The Summer of 2022 has been punctuated by the escalating cost-of-living crisis which led to a variety of appeals for higher pay. Commuters suffered from the disruption of nine days of national train strikes between June and August. These strikes followed a pandemic that transformed how commuters use public transport, with many now preferring the flexibility of hybrid working. So, how much impact did these strikes actually have? We turned to our real time consumer spending data to run some analysis on the decline in passenger transactions over the period and to look at the wider impact of the strikes on the high street.

A Comparison of National Rail services with the London Underground

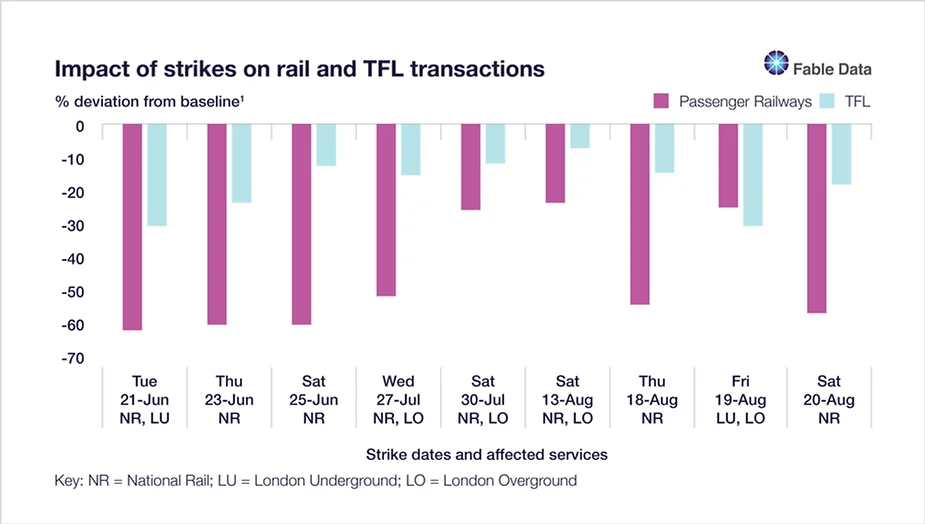

The chart below shows most strike days affecting National Rail (NR) services resulted in transaction volumes falling dramatically, between 50-60%, compared with normal volumes on the same day of the week. The largest drop came on 21 June at 62% while the smallest declines of around 25% coincided with the strikes on 30 July and 13 August that did not affect all railways franchises, such as Southern Rail and South Western Railway. So the impact of these Summer strikes is still considerable.

Turning to TFL, we can see that the relative decline in transaction volumes tended to be much smaller than for National Rail services, partly due to TFL bus services still being in operation. Nonetheless, the strongest declines in TFL card transactions were still a sizable 31%, coinciding with the London Underground strikes on 21 June and 19 August. There was also

some evidence of exclusive National Rail strikes affecting TFL transaction volumes, and vice versa. This likely reflects the need for many commuters calling on both services when travelling into London.

We Looked at the Impact of Travel Disruption on the Wider London Landscape

Unsurprisingly, the amount that people travelled by train and tube significantly reduced during strike periods. Commuters were forced to either seek alternative modes of transport or stay at home – but can we quantify the impact that this lack of commuting had on local businesses throughout the City?

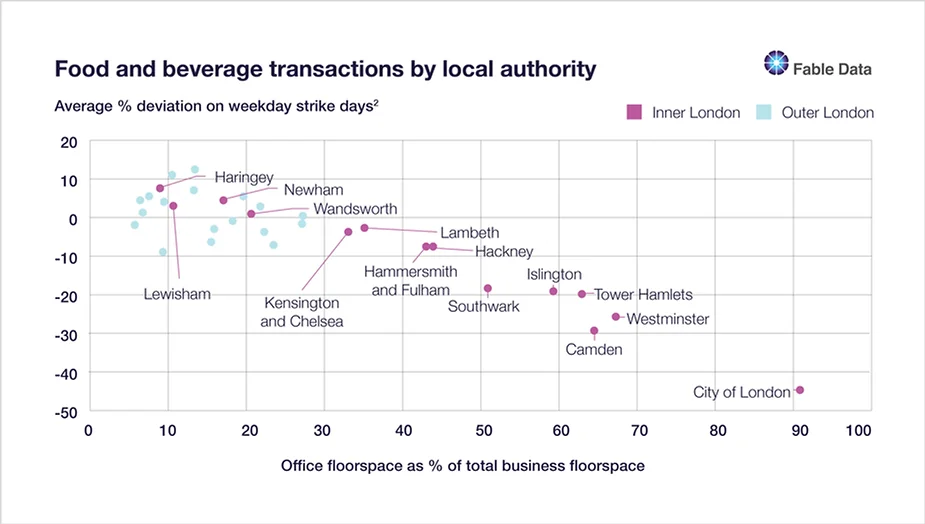

Using Fable’s precise innovative geo-location data, we can see that the merchants which were most affected by the strikes are based in Inner London boroughs. Drilling down further we can see that those local authorities with the highest proportion of office floorspace saw the largest drop in food and beverage transactions – owing to missing out on lucrative lunchtime trade while commuters stayed at home.

At the top of the list is the City of London, where offices make up 91% of all business floorspace (as of 2020-21) and where eating/drinking outlets saw the largest average decline of 45% during the non-weekend strike days. Local authorities with less than 30% of office space had a slightly more positive experience but even some of these saw a fall in transactions.

These areas are likely to be more residential and the relatively small effect (both positive and negative) of the strikes indicate that commuters were not eating out as much in their local high street to the same extent as in the office areas of some Inner London boroughs.

Going Beyond Food Services and Groceries we found much larger declines in spending

Narrowing our geographic focus to these London boroughs where offices make up the majority of business floorspace (Camden, City of London, Islington, Southwark, Tower Hamlets, and Westminster) but looking beyond food and beverages, the other key category with a high number of transaction volumes is the grocery sector. The key players within this spending category are familiar names, such as Tesco, Sainsbury’s and M&S Simply Food, which also receive custom from hungry commuters. However, there are other affected big names that service commuters beyond their lunchtime needs.

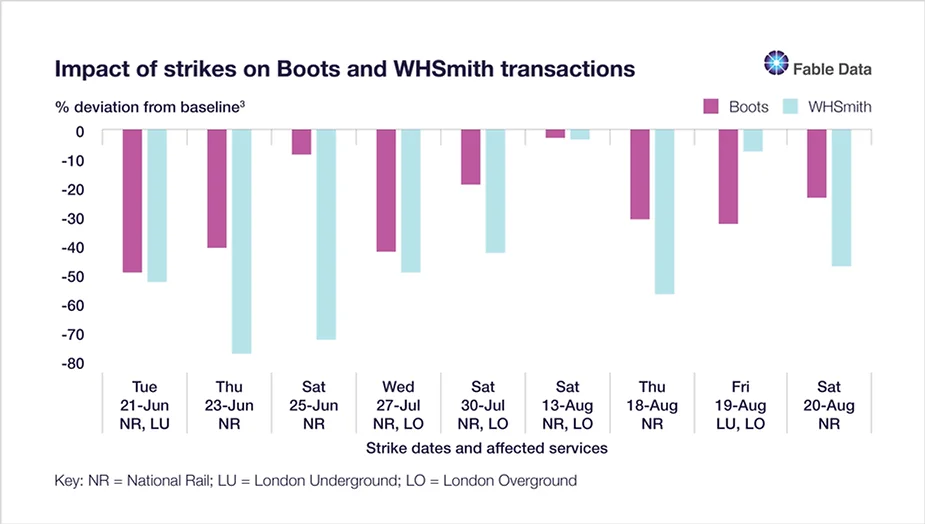

Boots and WH Smith were among the 20 most popular merchants in terms of transaction volumes in these “commuter hotspots” this Summer, with 15 of the other 18 consisting of eating places and grocers. Both Boots and WH Smith provide food options, but it is not their core business. Nonetheless, the pharmacy/beauty retailer and newsagent still have a strong presence in London’s commuter hubs and were both very much affected by the industrial action.

Indeed, transactions at Boots fell over 30% on the five weekday strikes dates, indicating the extent commuters shop at Boots, with the largest drop on 21 June at 50%. WH Smith transaction volumes typically saw much steeper declines, even on some weekend strike dates, as all but two strike days resulted in falls exceeding 40%. Indeed, the strongest drop came on 23 June at a whopping 78%.

Looking Ahead

With industrial disputes continuing into the Autumn, the strikes over the Summer have provided a taste of what to expect during the next set of strikes in October. Whether or not the strong impact of strikes seen in the Summer continues, we certainly expect to see expenditure in central London take another hit. Fable’s data can be a useful indicator for businesses determining their supplies, staffing and investment levels during such uncertain times.

To learn more about the data behind this article and what Fable Data has to offer, visit https://www.fabledata.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.