ATTOM’s just released Q1 2023 U.S. Single Family Rental Market Report, which ranks the best U.S. counties for buying single-family rental properties in 2023, found that the average annual gross rental yield on three-bedroom properties (annualized gross rent income divided by purchase price) is projected to be 7.5 percent in 2023.

According to ATTOM’s latest single family rental market analysis, that figure is up from an average of 6.7 percent in 2022 in those same markets and marks the first time since at least 2019 that the figure rose across the country. Also, according to the report, the single-family rental yield is increasing from 2022 to 2023 in 91 percent of those counties, after declining from 2021 to 2022 in 72 percent of them.

The report notes that with rental yields on the rise, rents are increasing faster than home prices across most of the country. Also, from 2022 to 2023, three-bedroom rents rose more than single-family home prices in 91 percent of the markets analyzed. According to the report, rents commonly have risen by around 5 percent to 20 percent over the past year, while changes in home values have typically ranged from a 5 percent loss to a 5 percent gain.

ATTOM’s 2023 SFR report found that counties with the highest potential annual gross rental yields for 2023 are Indian River County, FL, in the Sebastian-Vero Beach metro area (15 percent); Collier County, FL, in the Naples metro area (14.7 percent); Wayne County, MI, in the Detroit metro area (13 percent); Mercer County, NJ, in the Trenton metro area (12.7 percent) and Charlotte County, FL, in the Punta Gorda metro area (12 percent).

ATTOM’s latest report also identified 17 “SFR Growth” counties where wages grew over the past year and potential 2023 annual gross rental yields exceed 10 percent. The report showed those 17 SFR Growth markets included Cook County (Chicago), IL; Wayne County (Detroit), MI; Cuyahoga County (Cleveland), OH; Shelby County (Memphis), TN, and New Haven County, CT.

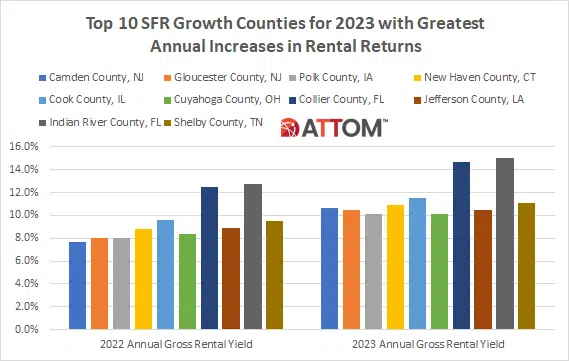

In this post, we dig deep into the data behind ATTOM’s Q1 2023 SFR market report to reveal the top 10 “SFR Growth” counties with the greatest annual increases in gross rental yields. Those counties include: Camden County, NJ (38.0 percent change in annual gross rental yield); Gloucester County, NJ (30.9 percent); Polk County, IA (26.3 percent); New Haven County, CT (23.3 percent); Cook County, IL (20.6 percent); Cuyahoga County, OH (20.1 percent); Collier County, FL (18.1 percent); Jefferson County, LA (17.6 percent); Indian River County, FL (17.3 percent); and Shelby County, TN (17.1 percent).

ATTOM’s Q1 2023 Single-Family Rental report analyzed single-family rental returns in 212 U.S. counties with a population of at least 100,000 and sufficient rental and home price data. The analysis for this report incorporated median rents on 3-bedroom properties and median single-family home prices collected from ATTOM’s nationwide property database, as well as publicly recorded sales deed data licensed by ATTOM.

To learn more about the data behind this article and what Attom Data Solutions has to offer, visit https://www.attomdata.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.