For the past few years, some superstore retailers have hosted their own sales events to coincide with Amazon Prime Day. In 2021, these companies included Walmart, Target, Best Buy, and Bed Bath & Beyond. Consumer transaction data reveals that despite competing sales events during Prime Day 2021, Amazon sales increased and the company experienced higher week-over-week sales growth than a select set of retailers. Additionally, Amazon captured market share from top retail competitors, especially Walmart and Target.

Amazon increased its share of sales among retail competitors during Prime Week

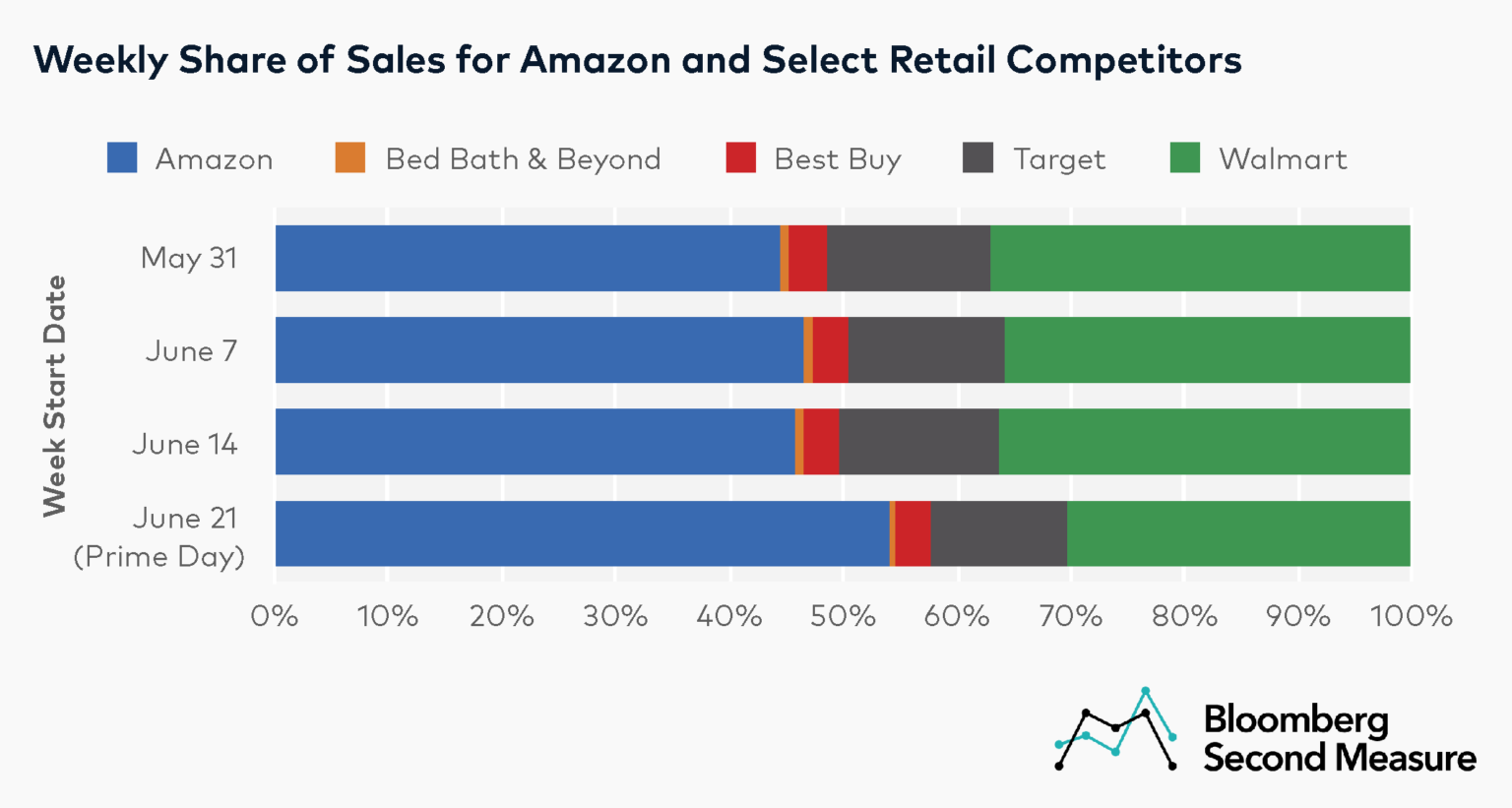

Among a select group of retailers that hosted competing sales events, Amazon increased its share of sales during the week of Prime Day 2021. For the three weeks leading up to Prime Day, Amazon’s share of sales remained fairly consistent—44 percent the first week in June, 46 percent the second week, and 46 percent the third week. However, the week of June 21 (which coincided with Prime Day 2021), Amazon’s share of sales jumped to 54 percent.

By contrast, Target’s share of sales during Prime Week decreased 2 percentage points compared to the week before, while Walmart’s share of sales decreased 6 percentage points in the same time frame. The share of sales for other superstores–Bed Bath & Beyond and Best Buy–remained fairly stable.

Most of Amazon’s market share gains during Prime Week came from consumers who shopped at Target and Walmart

The week of June 21, 2021, overall sales for the competitive set in our analysis grew 8 percent compared to the week before. Amazon’s sales growth during Prime Week overperformed the competitive set and the company’s relative share growth–or growth rate of market share–was 18 percent.

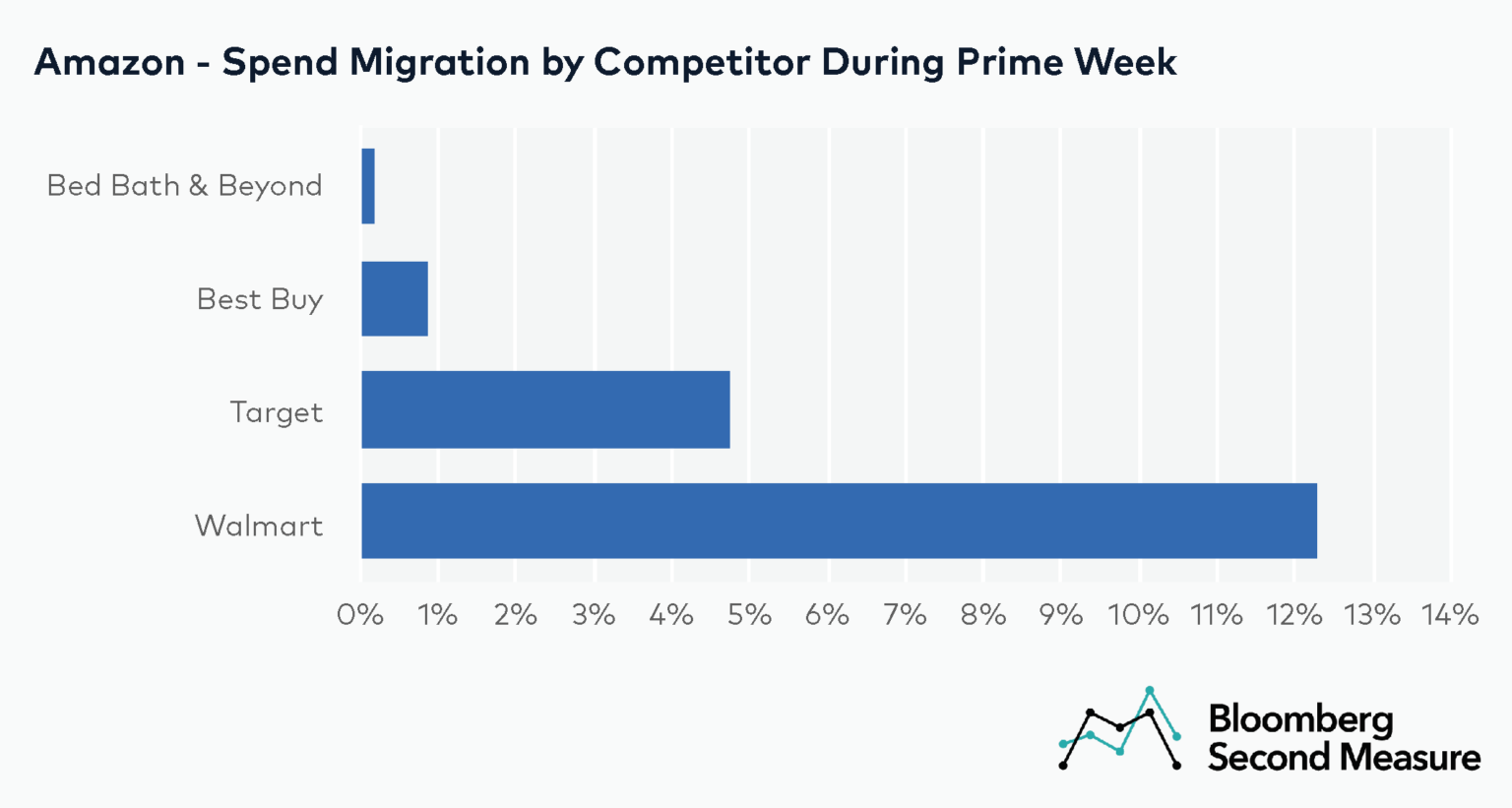

A closer look at spend migration data found that Amazon captured spend from all competitors within the select set during Prime Week, with the most growth coming from Walmart and Target. These two companies were responsible for 12 percentage points and 5 percentage points of market share growth, respectively. More modest gains under one percentage point each came from Best Buy and Bed Bath & Beyond.

Amazon saw strong week-over-week growth during Prime Week, while most retail competitors’ sales declined

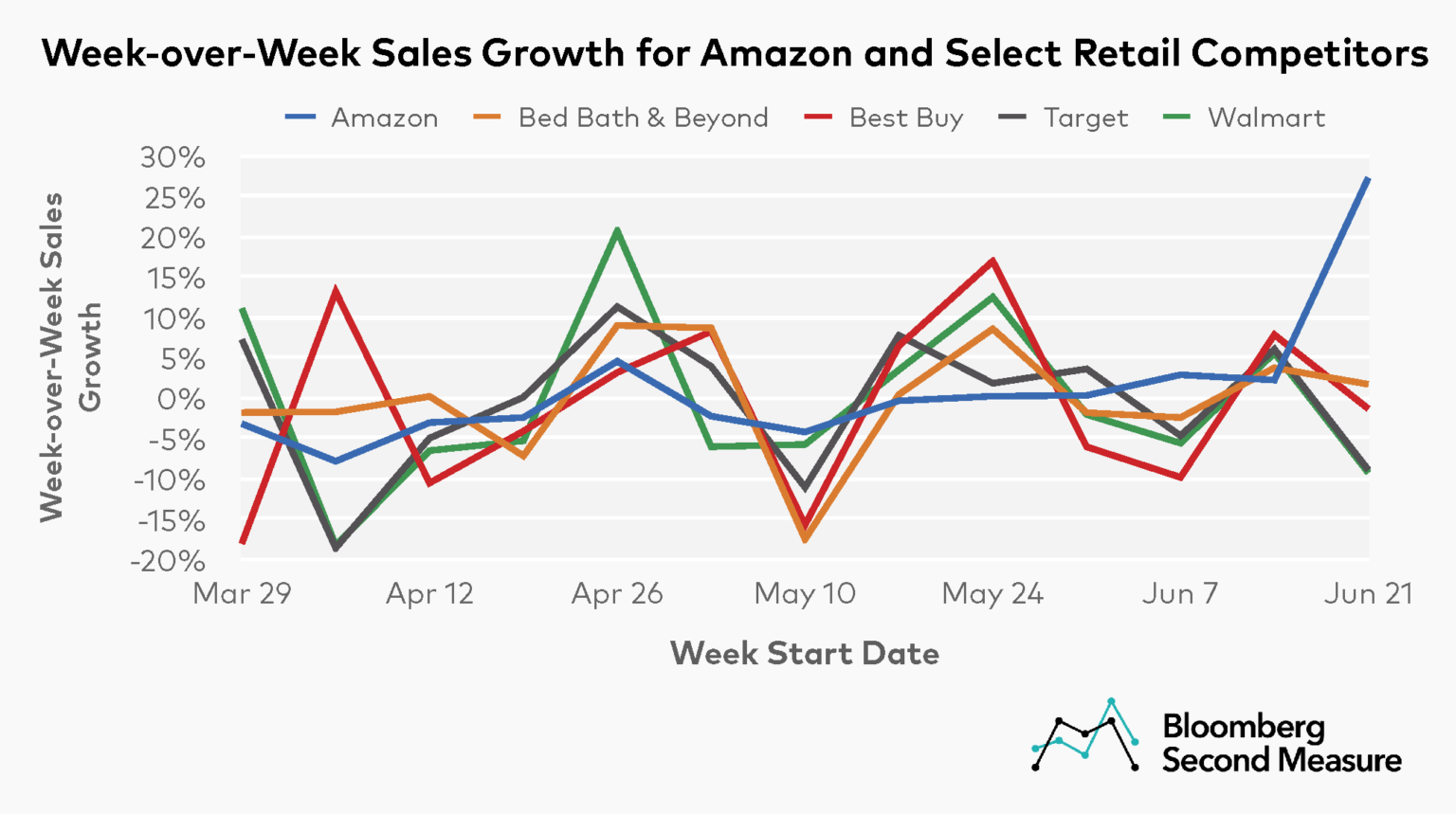

Although superstores experienced a strong increase in week-over-week sales during Prime Day 2020, the same phenomenon was not present for Amazon Prime Day 2021. With the exception of Bed Bath & Beyond, which increased its sales 2 percent week-over-week, the other companies in the competitive set saw declining week-over-week sales during Prime Week in 2021. Sales at Best Buy declined 1 percent, while sales at Target and Walmart each declined 9 percent. However, this phenomenon may not necessarily be attributed to Prime Day, since week-over-week sales growth for these companies fluctuated similarly in previous weeks.

The week of June 21, Amazon experienced sales growth of 27 percent week-over-week. Interestingly, this is significantly lower than week-over-week growth from Prime Day 2020, which was 39 percent. Amazon Prime Day 2021 marked a return to a July date after the 2020 event was rescheduled for October due to the COVID-19 pandemic.

To learn more about the data behind this article and what Second Measure has to offer, visit https://secondmeasure.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.