As online and brick-and-mortar giants like Amazon, Walmart, and Target continue to expand their health and wellness offerings, the traditional pharmacy sector has had to adapt. We took a look at three of the biggest players in the market – CVS, Walgreens, and Rite Aid – to see how they are reinventing themselves in an increasingly competitive space.

CVS and Walgreens Adapting to New Challenges

Foot traffic to CVS and Walgreens increased dramatically over the pandemic as the brands became a prime destination for vaccines and COVID tests. However, as most who choose to vaccinate have already done so, and as inflation continues, foot traffic has been tapering off. Shoppers have been both consolidating their errands and “trading down,” a trend that could be impacting visits.

Pharmacy leaders have been adapting to the changes in the traditional pharmacy space – expanding their omnichannel options, strengthening loyalty programs, and perhaps most crucially, establishing themselves as healthcare providers as well.

CVS Goes Digital

When the pandemic forced a lot of medicine to go online, CVS was already ahead of the curve. In 2018, the company bought insurer Aetna and has been establishing its MinuteClinics ever since. More recently, in May 2022, the company launched an online primary-care program called CVS Health Virtual Primary Care. According to the company’s website, “CVS Health Virtual Primary Care will give members access to primary care, on-demand care, chronic condition management, and mental health services virtually, with the option of being seen in-person when needed at an in-network provider, including MinuteClinic.” As CVS invests in its digital channels, the company has been optimizing its store fleets, with plans to close roughly 900 of its 10,000 stores by 2023.

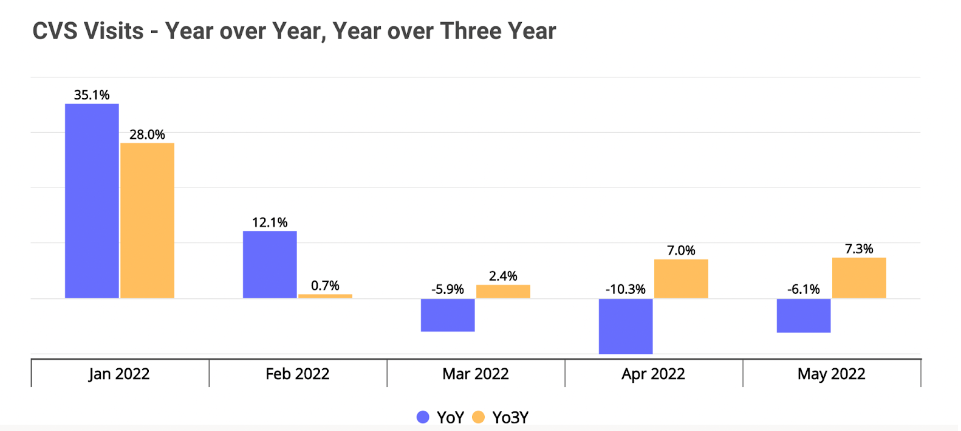

Digging deeper into the numbers, visits were up compared to three years ago, which means that, despite the store closures already under way, customers are still visiting CVS in higher volumes than before the pandemic. Foot traffic has been trending downward as compared to one year ago, but with visits up year-over-three-year (Yo3Y), the year-over-year (YoY) drop is likely due to patterns normalizing following a COVID-induced surge in visits to pharmacies.

Walgreens Focusing on Optimization

Walgreens, too, has been expanding out its healthcare services since before the pandemic, but the past two years have accelerated the pace. In October 2021, the company announced a “$5.2 billion investment [to] accelerate the opening of at least 600 Village Medical at Walgreens primary care practices in more than 30 U.S. markets by 2025 and 1,000 by 2027.” Walgreens also built the Walgreens Find Care, an online platform that connects patients with digital health service providers.

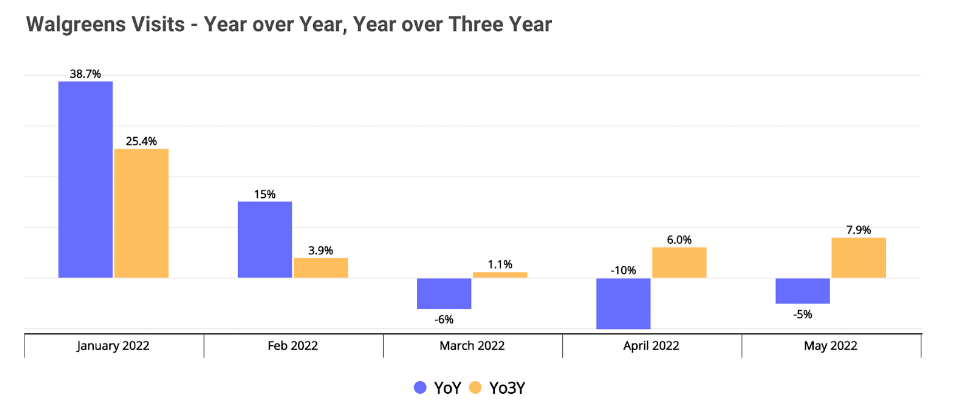

Like CVS, Walgreens is seeing Yo3Y strength while YoY visits are down slightly – May 2022 visits were up 7.9% relative to 2019 but down 5.6% relative to 2021. This means that, like CVS, Walgreens is in a stronger position than it was pre-pandemic, even as COVID wanes.

Rite Aid Rightsizing Effectively

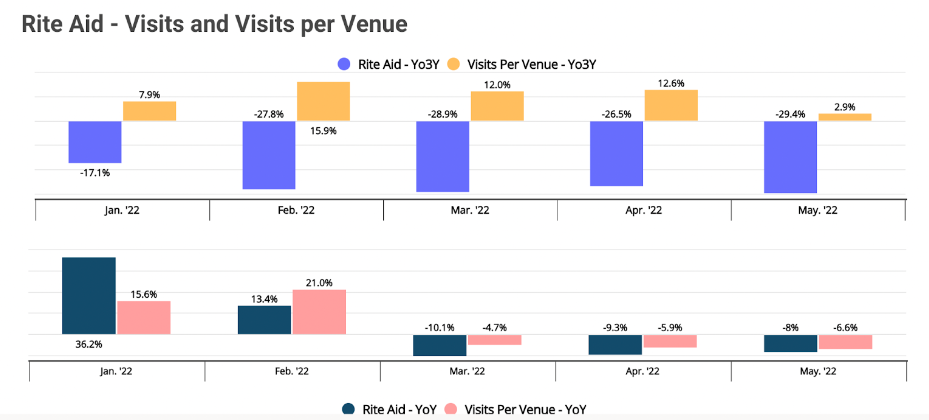

Rite Aid began an aggressive consolidation of its store fleet in 2017, when competitor Walgreens purchased almost 2,000 Rite Aid stores. It spent the last few years focusing on its best-performing stores and expanding its other healthcare offerings. Looking at the foot traffic, visits per venue are relatively strong, and despite the fact that Yo3Y foot traffic is down, visits per venue are significantly elevated. These elevated visits may show that the plan to focus on higher-performing stores is working, as visits per venue is one of the more important and telling metrics used to gauge .

April 2022 saw 12.6% more visits per venue than the chain had seen three years prior, and although foot traffic was down by 26.5%, this is likely a result of the store closures that the company has been implementing rather than a depression in visitors.

Year over year visits were strong in the new year, and while the brand experienced a downturn in foot traffic from March 2022 onwards, it’s been narrowing its visit gap each month since. As the company continues to make inroads into healthcare, plan to see foot traffic patterns continue to trend upwards.

All three brands are adapting with the challenges that they face as customer needs evolve and are investing in new ways to provide innovative services to their communities.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.