Source: https://secondmeasure.com/datapoints/dtc-companies-capturing-larger-share-of-furniture-sales/

Consumer spending data reveals that home furniture sales have grown during the pandemic. While traditional furniture retailers have experienced modest sales growth since summer 2020, DTC furniture companies are experiencing greater growth and capturing an increasing percentage of market share. This is likely due to both the closure of brick and mortar stores and homeownership being on the rise.

Sales for DTC furniture companies outpacing traditional retailers

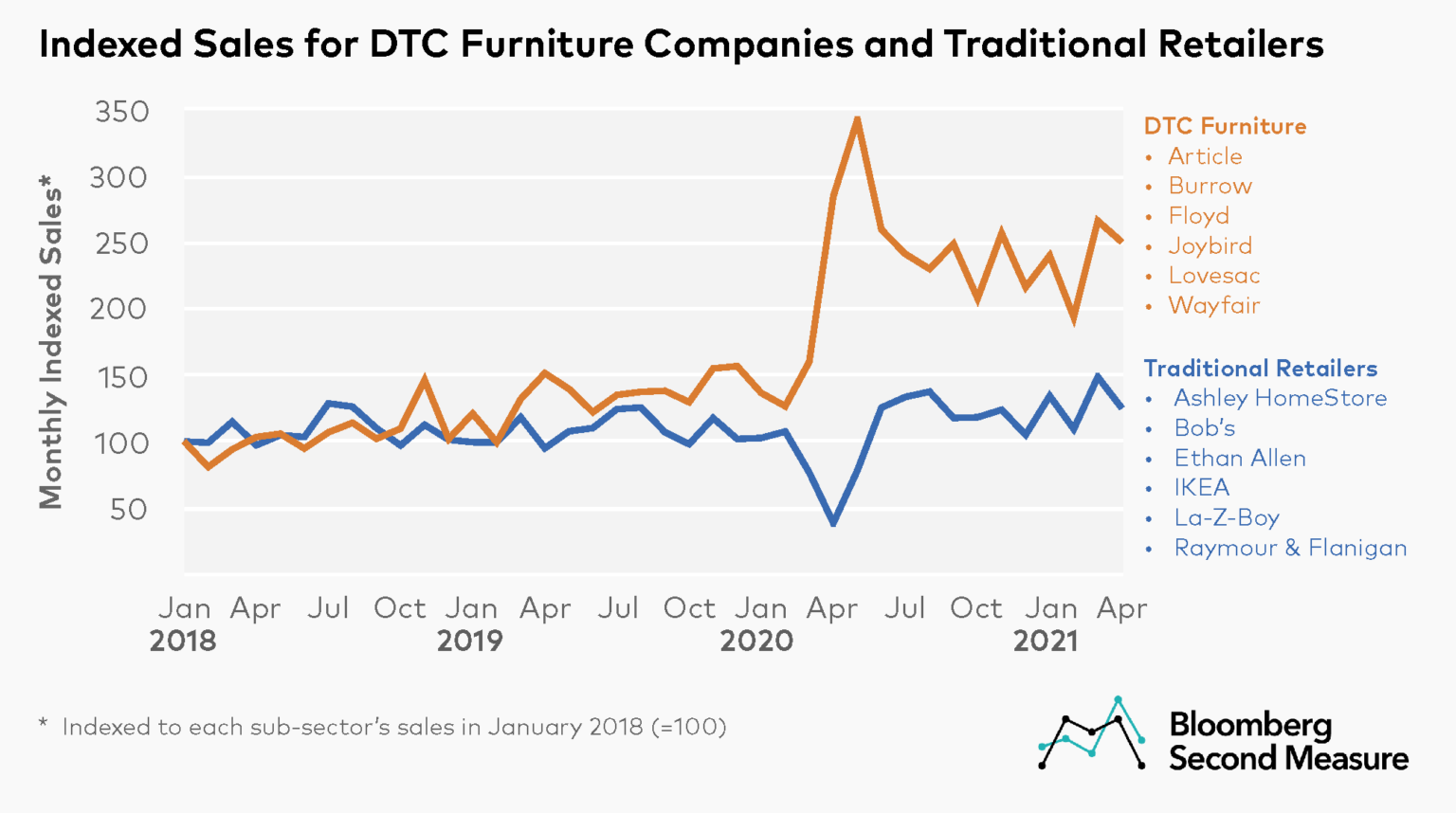

Even before COVID-19, DTC furniture brands saw greater sales growth than traditional retailers. In 2019, the average monthly year-over-year growth rate for traditional furniture retailers was relatively flat, while DTC companies saw an average monthly increase of 29 percent year-over-year. By 2020, average monthly year-over-year growth ballooned to 67 percent for DTC furniture companies while traditional retailers’ sales declined an average of 3 percent year-over-year.

Zooming in, at the onset of shelter-in-place orders in March 2020, overall furniture sales declined 16 percent year-over-year. Traditional furniture retailers, which largely rely on brick-and-mortar locations, experienced a sales decrease of 35 percent year-over-year in March 2020, while DTC brands experienced an increase of 21 percent year-over-year.

DTC sales growth accelerated between March 2020 and May 2020, with sales more than doubling over the course of the three months. Sales for traditional furniture retailers took a few months to recover, reaching pre-pandemic levels in June 2020. Since then, rising sales and supply chain challenges over the past several months have strained furniture companies and led to increased delivery delays.

DTC furniture companies have been gaining market share

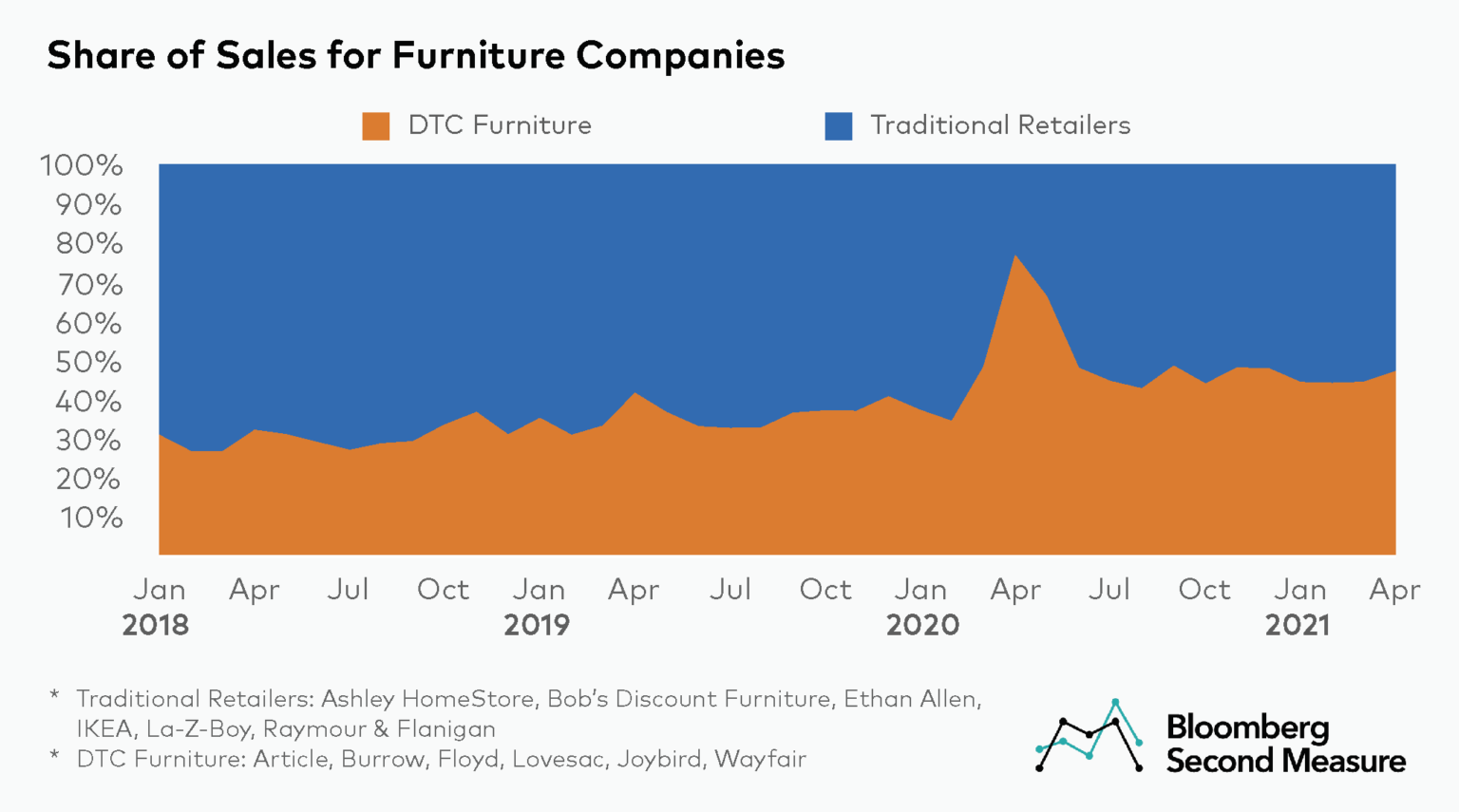

Over the past few years, DTC furniture companies have been capturing market share from traditional retailers. DTC furniture companies accounted for a monthly average of 30 percent of furniture sales in 2018 and a monthly average of 36 percent in 2019. In 2020, DTC furniture companies accounted for a monthly average of 49 percent of furniture sales, with growth accelerated by the pandemic.

Examining trends on a company level, 45 percent of April 2021 sales among all furniture companies in the chosen competitive set were from Wayfair. Ikea was a distant second with 26 percent of sales and Ashley HomeStore was in third with 14 percent.

Among the DTC furniture companies in our analysis, most of the sales came from Wayfair. In April 2021, Wayfair accounted for 95 percent of DTC sales. Lovesac represented 2 percent of sales, and Article and Joybird each had 1 percent of sales.

Wayfair’s Way Day sales continue to grow

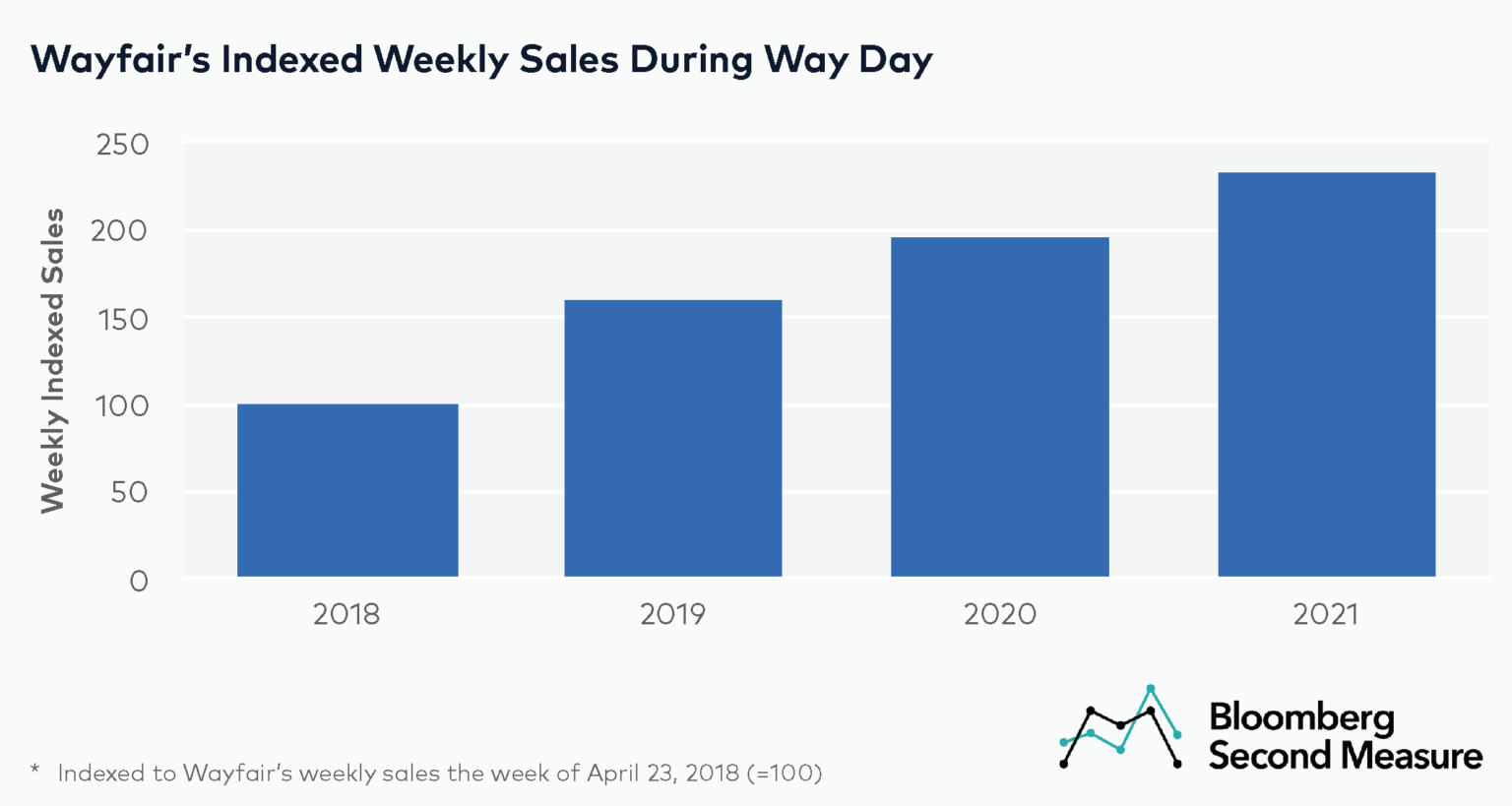

Despite being held only seven months after the last event, Way Day 2021 had the best sales performance to date. Wayfair’s sales the week of Way Day in 2021 were more than double the sales from the week of the first event in 2018. Sales the week of Way Day 2021 were also 19 percent higher than sales the week of Way Day 2020. Bloomberg Second Measure is unable to separate data for Wayfair from its parent company, Wayfair, Inc., after December 2020.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.