Notable Hit 1: (NKE:NYSE) On Tuesday March 21, 2023 NIKE, Inc. (NKE) posted revenues of $12.39 bn, surpassing the consensus estimates by +8.3% and in the same direction as Advan's forecasted sales. The revenue increased 14% YoY - in line with Advan's foot traffic data increase of 10% YoY at its stores for Q4 2022. Advan's footfall data has a correlation of 0.94 on a YoY basis with NKE's top-line revenue over the last 16 quarters.

Notable Hit 1: (FIVE:NASDAQ) On Wednesday March 15, 2023 Five Below, Inc. (FIVE) posted revenues of $1.12 bn, surpassing the consensus estimates by +1% and in the same direction as Advan's forecasted sales. The revenue increased 12.7% YoY - in line with Advan's foot traffic data increase of 14.5% YoY at its stores for Q4 2022. Advan's footfall data has a correlation of 0.82 on a YoY basis with FIVE's top-line revenue over the last 15 quarters.

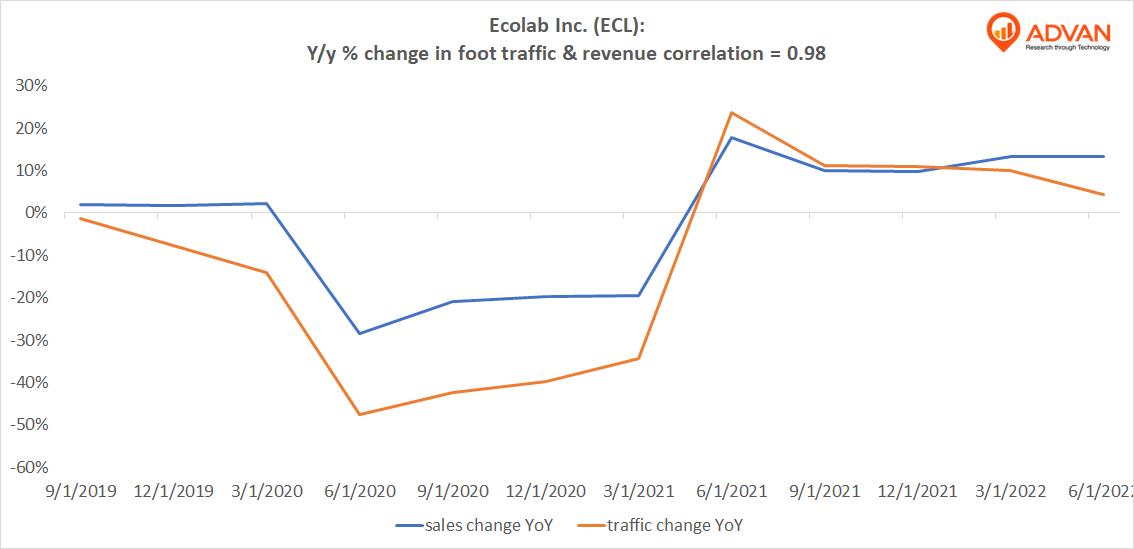

Notable Hit 1: (ECL:NYSE) On Tuesday July 26, 2022 Ecolab Inc. (ECL) posted better than expected revenues of $3.58bn surpassing the consensus estimate of $3.50bn or by +2% and in the same direction as Advan's forecasted sales. The revenue was up 13.2% YoY and in line with Advan's employee foot traffic data increase of 4.3% YoY at its factories for Q2 2022. Advan's footfall data has a correlation of 0.98 on a YoY basis with ECL's top-line revenue over the last 12 quarters.

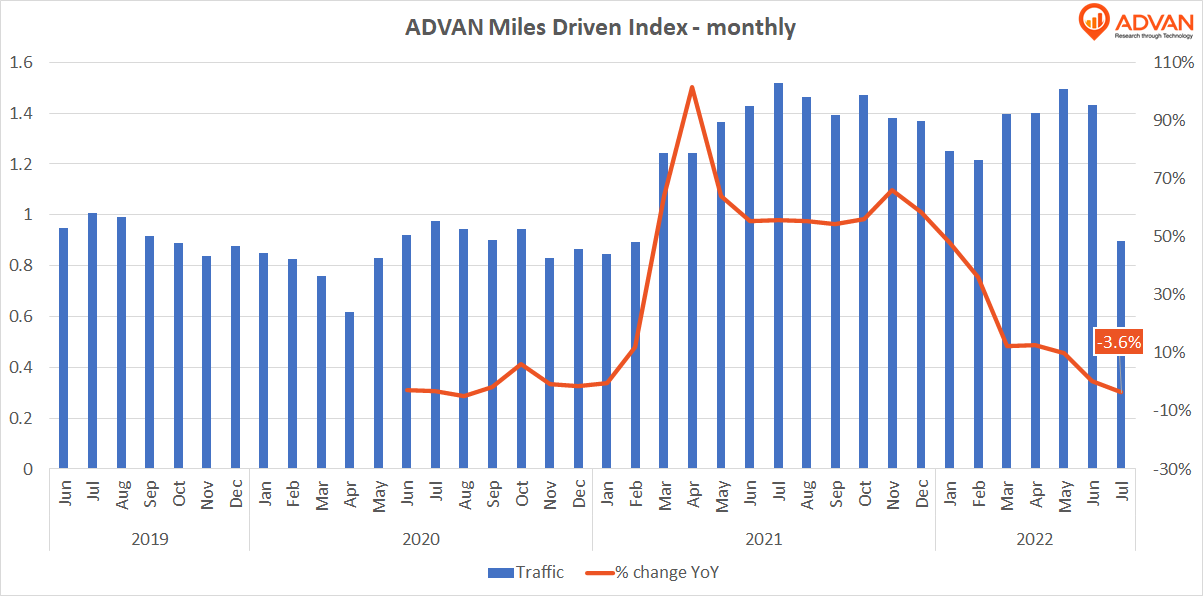

Historically, gas demand has been pretty predictable for any given time of the year, so the supply has been what mostly determined the pricing we see in the pumps. With the advent of remote working and as a result the ability to commute less, however, Americans have at least one lever to reduce the amount of gas they purchase. The other major aspect of the demand of course being leisure travel.

Target (NYCE: TGT) announced today that it expects lower profit due to high inventory. It is counter-intuitive, but cellphone location data is measuring this discrepancy by monitoring Target’s supply and demand sides. On the demand side, in the image below we can see foot traffic in Target stores (in blue) and its associated blue trendline being relatively steady, at a 3% Y/Y increase vs same quarter last year, and closely following the revenue y/y change

On Wednesday May 4, 2022 Marriott International, Inc. (MAR) posted better-than-expected revenues of 4.2bn surpassing the consensus estimate of $4.15bn or by +1.2% and in the same direction as Advan's forecasted sales. The revenue was up 81% YoY and in line with Advan's foot traffic data increase of 35% YoY at its properties for Q1 2022. As a result of beating the sales and EPS the stock closed at $181.24, +4.7% from previous close. Advan's footfall data has a correlation of 0.92 on a YoY basis with MAR's top-line revenue over the last 13 quarters.

As we are into the third year of the Covid-19 pandemic, here are the latest developments in travel industry as of 4/18/2022. Starting off with the US airports, following a strong first quarter of 2022, despite the Omicron wave that led to thousands of flight cancelations, foot traffic picked up steam in March and is on track to hit its highest level in the next days since the beginning of 2022. Airport visits across the country are 22.5% down compared to April 2019 so far but our data indicates that the total number of visits at the end of this month will likely surpass March’s mark of approximately 112mm.

The hardest-hit New York City is bouncing back once again as Omicron cases continue to rapidly fall at the same speed they increased in mid-December and New Yorkers look forward to enjoy the city as it was before the pandemic. ADVAN’s foot traffic data shows an uptick in foot traffic mobility overall however the trends differs from area to area. For example, foot traffic in fashionable SoHo started to increase significantly the first weekend of this month after the Omicron wave started to subside in the second half of January.

Notable Hit: (PENN:NASDAQ) On Thursday February 3, 2022 Penn National Gaming, Inc. (PENN) posted better-than-expected revenues of $1.57bn surpassing the consensus estimate of $1.49bn or by +5.4% and in the same direction as Advan's forecasted sales. The revenue was up 53% YoY - Advan's foot traffic data captured an increase in foot traffic of +43% YoY at its casinos for Q4 2021. The stock was up +11.5% the from previous close shortly after the opening bell. Advan's footfall data has a correlation of 0.99 on a YoY basis with PENN's top-line revenue over the last 12 quarters.

Notable Hit 1: (UAL:NASDAQ) On Thursday January 21, 2022 United Airlines Holdings, Inc. (UAL) posted better-than-expected revenues of $8.192bn surpassing the consensus estimate of $7.93bn or by +3.3% and in the same direction as Advan's forecasted sales. The revenue was up 140% YoY - Advan's foot traffic data captured an increase in foot traffic of +79% YoY at United's passenger terminals for Q4 2021. Advan's footfall data has a correlation of 0.94 on a YoY basis with UAL's top-line revenue over the last 12 quarters.

Notable Hit 1: (THO:NYSE) On Wednesday December 8, 2021 Thor Industries, Inc. (THO) posted better-than-expected revenues of $3.96bn beating the consensus estimate of $3.48bn or by 13.8% and in the same direction as Advan's forecasted sales. The revenue was up 56% YoY - Advan's foot traffic data captured an increase in employee foot traffic of +39% YoY at its factories for Q3 2021. As a result of beating the sales and EPS, the stock opened at $107.92, up 1.4% from its previous day's closing price while hit a high of $110 (+3.4%) during the trading session.

Traffic on Black Friday after Thanksgiving was materially higher across Advan Indices compared with last year’s levels. But visits are still down compared to 2019 records for most of the indices. Clothing and Accessories index saw an increase of 55% yoy but down 15.3% Yo2Y while Furniture and Food Stores including food stores such as Kirkland’s/Restoration Hardware and Kroger’s and Whole Foods respectively have bounced back to pre-pandemic levels.

The lower tranches of MSBAM 2013-C10 have been in trouble since the beginning of the pandemic. Fitch details their latest downgrade in their last update at the end of September. In particular, the downgrade is due to the troubles at Westfield Citrus Park, which is in a friendly foreclosure; Southsdale Center; and the Mall at Tuttle Crossing. Let’s look at these centers in sequence. According to Fitch, Westfield Citrus Park reported June 2021 TTM in-line sales of approximately $120 compared to $379 per sqft at YE 2019.

Notable Hit 1: (BURL:NYSE) On Tuesday November 23 , 2021 Burlington Stores, Inc. (BURL) posted better-than-expected revenues of $2.3bn beating the consensus estimate of $2.22bn or by 3.44% and in the same direction as Advan's forecasted sales. The revenue was up 38.19% YoY - Advan's foot traffic data captured an increase in foot traffic of +24.53% YoY at its stores for Q3 2021. As a result of beating the sales and EPS, the stock opened at $271.99, up 3.4% from its previous day's closing price.

Notable Hit 1: (ROST:NASDAQ) On Thursday November 19 , 2021 Ross Stores, Inc. (ROST) posted better-than-expected revenues of $4.57bn beating the consensus estimate of $4.31bn or by 6% and in the same direction as Advan's forecasted sales. The revenue was up 22% YoY - Advan's foot traffic data captured an increase in foot traffic of +32% YoY at its stores for Q3 2021. Advan's footfall data has a correlation of 0.92 on a YoY basis with ROST's top-line revenue over the last 12 quarters.

The US borders finally opened on November 8. Did that result in a material influx of tourists that will help increase hotel and retail traffic? Not yet... Let's review 5 airports that showcase both domestic and international travel: LAX and ORD (Chicago O'Hare) that capture international visitors from the Asia-Pacific region, and JFK and EWR (Newark) that capture traffic from Europe; plus LGA (LaGuardia) which has mostly domestic traffic for comparison.

Notable Hit 1: (PLNT:NYSE) On Thursday November 5 , 2021 Planet Fitness (PLNT) posted better-than-expected revenues of $154.26mm beating the consensus estimate of $135.09 (-14.2%) and in the same direction as Advan's forecasted sales. The revenue was +46.4% YoY - Advan's foot traffic data captured an increase in employee foot traffic of +58.7% YoY at its fitness clubs for Q3 2021. As a result of beating the sales and EPS, the stock opened at $91.27, up +15.5% from its previous day's closing price.

Workers at Deere & Co. (DE), the world’s top agriculture equipment manufacturer, walked out of its factories to demand better pay and health benefits, a move that had not be seen in over 30 years, and while the company is on track for its most successful year ever. The strike started on Oct. 14 with about 10,000 employees or about 15% of Deere’s workforce (according to Bloomberg), refusing to work in an effort to change their contracts.

Notable Hit 1: (ECL:NYSE) On Tuesday October 26 , 2021 Ecolab Inc. (ECL) posted better-than-expected revenues of $3.32bn beating the consensus estimate of $3.28bn (-1.27%) and in the same direction as Advan's forecasted sales. The revenue was +10% YoY - Advan's foot traffic data captured an increase in employee foot traffic of +3.3% YoY at its factories for Q3 2021. As a result of beating the sales and EPS, the stock closed at $230.28, up +3.9% from its previous day's closing price.

Notable Hit 1: (TSCO:NASDAQ) On Thursday October 21 , 2021 Tractor Supply Company (TSCO) posted better-than-expected revenues of $3.017bn beating the consensus estimate of $2.84bn (-6.2%) and in the same direction as Advan's forecasted sales. The revenue was +15.8% YoY - Advan's foot traffic data captured an increase in foot traffic of +25% YoY at its locations for Q3 2021. As a result of beating the sales and EPS, the stock opened at $211.51, up +4.5% from its previous day's closing price and hit a high of $212.88 (+5.2%) shortly after the opening bell.