Source: https://advanresearch.com/thor-industries-tho-dave-and-buster-play-foottraffic-revenue-correlation

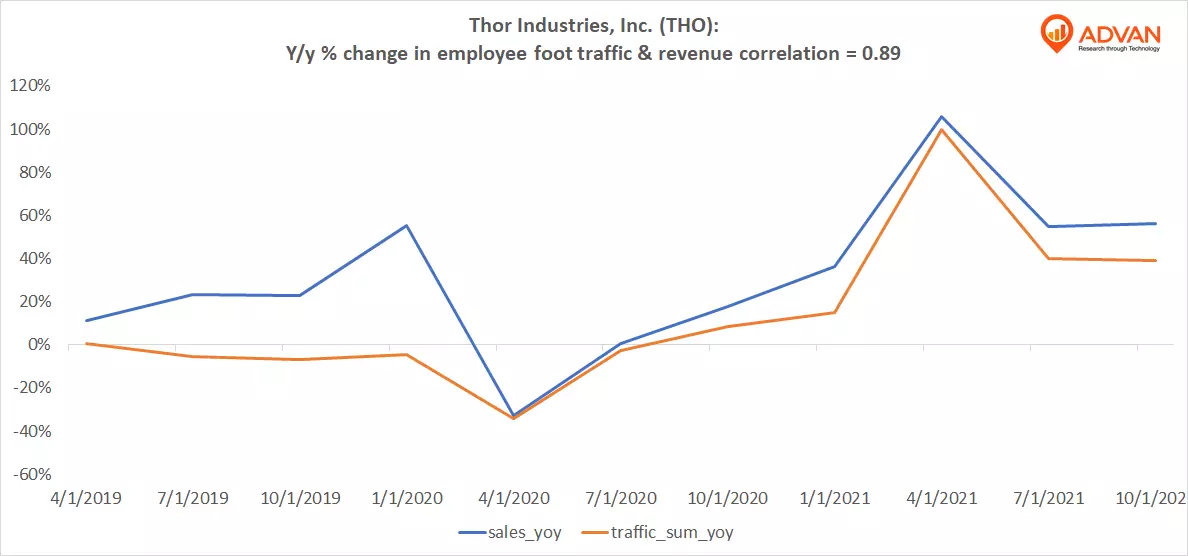

Notable Hit 1: (THO:NYSE) On Wednesday December 8, 2021 Thor Industries, Inc. (THO) posted better-than-expected revenues of $3.96bn beating the consensus estimate of $3.48bn or by 13.8% and in the same direction as Advan’s forecasted sales. The revenue was up 56% YoY - Advan’s foot traffic data captured an increase in employee foot traffic of +39% YoY at its factories for Q3 2021. As a result of beating the sales and EPS, the stock opened at $107.92, up 1.4% from its previous day’s closing price while hit a high of $110 (+3.4%) during the trading session. Advan’s footfall data has a correlation of 0.89 on a YoY basis with THO’s top-line revenue over the last 11 quarters.

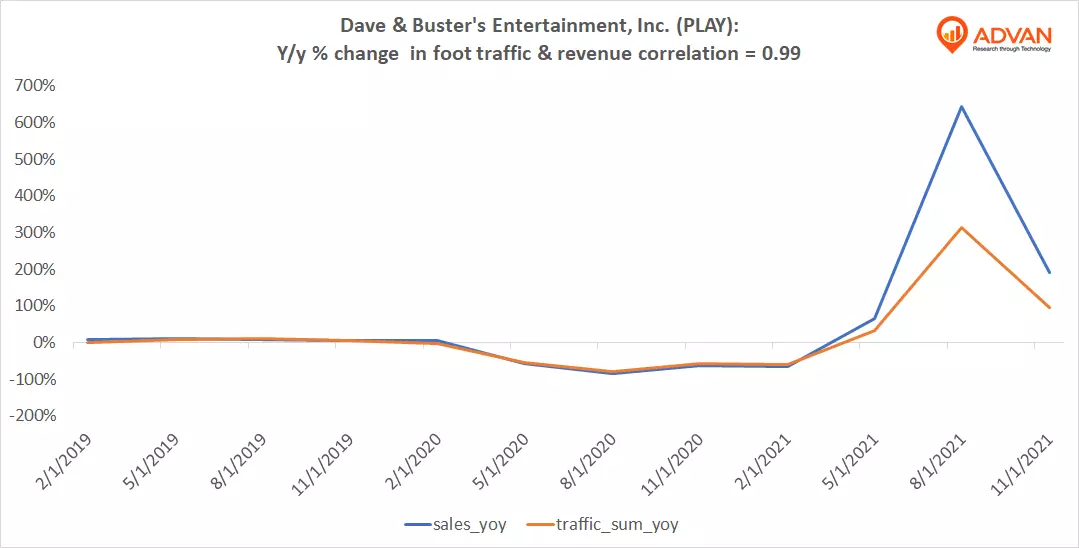

Notable Hit 2: (PLAY:NASDAQ) On Wednesday December 7, 2021 Dave & Buster’s Entertainment, Inc. (PLAY) posted worse-than-expected revenues of $317.98mm slightly missing the consensus estimate of $321mm or by -0.9% and in the same direction as Advan’s forecasted sales. The revenue was up 197.6% YoY - Advan’s foot traffic data captured an increase in foot traffic of +96% YoY at its restaurants and entertainment venues for Q3 2021. The restaurant chain although slightly missed sales estimates however beat EPS and presented a 6% Yo2Y increase in revenue, facts that pushed the stock to open at $34.45, up 4% from its previous day’s closing price while hit a high of $36.45 (+10.1%) during the trading session. Advan’s footfall data has a correlation of 0.99 on a YoY basis with PLAY’s top-line revenue over the last 12 quarters.

To learn more about the data behind this article and what Advan has to offer, visit https://advanresearch.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.