Credit Benchmark have released the December Credit Consensus Indicators (CCIs). The CCI is an index of forward-looking credit opinions for US, UK and EU Industrials based on the consensus views of over 30,000 credit analysts at 40 of the world’s leading financial institutions.

Drawn from more than 800,000 contributed credit observations, the CCI tracks the total number of upgrades and downgrades made each month by credit analysts to chart the long-term trend in analyst sentiment for industrials. A monthly CCI score of 50 indicates neutral credit quality, with an equal number of upgrades and downgrades made over the course of a month. Scores above 50 indicate that credit quality is improving. Scores below 50 indicate that credit quality is deteriorating.

The December CCIs show yet another month of credit deterioration for UK, EU and US Industrial companies. While the overall severity of the downwards trend is lessening, US and EU Industrials both performed worse this month than last month.

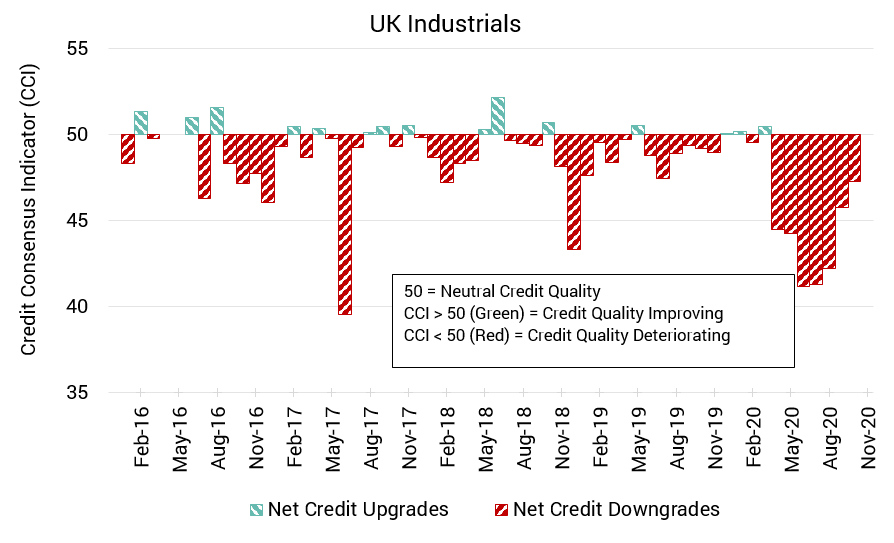

UK Industrials: More Improvement

For the seventh consecutive month, UK Industrial companies have seen credit sentiment in negative territory. But the overall trend continues to be one of improvement, and the overall position remains the best since March.

The CCI for this month sits at 47.3, better than the prior month’s 45.7, and still better than the CCI for the EU or US.

Despite improving sentiment, there are many lingering threats to the sector, from COVID and its economic turmoil, changes in travel patterns, and ever-looming Brexit.

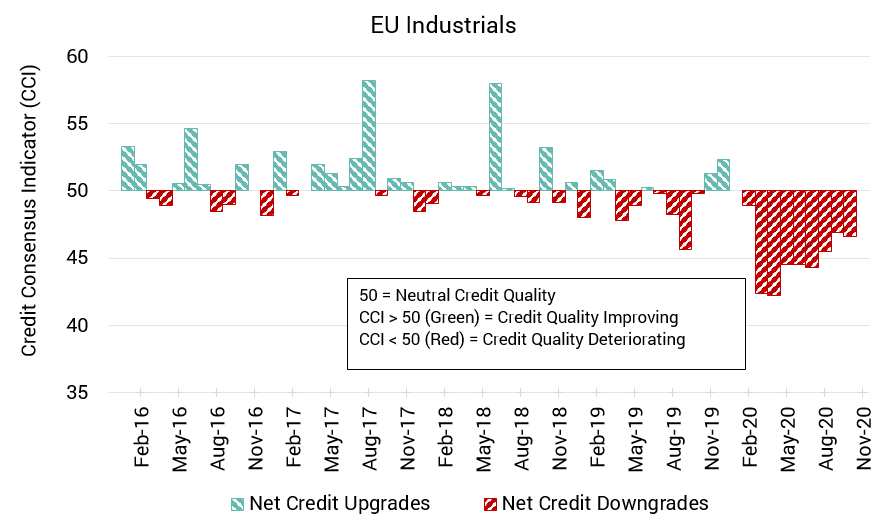

EU Industrials: A Slight Worsening

Net credit improvement has been elusive for EU Industrials. Not once this year has the sector’s CCI score been over 50. But the deterioration in sentiment for this sector has been milder and more consistent than for the UK and US.

The latest CCI registers at 46.6, compared to 46.9 last month.

Data on Eurozone manufacturing trends continue to paint a mixed picture, with some countries faring better than others. Germany remains the driver of recovery in the region. As is the case around the world, COVID remains an obstacle to more lasting recovery.

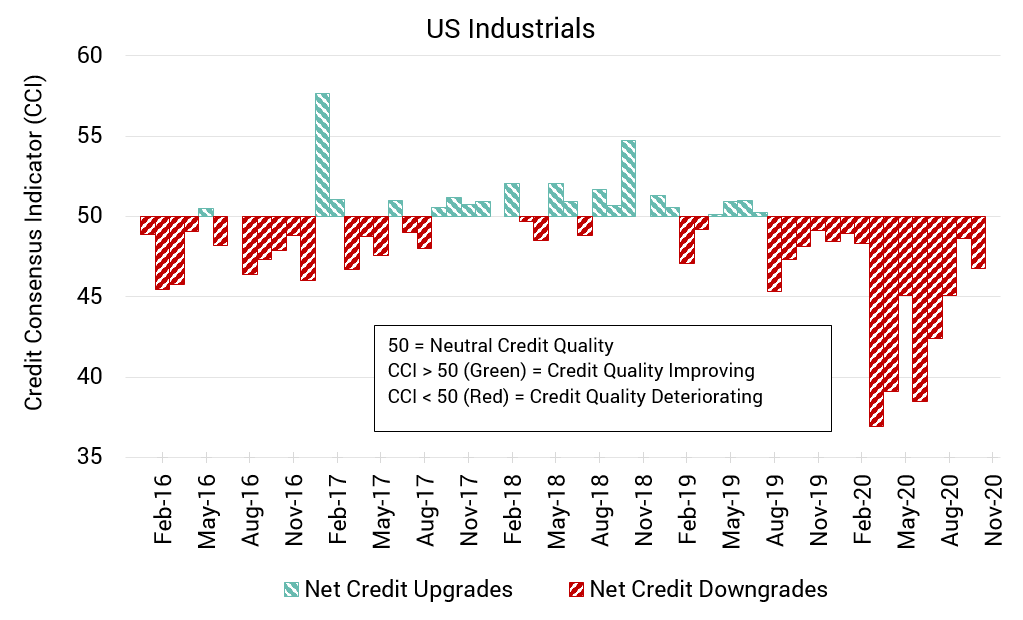

US Industrials: Credit Quality Sentiment Drops

The CCI for US Industrials dropped this month, thus halting a 3-month upward trend in sentiment. However, the CCI remains in a better position than it has been in for most of this year.

The current CCI is 46.8, compared to last month’s 48.6.

Like in the UK and EU, COVID continues to act as an anchor to US Industrials’ prospects. While overall output for spaces like US manufacturing remains relatively strong, the recent momentum observed in some areas like vehicle production could slow.

To learn more about the data behind this article and what Credit Benchmark has to offer, visit https://www.creditbenchmark.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.