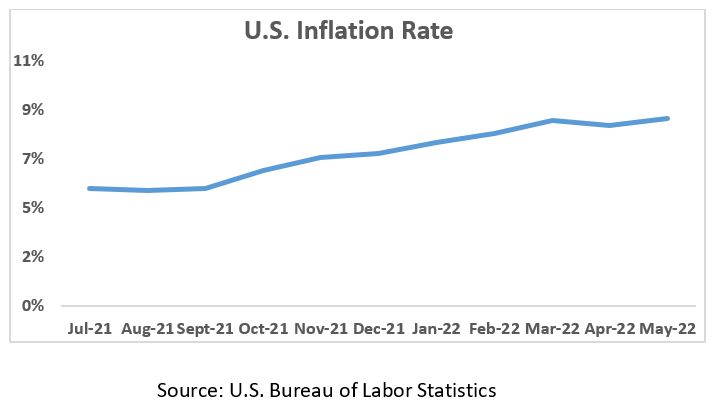

Record high inflation

Inflation rate in the U.S. rose in August 2021 and continued its upward trajectory on the back of post-pandemic recovery spending, supply constraints and the war in Ukraine, impacting commodities’ supply.

While there are multiple forecasts suggesting that the economy might tip into recession as the Federal Reserve takes steps to rein in inflation; the job market, has continued to show strong signs of recovery in 2022.[1]

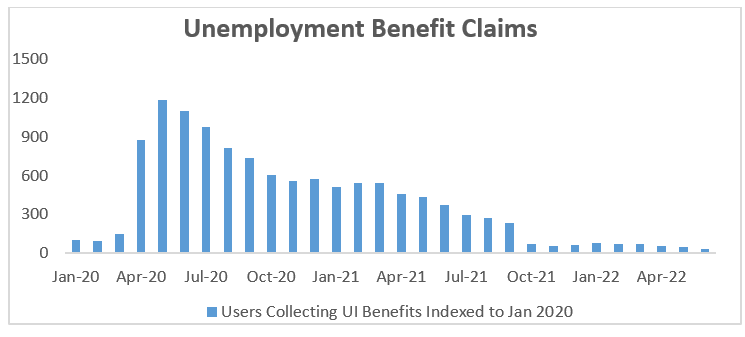

Falling unemployment benefit claims point towards intense demand for labor

There has been a decline in users collecting unemployment benefits starting in July 2021, and this has now fallen below pre-pandemic levels. The drop in unemployment benefit claims unambiguously indicates a strong demand for labor in the U.S. job market. Reports suggest there were roughly two job openings per unemployed worker in April 2022.[2]

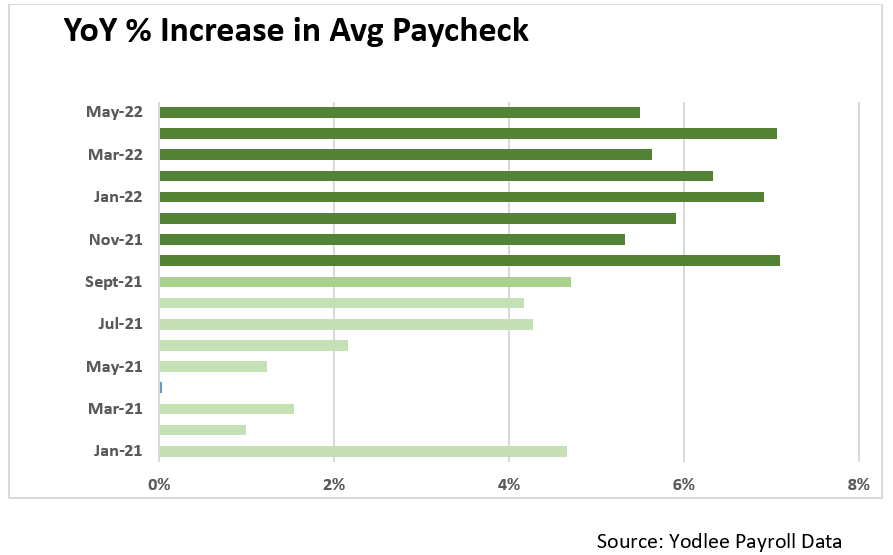

More money in workers’ wallets?

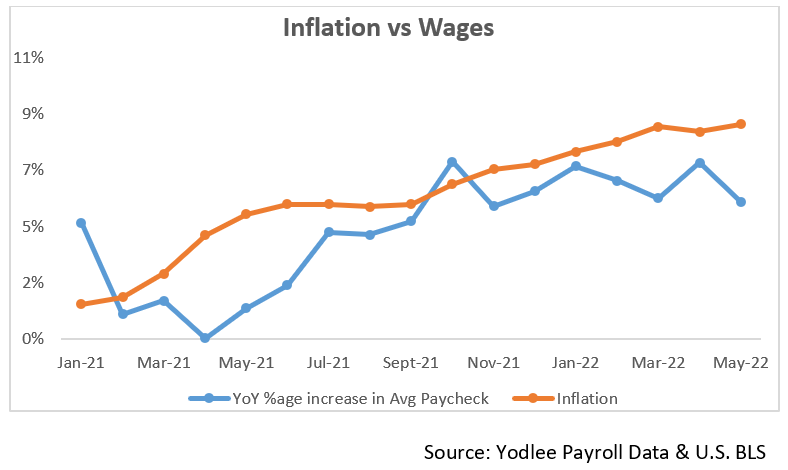

Record high inflation and strong labor demand has also translated into higher paychecks.

The average annual pay raise has consistently been over 5% since October 2021. For the first five months of 2022, Yodlee data indicates an increase of 6% in paychecks versus 2021.

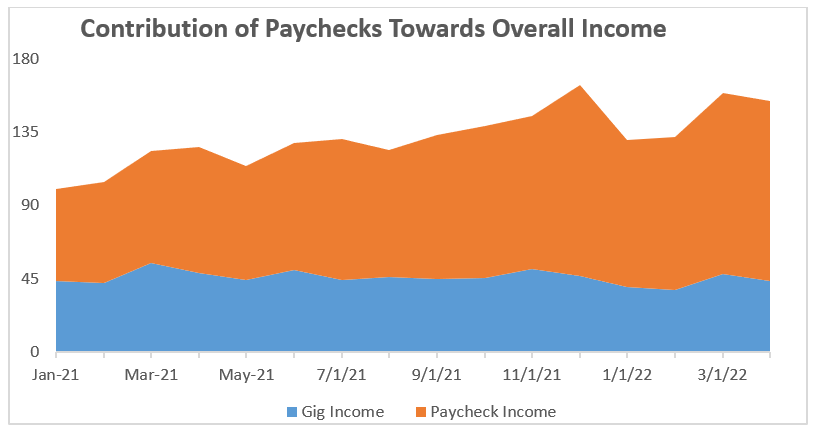

Gig workers take advantage of the hot hiring market

The gig economy saw an uptick in participation since the onset of the pandemic. This was primarily driven by demand for home delivery services with shelter in place restrictions and layoffs by regular employers. As job openings have increased, some of the gig workforce has started to opt for full time jobs vis-à-vis unstable income from gig jobs.

For workers who received income via the gig economy pre-pandemic, Yodlee data indicates an increasing contribution of paychecks towards overall income.

Not only did the overall income earned by this cohort increase, a significant portion of their income has now started coming in via regular paychecks.

Inflation: juxtaposed with wage increase

While wages have seen considerable growth in 2022 over 2021, inflation seems to have outpaced salary gains for consumers.[4] Despite the pay bump, higher consumer prices ate into household budgets, depleting the benefits of pay rise.

To learn more about the data behind this article and what Yodlee has to offer, please reach out to Dylan Curtis at Dylan.Curtis@yodlee.com.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.