Warby Parker (NYSE: WRBY) isn’t disappointing Wall Street so far. After going public via a direct listing, WRBY surged 36% on its Sept. 29 NYSE debut to close at $54.90. Investors are now left wondering: What’s ahead for the New York City-based eyewear retailer?

The Gen Z and millennial favorite has successfully sustained its strength. But is that enough to maintain outsized growth and sales amidst improving competition from legacy retailers?

An earnings report gives investors the opportunity to assess a company’s alpha-generating potential. Some of the critical questions that earnings can answer are: Is the company growing fast enough? How profitable is it? Which are the best-performing segments? And ultimately, is the company poised for long-term success? Based on this information, an investor may decide to hold the stock long-term or to sell as soon as possible.

With Robinhood’s IPO a little more than a week behind us, plenty of headlines detail how the stock is performing. But we wanted to know: how is the retail investment app advertising, and how does it compare to other investment firms? Last month we discussed how Robinhood’s programmatic spending increased significantly in the lead-up to its IPO. It went from spending barely any on the format to becoming the top programmatic spender in its category.

After skyrocketing during the pandemic, Etsy is up just 6% so far this year. That’s despite the eCommerce stock smashing first quarter earnings estimates. But Etsy also warned of slowing revenue growth and gross merchandise sales. As global lockdowns ease and on-site activity returns, what will happen next for the handmade and vintage online marketplace? In this report, we analyze Etsy’s digital footprint as a window into 2Q21 earnings, using Similarweb’s powerful Stock Intelligence data.

Ahead of its forthcoming $35B IPO, we looked into Robinhood’s stated growth strategy to “continue adding new customers to \[their\] platform” as well as which customer cohorts are most valuable for the trading app. Customers who joined the Robinhood platform in 1Q20 or later have a far greater Cumulative Deposit Value than prior cohorts, starting with a higher initial deposit, in the range of $240-$340, vs. an appx. $200 in previous periods.

There has been lots of speculation around a potential initial public offering (IPO) from Klarna, which according to TechCrunch is the highest valued private fintech in Europe. The Swedish buy now pay later (BNPL) company is live in over 20 countries, and in May 2021 reported 90 million global active users, and 2 million transactions a day. So will Klarna IPO? We don’t know. But what we can tell you is that based on our web traffic alternative data the company’s online performance is looking robust.

ESG assets are set to reach over $50 trillion by 2025. According to Bloomberg, that’s a third of total global assets under management. Alternative data offers a powerful view into this fast-growing space. Here we’ll delve into ESG investing, what it is, how it’s scored, and why it matters now. ESG stands for environmental, social, and governance. You can use this framework to assess how one company performs in these three areas vs. its competitors.

Last week Robinhood agreed to pay $70 million to financial regulators. And without skipping a beat, the popular financial service app filed its initial public offering. Even though this was the largest fine FINRA has ever levied, Robinhood seems to be doing just fine. As the popular financial services and investments app prepares for its public debut, it’s gearing up by spending more on programmatic advertising. And it’s not alone. The entire investment category is spending more.

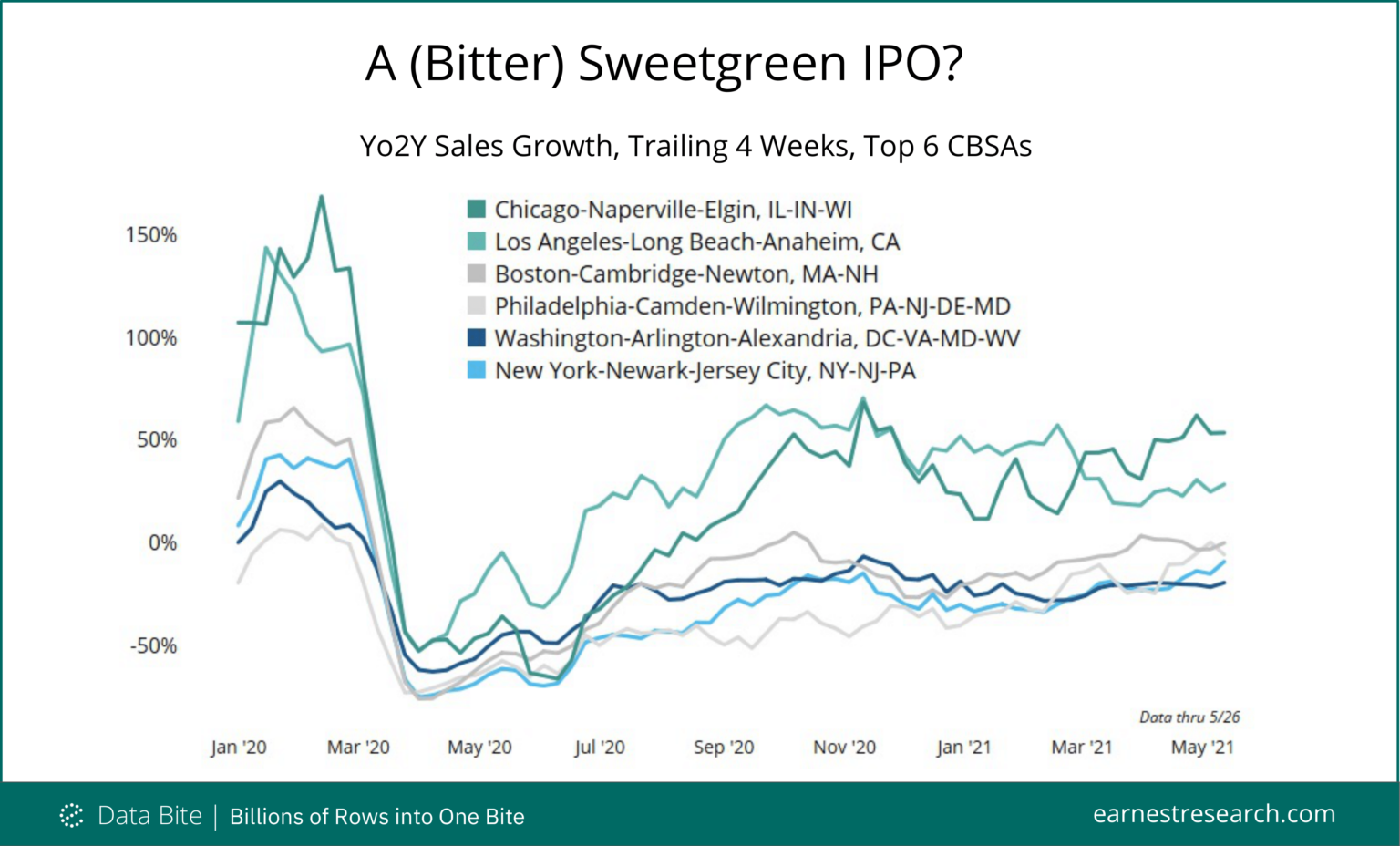

With reports that Sweetgreen is preparing to go public we looked at how the upscale salad chain has performed in its core urban markets. Regardless of pre-pandemic growth, all regions saw drops of 50% or more as offices closed and office lunches plummeted at the outbreak of COVID. Since then, Sweetgreen’s HQ market of Los Angeles rebounded the fastest, reaching >50% Yo2Y trailing 4 weeks in September last year, before tailing off to around 30% in recent weeks.

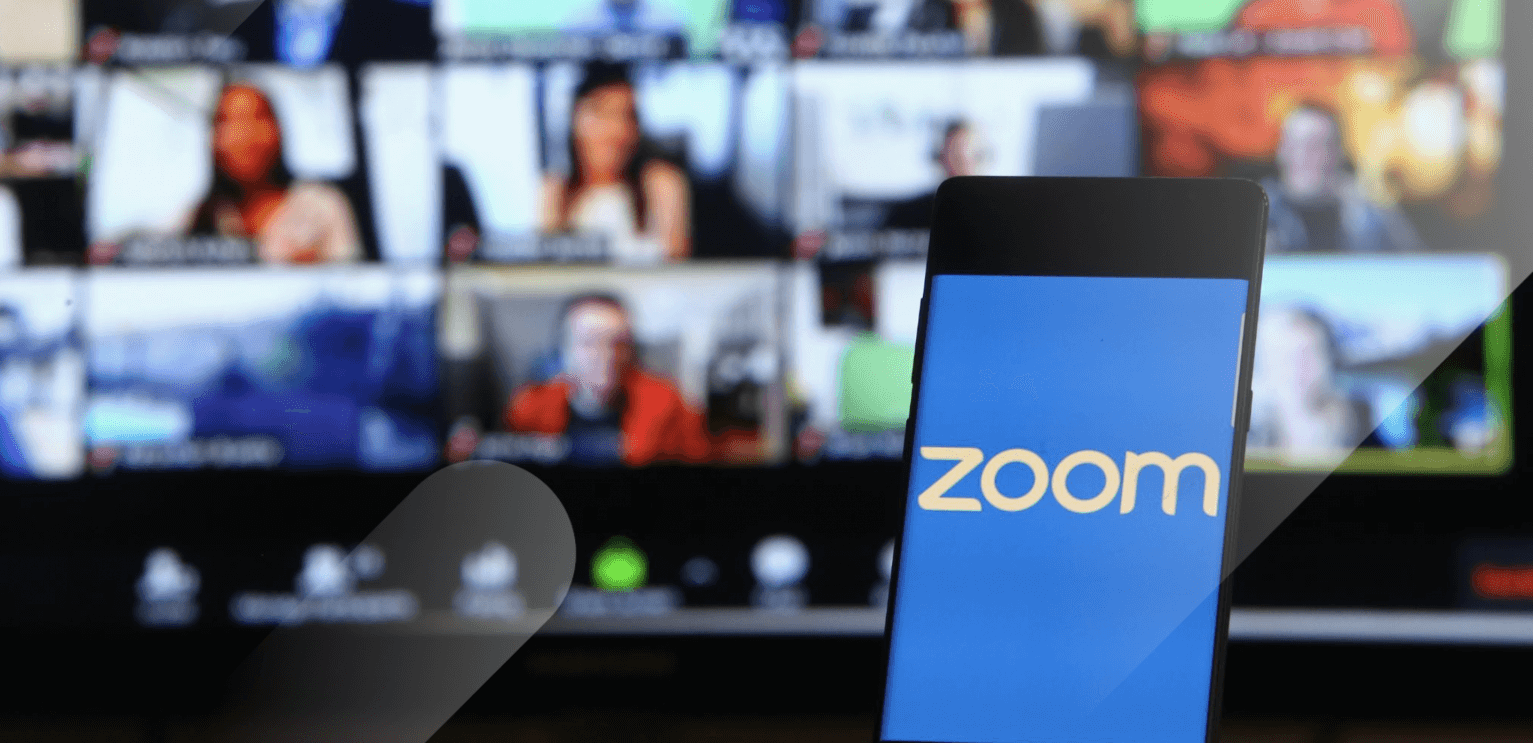

Zoom Video Communications (ZM) is on the cusp of its fiscal first quarter earnings report on June 1. As expected, Zoom’s momentum is fading as lockdowns ease and on-site activity returns. Shares are significantly underperforming year-to-date, even when compared to the overall weaker performance across the tech space.While many organizations are moving to adopt a more permanent flexible work environment, the risk-reward ratio for Zoom has now undeniably shifted.

The competitive landscape of the food delivery market in Asia has changed a lot in 2021. Previously our reports showed how major food delivery companies in Asia were performing during covid (Read The Roller Coaster Goes On: Food-Delivery Companies in Asia). After a year of pandemic, the battle goes on, and is heating up in one of the most densely populated markets – Hong Kong.

Etsy has been on a strong run. And expectations remain high for the eCommerce site known for selling handmade and vintage items. A strong 4Q20, greater-than-anticipated holiday sales, and a new personalized search feature all add to the bullish picture for the company. But, as vaccinations around the globe are rolled out and lockdowns ease, will the momentum continue?

It seems like everywhere you turn there’s another company touting plans to focus on crypto. And after years of downplaying the technology, JP Morgan is the latest to join the crypto craze with the recent announcement that they are hiring for blockchain. Is this really a significant hiring trend or merely a small one laced with PR opportunities?By looking at all of the positions with the “blockchain” keyword, we’re able to identify companies with the greatest count of these positions:

Retail trading has been booming during the pandemic, sending trading volumes to record highs as everyday investors joined in on the historic rally in equities. Momentum has been growing for several years, as the barriers to entry have fallen. App-based brokerages such as Robinhood and Webull have grown in popularity and made investing more accessible through commission-free trades and user-friendly interfaces. Transaction data reveals how trading deposits have grown in the COVID-19 era, as well as how app-based brokerages have performed compared to more established industry competitors.

Last week, Coinbase (COIN) IPO’d. This highly anticipated event exceeded expectations, as Coinbase’s valuation reached over $80 billion after its first day of public trading. It also marked a turning point for cryptocurrency, which is now well on its way to wide acceptance. In its first week as a public company, Coinbase’s four main apps were downloaded about 2.7M times total, 2.3M of which were for its Coinbase - Buy & Sell Bitcoin app. All of its apps, except Coinbase Card, broke their lifetime records for single-day downloads and daily active users (DAU).

Here we dive into the digital health of three major tech stocks: Facebook (FB), Twitter (TWTR), and Microsoft (MSFT). What do the online trends reveal about these mega-caps? Using our powerful alternative data, we reveal the key digital insights heading into the print. Let’s take a closer look at these internet giants now.

On March 26, the co-working space company announced a definitive merger agreement with a special purpose acquisition company (SPAC), BowX Acquisition Corp. (NASDAQ: BOWX). Once the merger completes, WeWork will be a publicly listed company, and a must-follow for stock intelligence enthusiasts. It will also receive $1.3 billion of cash, “to fund its growth plans into the future.”

Cryptocurrencies had a monumental year. In December, Bitcoin (BTC) shot past $20 thousand, and at the time of writing, BTC is trading just below the $60 thousand level. This rapid ascent may bring déjà vu of 2017 when BTC climbed from $975 to $20,089. An analysis of the digital growth of U.K. cryptocurrency sites, along with worldwide events, indicates that financial services companies should keep a close eye on crypto this time. We’ll show you some tools to help.

Expectations for Chewy are high heading into the print on March 30. The eCommerce pure play beat consensus revenue estimates for the past six consecutive quarters. And in its last earnings report, the company issued strong guidance for the current quarter (November–January 2021). However, shares have pulled back recently on valuation concerns. Chewy is down 13% year-to-date following a massive build-up in 2020. Given the recent weakness in its stock over the past month, the key question now is: Will CHWY be able to beat revenue consensus estimates again and propel its stock price higher?

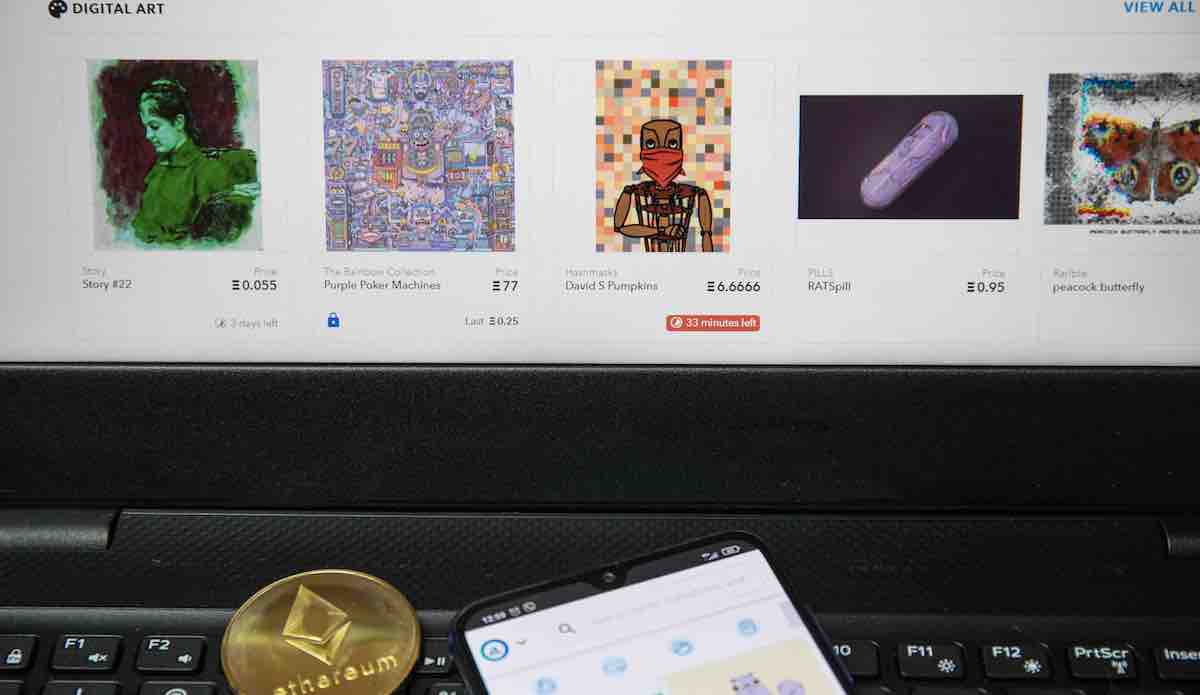

Everyone’s talking about non-fungible tokens, or NFTs. Whether this craze is a flash in the pan or a major shift for the blockchain economy, one thing is certain: NFTs, and NFT enthusiasts, are going mobile. Investment, trading, and crypto apps received a lot of attention over the past few months as crypto prices soared and investors like Roaring Kitty made trading more interesting. In fact, Robinhood, TD Ameritrade, Webull and more broke their lifetime records for engagement during the Game Stop saga.