If you’ve been paying attention to the news, we’ve been hearing a lot about inflation and recession. A quick look at some high level indicators help explain why:

So as you can see, things are going pretty well -_- . These kind of market conditions tend to change the way people spend. We’ve already reported that consumers are flocking to grocery store apps to access digital coupons to save on their supermarket shopping. We’ve also seen downloads increase sharply for membership wholesale clubs so people can save on gas.

Let’s take a step back and determine more broadly, how inflation and these aforementioned market conditions are impacting various sectors of retail, through mobile app performance.

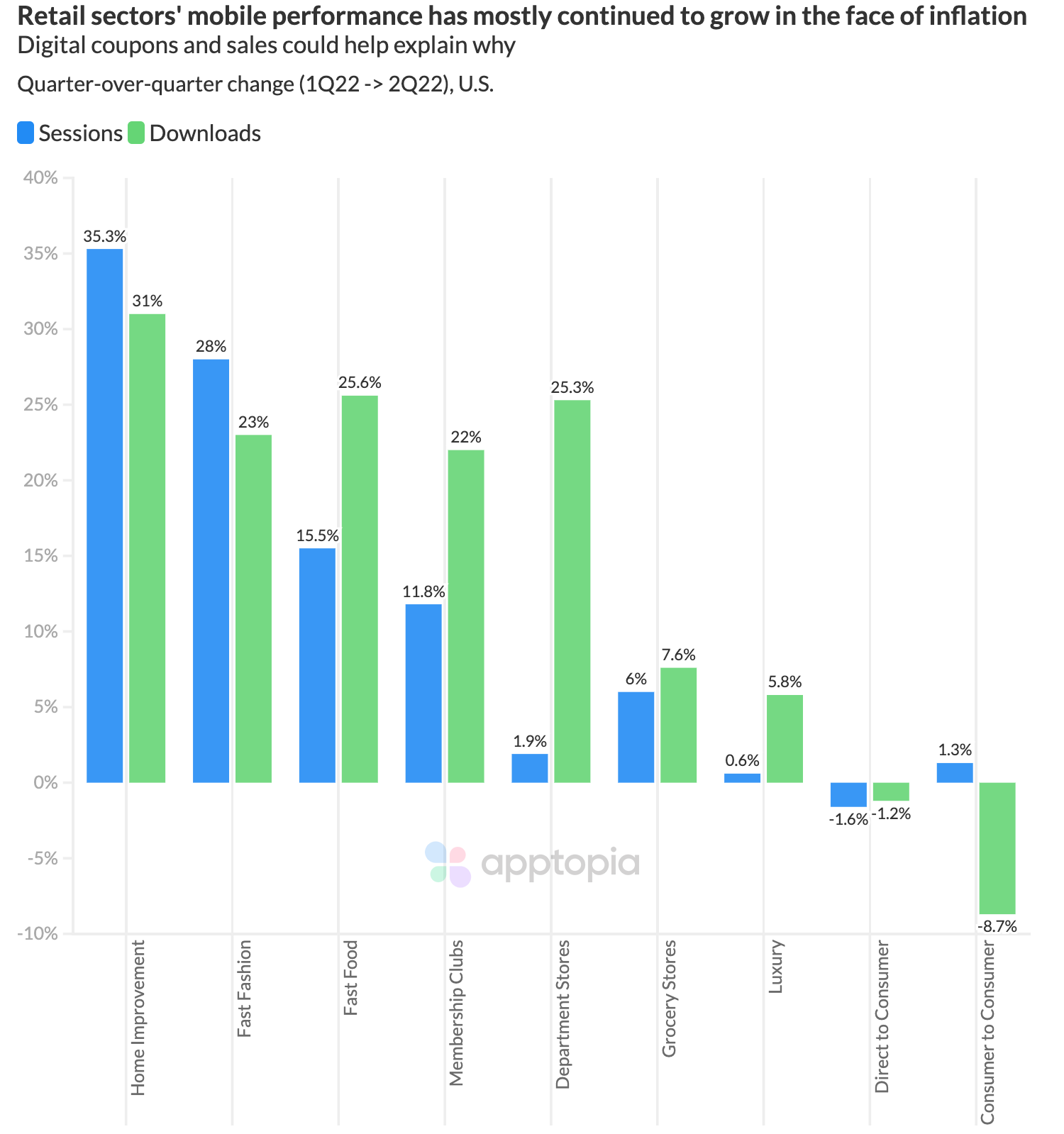

From this data alone, we see continued growth for most sectors that we analyzed. Every sector with the exception of Direct to Consumer has seen an increase in app usage, suggesting this sector is struggling the most with sales in the face of inflation. Brands like Champs Sports, Victoria’s Secret, and Hollister are included here.

Home Improvement remains hot inline with the housing market. Home supplies are still viewed as a need and brands like Home Depot and Lowe’s have done a great job implementing desired app features such as curbside pickup and buy online and pickup in store (BOPIS). Fast Fashion continues its growth trend as well and it may not falter as these clothes and shipping costs tend to be very inexpensive.

Looking at department stores, we see its growth in new downloads are substantially out-gaining its growth of user sessions. Through this, we can surmise that while these brands are acquiring more users, lately there has not been enough incentive to use the app, or for users who had already installed the app to open it up again.

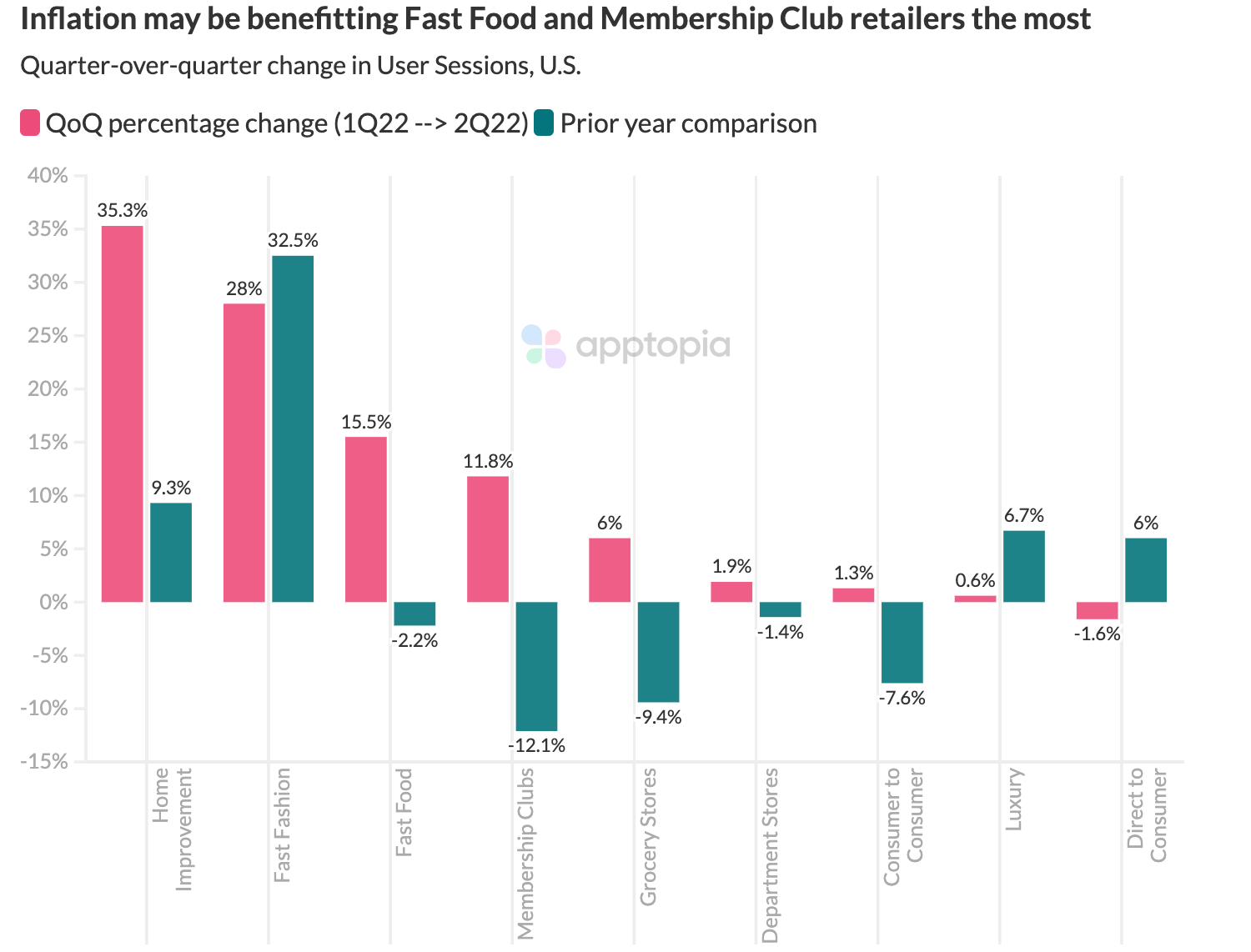

Another angle to analyze the impact of economic market conditions is through comparing the growth of these retail sectors from Q1 2022 to Q2 2022 with that of the growth seen from Q1 2021 to Q2 2021. To make the chart less crowded and easier to read, we’ve focused just on User Sessions.

With the exceptions of Fast Fashion and Department Stores, we see large changes in quarter-over-quarter user engagement performance between 2021 and 2022. Fast Food apps [McDonald’s, Taco Bell, Chick-fil-A, etc.] had a positive swing of 17.7 points, the second most of our grouping. Cheaper meals, combined with lots of app-specific discounting that we see in the fast food space, makes this sector prevail in times likes these. Membership Clubs (think Costco) enable users to buy in bulk as well as save at the pump, had the third largest positive swing of 23.9 points.

Home Improvement continues to be a bit of an outlier, likely more correlated with housing market that continued to accelerate from 2021 into 2022, than the more recent economic changes.

To learn more about the data behind this article and what Apptopia has to offer, please reach out to Connor Emmel at cemmel@apptopia.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.