To make economic decisions, we need to understand how people and businesses spend their money. To do this, government and academics have historically had to rely on datasets that are small or significantly delayed. However, with the advent of digital economies, we are seeing a new wave of economic research and statistics based on large-scale anonymised transaction datasets. Such data helps us to understand and react to economic movements in real time, without the recurring risk of significant data revisions.

The Summer of 2022 has been punctuated by the escalating cost-of-living crisis which led to a variety of appeals for higher pay. Commuters suffered from the disruption of nine days of national train strikes between June and August. These strikes followed a pandemic that transformed how commuters use public transport, with many now preferring the flexibility of hybrid working. So, how much impact did these strikes actually have? We turned to our real time consumer spending data to run some analysis on the decline in passenger transactions over the period and to look at the wider impact of the strikes on the high street.

Quick Commerce has enjoyed rapid growth over the past couple of years, with nascent organisations enjoying sizeable valuations. Getir was valued at $12bn in March 2022 in their Series E; Gorillas was valued at $2.1bn in October 2021 in their Series C, and Zapp has raised over $300m. Whilst the volatile economic environment is challenging some of these valuations, one thing is for sure, Q-Commerce organisations are shaking up the Grocery landscape and the incumbents need to have a clear and fast strategy on how to manage this strongly emerging threat.

Wembley Stadium is one of the UK's most iconic venues hosting some of the world's highest profile sporting and musical events. So, we were curious to know whether all events and all audiences are equal when it comes to splashing the cash locally on event days. By using a combination of Fable’s extensive consumer spend data and precise location capabilities, we were able to pinpoint spending at some of the most well-attended events in 2022 and the results were really interesting. Would music audiences outperform sports? Would Coldplay out perform Ed Sheeran?

The rise in the use of Food Delivery apps has been well documented with the pandemic serving up a hearty main course for many of the industry’s participants. However, as we have emerged from the depths of lockdowns delivering consistent tailwinds for growth in 2020 and 2021, we ask the questions - how has this sector performed through the first half of 2022? And what is the outlook in the current economic environment?

Buy Now Pay Later (BNPL) is the latest reincarnation of consumer borrowing and has quickly dominated the conscience of the consumer, the media, concerned regulators and incumbent mobile/electronic payment platforms and wallets. Here, I briefly trace the origins of consumer debt for context and then bring the narrative forward to a current review of the BNPL landscape and what Fable’s consumer spend data is telling us about BNPL consumers and their usage, its popularity, the effect it is having on established payment providers and what this might mean for the future.

Amazon held its annual Prime Day event on the 12/13th July this year. In an environment where online spending has continued to decline from the highs reached in 2020 and 2021 and the current cost-of- living crisis is biting hard, we were curious to know whether this squeeze on incomes might have dulled the consumer love affair with Amazon in 2022. However, our data shows that the number of Amazon transactions during the week that this year’s Prime Days took place, rose nearly 12% compared to 2021.

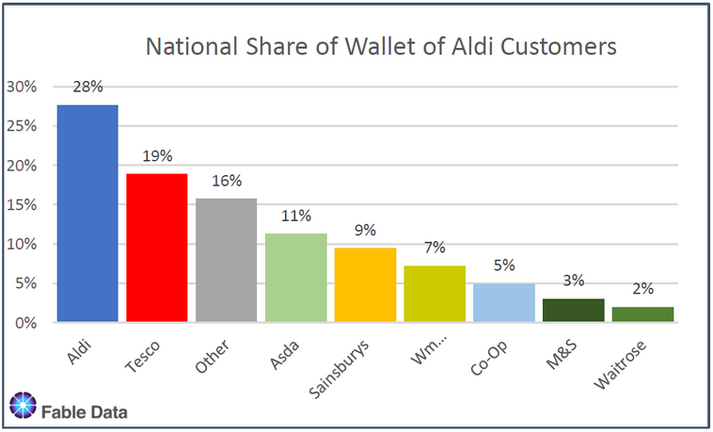

The current cost of living crisis has seen a significant shift in consumer spending patterns as household budgets have been increasingly squeezed. The Grocery sector traditionally acts as a reliable barometer for the wider economy, so it’s perhaps unsurprising that since April, there has been a noticeable shift in consumer spend towards Discounters - Aldi, Lidl and Iceland. This has occurred at the expense of the large Multiples, and Sainsbury’s, Waitrose and Morrisons are particularly feeling the pinch, as shown in the graph below.

Fable Data, the European transaction data platform based in London, has today released figures that show spending at UK petrol stations almost doubled during the peak of the crisis last Friday. Fable Data has analysed daily spending last week, using anonymised spend data from its panel of millions of consumers across Europe. Its analysis shows that the spike in UK fuel spending increased by 93% from last Friday compared with the average for the previous four weeks and remained elevated throughout the weekend.

We recently shared how our data is providing early and predictive signs that growth in Food Delivery spend remains elevated. While spend remains relatively high versus pre-pandemic levels, we can look at a number of underlying customer metrics to help unpack the reasons for the improvement. This week we look at how customer cohort analysis enables a deeper and more accurate understanding of customer behaviour trends over time, relating to retention, spend frequency, order size and customer spend value.

As we start what we hope will be a return to normality, Fable Data asks: how permanent are these new patterns of consumer behaviour? How predictive is the data from the last year? Where do we see industry players holding onto their gains, and where do we anticipate a reversal to pre-pandemic positions? Food Delivery spend was already growing between 20%-30% YoY in the quarters prior to March 2020, when the first lockdown occurred.

There is no question that spend in the Grocery sector has been elevated as a result of the pandemic – the real questions are by how much, and how that will change in 2021. Fable Data tracks real-time consumer spending, allowing us to provide valuable insights into the Grocery sector. In 2020, Grocery spend was up c. +12% YoY. The highest growth for this sector was seen in Q2, with spend up c.+18% YoY, as lockdown restrictions were put in place.

The recovery of spend in the UK and Germany continues month on month, however the trend is slowing – this week both countries plateaued. Transport-related categories across the UK and Germany (e.g. Fuel, Taxicabs and Limousines, Public Transport) YoY performance improved modestly versus last week, although still down YoY. UK Hardware Stores’ YoY growth continued again this week, although in Germany this has slowed.