A warm Memorial Day always feels like the start of Summer. It’s our usual cue to dine outside, hit the beach, and put the finishing touches on our vacation plans. But what will Summer look like in the age of social distancing?

We’ve started researching campsites and cabins, and heard similar plans from others. We’re looking for a safe break from home: something local, affordable, and compatible with social distancing. And, we’re not alone. Foot traffic to outdoor venues is outpacing all other categories and shows no sign of abating.

In this week’s edition we’ll look at how people are getting away. We’ll also take a look at whether or not dedicated senior hours are drawing a crowd, and we take note of the surprising reemergence of dealerships.

We’ve got a lot to cover in this one, so grab a coffee (or a cold brew) and settle in!

If there’s one insight to continue to take away from this newsletter it’s that we sheltered as a nation but are reemerging as regions. National trends help us see the big picture, but when we zoom down to the cities and counties the story varies greatly. Time and time again we’ve seen this play out in our data.

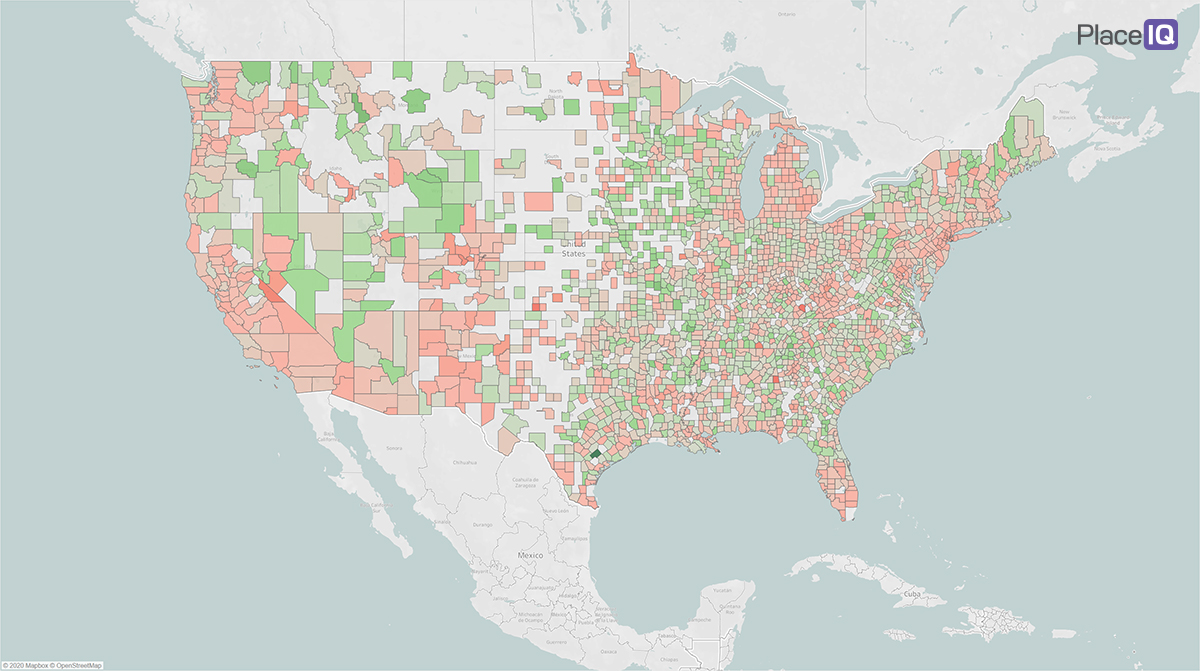

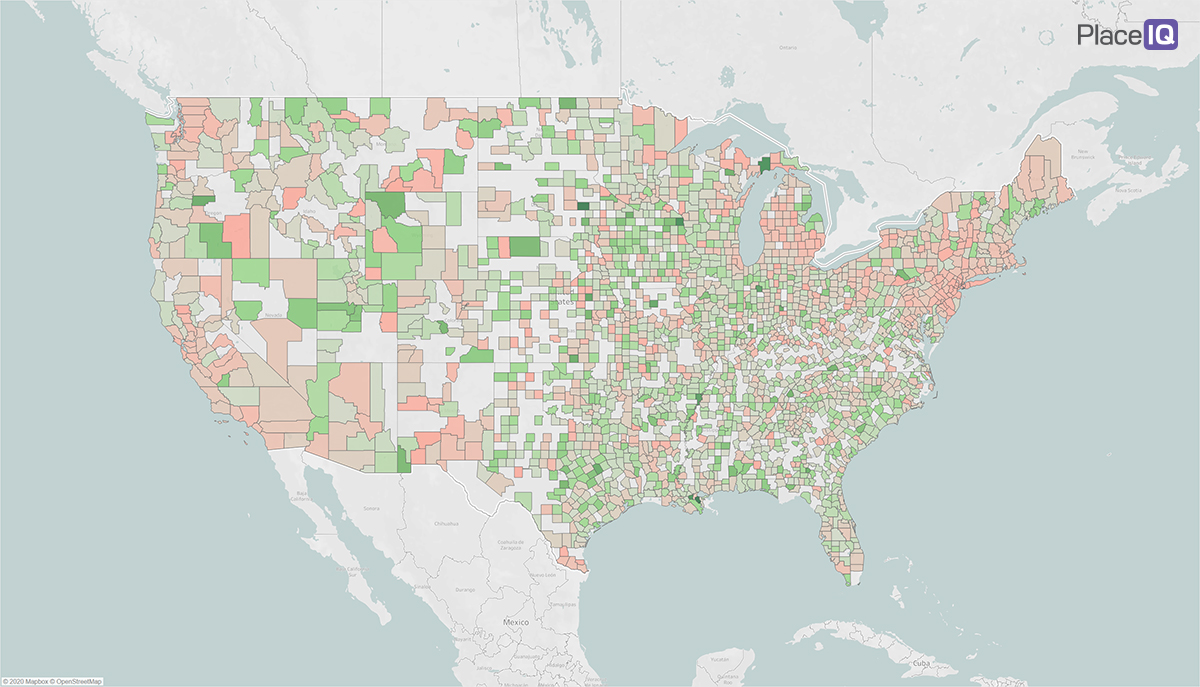

For example, here’s what reemergence looks like by county for McDonald’s:

In the green counties, traffic is up compared to pre-COVID norms. In red counties, traffic is down — often significantly.

If you’re a marketer, regional reemergence is a massive challenge to overcome. If the desire to venture out varies greatly from region to region, how can campaigns be effectively targeted without the complexity of individually adjusting for each county? How do you ensure you are optimizing your advertising investments to the specific areas where it will have a positive impact?

To overcome this challenge, PlaceIQ has built programmatic audiences to help manage this complexity for you. To do so, we analyzed behaviors at the household level to build three degrees of reemergent audiences:

These audiences will be available next Wednesday, June 3rd. Marketers can access our Reemergent Audiences via the LiveRamp Data Store or directly from PlaceIQ. Please email us if you’d like more details.

And now back to the data

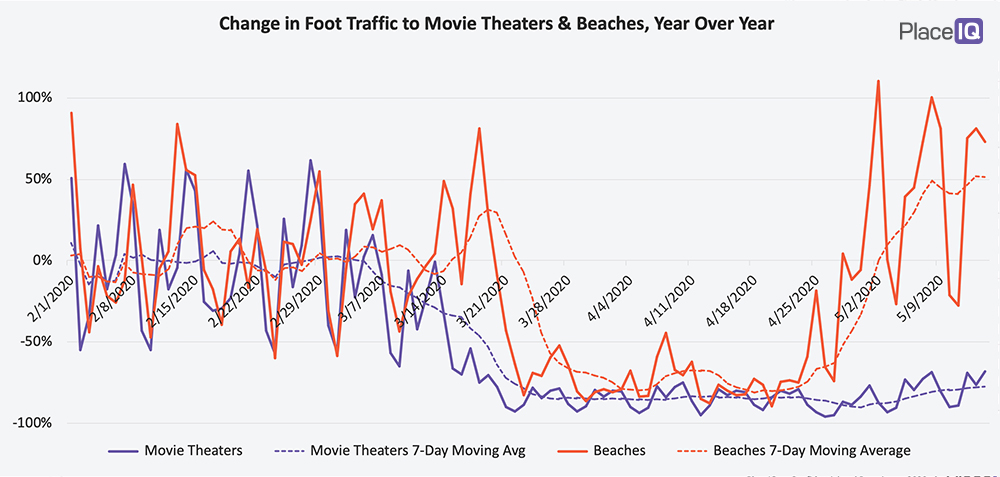

As temperatures climbed over the weekend in the Bay Area, we scouted out our town’s beach and found it more crowded than ever. Most blankets and umbrellas were well distanced, but the coverage of the beach was unlike any we’ve seen in California. Normally crowds seeking respite from the heat would be distributed among the malls, the movie theaters, and bars. But with those venues closed, we’re seeing demand shift:

Nationally, the trend is clear as day: movie theater attendance is down nearly 80% compared to 2019 while beach traffic is routinely doubled. This is a great example of shifting demand, a theme of our national quarantine. As activities closed and we stayed home, we spent our time streaming, gaming, baking, and gardening. Unprepared for the sudden onslaught of demand, companies struggled to keep flour and seeds in stock.

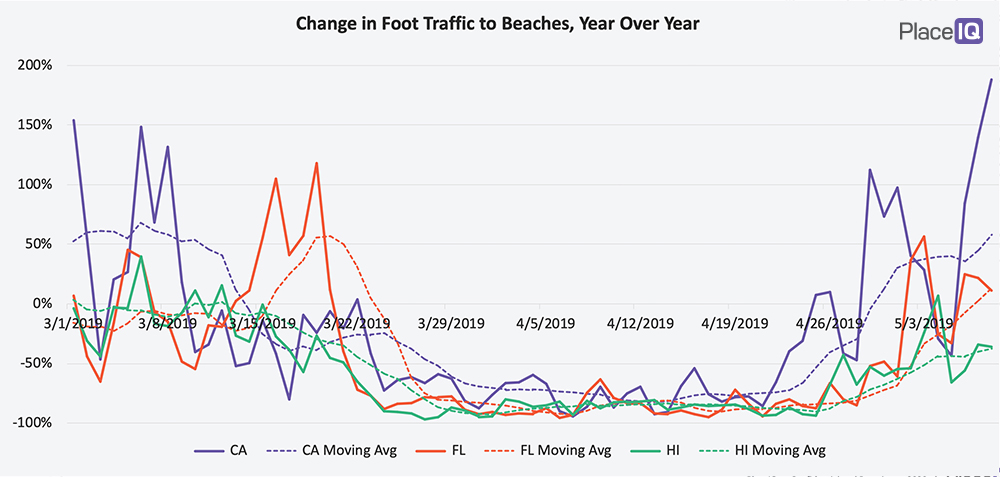

As people grow more comfortable reemerging while social distancing, we’re seeing this demand shift in foot traffic, too. Fast Food traffic is up in many counties by 60% or 70%, as emergent communities flock to one of the few activities in town. And, beaches aren’t just reemerging, they’re surging:

In California, one of the states which most embraced shelter-in-place, recent figures for beach traffic are up nearly 3x vs. 2019. Florida is on a similar trajectory. As temperatures continue to rise, we expect outdoor activities of all types to continue to spike.

Last week, The New York Times published an interesting piece on where New Yorkers moved as we began to shelter-in-place. Using data from postal service forwarding requests they mapped the exodus to surrounding cities and cross-country locales.

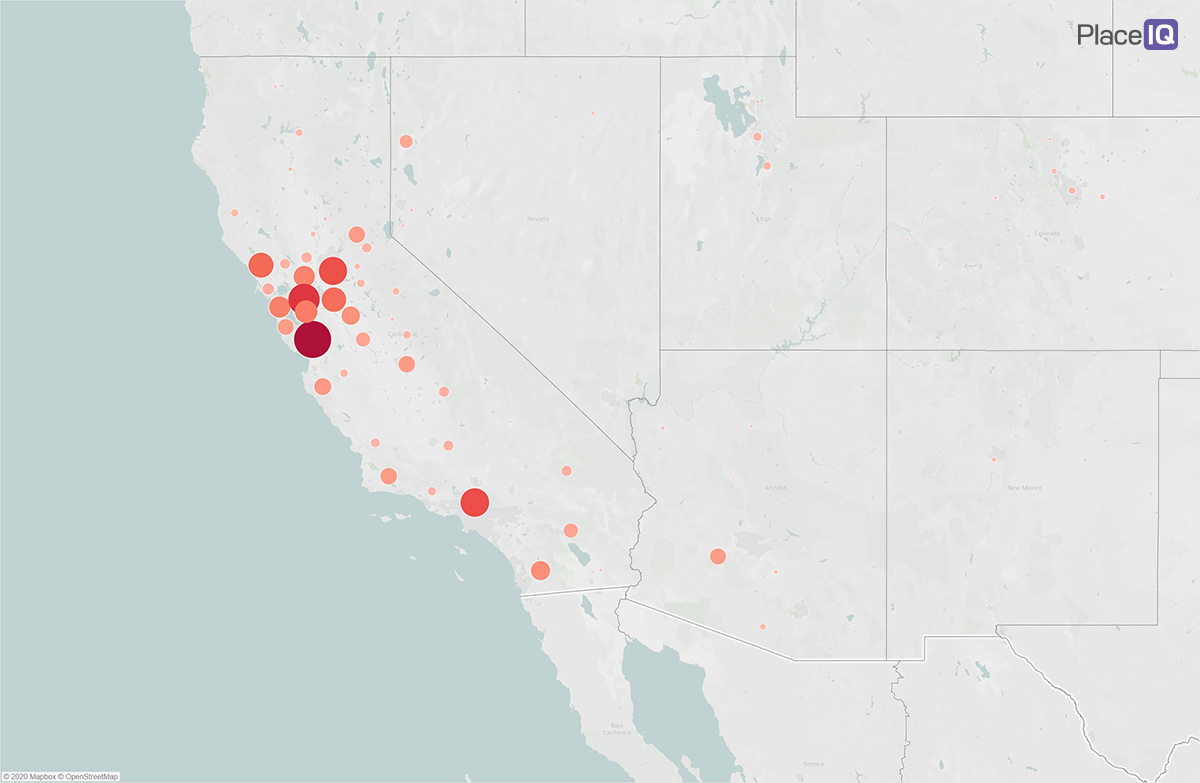

We’ve been working on a similar exploration, using our ability to map devices to residential parcels using movement data, and have seen very similar results. Like the NYT, we found that the largest chunk of relocations are to local ex-urban communities (say, relocating from Manhattan to the Hamptons). This pattern played out in all cities significantly affected by the Coronavirus. Here’s the San Francisco Bay Area:

Where Bay Area residents moved to following shelter-in-place orders. Larger and darker circles indicate more moves to that destination.

Most shuffling by people living in the five Bay Area counties was to nearby residences. The greatest county-to-county shift was by people with pied-à-terres in San Francisco shifting back to the Santa Clara suburbs.

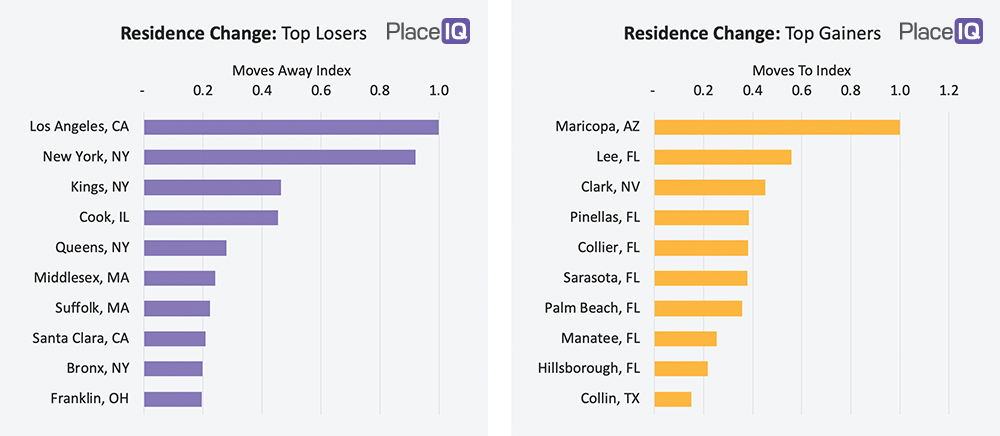

But when you stop focusing on a specific city a wholly different trend emerges. Snowbirds, it appears, are migrating early.

Looking at the counties with the greatest total influx of movers, 9 out of the top 10 are warm weather destinations for vacationers and retirees. This will likely lead to a softer hit to communities that cater to longer term rentals or summer homes. They’ll receive fewer total visitors, but the duration of visit will be longer as those with the option to remain away from cities.

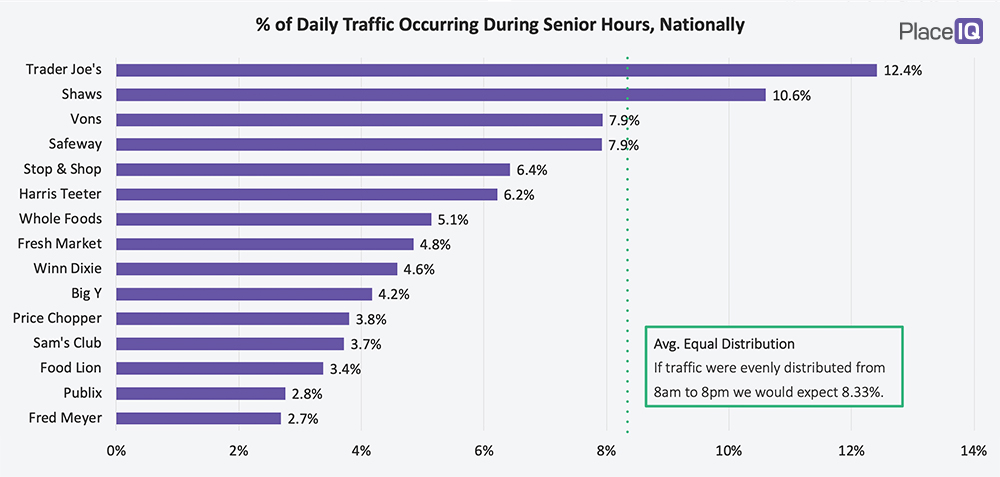

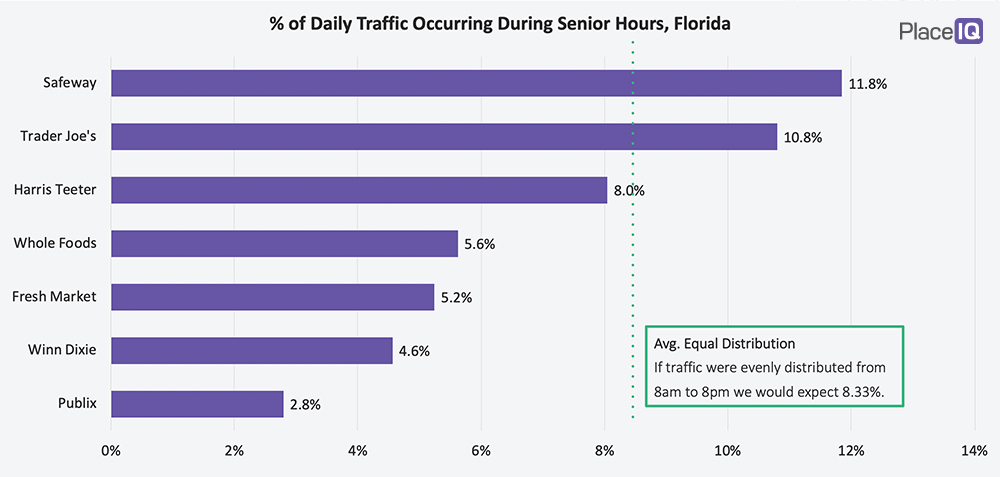

Speaking of retirees, we’ve received several questions about special opening hours for seniors and other at-risk populations. Many grocery and big box retailers have rolled out these rules, and many local governments are requiring them. But are they attracting a crowd? Well, it’s a mixed bag:

Only two brands we analyzed had senior hours that were busier than an average open hour, Trader Joe’s and Shaws. Retailers varied wildly, with some doing nearly 1/8th of an average hour. We zoomed into Florida to see if national trends were hiding interesting local stories, but it was more of the same:

Almost the exact same distribution among brands was seen in Florida. There was no correlation between adoption of senior hours and total foot traffic volumes.

In sum, dedicated shopping hours are a good idea for public health, but a wash when it comes to foot traffic.

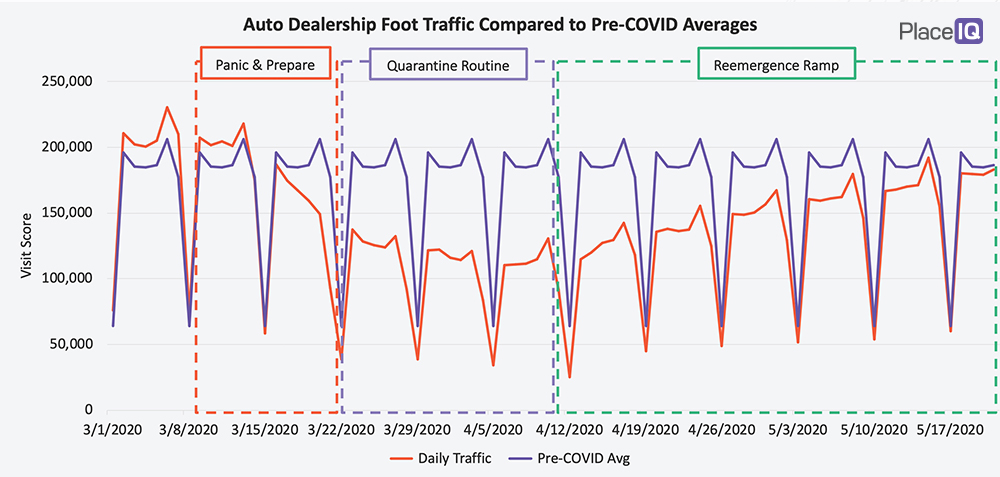

On March 31st, we wrote:

As we’ve previously covered, it appears the service side of the auto business is sustaining its foot traffic. Cars still break and need fixing during a pandemic, but if we decrease our driving they’ll break less frequently. Dealership traffic looks to be a textbook case of a lagging indicator. We do not believe an equilibrium has been reached yet, and we’d wager traffic might fall a bit more before the floor is found.

At the time we feared that if dealerships were a true lagging indicator, they’d not only have a slow decline but a slow recovery. Thankfully, it appears we were wrong:

Traffic to dealerships is nearly at its pre-COVID volume.

Sure, this reemergence varies significantly by county, but what doesn’t?

Green counties are up compared to pre-COVID norms, red counties are down.

We’re just now starting to dig into what’s going on here, especially since auto sales aren’t open in every region yet. But our current theory based on our discussions is that two months of sheltering has shifted two months of auto sales. Sure, demand will still be down over the medium term, but we’re seeing signs that many needed to buy or service cars during quarantine and are only now getting the chance. We will certainly be following this thread closely in the coming weeks…

To learn more about the data behind this article and what PlaceIQ has to offer, visit https://www.placeiq.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.