With Robinhood’s IPO a little more than a week behind us, plenty of headlines detail how the stock is performing.

But we wanted to know: how is the retail investment app advertising, and how does it compare to other investment firms?

Robinhood vs Investment Firms

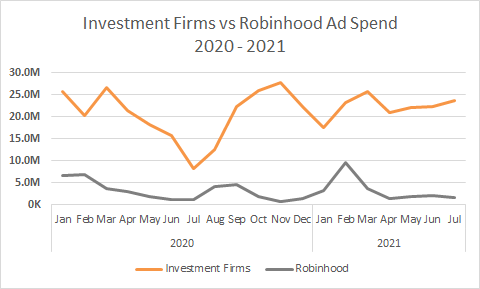

Last month we discussed how Robinhood’s programmatic spending increased significantly in the lead-up to its IPO. It went from spending barely any on the format to becoming the top programmatic spender in its category.

Now that the company is officially a public company, we wanted to follow up on its overall advertising behavior.

For context, the company’s first week of public trading has been volatile. The company that propelled meme stock frenzies over the past year has ironically, and not surprisingly, become a meme stock itself.

As of Friday, the financial app was worth $46 billion at the close of trading, according to the New York Times. This is up 60% from its lackluster debut the week before. Though its valuation is up, its legal battles might be a hurdle for sustained growth.

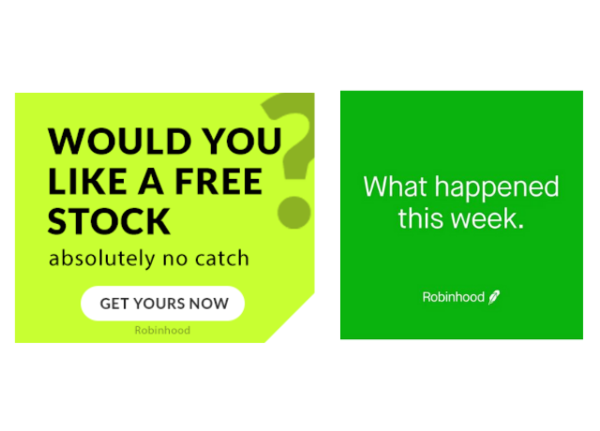

As its share prices smoothe out, the investment app’s ad creative and spending will adjust accordingly. But for now, it seems that Robinhood is investing in its social referral program for its primary growth strategy.

According to AdAge, paid advertising is making up a smaller amount of the company’s marketing budget. Instead, Robinhood spent 57% of its first-quarter marketing spending on referral rewards (Robinhood Referral Program), up 14% from the year prior.

When you look at how the company compares to other firms, Robinhood makes up 15% of all spend from investment firms.

Between January and July 2021, there have been 495 investment firms spending $146.8mm across TV, digital, and print formats. This is up 11% from 2020, when 428 investment firms spent $132.5mm.

Early in 2020 Robinhood focused on direct response ads, but after the Gamestop fiasco, the company changed its ads to be more education-based, furthering its position as the advocate for retail investors.

When it comes to other investment firms, top investment firm advertisers in 2021 include:

Their ad spend in 2021 accounts for 64% of all investment firm ad spend.

When Robinhood is added to top advertisers, six investment firms account for 79% ($108.8mm) of all investment firm advertising spend.

To learn more about the data behind this article and what MediaRadar has to offer, visit https://mediaradar.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.