data.ai’s report, Powered by App IQ, illustrates how businesses can meet new mobile-first customer expectations for accessing groceries, drinks and meals.

Mobile is the Battleground for Hungry Customers: What are the Unique Market Opportunities for Food & Drink Providers?

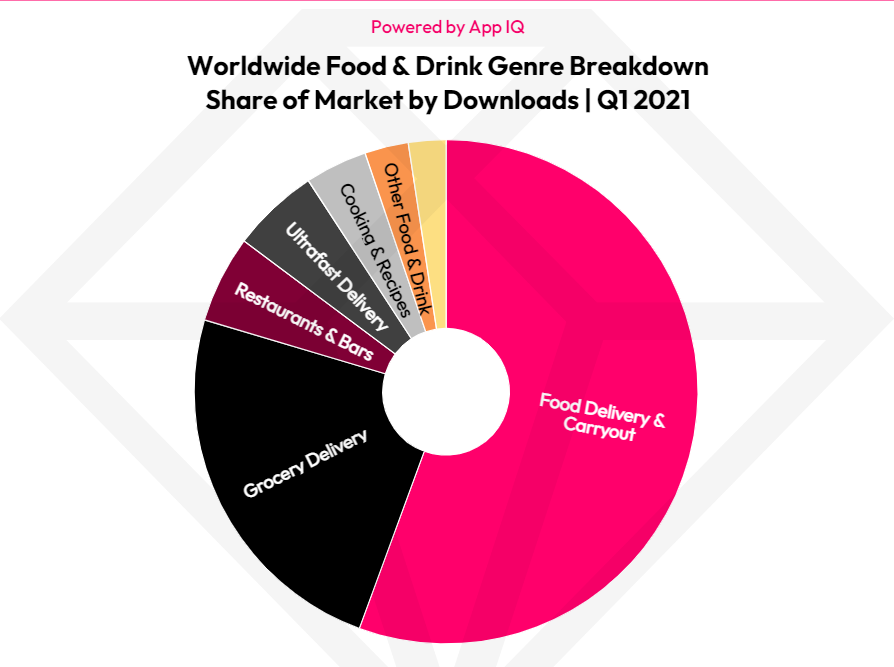

Our latest report unveils the State of Food & Drink on mobile with unprecedented granularity. Powered by App IQ, we dive deep into 7 subgenres including Food Delivery & Carryout, Ultrafast Delivery, Grocery Delivery and more. Our State of Food & Drink report uncovers nuanced insights publishers need to succeed in the new mobile-first food & drink landscape across 20 key markets.

Record Demand for Food & Drink Apps: Where are the High-Growth Mobile Sectors Post-Pandemic?

Demand for mobile-first food services reached a new high in Q1 2022. Global time spent in Food & Drink apps grew 65% YoY. The global growth rate of sessions grew 8x faster than downloads, showing habits formed during peak COVID quarantine periods are more ingrained than ever. Mobile is the battleground for businesses to keep these loyal, repeat customers.

Convenience, cheap food and quick fulfillment are fueling demand in high-growth subgenres:

App Transparency: What Engagement & Monetization Features Power Top Grocery Delivery Apps and Drive Sales?

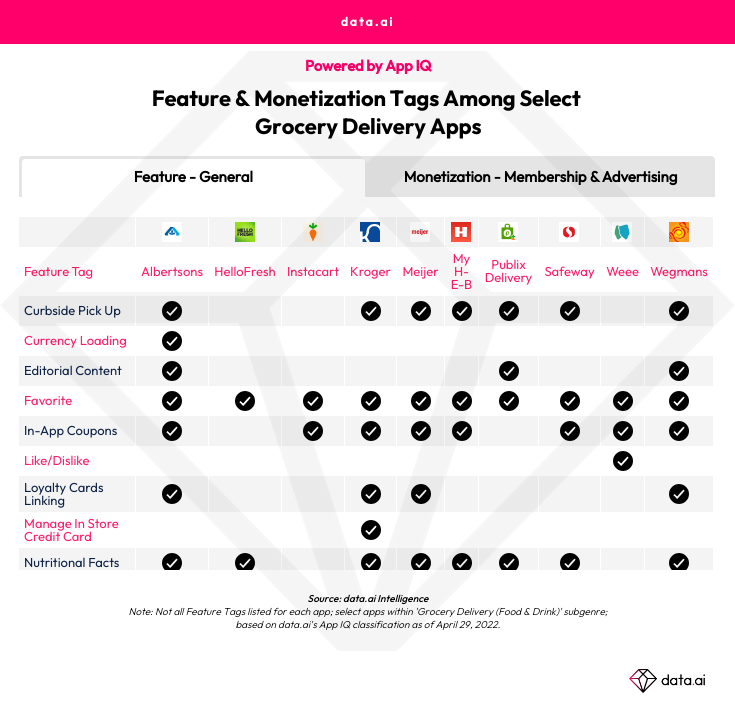

App IQ’s Feature Tags allow you to go even deeper and compare detailed in-app features. Using Feature Tags in the State of Food & Drink report, we discovered what features are table stakes for Grocery Delivery apps, and what are competitive advantages.

Albertsons, HelloFresh and Instacart all share the Recurring Order feature. data.ai’s data illustrates that this could be a key feature in driving engagement and retention, leading to increased basket sizes and conversions. Compared to its peers, Instacart saw 2x more sessions on average per user than the top 10 grocery delivery apps. More ‘digital foot traffic’ and a large audience (#2 by MAU) can translate to greater sales. Recurring Order is a savvy feature tapping into the convenience customers crave and keeping customers coming back. In fact, HelloFresh saw the highest 30-day retention rate among top grocery delivery apps.

To learn more about the data behind this article and what AppAnnie has to offer, visit www.appannie.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.