ESG assets are set to reach over $50 trillion by 2025. According to Bloomberg, that’s a third of total global assets under management. Alternative data offers a powerful view into this fast-growing space. Here we’ll delve into ESG investing, what it is, how it’s scored, and why it matters now.

ESG investing: What’s the story?

ESG stands for environmental, social, and governance. You can use this framework to assess how one company performs in these three areas vs. its competitors. For instance, does the company make a positive impact on the customers and communities it serves? How does the company deal with social unrest, climate change, and racial inequality?

Within the corporate environment, institutions are prioritizing their emphasis on ESG, moving beyond traditional corporate responsibility. Large financial institutions increasingly see ESG and corporate social responsibility (CSR) as a key part of their risk-management strategy.

What’s more, as KPMG points out:

“Awareness is also growing that responsible banking approaches and skillful management of ESG can improve risk-adjusted returns, enhance reputation, spark commercial opportunities, mitigate portfolio risks, and improve market positions and value.”

Why ESG investing is so hot right now

Global ESG assets are on track to exceed $53 trillion by 2025, calculates Bloomberg, representing more than a third of the $140.5 trillion in projected total assets under management. It predicts that ESG assets will hit $37.8 trillion by year-end.

Did you know that the data suggests that ESG investments perform as well, if not better than traditional investments?

Now for the evidence: The S&P Global Market Intelligence analyzed 26 ESG exchange-traded funds and mutual funds with more than $250 million in assets under management. It found that from March 5, 2020, the month that the World Health Organization officially declared COVID-19 a pandemic, to March 5, 2021, 19 of those funds performed better than the S&P 500.

Those outperformers rose between 27.3% and 55% over that period. In comparison, the S&P 500 increased just 27.1%.

An ethical investment portfolio can actually protect you from risk, while allowing you to make a positive impact.

How ESG investing came to be

Back in 2004, UN Secretary-General Kofi Annan issued an ESG proposal submitted to the CEOs of the world’s leading financial institutions.

Annan invited the CEOs to join an initiative, later known as Principles for Responsible Investment, that would tighten the relationship between investors and environmental, social, and corporate governance issues. Participants had to submit annual activity reports on their responsible investments.

More than 2000 money managers accepted the invitation, including Morgan Stanley, BlackRock, and J.P. Morgan. But the concept of focusing on ESG stocks had yet to reach mainstream investors.

Here’s when ESG popularity really picked up

It would take another 16 years before the concept of ESG investing would advance.

In 2020, billionaire and BlackRock CEO Larry Fink sent an unusual letter to CEOs. He suggested that “climate change has become a defining factor in companies’ long-term prospects.”

Fink went on to discuss research studies from the UN, the BlackRock Investment Institute, and McKinsey on the socioeconomic implications of climate risk, suggesting sufficient data to deepen our understanding of how climate change impacts the physical world and the global system finances economic growth.

The bottom line was that climate risk equals investment risk. Fink expressed that it was BlackRock’s fiduciary responsibility to help their clients navigate this new reality. As a result, BlackRock announced several initiatives are emphasizing sustainability, such as exiting thermal coal production companies and fossil fuels investments.

The pandemic spikes interest in ESG investing

The pandemic highlighted social and global inequality. It also pushed millions into poverty. The World Bank calculates that COVID-19 sent around 97 million people into poverty in 2020 and the negative impact continues to weigh.

Fink writes, “I believe that the pandemic has presented such an existential crisis – such a stark reminder of our fragility – that it has driven us to confront the global threat of climate change more forcefully and to consider how, like the pandemic, it will alter our lives. It has reminded us how the biggest crises, whether medical or environmental, demand a global and ambitious response.”

At the same time, the creation of sustainable index investments has enabled a massive acceleration of capital towards companies better prepared to address ESG factors.

Indeed, from January through November 2020, investors in mutual funds and ETFs invested $288 billion globally in sustainable assets, a 96% increase over the whole of 2019.

ESG and performance: What the data shows

Initially, ESG investments had a reputation for generating limited returns. But, today, the data actually suggests that there is an intrinsic relationship between a company’s ESG performance and long-term financial health. For instance, an oil spill or emissions scandal can quickly rock a company’s stock prices, resulting in billions of dollars in losses.

This Harvard Law School post clearly sets out the cycle of profitability and sustainability:

“While… more profitable firms have the resources to invest in areas that positively influence ESG, it could also be that profitability rises as a result of a company better managing its material ESG risks, or it could be a little bit of both.

If it is a little bit of both, then this means that good-ESG initiatives drive up financial performance, which then provides the monetary resources to invest to be an even better-ESG firm, which then drives up performance again, and so on.”

Indeed, a 2021 Morgan Stanley white paper on sustainable investing and ESG states that ESG investing demonstrated less risk, regardless of the asset class. During turbulent market years like 2008, 2009, 2015, and 2018, traditional funds showed higher potential for loss, while sustainable funds posted strong performance.

Millennials boost the movement

According to Bank of America, ESG investing could rise by $15 trillion to $20 trillion over the next decade because of changing demographics. As millennials, GenZers, and the generations to follow step into investor shoes, they are increasingly likely to select their portfolios based on companies that measure up to ESG metrics.

“Many of the Millennials we work with today want to know that what they’re investing in is having a positive impact. It’s not just about achieving returns, but also incorporating their core values into the process,” says Gregory Yong, a relationship manager at RBC Wealth Management in Singapore.

Millenials are looking to invest in social and environmental issues, whether it’s “electric cars, promoting clean water or giving back to communities,” they are putting “at least some of their money into places where they feel it can make a difference.”

ESG metrics: How are companies ranked?

ESG investments are guided by criteria that measure a company’s performance in three areas: environmental, social, and governance. So rather than focusing on the balance sheet, you’re looking at the company’s impact on the world. How does the company perform as a steward of the environment? How does it treat its customers, suppliers, employees, and the communities where it operates?

When researching the top ESG stocks, before you make any investment decisions, you will want to know the metrics and how they are measured.

As mentioned earlier, ESG stands for environmental, social, and governance. Within these categories, there are a broad range of metrics that investors can use to score a company’s performance.

Environmental criteria include:

Social criteria looks at the company’s social impact, including:

Governance looks more specifically at the company’s business model and includes:

How are ESG issues measured?

While there are three broad ESG categories many metrics are used to assess performance. Rankings can be different depending on the resources you use.

Investor’s Business Daily, for example, selected the best ESG companies by industry. They looked for those with AAA or AA ESG ratings and then narrowed the selection further by looking for those with the highest IBD Composite Rating. Financial performance was also considered. Ultimately, they came up with a list of 50 top-performing ESG stocks, divided by industrial vertical.

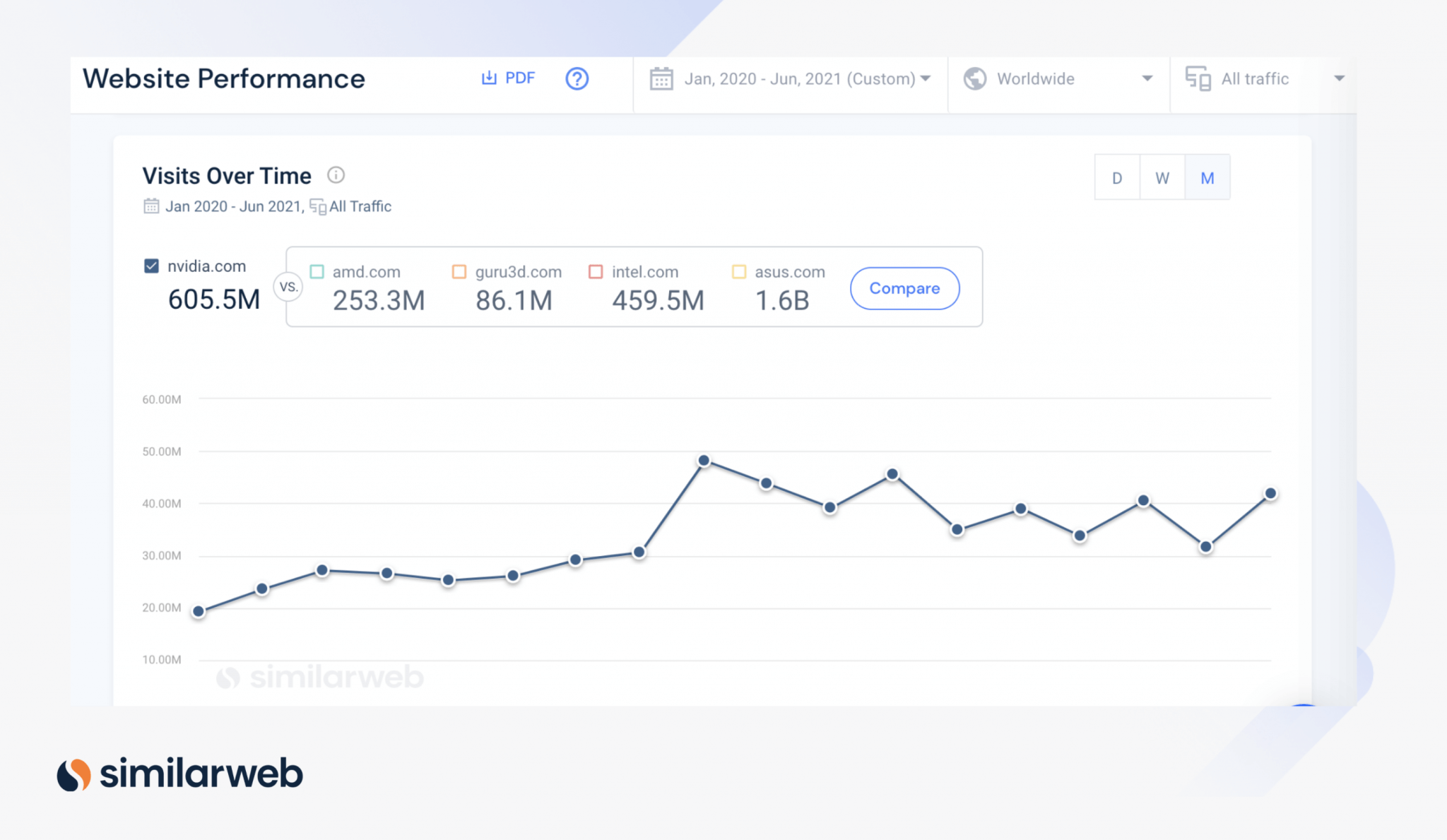

Ranked among the top 10 ESG stocks across all verticals were stocks like Nvidia (NVDA), Salesforce (CRM), iRobot (IRBT), and Lam Research (LRCX).

Is ESG skewed by self-reporting?

Information regarding ESG performance is primarily self-reported. Larger companies may have more available resources for ESG reporting, which could skew results. Still, reports are available for small-cap companies, international corporations, and also those in developing markets. In addition, analysts review annual reports, employee and financial management data, corporate sustainability measures, and other published data.

Resources like the Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB), Task Force on Climate-Related Financial Disclosures (TCFD), CDP Worldwide, and EcoVadis, measure the company’s ESG performance. Collectively, they are working to formulate consistent standards to help investors make informed decisions.

Ethisphere produces an annual list of the most ethical companies. The Dow Jones Sustainability Indices (DJSI) looks at ESG metrics for more than 4,0000 global corporations.

It’s anticipated that in 2021, ESG investors will have access to better tools to evaluate companies, such as standardized disclosures and regulatory requirements.

It’s a rare company that measures high on all ESG criteria. So as an investor, you need to decide which ones are the most important to you.

Pinpointing top ESG stocks

So, how do you find the strongest ESG stocks for your investment strategy?

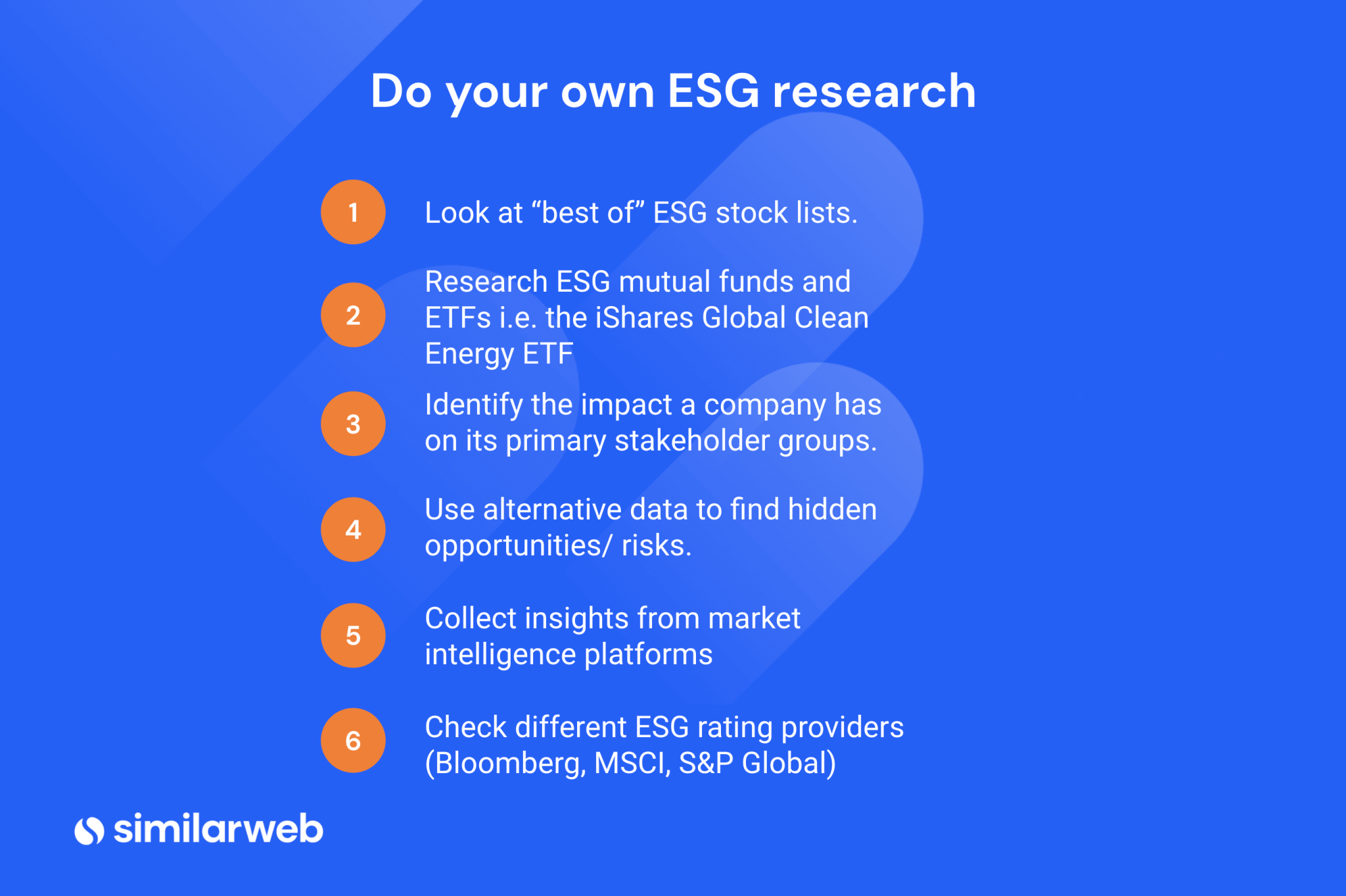

You can start by looking at lists of ESG stocks. Alternative data from Stock Intelligence plays a critical role in the ESG investor’s toolkit.

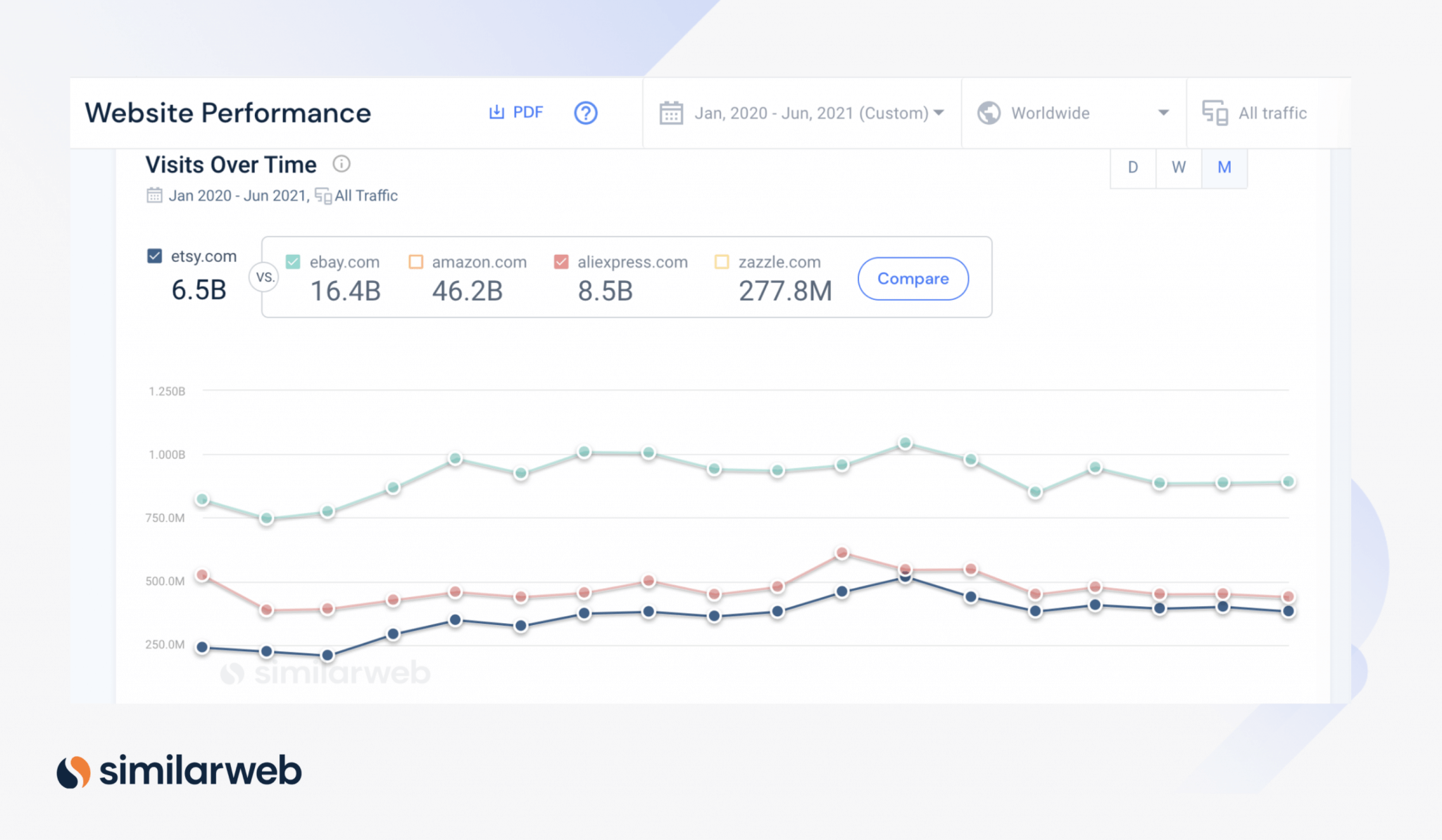

For example, national language processing, artificial intelligence, big data, and other technologies help investors identify hidden opportunities and risks that might not be apparent on ESG disclosures. Digging into page visits, conversion rates, and other engagement metrics, you can break down a company’s digital performance (and compare it to their competitors).

For instance, this chart shows how the gap between etsy.com and aliexpress.com global web visits has narrowed over time. We can also see that Etsy’s web traffic is notably higher than it was pre-pandemic. Now investors will need to watch Etsy’s trends closely in the coming months to ensure that robust growth continues even in a post-COVID world.

You can also research ESG funds. For instance, most of Vanguard’s ETF funds follow an exclusionary strategy that omits companies that don’t meet certain ESG criteria. The Vanguard ESG U.S. Stock ETF (ESGV), for example, seeks to track the performance of the FTSE US All Cap Choice Index but excludes stocks from industries such as: adult entertainment, alcohol, tobacco, weapons, fossil fuels, gambling, and nuclear power.

Here’s a 6 step checklist summarizing how you can do your own ESG research:

Pro tip: Pay attention to expense ratios. They might be higher than other funds, but investigate the potential long-term performance. To align your investments with your values might be worth a higher expense in the short term.

And for less exposure, there are ESG ETFs

ESG ETFs provide a simple way to add a diversified portfolio of stocks and bonds in companies with proven ESG results. These mutual funds are built according to ESG criteria, in addition to stock performance. The Financial Times reports that 2021 investment in ESG bond funds has already reached $54 billion. A total of $51.1 billion in new money was invested in ESG ETFs in 2020.

A recent Forbes article lists iShares MSCI USA ESG Select Fund among the leading ESG EFTs. The Fund’s top holdings are Microsoft, Apple, Alphabet, The Home Depot, and Facebook. When researching these funds you can look at the digital data for the funds top holdings to dig into its health in near real time.

You’ll want to pay attention to whether the ESG ETF is focused solely on a single issue, such as climate change, or is more inclusive. The iShares Global Clean Energy EFT, for example, concentrates on global production, equipment and technology companies involved solely in the clean energy industry.

Beyond ESG

Socially responsible investing, or SRI and impact investing are two other ways y to create a more ethical portfolio. Socially responsible investing is broader than ESG investing and can often include ESG criteria. In fact, SRI gave birth to ESG. However, the terms are often interchanged and they can be confusing.

SRI investors filter out companies they see as responsible for global harm, such as tobacco, alcohol, or fossil-fuel companies. They use value judgments and negative screening when selecting their investments. For example, if sustainable farming is valuable to you, an SRI strategy would avoid all pesticide, herbicide, and other chemical manufacturing companies.

Making it to the list of top ten socially responsible stocks according to Statista are Nvidia, Microsoft, Cisco Systems Inc, Qualcomm, General Mills, Whirlpool, Illumina, and Citigroup. Five categories are measured: employee engagement and development, financial strength, customer satisfaction, innovation, and social responsibility.

ESG investing may also exclude these companies, but it doesn’t focus on the negatives like SRI.

Instead, ESG investors weigh other value assets and look for progress on environment, society, or governance issues. You might also hear the term impact investing, which usually refers to private markets strategies that intentionally seek to promote measurable solutions to global challenges like the United Nations Sustainable Development Goals (SDGs).

Also check out impact investing

Impact investing focuses on specific projects that a company has undertaken to improve the world. It’s another way to achieve your ESG goals. If you purchase a sufficient number of shares, you’ll be able to influence the outcome of shareholder meetings and potentially force change on the corporate leadership. Shareholder activism could be a powerful way to achieve your ESG goals without disinvesting from companies that run counter to your ethics.

Key takeaways

To learn more about the data behind this article and what Similarweb has to offer, visit https://www.similarweb.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.