When Colonial Pipeline was hit with a ransomware attack that forced it to shut down operations, millions of consumers on the East Coast were faced with long lines at gas stations and skyrocketing fuel prices. Although the press was awash in pictures of people hoarding gas in plastic shopping bags, how much impact did the shutdown really have? In today’s Insight Flash, we dig into this question by taking advantage of our unique ability to cut spend at grocery stores and service stations by fuel vs. non-fuel spend, looking at geographical differences in fuel ASP and number of transactions, as well as whether rising fuel prices cannibalized non-fuel sales for these retailers.

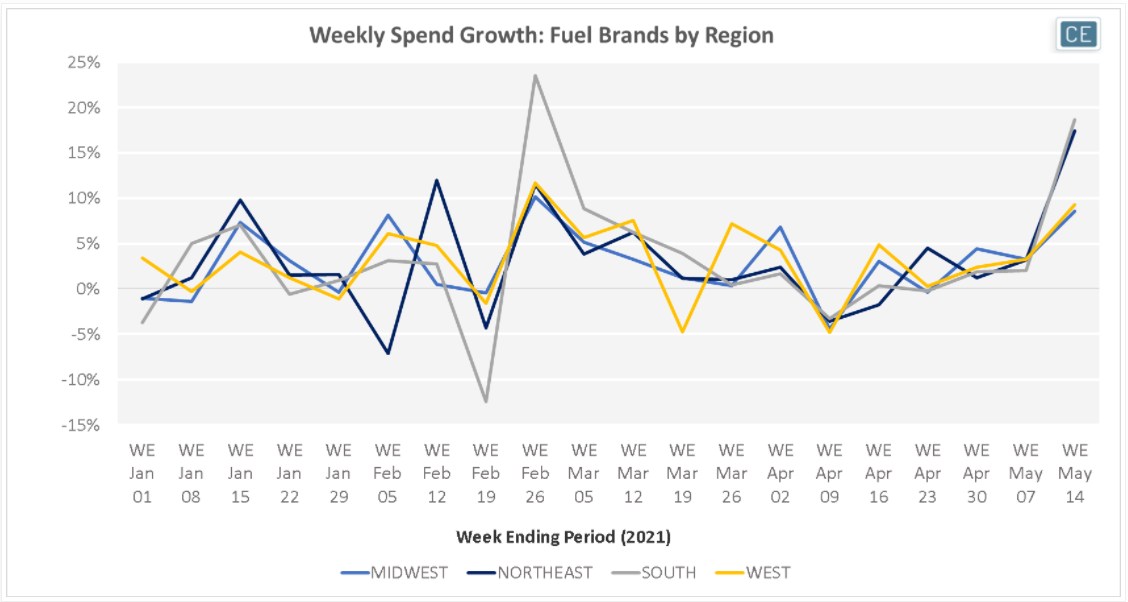

The surge in fuel spend is clear from weekly data. For the week ending 5/14/2021, spend at retail fuel POS was up 19% in the South and 17% in the Northeast. Interestingly, even those in the West and Midwest began to stock up, with spend up 9% in both of those regions.

Fuel Spend by Region

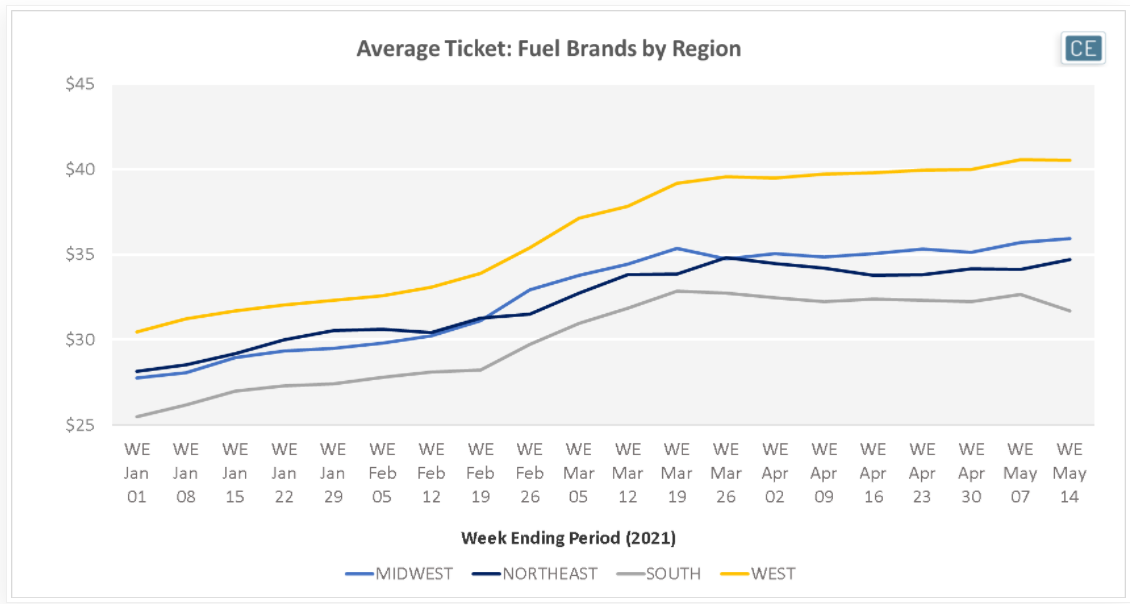

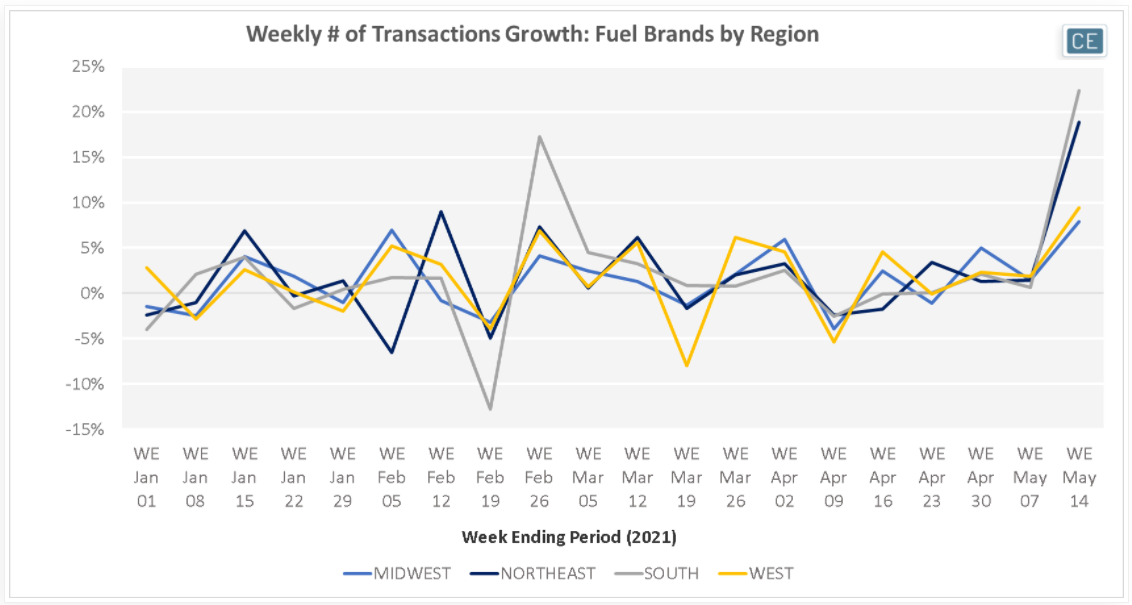

Despite an increased price per gallon, purchase limits at gas stations meant that average tickets at fuel pumps were relatively steady the week ending 5/14/2021. However, drivers were not to be deterred. The number of transactions at fuel POS the week ending 5/14/2021 soared in the South and Northeast, up 22% and 19% y/y respectively.

Fuel ASP and Transactions by Region

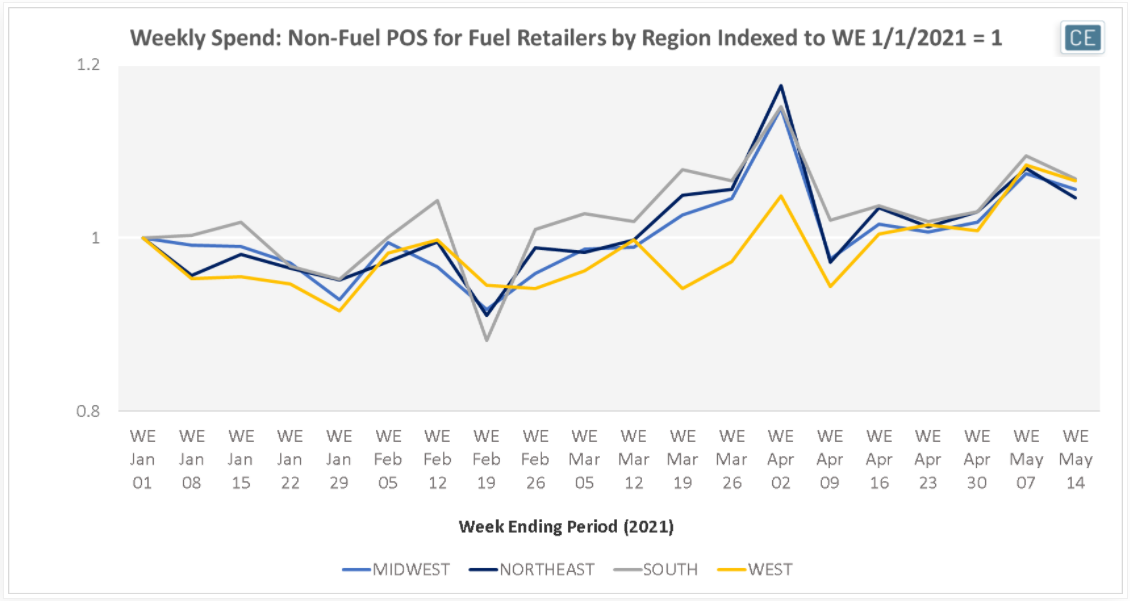

Interestingly, the pop in fuel prices doesn’t seem to have depressed spending on other categories. In fact, the increased trip frequency may have actually led to slightly more spend at non-fuel POS in the South. In the South, spend at non-fuel POS was up 6.8% in the week ending 5/14/2021 vs. the week ending 1/1/2021. This was versus 6.6% in the West, 5.5% in the Midwest, and 4.6% in the Northeast.

Ex-Fuel Spend

To learn more about the data behind this article and what Consumer Edge Research has to offer, visit www.consumer-edge.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.