Source: https://www.placer.ai/blog/placer-ai-spotlight-subways-rightsizing-and-innovations-drive-visits/

Subway has made headlines for both its store closures and creative menu updates, so we decided to dive into recent foot traffic data to understand how these changes are impacting Subway visits nationwide.

Extensive Rightsizing since 2019

Rightsizing has been classically seen as a softer terminology to discuss store closures. But there is a significant trend of rightsizing that is more focused on optimization.

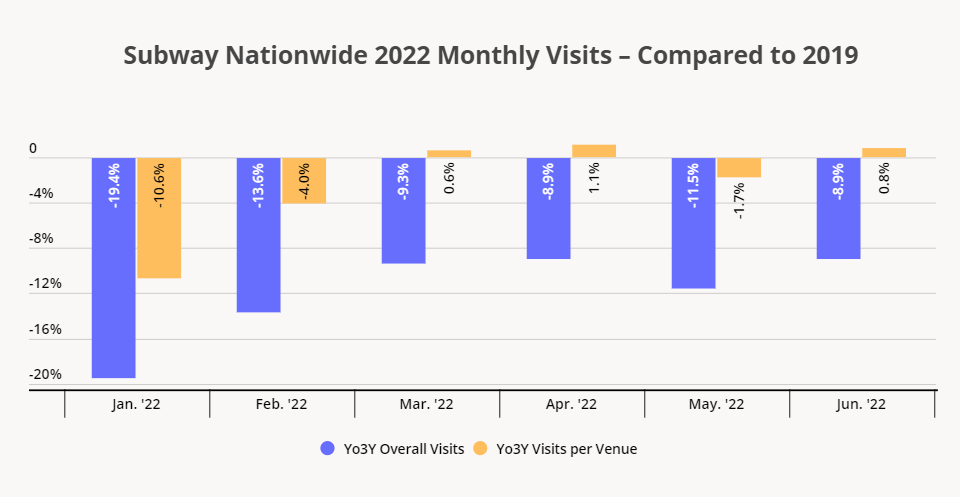

Foot traffic data shows that Subway’s overall visits are down year-over-three-year (Yo3Y) while Yo3Y visits per venue are nearing or exceeding 2019 levels. This likely has to do with Subway’s rightsizing efforts – the brand has been closing around 1,000 locations per year since 2019, with a spike in closures in 2020 when Subway closed more than 1,500 venues. The effect of this store optimization is the stabilization of Yo3Y visits beginning in March 2022 when Yo3Y visits per venue climbed to 0.6%. Since then, visits per venue have stayed close to 2019 levels, with June 2022 visits per venue seeing an 0.8% increase compared to June 2019.

Rightsizing efforts shouldn’t raise any alarm bells with regard to Subway’s success. As the largest single-brand restaurant chain in the world, Subway isn’t going anywhere anytime soon. Subway has been riding this strategy to considerable success for a number of years – closing a few hundred stores annually in 2017 and 2018. Rightsizing has merely been a strategy to transform into what CEO John Chidsey calls an “experience-focused” organization – one with fewer locations, but of higher aesthetic and service caliber – that will ultimately drive sales.

Innovations Ramp Up YoY Growth

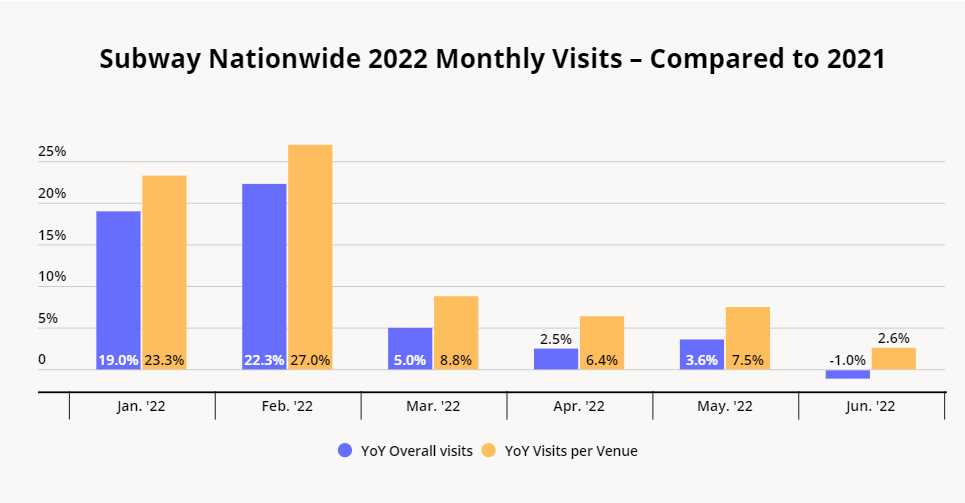

Beyond rightsizing, Subway is taking steps to drive foot traffic with significant updates. In July 2021 Subway unveiled the Eat Fresh Refresh menu which included 20 refreshed ingredients and sandwiches. The launch also included a revamped digital experience which improved ordering flow and allowed customers to place orders for in-store or curbside pickup and delivery nationwide. The move marks a substantial investment in digital integration of what Subway’s CEO calls “the same customized and consistent experience found in Subway restaurants.”

Building on this momentum in 2022, Subway began releasing a number of new sandwiches every few months. July saw the biggest menu overhaul of the year with the launch of the Subway Series, 12 new sandwiches aimed to “maximize taste and crave” while also streamlining the ordering process, according to Subway’s July press release. Subway’s President of North America Trevor Haynes believes the Subway Series “enhances the entire Subway guest experience… whether you leave the sandwich-making to us or are craving your custom creation.”

Looking at the first half of 2022 (H1 2022), Subway’s YoY foot traffic growth is likely being driven by investment in refreshed menu items and an enhanced customer experience. Visits per venue are up year-over-year (YoY) – with the COVID-plagued months of January and February to blame for the magnitude of the contrast at the start of the year.

Subway Take-Away

Subway’s rightsizing has driven yearly visit growth for the chain since 2017 and continues to be a successful strategy in 2022. The launch of new menu items in the last 11 months has the potential to expand on this positive trend. Not to be understated is Subway’s push to integrate a digital customer experience alongside the attractive updates taking place in stores.

To learn more about the data behind this article and what Placer has to offer, visit https://www.placer.ai/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.