2%.

So turning to our data, what we know with a far higher degree of certainty than anything stated previously, is the following…

• The job market is continuing to cool off

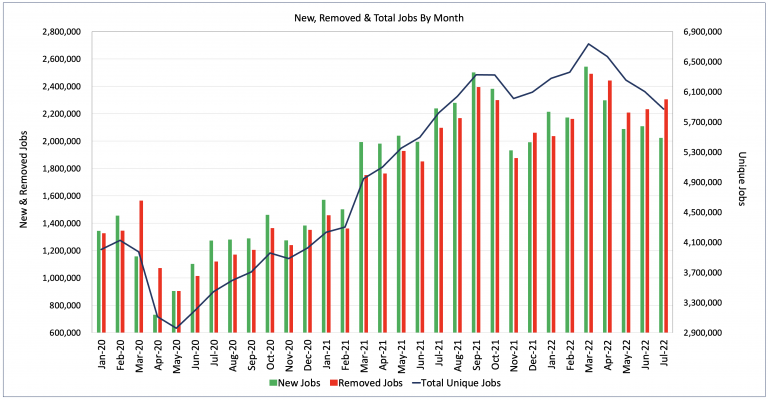

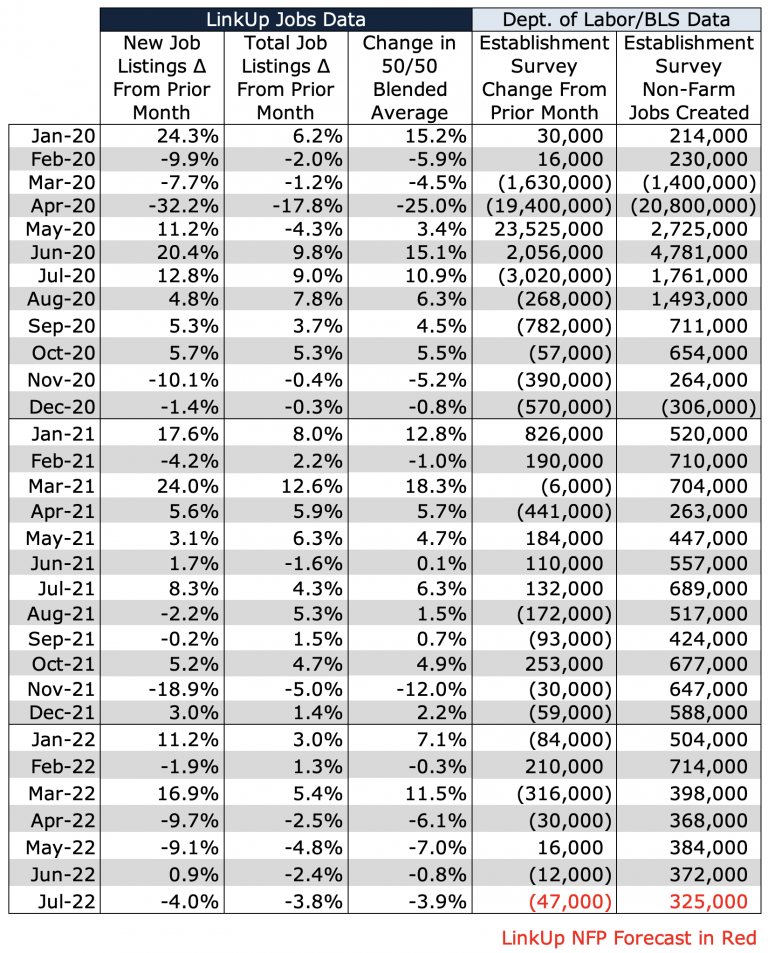

In July, total job openings dropped 4% while new jobs jobs fell 4% and removed jobs rose 3%. Labor demand has dropped 13% since March and with the continued decline in total job openings in July, labor demand has returned once again to precisely where it was a year ago.

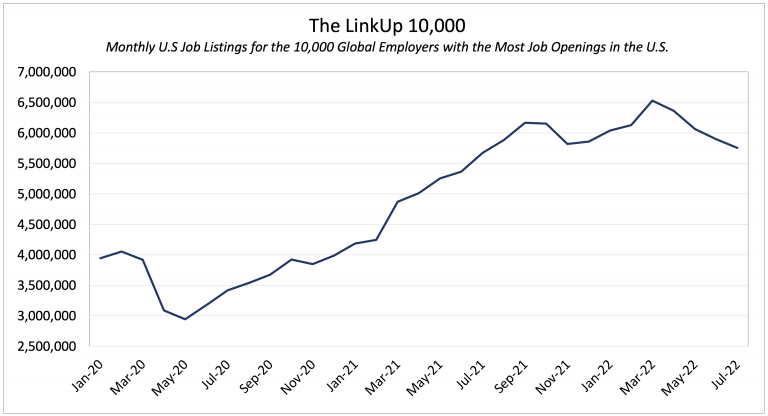

The LinkUp 10,000, which tracks total job openings from the 10,000 global employers that have the most job openings in the U.S., fell 2% in July.

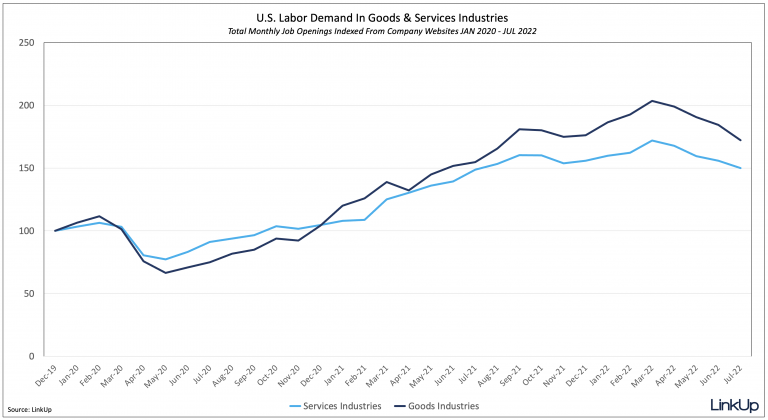

Nearly identical declines in labor demand were seen in goods and services industries alike.

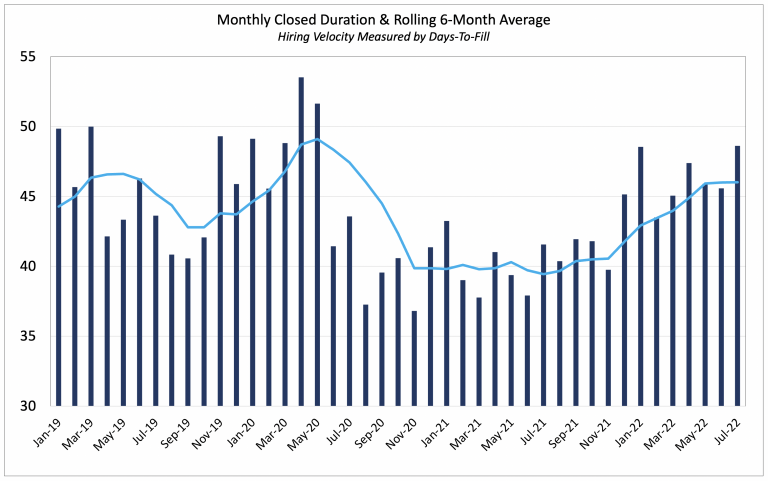

Hiring velocity slowed down significantly in July as Job Duration rose to nearly 47 days.

Job Duration, the average number of days that job openings are posted on company websites before they are removed – typically because the job was filled – tracks hiring velocity across the entire economy.

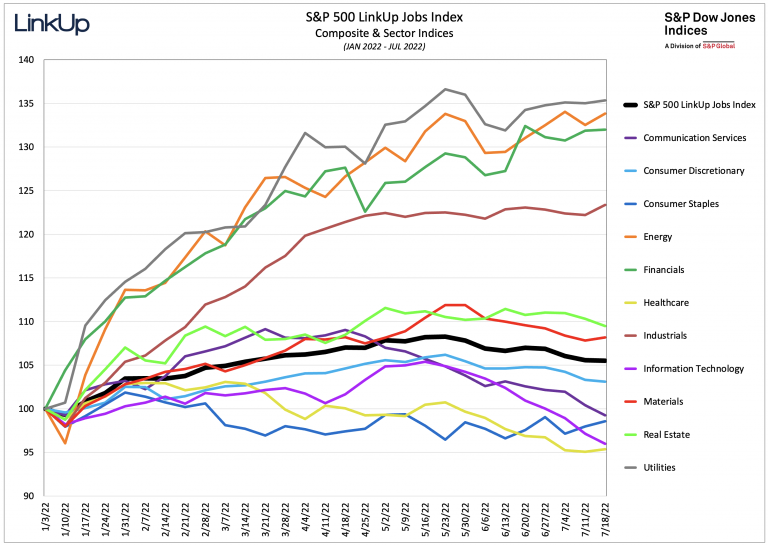

The S&P 500 LinkUp Jobs Index presents a very mixed picture with only a handful of sectors showing solid job opening growth this year and most sectors showing modest or anemic job opening growth and 4 sectors showing negative job growth (Healthcare, Information Technology, Consumer Staples, & Communication Services).

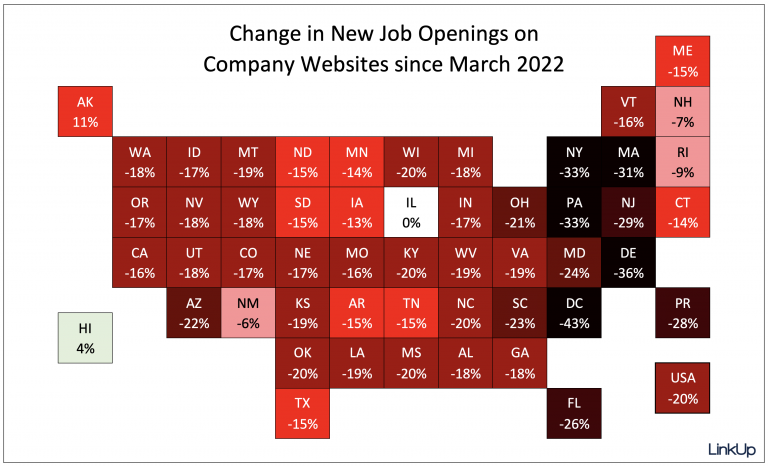

Since March, new job openings across the country have plummeted 20% with greater declines seen in the eastern third of the country.

Given the lag between job openings being posted on company websites and those jobs being filled with new hires, our non-farm payroll forecast for July is based on our data from June when the blended average of new and total jobs dropped 1%. As a result, we are forecasting a net gain of 325,000 jobs in July – a very solid number but the smallest gain of any month this year.

So the million dollar question everyone is debating is if and when a recession will arrive (or perhaps whether we might already be in one). Politicians, CEO’s, economists, pundits, and the media are rightly fixated on the debate as well as the underlying factors, and for every article or economist’s quote pointing emphatically in one direction, there is another, equally as adamant, pointing in the other.

Needless to say, the data is all over the map, much of it is contradictory, and reading the tea leaves these days is extraordinarily difficult. But armed with an alethiometer powered by our job market data, our view is the job market will prove sufficiently resilient to enable a soft-landing (if the Fed can be patient and give their hikes time to work). Labor demand will remain strong as it continues its slow taper, the Great Resignation/Reshuffle will persist but eventually sort out, and ultimately, the labor market will reach some sort of equilibrium.

That equilibrium will be a ‘new normal’ characterized by a somewhat lower labor force participation rate, a slightly more balanced relationship between employees and employers, more liquidity in the job market, and elevated wage inflation that will lead to broader inflation persistently anchored around 4%.

That all sounds like a pretty good place to be for a while and perhaps our viewpoint is a bit too optimistic (maybe even delusional), but we tend to be of the mind that while markets are never perfectly efficient, large markets (and there is none larger than the global job market) always trend, over the long term, towards great efficiency.

To be sure, volatility associated with massive tectonic shifts affecting the labor market (technology, demographics, climate change, the pandemic, politics, etc.) will remain high, but the current chaos will sort out eventually. Just don’t expect that to happen starting this Friday when the jobs numbers beat consensus and the hawks escalate their hysteria for a 75bp hike next month.

P.S. For anyone still reading this and wondering about the title of this post, I wanted to highlight the fact that for 90% of my 20 years in the human capital management industry, wages have remained stagnant, the balance of power between employers and employees has tilted more and more in favor of employers, and profits have nearly always trumped people (heads, employers win).

And now, following the only time in my career that employees have gone toe to toe against employers and won at scale, when wages are finally rising at a rapid clip, most companies are still reporting record earnings (heads, employers still win). At the same time, inflation is at a 40-year high and real wages for employees (wages that factor in inflation) are still falling (tails, employees lose). So that’s where the headline comes from.

Everybody knows the fight was fixed.

To learn more about the data behind this article and what LinkUp has to offer, visit https://www.linkup.com/data/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.