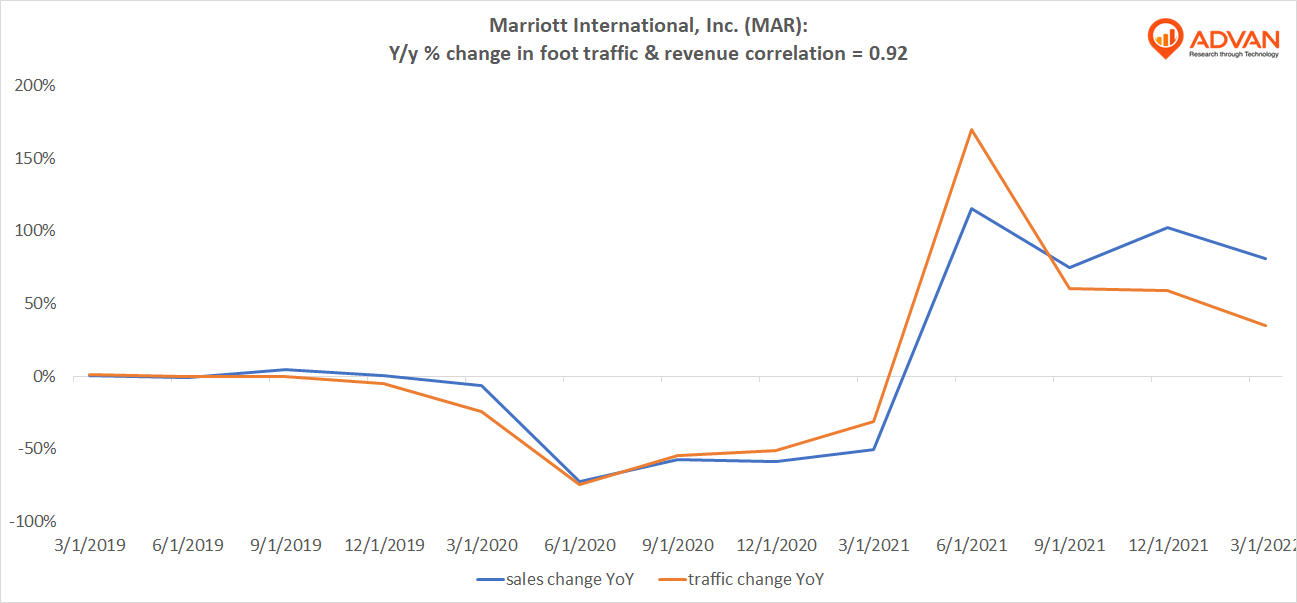

Notable Hit 1: (MAR:NASDAQ) On Wednesday May 4, 2022 Marriott International, Inc. (MAR) posted better-than-expected revenues of 4.2bn surpassing the consensus estimate of $4.15bn or by +1.2% and in the same direction as Advan’s forecasted sales. The revenue was up 81% YoY and in line with Advan’s foot traffic data increase of 35% YoY at its properties for Q1 2022. As a result of beating the sales and EPS the stock closed at $181.24, +4.7% from previous close. Advan’s footfall data has a correlation of 0.92 on a YoY basis with MAR’s top-line revenue over the last 13 quarters.

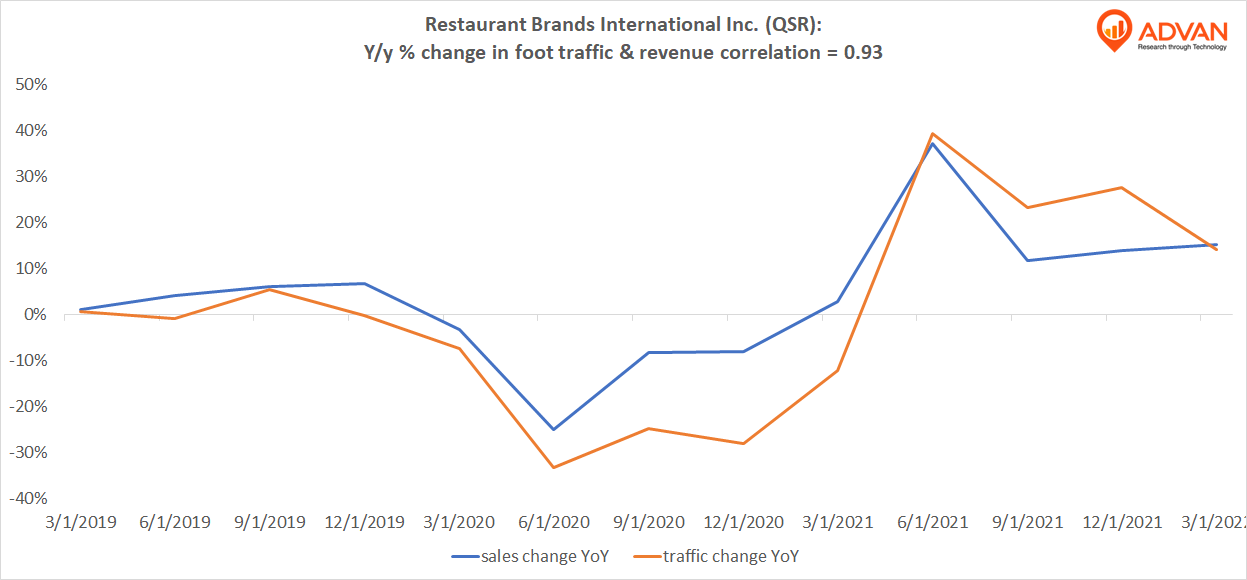

Notable Hit 2: (QSR:NYSE) On Tuesday May 3, 2022 Restaurant Brands International Inc. (QSR) posted better-than-expected revenues of $1.45bn surpassing the consensus estimate of $1.42bn or by +2.2% and in the same direction as Advan’s forecasted sales. The revenue was up 15% YoY and in line with Advan’s foot traffic data increase of 14% YoY at its restaurants for Q1 2022. As a result of beating the sales and EPS the stock opened at $58.4, +2.5% from previous close. Advan’s footfall data has a correlation of 0.93 on a YoY basis with QSRs top-line revenue over the last 13 quarters.

To learn more about the data behind this article and what Advan has to offer, visit https://advanresearch.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.