Auto manufacturers have been preparing plant restarts for weeks, balancing county ordinances, financial concerns, demand shock, and protecting the safety of their workers.

Orbital Insight has been closely monitoring U.S. and international auto production, plant by plant, to help investors quantify the economic impact of COVID-19 on the autos sector and recovery by geography and brand.

This week Detroit auto manufacturers reopened their plants in after a two-month lockdown in a slow revival of a sector that employs one million people in the U.S. and makes up 6% of economic activity.

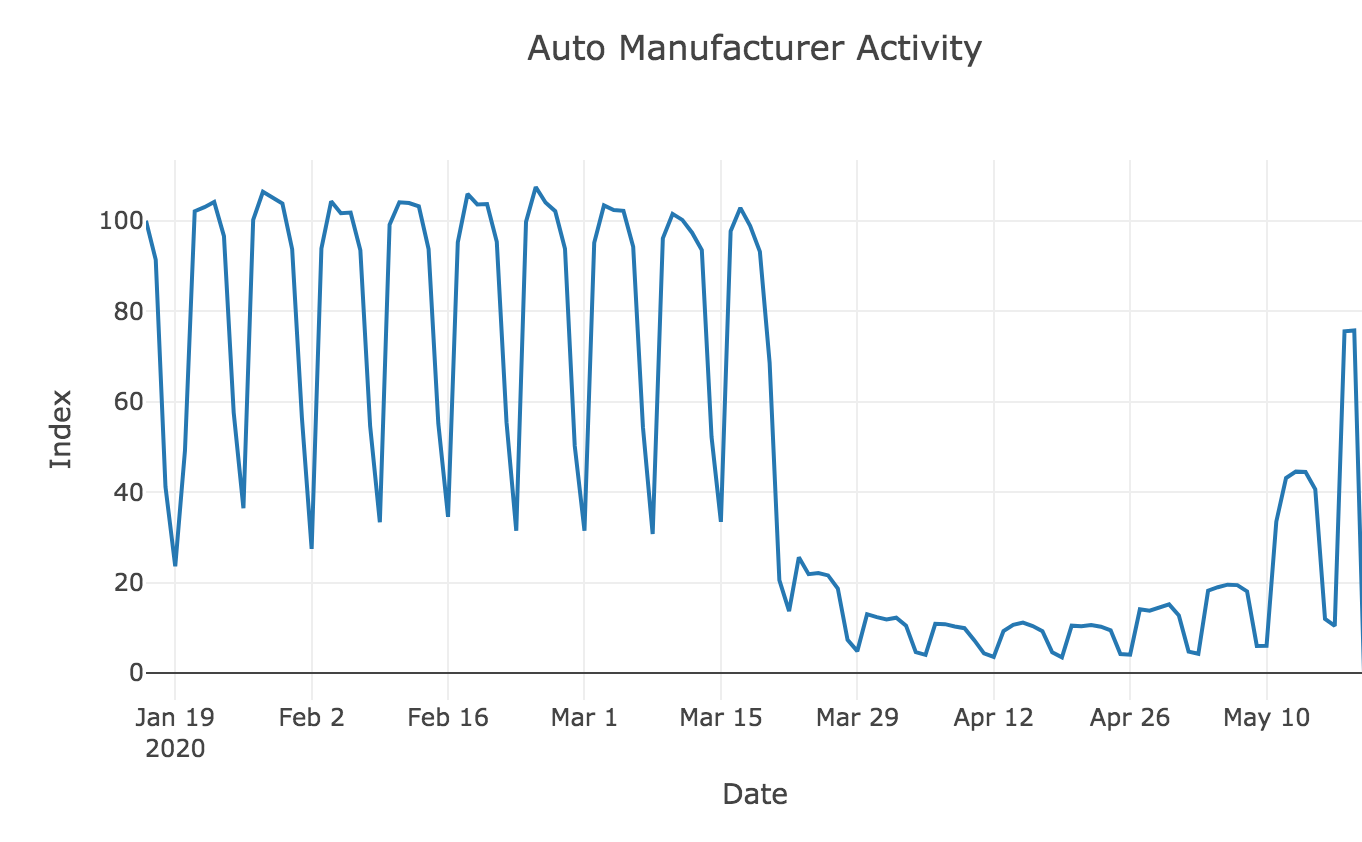

By analyzing anonymized mobile location data, we see the U.S. auto workforce at approximately 75% of Pre-COVID levels.

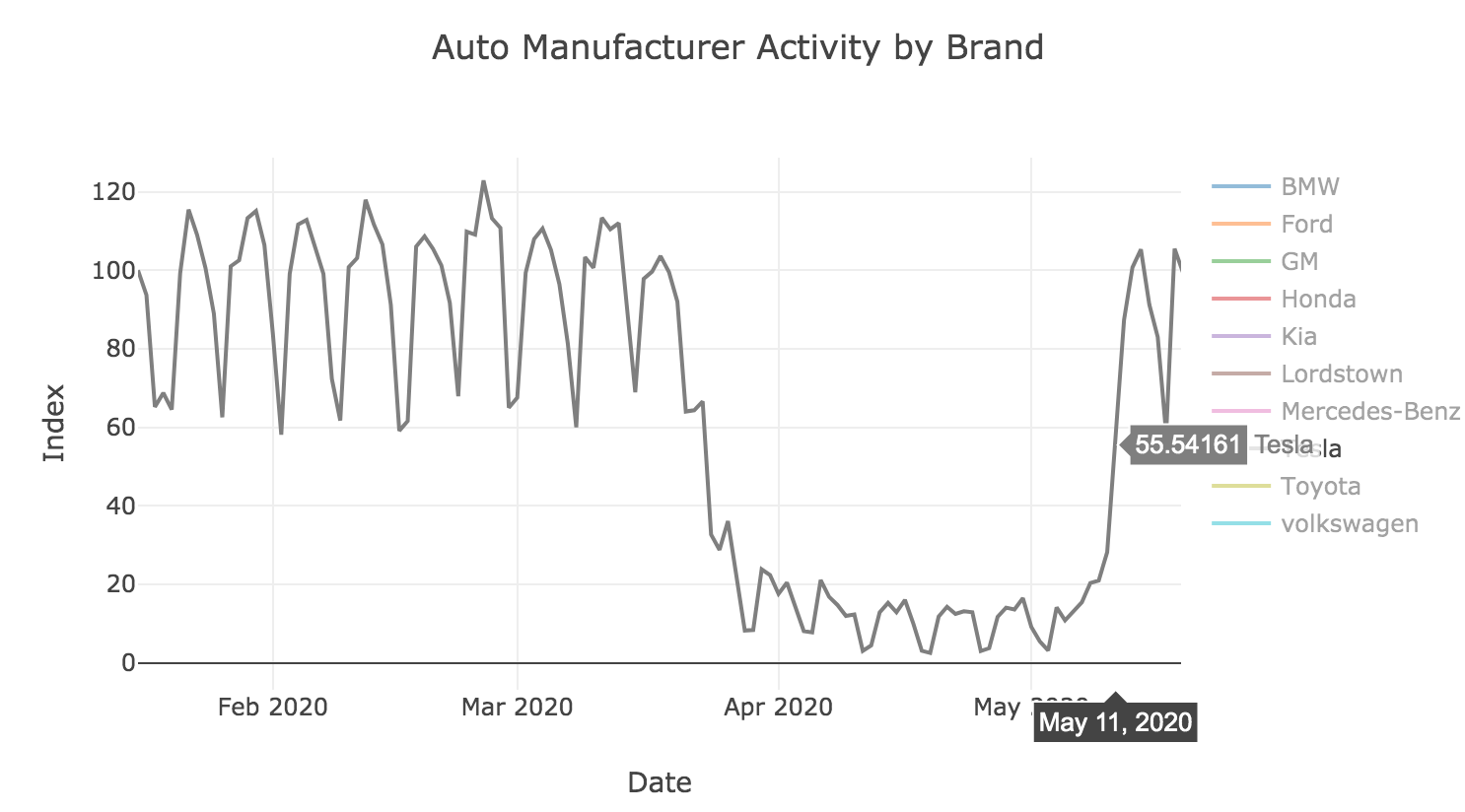

As the traditional automotive industry in Michigan opened this week, headlines were still featuring Elon Musk’s battle with Alameda County and his reopening of the Tesla Fremont Plant.

Orbital Insight’s geolocation data showed plant activity moving from a minimum operational workforce to just above 55% of Pre-COVID levels as of May 11. Two days later we saw those levels reach 100% as Tesla’s HR department emailed workers confirming the plant’s intent to ramp up production.

Musk’s email to employees states that Tesla is offering unpaid leave until May 31, 2020 with HR approval and we will monitor daily for any potential change in workforce. Orbital Insight observed a minimal workforce decline when Musk informed staff that there was no obligation to come into the plan on the week of March 16th prior to operations winding down one week later.

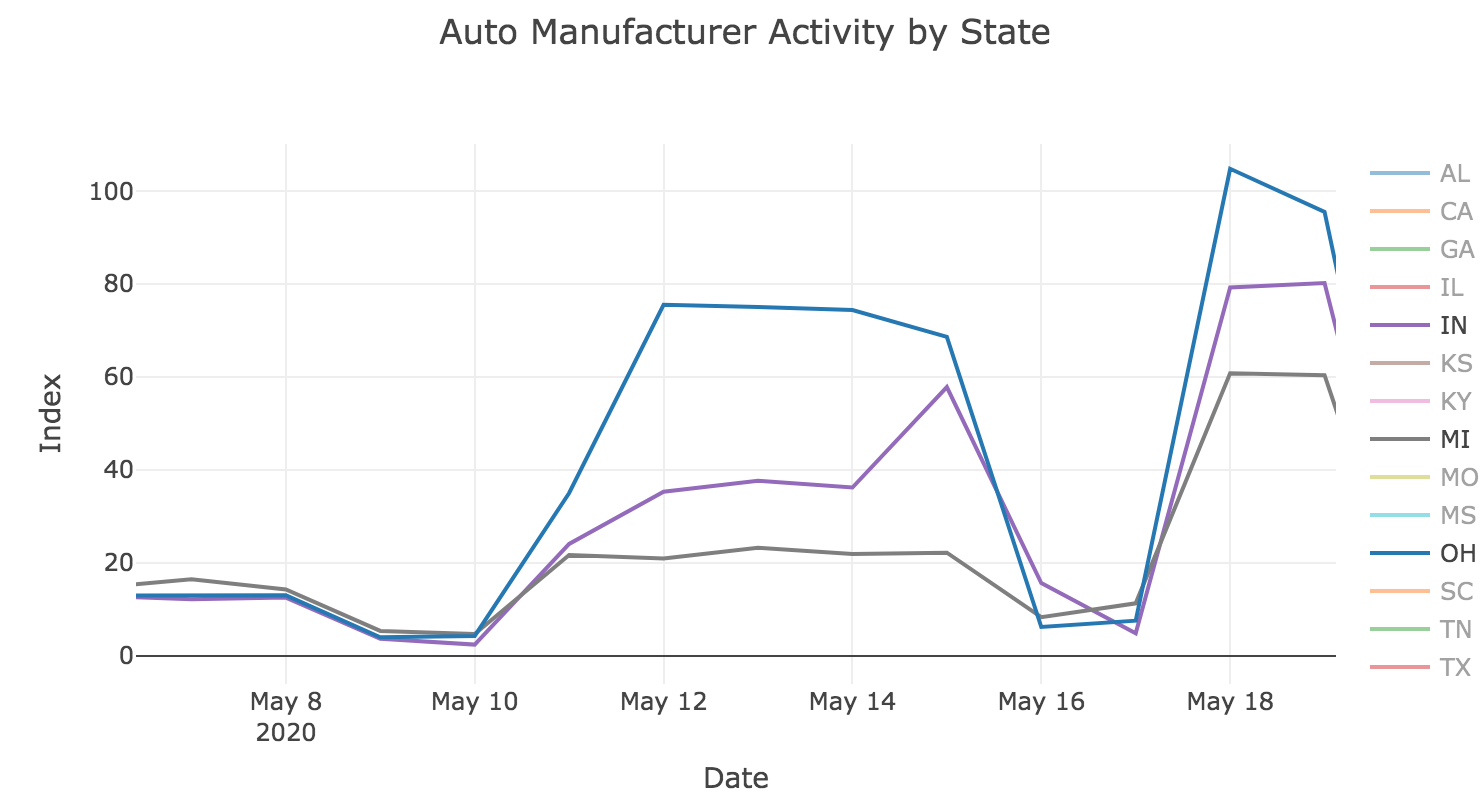

While Michigan is the largest state for U.S. auto manufacturing jobs, cellphones located in the state’s auto plants show that its workforce is at approximately 60% of pre-COVID levels. Ohio, which reopened plants the previous week at near full recovery in the workforce with neighboring Indiana trailing at 80% pre-COVID workforce levels.

U.S. Plants have supply chain dependencies and large assembly operations in Mexico, as plants reopen this week. Orbital Insight’s access to over 1.6 billion global device pings every day allows us to analyze supply chain activity and detect potential vulnerabilities as they arise on a global scale.

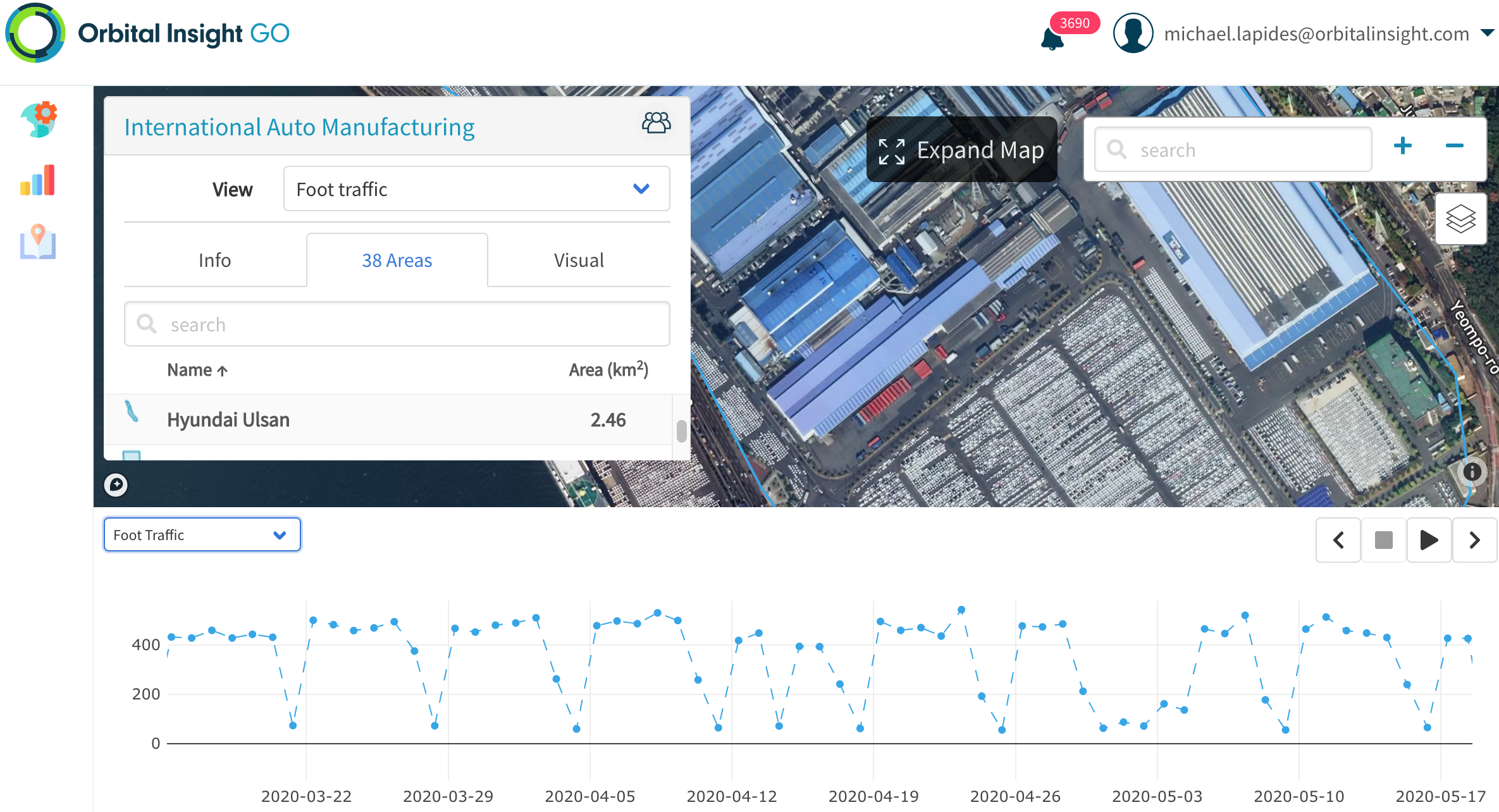

For example, data covering Hyundai’s Ulsan plant show 5 days of downtime at the beginning of May.

Our geospatial analytics product, Orbital Insight GO, tracks activity at any area of interest in the world to understand normal activity and alert our customers to relevant changes such as an uptick in weekend shifts at a factory or a slowdown at nationwide gas stations.

This analysis specifically used anonymized location data, aggregated from thousands of apps where users opt into location settings. Orbital Insight receives this data in an anonymized format from our partners and our product then cleans, normalizes, and analyzes the data in its product Orbital Insight GO, which quantifies activity with historical and ongoing activity within minutes.

Geolocation data is a challenging dataset to work with, as app usage and reporting is constantly evolving. Our data science team develops algorithms to clean this signal and isolate trends based on actual events on the ground and not an artifact of the data we receive from our partners. The company also takes privacy seriously and makes sure no Personally Identifiable Information (PII) is received or passed onto our clients.

While this blog post focused on specific auto manufacturing plants to quantify major headlines, many questions still remain. Are these plants at risk for additional COVID cases? How will downstream car dealerships fare in consumer demand? How many miles will people travel on highways as we working, commuting, and lifestyle changes take hold in the post-COVID world? All these questions can be answered quickly and objectively through GO.

To learn more about the data behind this article and what Orbital Insight has to offer, visit https://orbitalinsight.com/.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.

Sign up to receive our stories in your inbox.

Data is changing the speed of business. Investors, Corporations, and Governments are buying new, differentiated data to gain visibility make better decisions. Don't fall behind. Let us help.