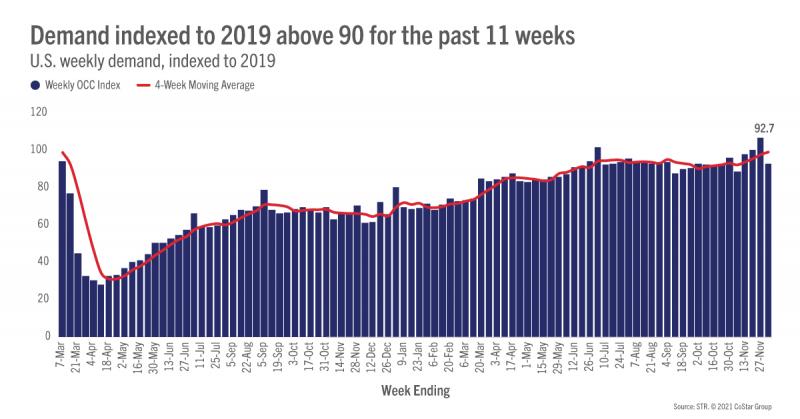

In a somewhat typical post-Thanksgiving week (28 November-4 December), U.S. hotel occupancy rose from the previous week to 54.8%. Occupancy indexed to 2019 was 91, which was good but lower than the previous three weeks. However, when compared with 2010, a year like 2021 because of calendar make up and the rebuilding after the Great Recession, occupancy was 10% higher. This week’s average daily rate (ADR) surprised on the downside, falling 0.6% week on week. But with the gain in occupancy, weekly revenue per available room (RevPAR) increased by 3% from the prior week.

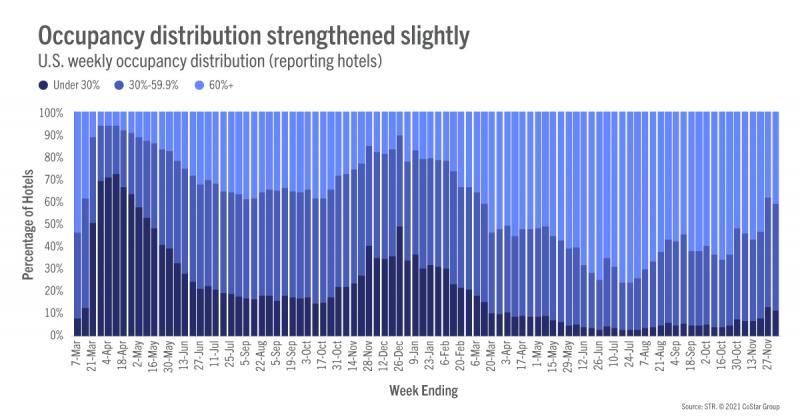

Among the 166 STR-defined markets, performance varied greatly with Miami leading the nation with 82% occupancy and Myrtle Beach at the low end with 35% occupancy. Overall, 79% of U.S. markets reported occupancy under 60% as compared with 64% in 2019 and 93% in 2010. While many market occupancies are nearing seasonal lows, 68 markets reported a higher occupancy this week than in the same week of 2019. Top 25 Market occupancy rose to 58% in the week, increasing to 63% from Tuesday through Saturday. Weekend occupancy for the Top 25 Markets was stronger at 71%, which was 94% of the level achieved in 2019.

Miami saw its highest weekly occupancy since the start of the pandemic, fueled by the return of Art Basel with many of the key events taking place from Thursday through Saturday. Weekend occupancy for the market surpassed 90%, which was a new pandemic-era high. Pandemic record highs were also seen on Tuesday, Wednesday, and Thursday. More than one third of reporting Miami hotels saw weekly occupancy above 90% with another third between 80% and 90%. Eleven hotels reported US$1,000+ ADR for the week with the market average at US$374 and the weekend topping US$422: both pandemic-era highs.

New York City had this week’s fourth highest occupancy (71%) among all markets. Excluding Sunday and Monday, occupancy was 77%, the second highest 5-day level since early 2020. Weekend occupancy soared to 86%, also the second highest of the pandemic era. There is little doubt New York is on the rebound, but the market still has a way to go. In 2019, weekly occupancy topped 90%, while in 2010 it was 82%.

After three weeks where 2021 weekly ADR was higher than in the comparable weeks of 2019, ADR dropped to just below the 2019 level. On an inflation-adjusted basis, this week’s real ADR was 7% below what was recorded in 2019. While the national average was somewhat disappointing, the Top 25 Markets saw their highest ADR since the start of the pandemic with the index to 2019 remaining above 95 as it has for the past three weeks. Week over week, Top 25 Market ADR rose 8%, driven by the strong growth seen in Miami. Excluding Miami, weekly ADR increased by 3%, better than the national average. However, without Miami, this week’s absolute ADR in the Top 25 Markets was not at a record high but higher than the previous two weeks.

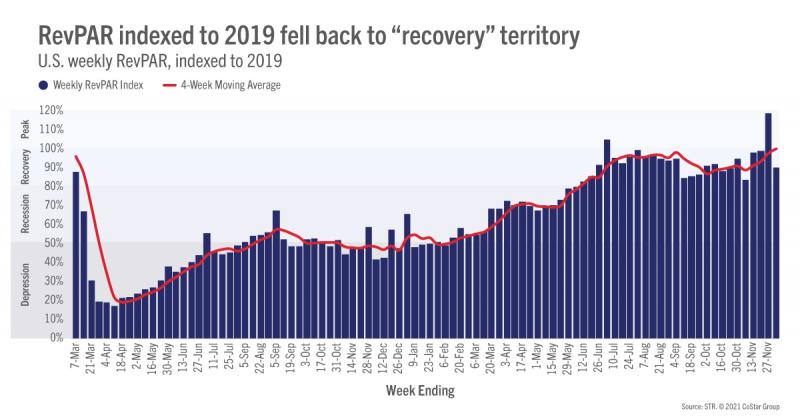

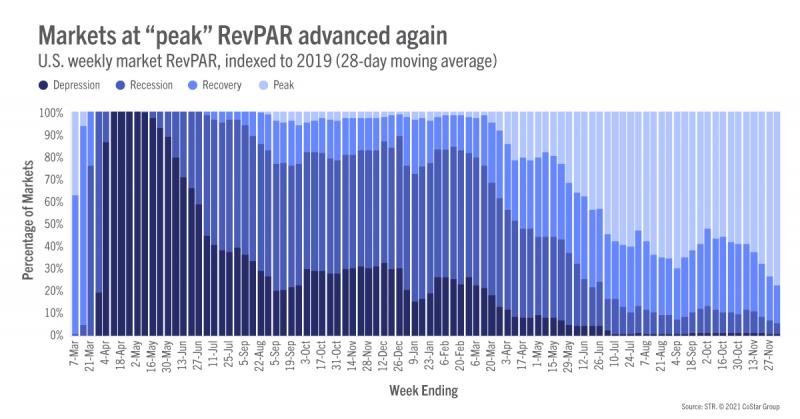

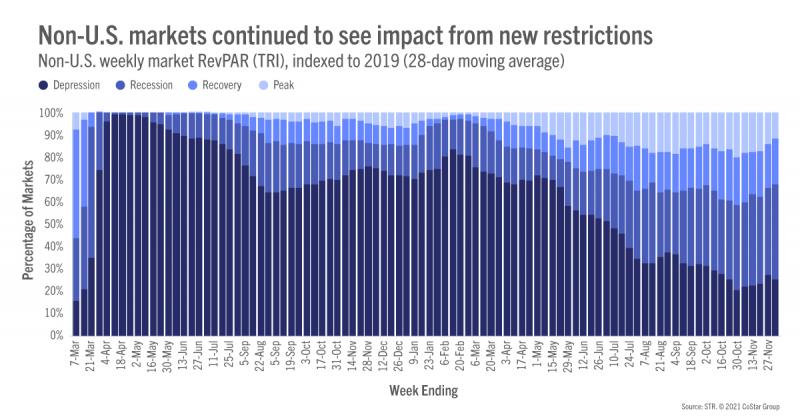

Weekly RevPAR rose after two weeks of declines. The increase was led by the Top 25 Markets, where the measure increased 12% week on week with half of the weekly increase coming from Miami. For the industry overall, this week’s RevPAR was 10% lower than what it was in 2019. In the Top 25 Markets, RevPAR was 20% lower than in the comparable week of 2019 and 24% lower when excluding Miami. Taking a longer view using the past 28 days, RevPAR indexed to 2019 increased to 101 from 99 in the previous week as a weaker week was dropped. As a result, 78% of markets were categorized as being at “peak” (RevPAR indexed to 2019 above 100), the highest percentage of the year, but we expect the percentage to decrease over the next several weeks as the Thanksgiving record-high index fades. Only nine markets (6%) were in “depression” (RevPAR indexed to 2019 under 50) or “recession” (RevPAR indexed to 2019 between 50 and 80). On an inflation-adjusted basis, 64% of markets were at “peak,” which is the most since the start of the pandemic, and 10% were in “recession” or “depression.” The remainder were in “recovery” (RevPAR indexed to 2019 between 80 and 100).

Outside of the U.S.

With tighter restrictions and increased concerns surrounding the Omicron variant, occupancy outside the U.S. fell three percentage points to 51%. The occupancy index to 2019 also decreased to 74 from 77 in the previous week. ADR showed little growth week over week (0.4%), like in the previous week, and like the previous week, the index to 2019 increased—to 102. Weekly RevPAR declined 5%, the sharpest such decrease in four weeks. RevPAR for the week was 25% lower than what was seen in 2019.

Occupancy also declined among nine of the top 10 largest countries based on supply. Indonesia was the only market to see growth in the week. As has been the case for several weeks, the U.K. had the highest occupancy of the top 10 countries (68%). Germany saw the lowest weekly occupancy of the top 10 countries (36%). Canadian occupancy was flat at 50%, while Mexico dropped to 59% from 62% a week ago.

Several key markets are seeing the impact of the new variant, including Vienna, where a new lockdown dropped occupancy to 10%. Morocco occupancy was down 43% compared with the prior week to 21% as the country has suspended all incoming flights due to the new variant. Amsterdam occupancy was 23%, which was down 70% from where it was in 2019 driven by a tightening of social restrictions. Shanghai also saw a 30% drop in occupancy week over week as three COVID cases were found, resulting in the cancellation of hundreds of flights and suspension of tour groups due to China’s strict zero-COVID policy. Some markets are on the upswing including several destinations in China (Zhengzhou, Chongqing, Chendu, Sichuan, Quindao, and Beijing). Sydney and Melbourne continue to come back to life. Despite some markets improving, the percentage of non-U.S. markets in “depression” or “recession” increased to 68% from 66% in the previous week.

Big Picture

While there were a few surprises this week, it seemed rather mundane, but that was expected after the Thanksgiving holiday—which is a good thing. The news regarding the Omicron variant appears to be more positive than it was a week ago. Based on what was seen in Miami and New York City, along with the number of markets where occupancy was higher than in the comparable week of 2019, the Omicron impact has also not been felt to any great degree. Based on history, next week should see a slight occupancy increase given it’s traditionally the last “high” (50%+) occupancy week of the year. We remain cautiously optimistic that the upcoming holiday travel season will also be robust.

To learn more about the data behind this article and what STR has to offer, visit https://str.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.