The Basic Materials Industry includes Chemicals, Metals, Mining, Forestry and Paper. Output prices for these sectors have been very volatile in the past 12 months, reflecting recent rapid structural changes in the global economy.

Metals for steel and alloy production – Aluminium, Iron Ore, Lead, Zinc, Manganese, Molybdenum and Tellurium are mainly down. Rare earths used in mobile phones, EVs, batteries, catalytic convertors, and flat screens – such as Rhodium, Titanium, Lithium, Palladium, Neodynium – are higher, with Lithium up over 200% YoY. Mined fuels such as Coal are up nearly 150% over the past 12 months in response to the Ukraine war. Urea ammonia for fertilizer is up more than 100%. Precious metals are modestly down, despite surging global inflation. Some key chemical outputs with wide consumer and industry applications – Polyethylene, Polypropylene and Polyvinyl – are also weaker although PVC prices have spiked more recently. Semiconductor inputs are mixed – Germanium (a largely China-controlled market) is down over 15%, but Gallium is up nearly 50%.

This environment is very positive for some Basic Materials firms but – overall – the sector faces increasing uncertainty as interest rates hit economic growth. US Basic Materials companies recorded a run of 15 months of net improvements from Nov-20 to early-2022. However, this year has been more erratic, with multiple months of net improvement and net deterioration.

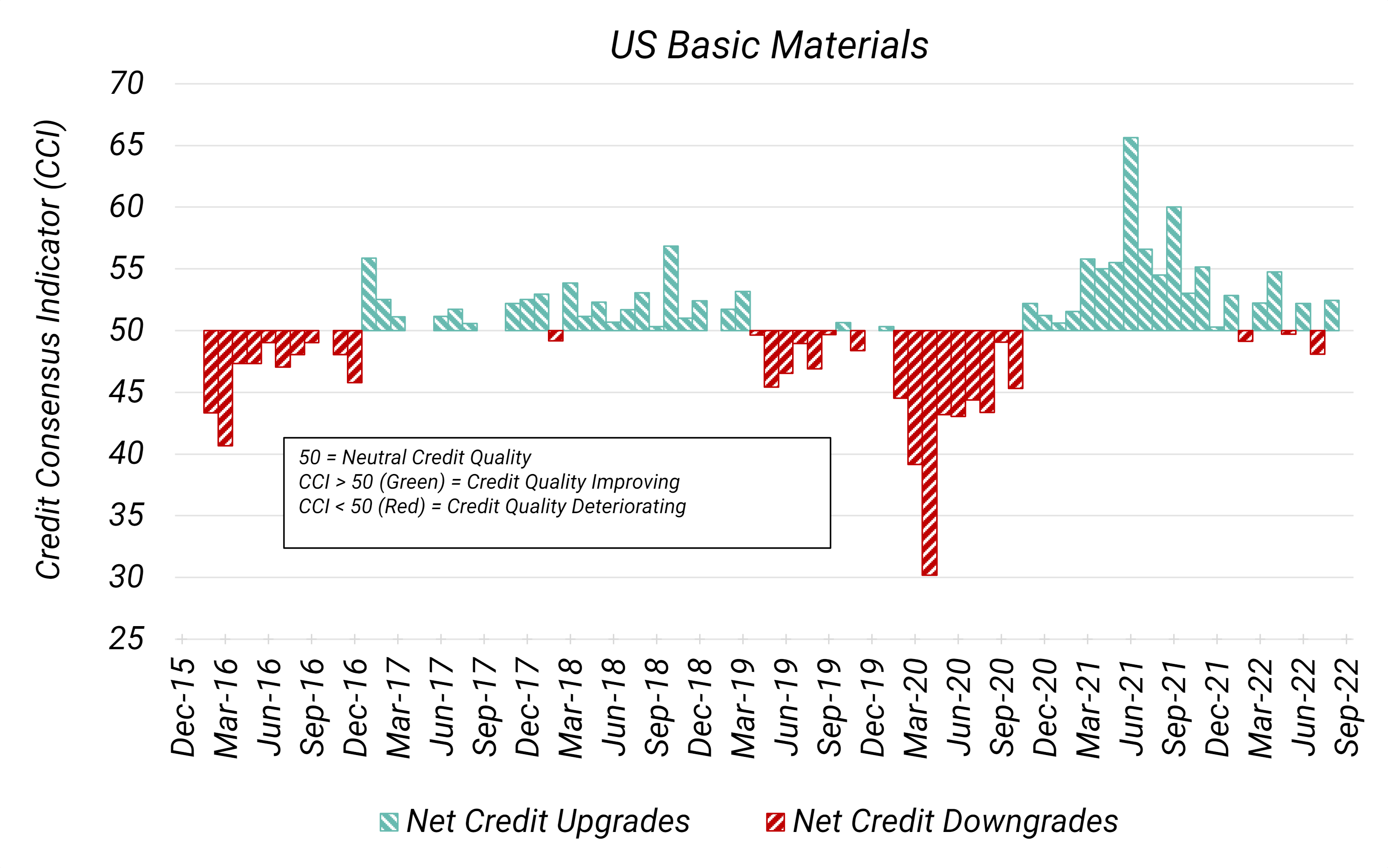

Figure 1 shows the Credit Consensus Indicators1 (CCIs) for US Basic Materials.

This sample of more than 350 US Basic Materials companies have recorded a few CCIs below 50 recently. However, in the latest month, US Basic Materials CCI is above 50, indicating that upgrades now outnumber downgrades.

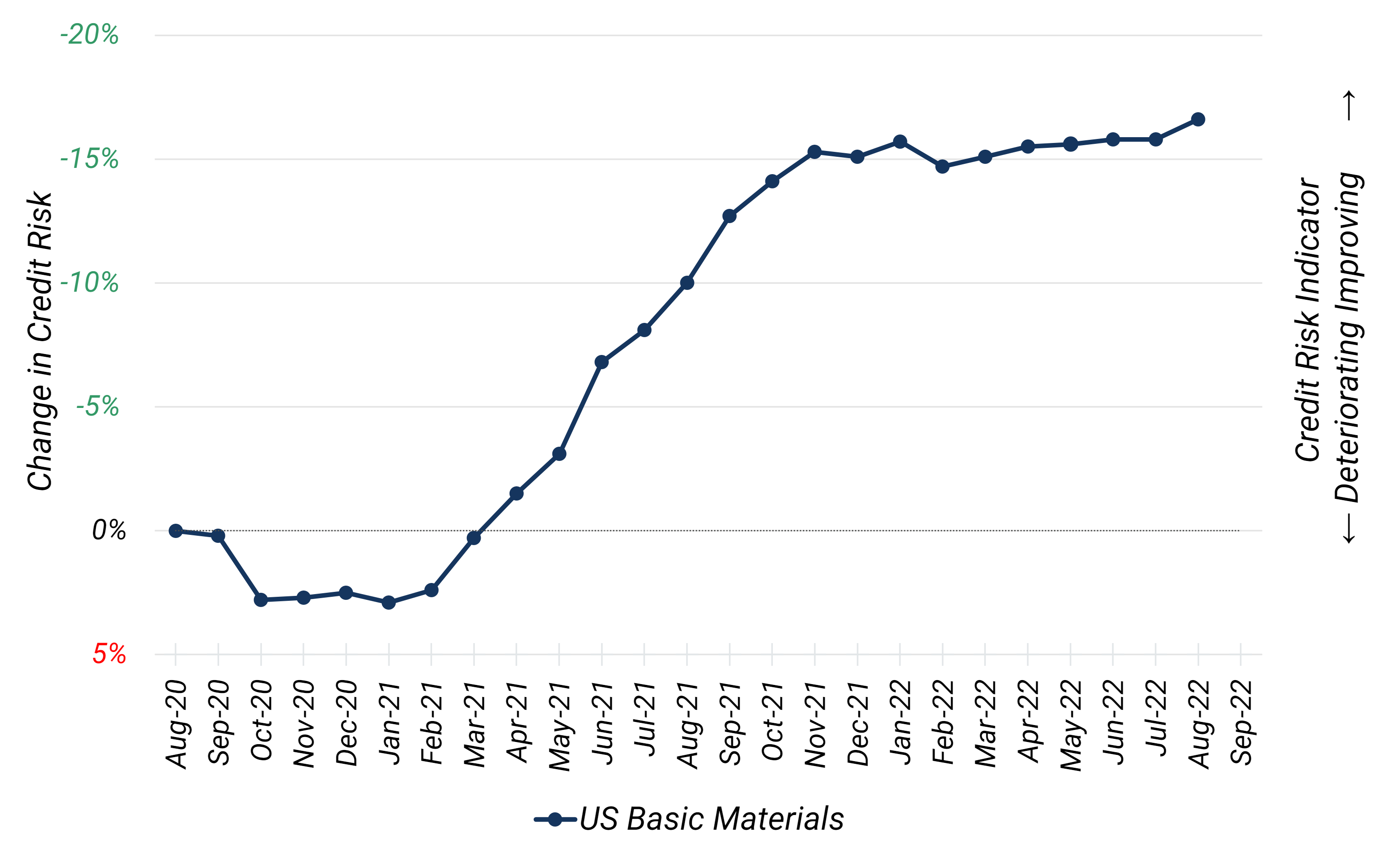

Figure 2 shows the credit trend for US Basic Materials.

US Basic Materials average credit risk – measured by default probability (axis inverted) – has shown some improvement this month. The CCI indicator may be picking up on early-stage changes in credit opinions that will feed into an even lower average PD in coming months.

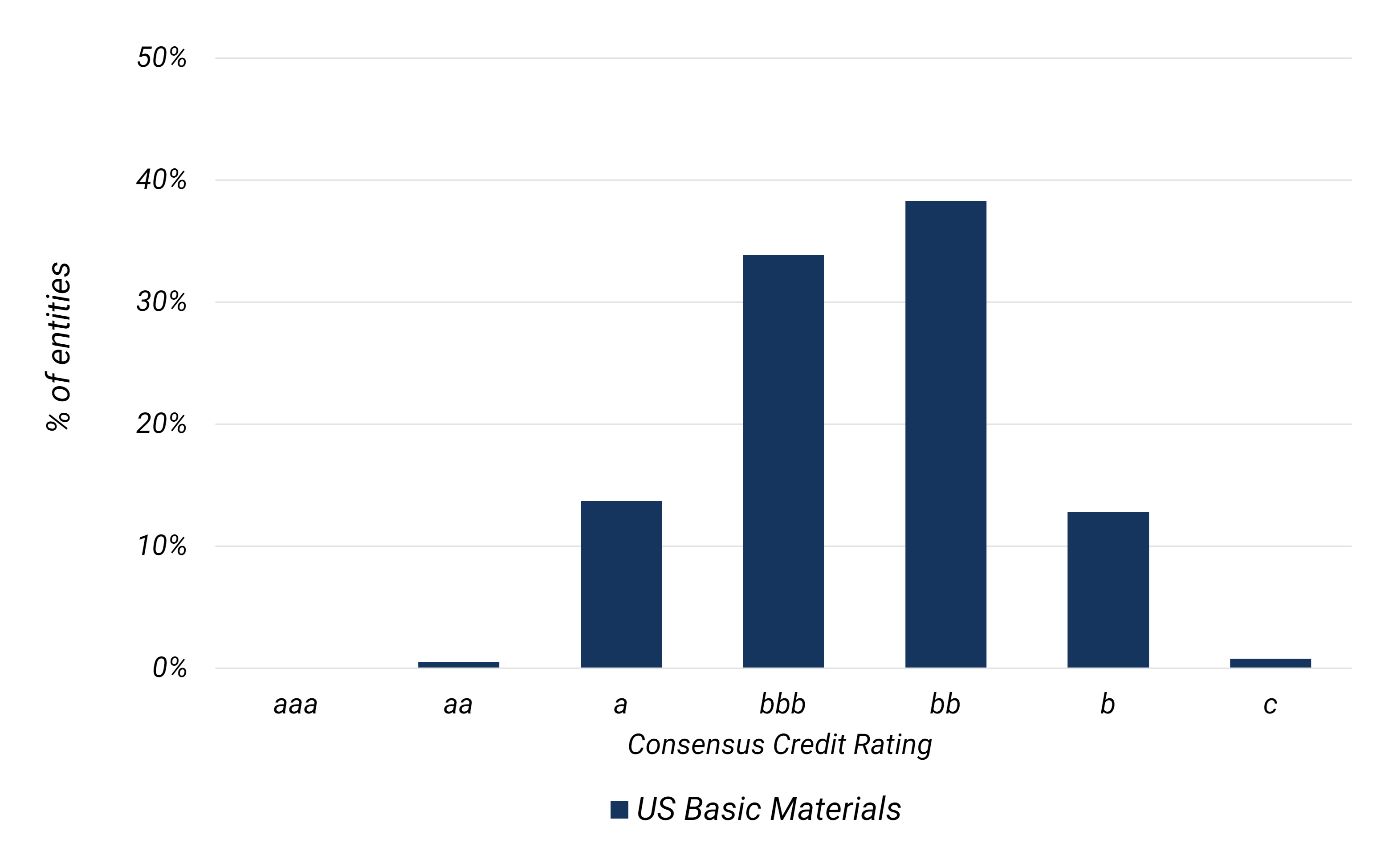

Figure 3 shows the current credit distribution for US Basic Materials; less than 50% are rated investment grade.

Figure 3: Credit Distribution, US Basic Materials; Aug-22

To learn more about the data behind this article and what Credit Benchmark has to offer, visit https://www.creditbenchmark.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.