Casual dining took a major hit during COVID as diners avoided enclosed spaces and states introduced capacity restrictions to curb the spread of the virus. Now, foot traffic analysis of twenty-eight leading casual dining chains shows that the sector is returning to pre-COVID levels.

Casual Dining Almost Recovered

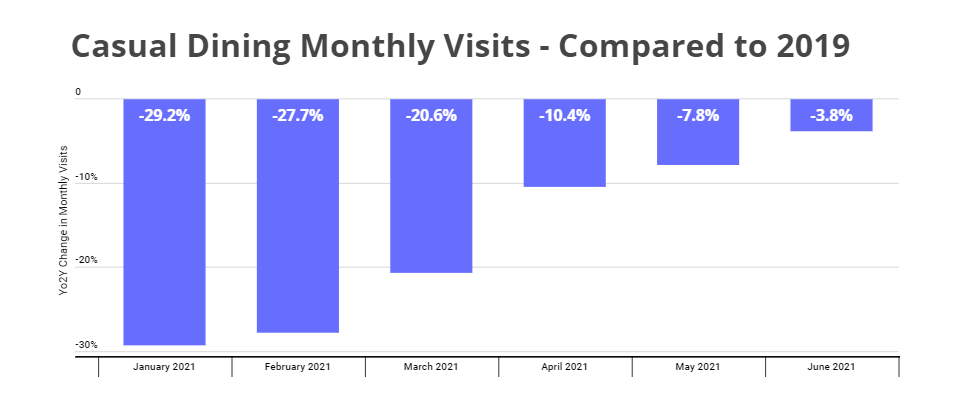

Restaurants were still struggling in Q1 as cold weather made outdoor seating impractical while COVID regulations and customer precautions limited indoor seating options. But since April, with the weather warming up, vaccination rates increasing, and restrictions lifting, the pace of recovery has been picking up. Monthly visits in April, May, and June were down -10.4%, -7.8%, and -3.8%, respectively, compared to the equivalent months in 2019. If current growth continues, casual dining visits could rebound fully before the end of the summer.

Higher-End Establishments Thriving

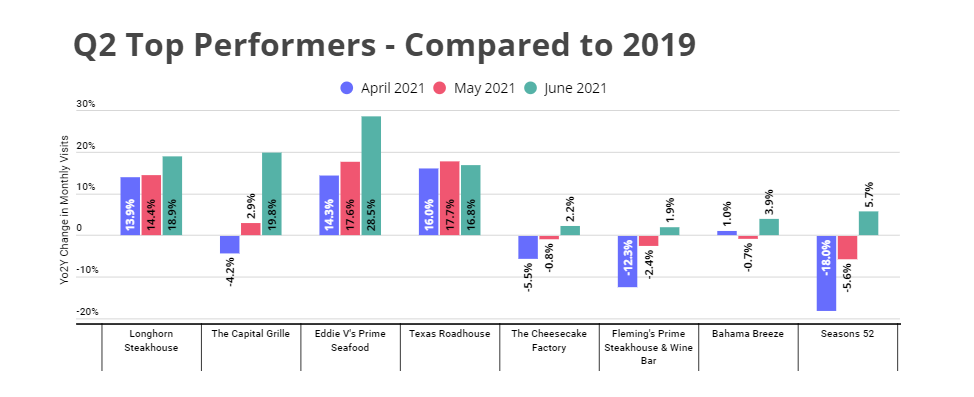

While overall visits to casual dining establishments were still down in June, some brands were doing particularly well and had already reached or surpassed 2019 visit levels. Darden Restaurants’ chains are doing particularly well, with June visits to Longhorn Steakhouse, the Capital Grille, Eddie V’s Prime Seafood, Bahama Breeze, and Seasons 52 up 18.9%, 19.8, 28.5%, 3.9%, and 5.7%, respectively. Texas Roadhouse also had a strong June, with Yo2Y visits up by 16.8%.

Foot traffic data also indicates that recoveries in this sector can happen quickly and suddenly. Some chains, such as Fleming’s Prime Steakhouse & Wine Bar and Seasons 42, had a strong June despite seeing a double-digit visit gap just two months before. This means that casual dining chains still seeing declines could find rebounds, especially those well aligned for the summer and Back to School seasons.

Slower Recovery for Diners and Traditional Neighborhood Restaurants

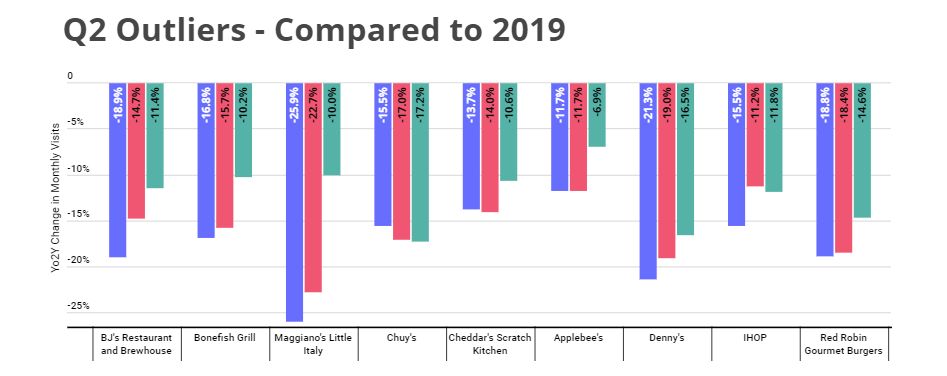

Some chains – most notably diners and casual neighborhood eateries – have struggled more to lure customers back. Many of these restaurants are clearly on the road to recovery, with the visit gap narrowing month after month. But some chains – notably Chuy’s and IHOP – performed worse in June than in May when compared to those same months in 2019, indicating that they may need to readjust their recovery approach.

Perhaps the success of the higher-end concepts coupled with the slower recovery of diners and fast casual chains means that customers are currently gravitating towards pricier, more festive restaurants to celebrate the return to normalcy. Over the next couple of months, lower-end chains may well catch up as the novelty of dining out fades and customers return to their pre-pandemic haunts.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.