Amazon held its annual Prime Day event on the 12/13th July this year. In an environment where online spending has continued to decline from the highs reached in 2020 and 2021 and the current cost-of- living crisis is biting hard, we were curious to know whether this squeeze on incomes might have dulled the consumer love affair with Amazon in 2022.

Amazon continues to deliver…

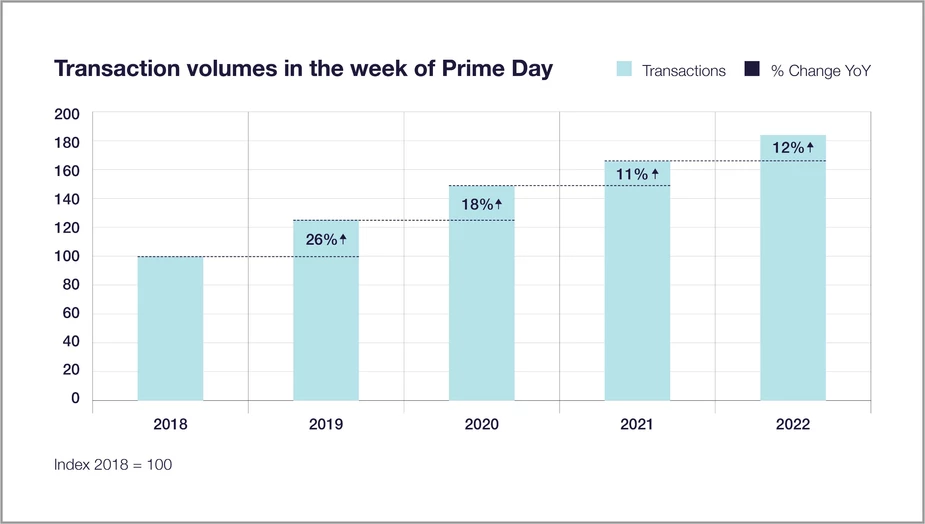

However, our data shows that the number of Amazon transactions during the week that this year’s Prime Days took place, rose nearly 12% compared to 2021. While the growth in transaction volumes was below that seen in 2019 and 2020, but still remained in healthy double-digit figures and was slightly up compared to 2021. This means that despite challenging market conditions, Amazon has continued to experience positive transaction growth during the week in which Prime Day falls for the past four consecutive years.

Spend over the week comprising Amazon Prime marked the fourth consecutive year of rising transaction volumes in the UK.

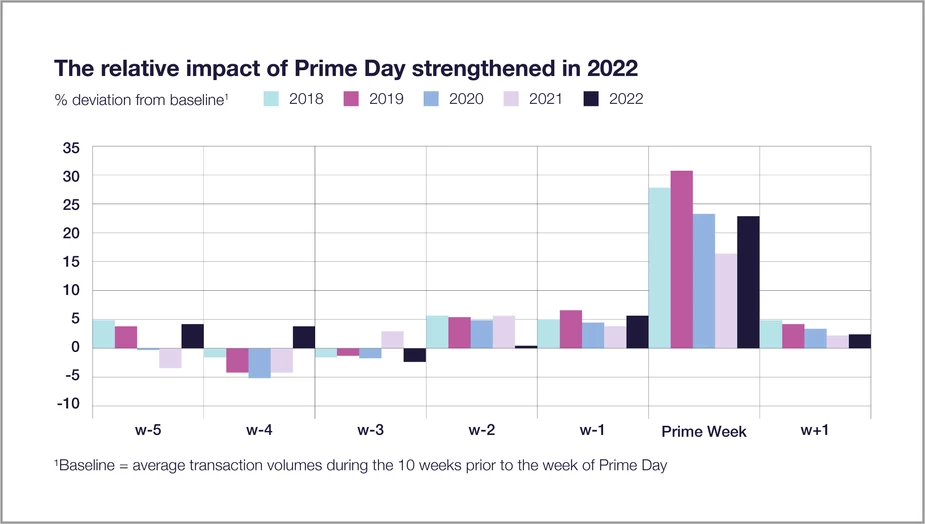

By comparing the number of transactions in the week of Prime Day to a normal week, we can gauge true impact.

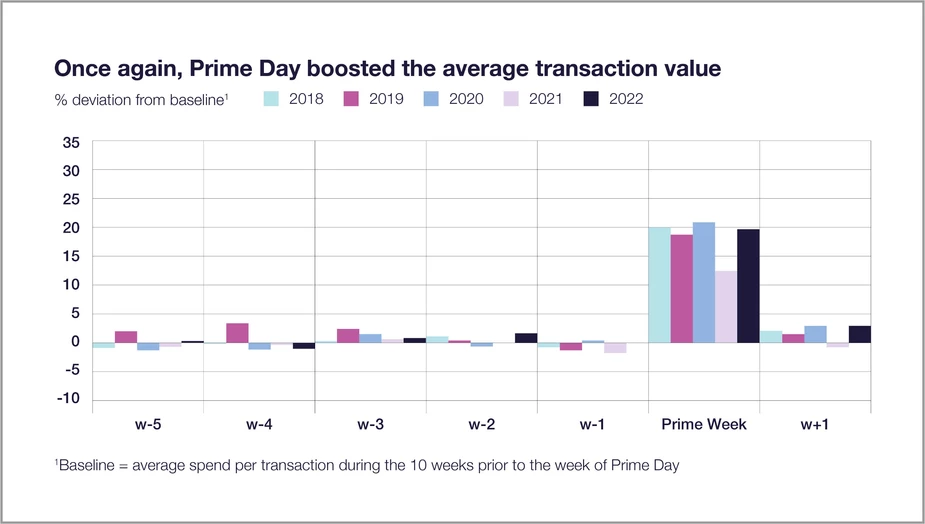

So what can we tell about the size of consumer purchases? Similar to prior years, we saw consumers opt for bigger ticket purchases during the Prime Day period.

With events such as Black Friday and Cyber Monday still to come later in the year, the Amazon experience bodes well.

To learn more about the data behind this article and what Fable Data has to offer, visit https://www.fabledata.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.