Rating agency downgrades have hit unprecedented levels over the past few months, but the majority of these are companies that were already classed as high yield. Fallen Angels – companies that cross the boundary from Investment-Grade to “Junk” – are still in a minority, as agencies (and their corporate clients) display an understandable reluctance to avoid the “BBB cliff”.

Consensus credit data from Credit Benchmark – which gathers the collective credit quality estimates of lenders to these firms – shows that a growing number of companies are falling over the cliff edge, providing clues to likely future default rates.

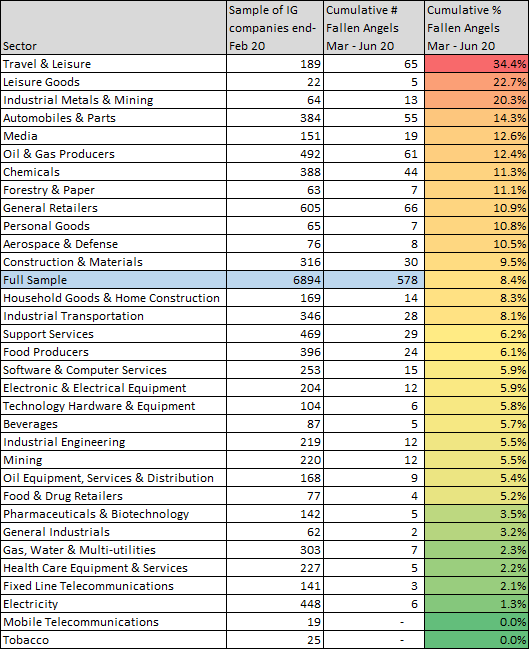

Consider the full set of global sectors. In this sample, of 6,894 companies, 578 (about 8%) have migrated to and remained in sub-Investment-Grade territory over this period, as seen in Figure 1.

Figure 1: Fallen Angels % by Global Sector

The sector showing the most significant deterioration is Travel & Leisure, with about 34% of firms now classified as Fallen Angels. The Leisure Goods and Metals & Mining sectors follow with roughly 23% and 20% of constituents now classified as Fallen Angels, respectively.

Other sectors showing double-digit rates in this month’s update include Automobiles & Parts, Media, and Oil & Gas Producers, with about 14%, 13%, and 12% of constituents classified as Fallen Angels, respectively.

The deterioration can also be seen further down in the chart. In the Oil Equipment, Services & Distribution sector, for instance, the percentage of Fallen Angels has grown from around 4% to about 5%.

Only two sectors – Mobile Telecommunications & Tobacco, each of which is new to the dataset – have no firms in the Fallen Angels category.

In the previous update, we noted that Ed Altman suggested that up to a third of all corporate bonds in the BBB category could move to “Junk” status, an estimate consensus credit data supports.

To learn more about the data behind this article and what Credit Benchmark has to offer, visit https://www.creditbenchmark.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.