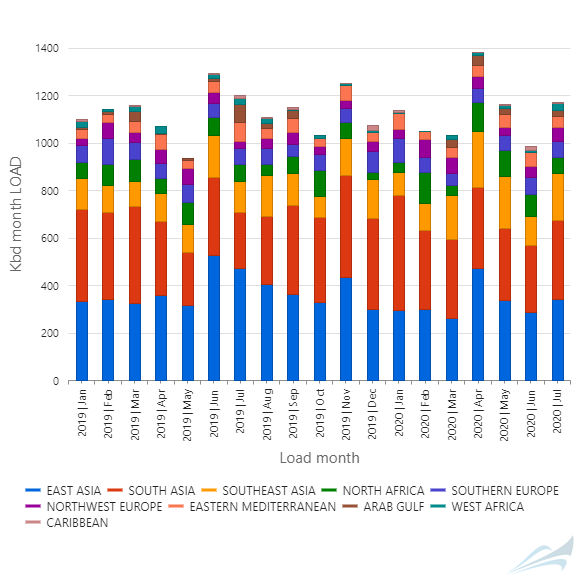

July finished with additional signs that the LPG markets are coming back into favor, with overall offtake increasing 14% from June. Higher discharges took place in parts of Asia, where Japanese and South Korean imports each grew 24%, to 324,000 bpd and 333,000 bpd respectively.

Greater demand from petrochemical manufacturers was a factor, as Idemitsu’s Chiba refinery in Japan offloaded more in July, while its Chita refinery also imported more. Similarly, SK Energy’s Ulsan refinery in South Korea discharged 118,000 bpd in July versus 83,000 bpd in June. The greater use of LPG as a feedstock over naphtha has come as naphtha prices moved to a premium to propane similar to what was in place at the highest levels this year.

OPEC’s decision on July 15 to reduce its production cut also means that more LPG is on its way to Asia. Loadings from the 10 countries that were subject to the cuts rebounded by 17% in July, with much of that volume on its way to Asia.

To learn more about the data behind this article and what ClipperData has to offer, visit https://clipperdata.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.